The entire cryptocurrency market capital dropped 8.1% previously 2 days after neglecting to break the $880 billion resistance on 12 ,. 14.

The rejection didn’t invalidate some-week-lengthy climbing funnel, however a weekly close below $825 billion will confirm a shift towards the lower band and lower the support level to $790 billion.

The general investor sentiment toward the marketplace remains bearish, and year-to-date losses add up to 66%. Regardless of this, Bitcoin (BTC) cost dropped only 2% around the week, lower towards the $16,800 level at 17:00 UTC on 12 ,. 16.

A much different scenario emerged for altcoins that are being pressured by pending regulation and fears that major exchanges and miners might be insolvent . This explains why the entire market capital had came by 4.7% since 12 ,. 9.

Based on court papers filed on 12 ,. 15, a U . s . States Trustee announced the committee responsible for a part of FTX’s personal bankruptcy proceedings. Among individuals is Wintermute Asia, a number one market maker and GGC Worldwide, a joint venture partner from the troubled lending platform Genesis. Investors remain at nighttime about who the greatest creditors in the unsuccessful FTX exchange group are which is fueling speculation that contagion could still spread.

On 12 ,. 15, The central bank from the Netherlands issued an alert to investors using KuCoin, saying the exchange was operating without legal registration. De Nederlandsche Bank added the crypto firm was “unlawfully offering services” and “unlawfully offering custodian wallets” for users.

Contributing to the drama, on 12 ,. 16, Mazars Group, a business noted for its proof-of-reserve audit services for crypto companies, apparently removed recent documents that detail exchange audits from the website. The firm was formerly hired being an official auditor for Binance’s proof-of-reserve updates, a movement which was adopted by Kucoin and Crypto.com.

The Bitcoin mining sector has additionally endured because of the strong correction in cryptocurrency prices and rising energy costs. Openly-listed miner Core Scientific was offered a $72 million contingent emergency line of credit to prevent personal bankruptcy. The financial loan provider requires suspension of payments to Core Scientific’s equipment lenders while Bitcoin remains below $18,500.

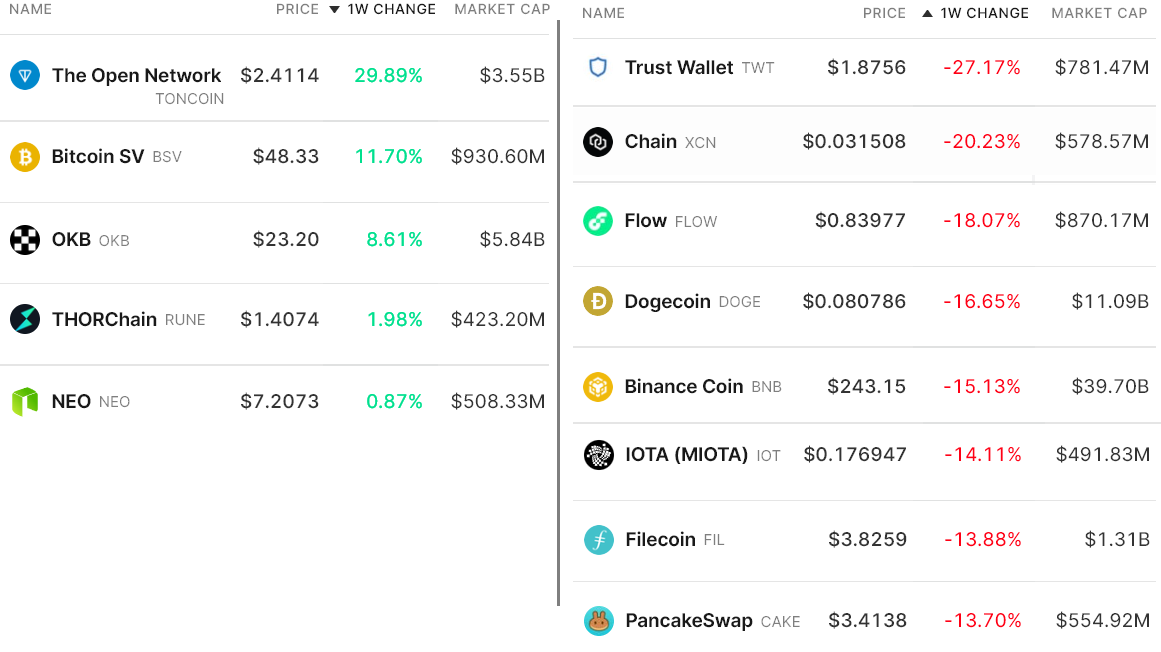

Some.7% weekly stop by total market capital was impacted largely by Ether’s (ETH) 5.4% negative cost move and BNB, which traded lower 15.1%. Consequently, the bearish sentiment considerably impacted altcoins, with 14 from the top 80 coins shedding 12% or even more at that time.

Outdoors Network (TON) acquired 30% after Telegram launched putting in a bid for anonymous phone figures offered for TON tokens.

Bitcoin SV (BSV) rallied 11.7% after Craig Wright, the self-announced Satoshi Nakamoto and leader from the altcoin project, attracted his reduction in Norwegian courts.

Trust Wallet (TWT) saw a 27.2% correction after its parent company (Binance) faced $1.9 billion in withdrawals in 24 hrs.

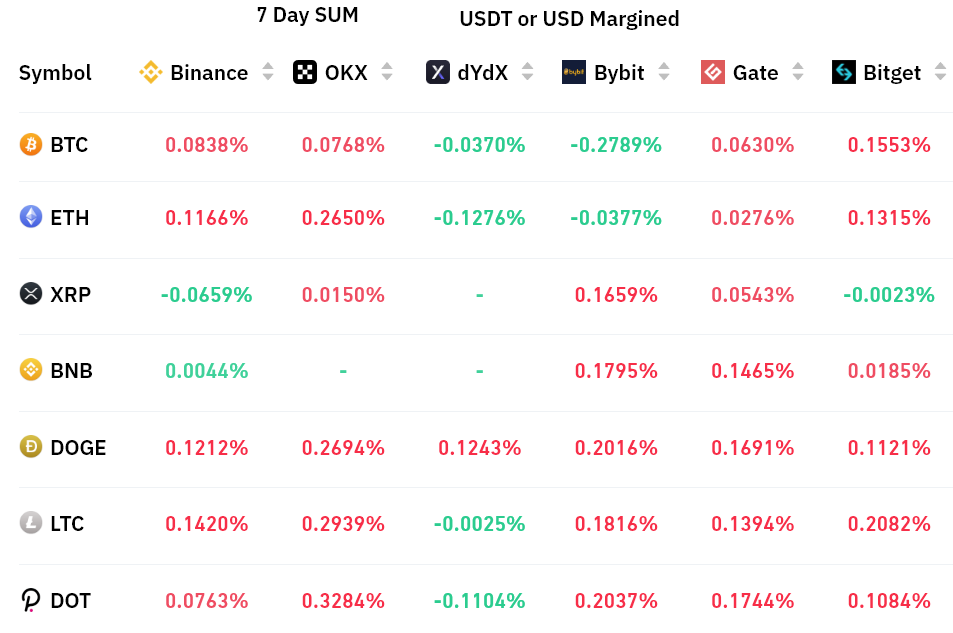

Leverage demand is balanced between bulls and bears

Presently, data shows interest in leverage is split between bulls and bears.

Perpetual contracts, also referred to as inverse swaps, come with an embedded rate usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

The 7-day funding rate was near zero for Bitcoin and altcoins, meaning the information suggests a well-balanced demand between leverage longs (buyers) and shorts (sellers) at that time.

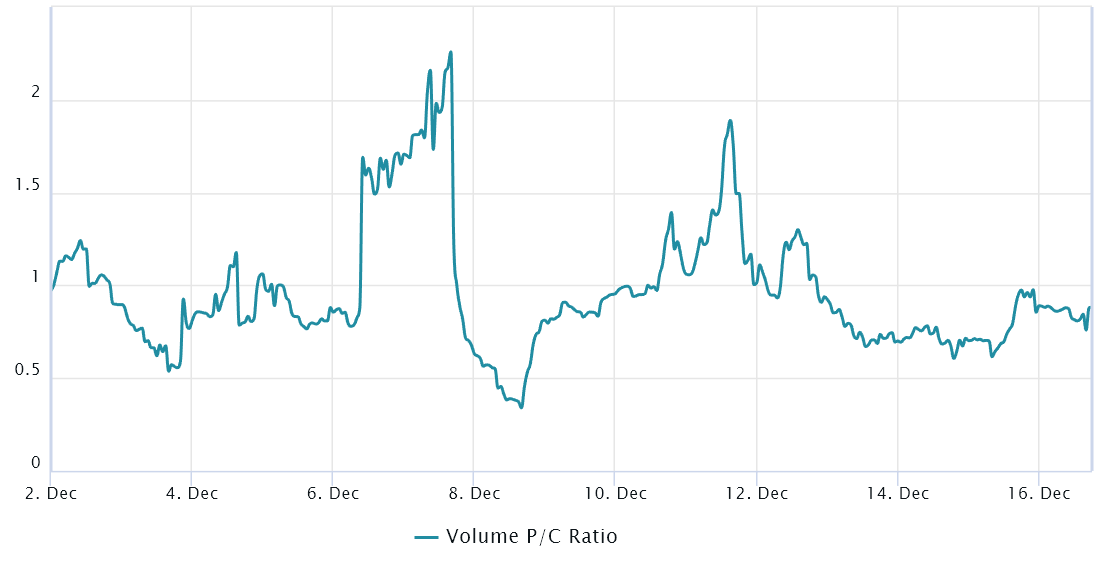

Traders also needs to evaluate the choices markets to know whether whales and arbitrage desks have placed greater bets on bullish or bearish strategies.

The choices put/call volume reflects an unbiased market

Traders can gauge the market’s overall sentiment by calculating whether more activity goes through call (buy) options or put (sell) options. In most cases, call options can be used for bullish strategies, whereas put choices are for bearish ones.

A .70 put-to-call ratio signifies that put options open interest lag the greater bullish calls by 30% which is bullish. In comparison, single.40 indicator favors put options by 40%, which may be considered bearish.

Despite the fact that Bitcoin’s cost unsuccessful to interrupt the $18,000 resistance on 12 ,. 14, there wasn’t any excessive interest in downside protection using options. More precisely, the indicator continues to be below 1.00, so slightly positive, since 12 ,. 12.

Presently, the put-to-call volume ratio stands near .88 since the options marketplace is more strongly populated by neutral-to-bullish strategies which favors call (buy) options by 12%.

Derivatives financial markets are neutral, however the newsflow is negative

Regardless of the substantial weekly cost loss of a number of altcoins and also the 4.7% stop by total market capital, derivatives metrics reflect no indications of panic.

There’s been a well-balanced interest in longs and shorts using futures contracts. Consequently, the BTC options risk assessment metric remains favorable despite Bitcoin’s 8.5% correction following a $18,370 at the top of 12 ,. 14.

Ultimately, bulls shouldn’t expect the $825 billion market capital to carry, which doesn’t always mean an instantaneous retest from the $790 billion support.

Presently, the low gang of the climbing funnel is constantly on the exert upward pressure, however the newsflow looks favorable for bears.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.