We do the research, you get the alpha!

Get exclusive reports and access to key insights on airdrops, NFTs, and more! Subscribe now to Alpha Reports and up your game!

Bitcoin took a brief dive Sunday after U.S. President Joe Biden announced he won’t be seeking a second term. The BTC dip lead to the liquidation of $159 million worth of futures contracts, according to Coinglass.

But the pain was short lived. The Bitcoin price has now climbed past where it was before the dip and briefly touched $68,000 early Monday morning. In fact, it rose as high as $68,480.36.

At the time of writing, Bitcoin has retraced to $67,284.98—but it’s still trading 0.4% higher than it was this time yesterday, according to Coingecko data. What’s more, BTC has gained 7% compared to this time last week and has seen $30.2 billion worth of volume in the past 24 hours.

Although Biden dropping out of the 2024 presidential election was no doubt a big catalyst for some investors, there are other macroeconomic factor at play.

The People’s Bank of China (PBOC) surprised markets with an unexpected cut to its short-term policy and benchmark lending rates on Monday—a big move from the world’s second-largest economy.

The announcement arrives as investors are looking ahead to the U.S. Federal Reserve’s next Federal Open Market Committee meeting—scheduled for July 31.

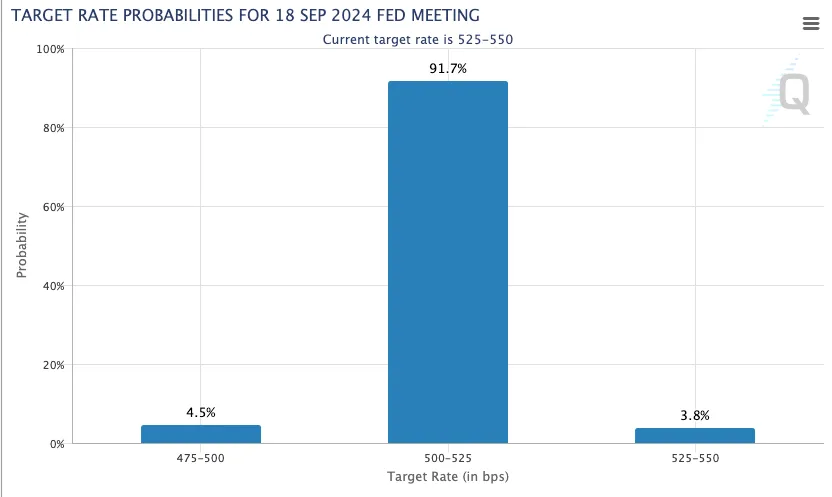

Roughly 95% of investors are now sure the FOMC will leave interest rates as they are in nine days time, according to the CME FedWatch Tool. But almost as many investors—92% as of Monday morning—expect that the FOMC will cut rates following the committee’s September 18 meeting.

Bitcoin tends to see U.S. interest rate cuts as bullish because it makes investments like treasury bonds less appealing. That tends to lead traders to allocate a larger portion of their assets to riskier categories, like stocks and cryptocurrency.

Now traders are looking ahead to this week’s release of new economic indicators from the Bureau of Economic Analysis to bolster their positions ahead of September.

“With significant macroeconomic indicators such as the U.S. GDP and PCE set to be released this week, we anticipate high market volatility in the coming days,” wrote BRN analyst Valentin Fournier in a note shared with Decrypt. “These figures are likely to confirm imminent rate cuts, potentially fueling the current rally.”

One other factor to watch: The start of trading for spot Ethereum ETFs in the U.S., which is scheduled for Tuesday, July 23 at 9:30 a.m. Eastern Time. Even though it’ll be the big debut for spot Ethereum funds, Fournier added that it could help supercharge the Bitcoin’s positive moment and send it to a monthly high.

“If this trend persists, Bitcoin could cross $70,000 tomorrow with the launch of Ethereum ETFs,” he wrote. “Although a parabolic acceleration for Bitcoin seems unlikely at this time, positive ETF inflows could sustain the rally longer than previously expected.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.