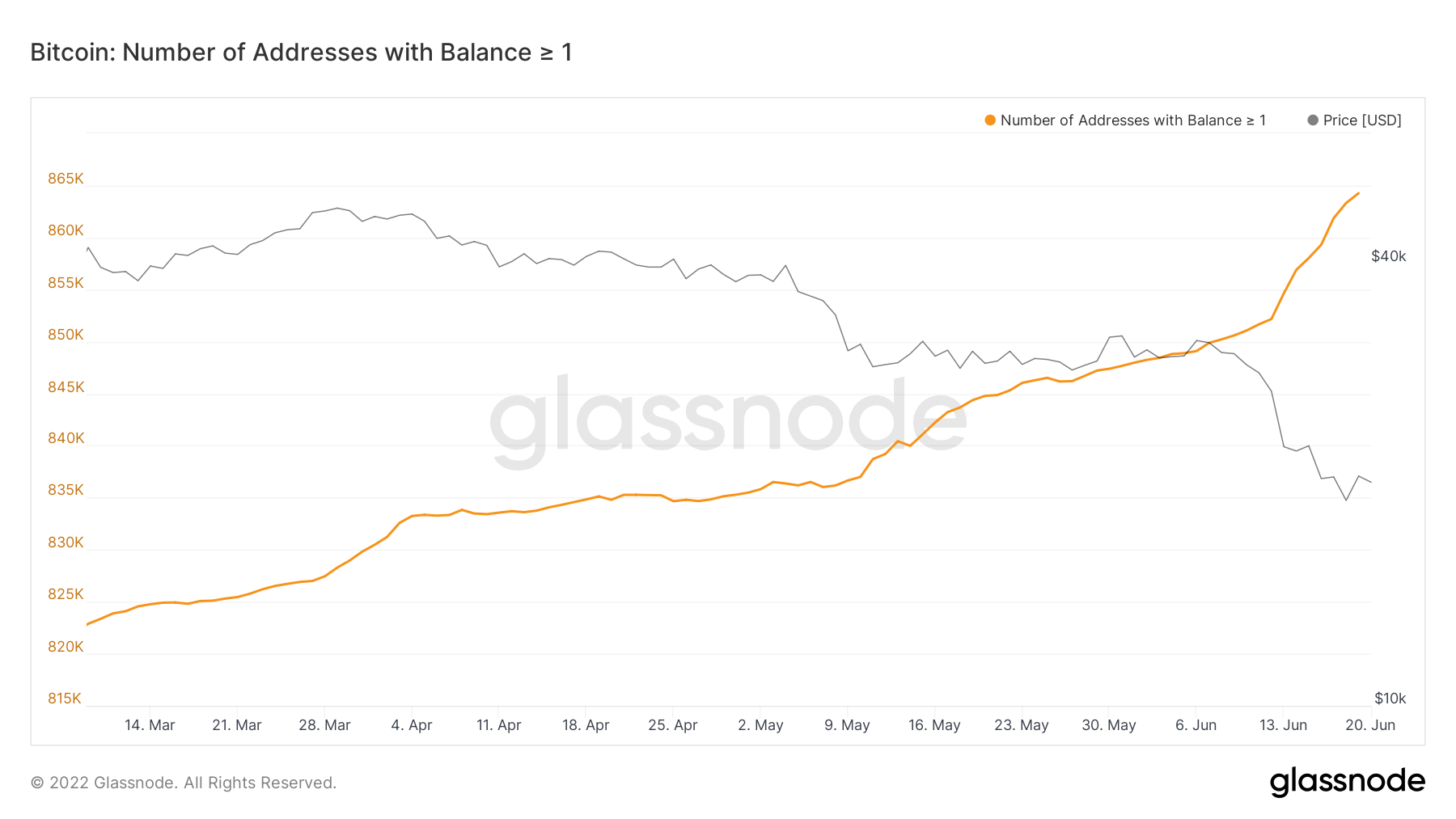

Bye-bye bear market blues thanks for visiting the network, Bitcoin (BTC) believers. In the last week, the amount of Bitcoin wallet addresses that contains one BTC or even more elevated by 13,091. The entire quantity of “wholecoiners” surged to 865,254.

The amount of whole coiners has rocketed throughout the downward cost action, highlighted through the hockey stick growth around the Glassnode graph:

Christian Ander, the founding father of the Swedish Bitcoin exchange BT.CX told Cointelegraph that “This will work for the ecosystem that it is growing in the ground-up because want the economy to become bottom up.” Ander ongoing:

“People possess a strong belief later on from the Bitcoin network and the need for the currency.”

In the last ten days, because the May tenth market slump to $30,000, over 14,000 whole coiners have became a member of the network. Because there is only going to be 21 million Bitcoin found, these wallet addresses will own one twentyone millionth of Bitcoin.

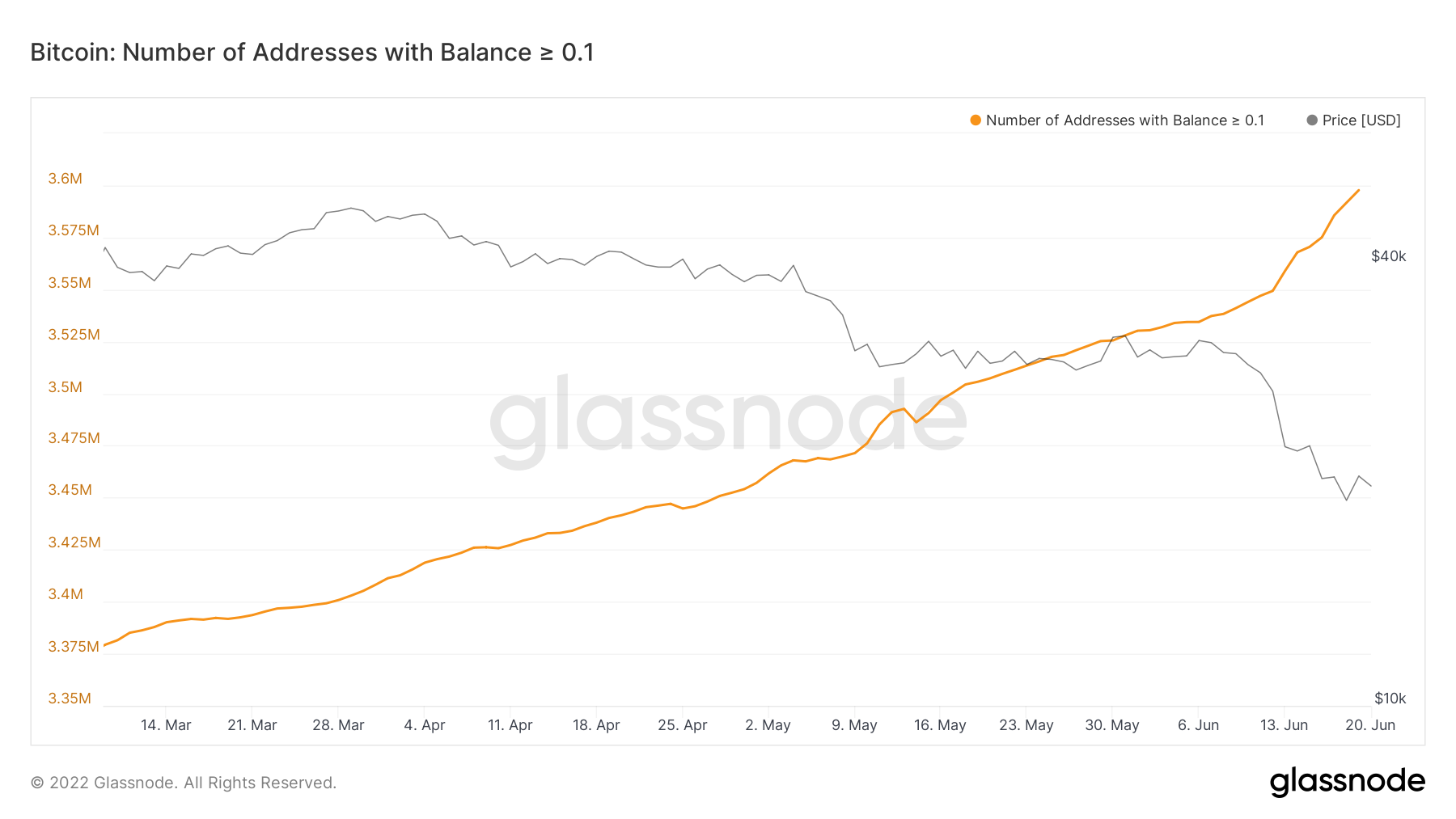

In an approximate cost of $20,000 per Bitcoin, the sharp rise in the amount of whole coiners indicate that retail–or “plebs” because they are passionately known–are buying Bitcoin as quickly as their incomes allows. The amount of addresses adding .1 BTC ($2,000) or even more has additionally begun a parabolic run in the last 10 days.

In comparison, the amount of wallets that contains greater than 100 BTC has dropped by 136 within the same period. By inference, “whale” wallets (large BTC wallet addresses) might be unloading their bags.

Related: El Salvador president addresses bear market concerns with Bitcoin hopium

When Satoshi Nakamoto found the very first Bitcoin on ninth The month of january, 2009, the Gini coefficient was 1, i.e earnings inequality around the network was the greatest ever. The Gini coefficient, produced by statistician Corrado Gini, represents earnings inequality or wealth inequality inside a social group. In Bitcoin, it may be mapped onto wallet addresses.

When Hal Finney, the very first Bitcoin believer started mining and receiving Bitcoin, the gini coefficient dropped from 1. It’s trended less and less since, indicating the wealth distribution around the Bitcoin network has become fairer and fairer.

For Ander, he told Cointelegraph he “stacked more SATs yesterday!”