Polygon (MATIC) required a rest from the prevailing bearish course, posting certainly one of sharpest rebound within the crypto market now.

Particularly, MATIC’s cost has risen to $.50 this June 23, four days after hitting $.317, its cheapest level since April 2021. This comes down to roughly a 60% gain, surpassing the performances of even Bitcoin (BTC) and Ether (ETH) within the same time-frame.

Nonetheless, MATIC continues to be lower considerably from the December 2021 a lot of $2.92, coinciding using the overall crypto bear market along with a hawkish Given putting pressure on risk-on assets.

MATIC “in a reasonably large accumulation”

Meanwhile, a number of its wealthiest investors happen to be accumulating MATIC tokens regardless of the general downtrend, on-chain data suggests.

Particularly, the so-known as MATIC sharks and whales will be in accumulation, based on data supplied by Santiment. Which includes the tiers of Polygon token holders varying from 10,000 to ten million coins, that have “with each other added 8.7% more for their bags” since May 9.

$MATIC sharks and whales will be in a reasonably large accumulation trend for around six days. The tiers of holders varying from 10k to 10m coins held have with each other added 8.7% more for their bags within this timespan. https://t.co/oasCn72rxt pic.twitter.com/lm4au2fWkn

— Santiment (@santimentfeed) June 22, 2022

Interestingly, MATIC’s cost has fallen by 50% within the same period, underscoring that lots of whales are confident about its lengthy-term recovery.

Inverse mind and shoulders

From the technical perspective, MATIC/USD seems to become heading toward a brand new multi-week high.

At length, the Polygon token continues to be breaking from its “inverse mind and shoulders,” or IH&S pattern, since June 22. IH&S is really a bullish reversal setup that forms following the cost forms three troughs consecutively while hanging upside lower with a common support line known as the “neckline.”

Also, an IH&S’s middle trough (the mind) is much deeper compared to other two, known as left and right shoulders, correspondingly. Ultimately, the setup resolves following the cost breaks over the neckline, and, usually of technical analysis, increases up to the space between your mind and also the neckline.

Because of its IH&S pattern, MATIC’s cost could rally toward $.60 in June or early This summer, up about 20% from today.

Caution for MATIC bulls

Whale buying isn’t always a bullish signal, and also the IH&S pattern includes a failure rate of 16.5%. So, an additional cost rally may also prompt whales to switch MATIC for any quick profit, because of the tight conditions elsewhere within the cryptocurrency and traditional markets that could cause false recovery signals.

Related: ‘Bitcoin dead’ Google searches hit new all-time high

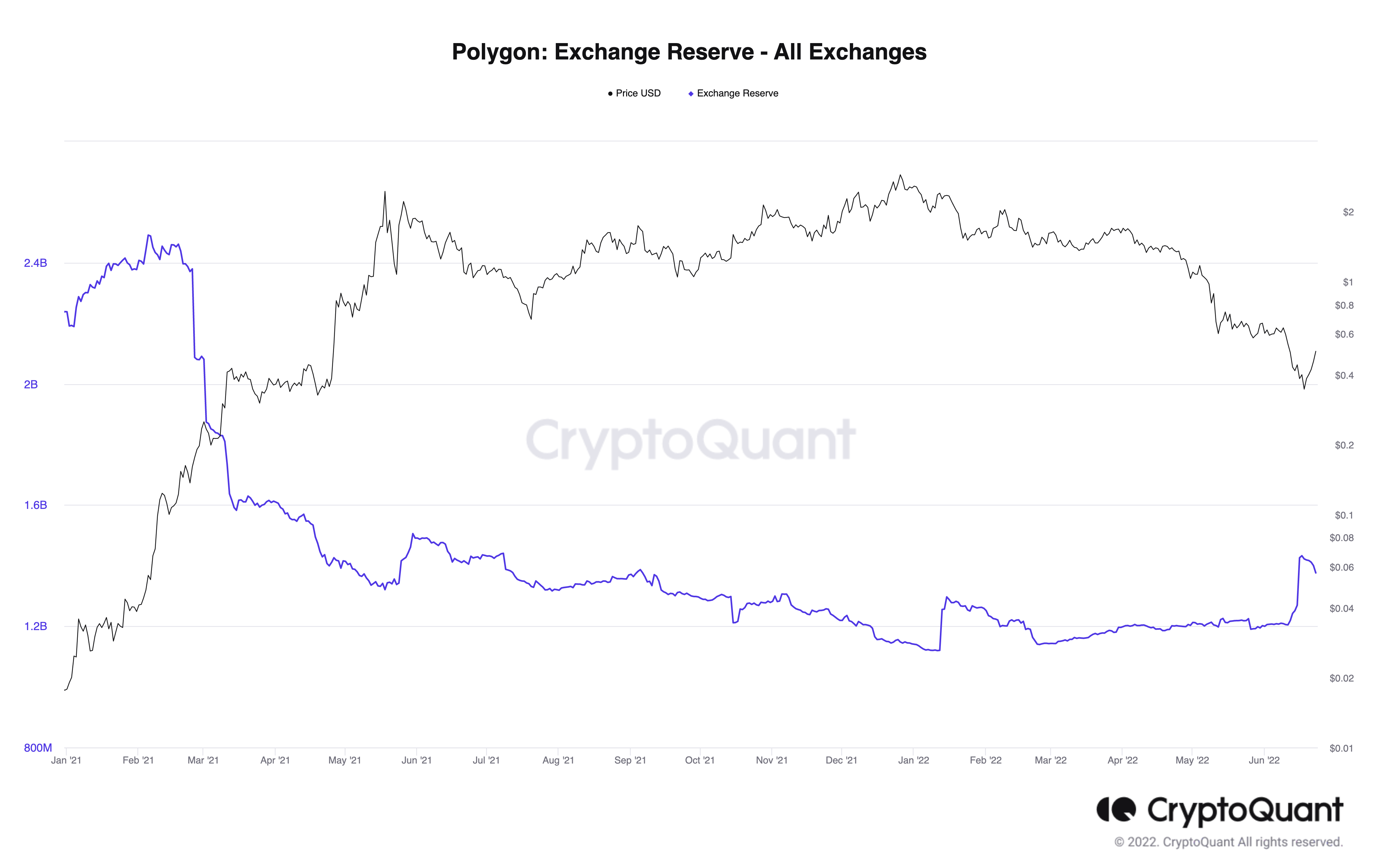

Furthermore, the MATIC balance across all of the crypto exchanges has leaped from 1.21 billion to at least one.37 billion between May 1 and June 23, based on data from CryptoQuant, indicating additional potential sell-pressure soon.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.