Bitcoin (BTC) might have already seen a cost bottom or perhaps be “really close” to 1, analysts believe eyeing new data now.

Inside a Twitter thread on June 22, well-known indicator creator David Puell revealed what he argues “looks interesting” about current Bitcoin exchanging.

“High likelihood” bottom is within

With lots of sources with BTC/USD to dip to $14,000 or lower, bullish assumes current cost action are couple of and between.

For Puell, however, dynamics between lengthy-term (LTHs) and short-term holders (STHs) hint that everything is not always as bearish as numerous fear.

Highlighting the price grounds for each group, Puell demonstrated that individuals who’ve been on the market longer compensated less in general for his or her BTC than recent investors.

With Bitcoin at multi-year lows, the discomfort thus lies with STHs greater than LTHs. Capitulation selling in the former could thus have previously expressed itself.

“imo, high likelihood we either had or are actually near to a bottom,” popular analyst Root responded.

Correction:

LTH recognized cost: $22.2k.

STH recognized cost: $31.7k.https://t.co/1YEGkriVAJ— David Puell (@dpuellARK) June 22, 2022

As Cointelegraph reported, however, even LTHs — understood to be wallet entities holding coins for 155 days or even more — have still been disbursing towards the market in recent days.

Mayer Multiple gets near historic floor

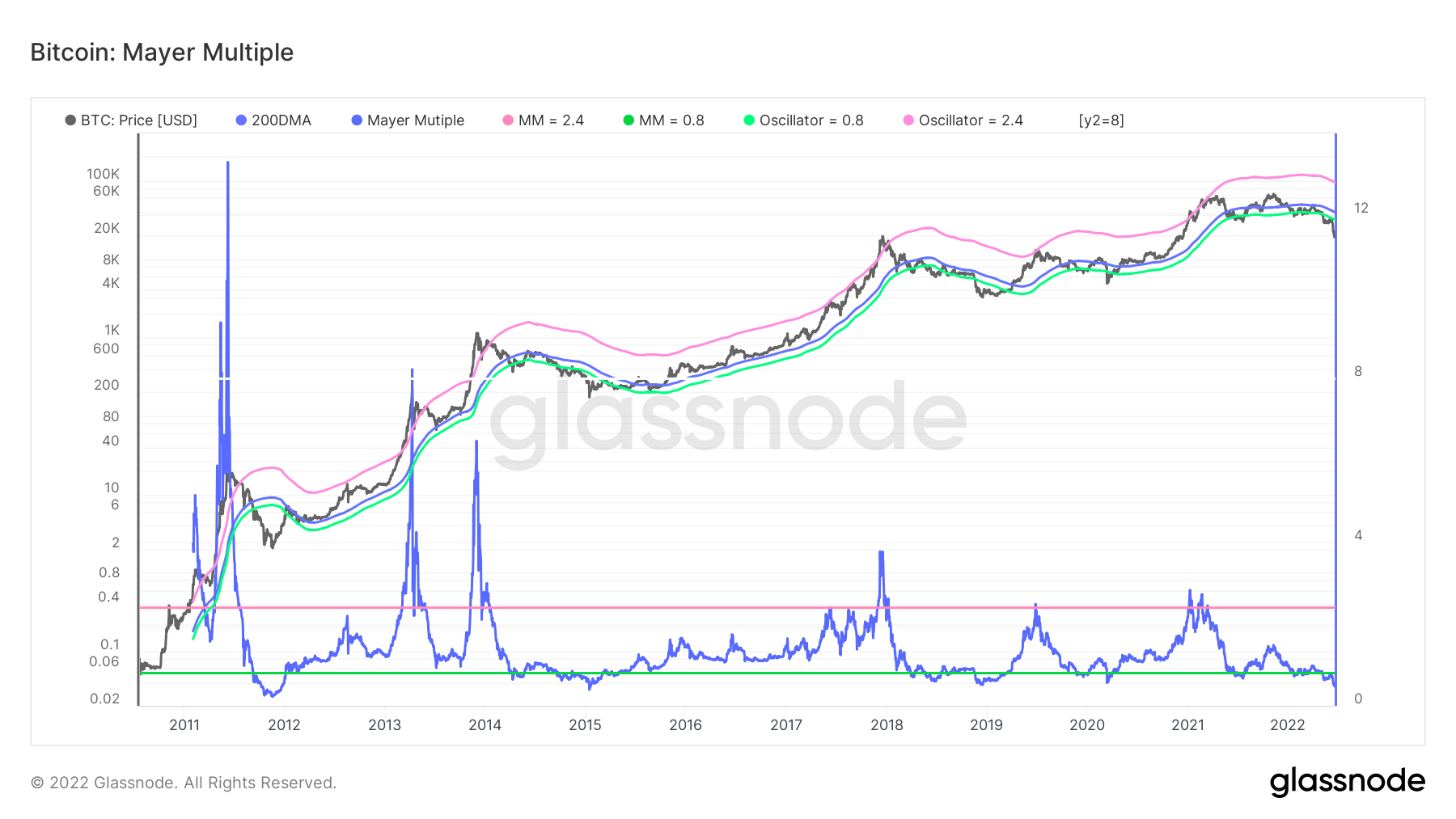

Individuals searching for any lucrative “buy the dip” chance on Bitcoin nevertheless might be fortunate, based on one other popular on-chain metric, the Mayer Multiple.

Related: Bitcoin cost increases to $20.7K as Fed’s Powell states more rate hikes ‘appropriate’

By June 22, the indicator, which shows what lengths underneath the 200-day moving average (DMA) current place cost is, is meaning that roi rarely will get better.

At .5, the Multiple is 50% underneath the 200 DMA, and it has been lower just 2% of Bitcoin’s lifetime.

“Macro-economic the weather is different this time around but best to keep close track of,” crypto entrepreneur Kyle Chasse commented around the figures.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.