- Bitcoin cost is hovering below USD 21,500.

- Ethereum is facing hurdles near USD 1,250, XRP is consolidating above USD .35.

- DOGE and STX are the best performers.

Bitcoin cost began a consolidation phase over the USD 20,500 zone and moved over the USD 21,200 level. It’s presently (11:59 UTC) buying and selling near USD 21,350 and it is lower over 1% per day or more 4% per week.

Similarly, most major altcoins will also be searching for direction. ETH still could test the USD 1,250 hurdle and continue greater. XRP is consolidating above USD .350 while ADA must settle over the USD .50 level to begin a stable increase.

Total market capital

Bitcoin cost

Following a minor decline below USD 21,000, bitcoin cost found support. BTC continued to be stable and rose over the USD 21,200 level. Around the upside, an instantaneous resistance is close to the USD 21,500 level. The following major resistance has become near USD 21,800. A obvious move over the USD 21,800 and USD 22,000 resistance levels might begin a fresh increase.

Around the downside, a preliminary support is close to the USD 20,800 level. The following key support is close to the USD 20,500 zone, below that the cost could gain bearish momentum.

Ethereum cost

Ethereum cost also continued to be over the USD 1,180 level and were able to return over the USD 1,220 level of resistance. ETH is lower almost 4% per day or more almost 9% per week. The following major resistance is near USD 1,250, above that the cost may even obvious the USD 1,280 resistance. Within this situation, the cost may possibly rise to USD 1,350.

Around the downside, a preliminary support reaches USD 1,200. The following major support is near USD 1,150, below that the cost could decline to USD 1,050.

ADA, BNB, SOL, DOGE, and XRP cost

Cardano (ADA) is wanting a detailed over the USD .50 resistance. When the cost stays over the USD .50 zone for a while, it might begin a wave for the USD .532 level.

BNB is moving greater for the USD 240 level. The very first major resistance is close to the USD 245 level. A detailed above USD 245 may even push the cost towards USD 262.

Solana (SOL) has returned over the USD 40 zone and it is consolidating inside a range. The very first major resistance is close to the USD 42 level, above that the cost could rise toward the USD 45 level.

DOGE continues to be buying and selling over the USD .0750 resistance zone. The cost expires almost 5% and can rise for the USD .0800 level. The following major resistance reaches USD .0820. DOGE can also be up 27% per day.

XRP cost is consolidating over the USD .35 resistance. It’s facing resistance close to the USD .375 level. A obvious move above USD .375 could initiate moving for the USD .40 level.

Other altcoins market today

A couple of altcoins are showing positive signs, including TRX, AVAX, UNI, STX, ATOM, ETC, EOS, QNT, and KAVA. From these, STX expires over 15% and buying and selling over the USD .49 level. STX can also be up 42% per week. Both DOGE and STX are the most useful performers one of the best players cryptoassets by market capital today.

To summarize, bitcoin bulls appear to become targeting moving over the USD 21,800 level. When they succeed, BTC could obvious the USD 22,200 resistance soon.

_____

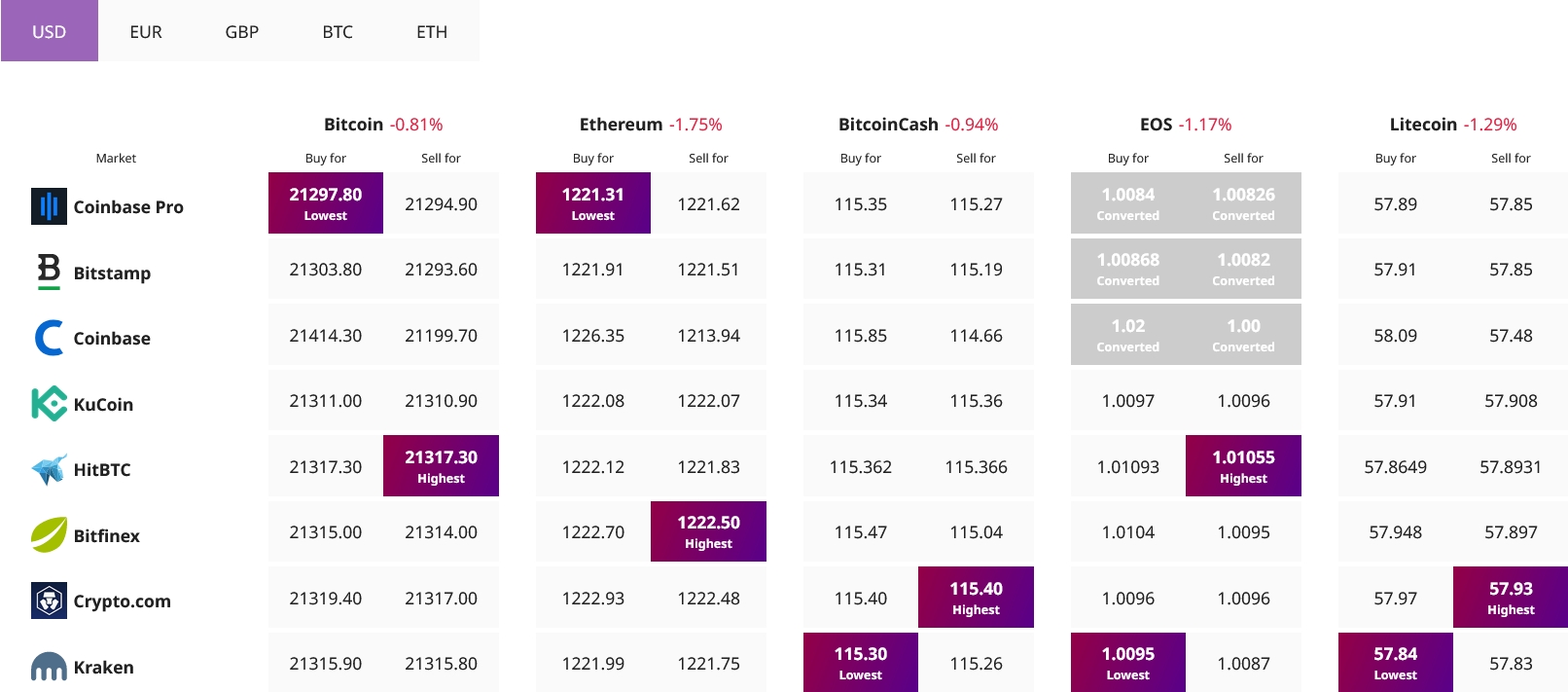

Get the best cost to purchaseOrmarket cryptocurrency: