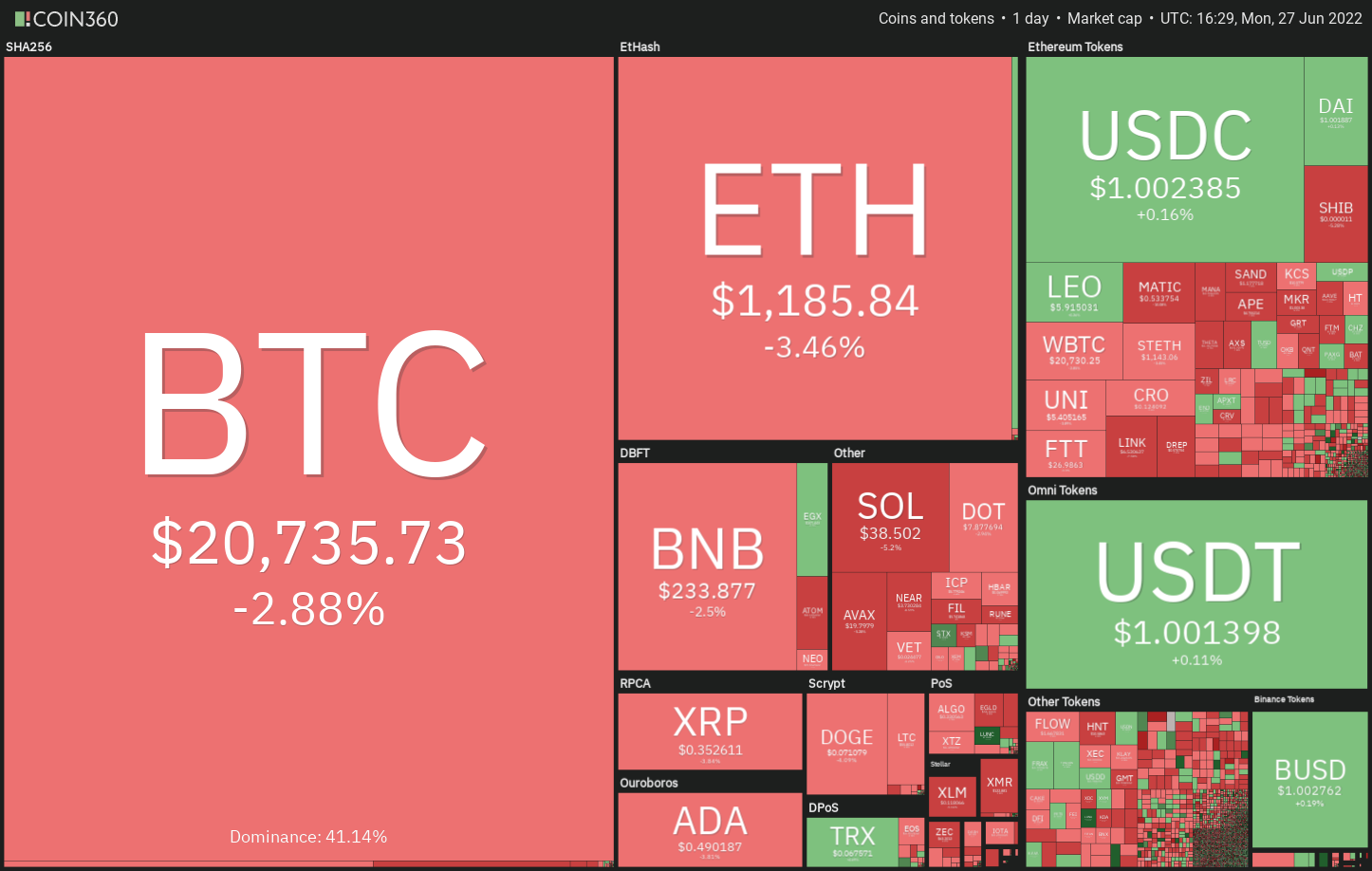

Bitcoin’s (BTC) current bear market is among the worst, based on a study by on-chain analytics firm Glassnode. It was the very first time ever the Mayer Multiple tucked underneath the previous cycle’s low. Bitcoin’s fall below $20,000 on June 18 also marked the greatest loss ever booked by investors right away at $4.23 billion. Thinking about the above mentioned factors along with a couple of other occasions, Glassnode believes the capitulation in Bitcoin might have began.

Bitcoin whales appear to possess began their purchasing, suggesting the bottom might be close as well as on June 25, analytics resource “Bet on Trades” highlighted that demand from whales holding 1,000 to 10,000 Bitcoin observed a clear, crisp spike sought after.

Another sign that traders are getting originates from Glassnode comments suggesting the 30-day average alternation in the supply stored on exchanges plummeted by 153,849 Bitcoin on June 26, the biggest ever ever.

Could bulls continue their purchases on dips and form a greater low? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin switched lower from $22,000 on June 26, indicating the sentiment remains negative and traders can sell on minor rallies. The bears will attempt to drag the cost towards the mental degree of $20,000.

When the cost rebounds off $20,000, it’ll claim that bulls are accumulating on dips. That may keep your pair range-bound between $20,000 and $22,000 for any couple of days.

The very first manifestation of strength is a break and shut over the 20-day exponential moving average (EMA) ($22,890). That may open the doorways for any possible rally towards the 50% Fibonacci retracement level at $24,693.

This level could again behave as a resistance, but when bulls overcome the barrier, the BTC/USDT pair could rally towards the 50-day simple moving average (SMA)($27,150). The bulls will need to push the cost above this level to point the pair might have bottomed out.

ETH/USDT

Ether (ETH) arrived at the 20-day EMA ($1,300) on June 26 however the bulls couldn’t push the cost over the resistance. This means the bears will not surrender their advantage easily.

When the cost turns lower in the current level, the bears will attempt to drag the ETH/USDT pair to $1,050. It is really an important level to take into consideration just because a break below it might claim that bears have been in control.

On the other hand, when the cost appears in the current level or increases from $1,050, the bulls will attempt to propel the happy couple over the 20-day EMA. When they manage to achieve that, the happy couple could rally towards the breakdown degree of $1,700. A rest and shut above this resistance could indicate the beginning of a brand new upward trend.

BNB/USDT

BNB has been clinging towards the 20-day EMA ($241) since June 24. This means the bears are protecting the amount however the bulls haven’t yet quit because they anticipate moving greater.

If buyers thrust the cost over the 20-day EMA, the BNB/USDT pair could rally towards the 50-day SMA ($277). This level may again behave as a stiff hurdle but when entered, the happy couple could chance a rally toward $350.

On the other hand, when the cost turns lower in the current level, the happy couple could drop to $211. It is really an important level to keep close track of just because a rebound off it’ll claim that bulls are trying to form a greater low. However, if the level cracks, the happy couple could retest the vital support at $183.

XRP/USDT

Ripple (XRP) broke and closed over the overhead resistance at $.35 on June 24 however the bulls couldn’t obvious the barrier in the 50-day SMA ($.38). This means the bears are protecting the amount strongly.

A small positive would be that the bulls haven’t permitted the cost to dip back underneath the 20-day EMA ($.35). This means buying on dips. When the cost rebounds from the current level, the bulls will again make an effort to push the cost over the 50-day SMA.

Whether they can accomplish it, it’ll claim that the downtrend might be weakening. The XRP/USDT pair could then rise to $.45.

Another possibility is the fact that bears pull the cost back below $.35. In the event that happens, the happy couple could slide to $.32 after which to $.28.

ADA/USDT

The buyers pressed Cardano (ADA) over the 20-day EMA ($.50) on June 26 however the lengthy wick around the candlepower unit implies that bears strongly offered at greater levels.

A small positive would be that the bulls haven’t quit ground and therefore are again trying to obvious the overhead hurdle in the moving averages. When they succeed, the ADA/USDT pair could rise toward $.70 in which the bears may again set up a powerful defense.

When the cost turns lower dramatically out of this level, it’ll claim that the happy couple may remain range-bound between $.40 and $.70 for many additional time.

This positive view might be negated for the short term when the cost turns lower in the current level and breaks below $.44. That may pull the happy couple to $.40.

SOL/USDT

Solana (SOL) continues to be stuck between your moving averages since June 24. This means that bears can sell on rallies towards the 50-day SMA ($43) and bulls are purchasing on dips towards the 20-day EMA ($38).

The moving averages are near to a bullish crossover and also the relative strength index (RSI) is close to the midpoint, suggesting that bulls try a comeback. If buyers propel the cost over the 50-day SMA, the SOL/USDT pair could rise to $60.

This level may again behave as a stiff resistance but when bulls obvious this hurdle, the momentum could get. On the other hand, when the cost turns lower and plunges underneath the 20-day EMA, it’ll claim that bears have overpowered the bulls. The happy couple could then slide to $33.

DOGE/USDT

Dogecoin (DOGE) broke and closed over the 20-day EMA ($.07) on June 25. The buyers extended the recovery on June 26 and pressed the cost towards the 50-day SMA ($.08) however the lengthy wick around the candlepower unit shows that bears are protecting the amount with vigor.

The buyers are again attempting to push the cost over the 50-day SMA. When they manage to achieve that, the Us dot/USDT pair could rally to $.09 after which towards the mental level at $.10. This level could again behave as a resistance but when bulls overcome this barrier, the momentum will probably get.

Alternately, when the cost does not sustain over the 50-day SMA, it’ll claim that bears still sell on rallies. The bears will attempt to pull the cost back underneath the 20-day EMA.

Related: Dogecoin cost could rally 20% in This summer with this particular bullish reversal pattern

Us dot/USDT

The bears happen to be strongly protecting the 20-day EMA ($8.11) in Polkadot (Us dot) since June 24 however a positive sign is the fact that bulls haven’t quit much ground. A good consolidation near a resistance usually resolves towards the upside.

If buyers drive the cost over the 20-day EMA, the Us dot/USDT pair could rise towards the 50-day SMA ($9.13). This level may again behave as a hurdle but the probability of a rest above it’s high. In the event that happens, the happy couple could rally to $10.75.

Unlike this assumption, when the cost turns lower in the 20-day EMA, it’ll claim that bears are active at greater levels. The sellers will attempt to pull the happy couple below $7.30 and challenge the important support at $6.36.

SHIB/USDT

Shiba Inu (SHIB) broke over the 50-day SMA ($.000011) on June 25 however the bulls couldn’t continue the recovery. The bears offered near $.000012 on June 26 and are attempting to pull the cost back underneath the 50-day SMA.

The 20-day EMA ($.000010) has began to show up progressively and also the RSI is incorporated in the positive territory. This means that buyers possess a slight edge. When the cost rebounds from the current level or even the 20-day EMA, the bulls will again make an effort to resume the up-move.

When the cost increases above $.000012, the SHIB/USDT pair could rally towards the overhead resistance at $.000014. This positive view might be negated for the short term when the cost turns lower and plummets underneath the 20-day EMA.

AVAX/USDT

Avalanche (AVAX) continues to be stuck inside a tight range from the 20-day EMA ($20) and also the overhead resistance at $21.35 since June 25. This means indecision one of the bulls and also the bears.

The 20-day EMA has flattened out and also the RSI is simply underneath the midpoint, which implies an equilibrium between consumers. If bulls push the cost above $21.35, the AVAX/USDT pair could rally towards the 50-day SMA ($25). This level may behave as a small hurdle but when entered, the happy couple may rise to $30.

This positive view could invalidate for the short term when the cost turns lower in the current level or even the 50-day SMA and plummets underneath the 20-day EMA. That may open the doorways for any possible decline to $16.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.