A gentle feeling of hope emerged among Bitcoin (BTC) investors following the June 18 drop to $17,600 gets to be more distant as well as an early climbing pattern points toward $21,000 within the short-term.

Recent negative remarks from lawmakers ongoing to curb investor optimism. Within an interview with Cointelegraph, Swiss National Bank (SNB) deputy mind Thomas Muser stated the decentralized finance (DeFi) ecosystem would disappear if current financial rules are implemented within the crypto industry.

Articles printed in “The People’s Daily” on June 26 pointed out the Terra network’s collapse and native blockchain expert, Yifan He known crypto like a Ponzi plan. When requested by Cointelegraph to explain the statement on June 27, Yifan He mentioned that “all unregulated cryptocurrencies including Bitcoin are Ponzi schemes according to my understanding.”

On June 24 Sopnendu Mohanty the main FinTech officer of the Financial Authority of Singapore (MAS) promised to become “brutal and unrelentingly hard” on any “inappropriate behavior” in the cryptocurrency industry.

Ultimately, Bitcoin investors face mixed sentiment as some think the underside is within and $20,000 is support. Meanwhile, others fear the outcome that the global recession might have on risk assets. Because of this, traders should evaluate derivatives markets data to know if traders are prices greater likelihood of a downturn.

Bitcoin futures show a well-balanced pressure between consumers

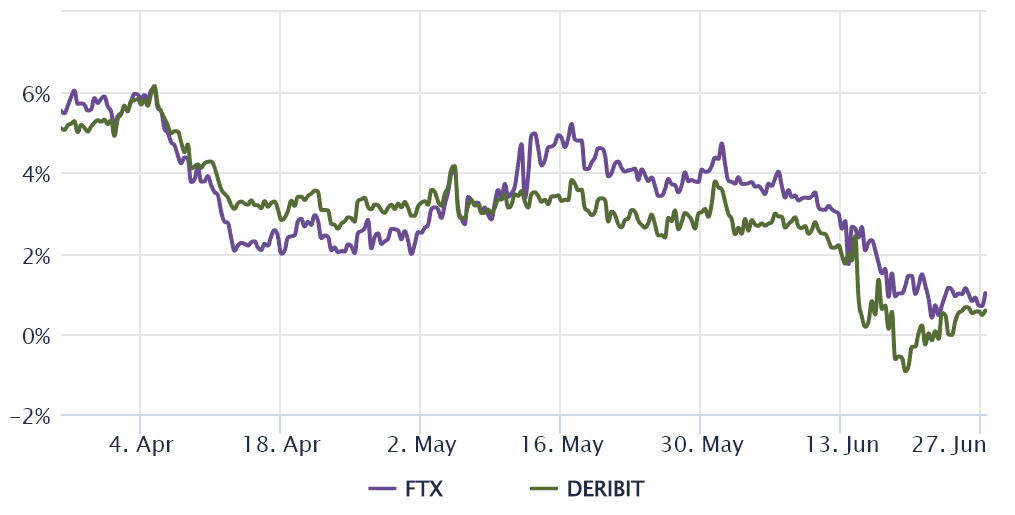

Retail traders usually avoid monthly futures as their cost is different from regular place markets at Coinbase, Bitstamp and Kraken. Still, individuals are professional traders’ preferred instruments because they steer clear of the funding rate fluctuation from the perpetual contracts.

These fixed-month contracts usually trade in a slight premium to place markets because investors require more money to withhold the settlement. Consequently, futures should trade in a 5% to 10% annualized premium in healthy markets. You ought to observe that this selection isn’t only at crypto markets.

Whenever this indicator fades or turns negative, it is really an alarming, bearish warning sign signaling a scenario referred to as backwardation. The truth that the typical premium barely touched the negative area while Bitcoin traded lower to $17,600 is outstanding.

Despite presently holding an very low futures premium (basis rate), the marketplace has stored a well-balanced demand between leverage consumers.

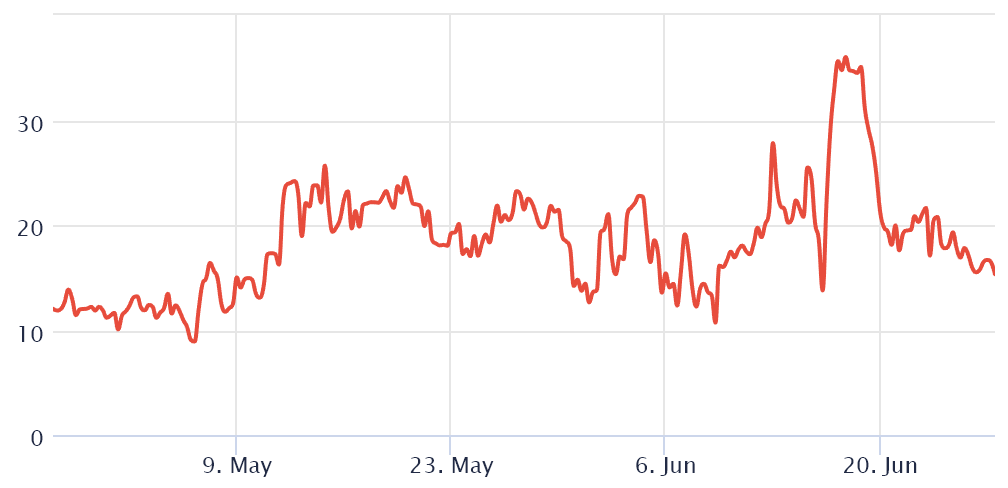

To exclude externalities specific towards the futures instrument, traders should also evaluate the Bitcoin options markets. For example, the 25% delta skew shows when Bitcoin whales and arbitrage desks are overcharging for downside or upside protection.

During bearish markets, options investors give greater odds for any cost crash, resulting in the skew indicator to increase above 12%. However, a market’s generalized FOMO induces an adverse 12% skew.

After peaking at 36% on June 18, the greatest-ever record, the indicator receded to the present 15%. Options markets had proven extreme risk-aversion until June 25, once the 25% delta skew finally broke below 18%.

The present 25% skew indicator is constantly on the display greater perils of a drawback from professional traders however it no more sits in the levels reflecting extreme risk aversion.

Related: Celsius Network hires advisors in front of potential personal bankruptcy – Report

The underside might be in based on on-chain data

Some metrics claim that Bitcoin might have bottomed on June 18 after miners offered significant amount of BTC. Based on Cointelegraph, this signifies that capitulation has happened and Glassnode, an on-chain analysis firm, shown the Bitcoin Mayer Multiple fell below .5 that is very rare and has not happened since 2015.

Whales and arbitrage desks might take a moment to regulate after key players like Three Arrows Capital face serious contraction and liquidation risks because of insufficient liquidity or excessive leverage. Until there’s enough evidence the contagion risk is alleviated, Bitcoin cost most likely still trade below $22,000.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.