Bitcoin (BTC) performed wait-and-see with traders on June 28 as Wall Street opened up to flat performance.

Bollinger eyes “logical place” for Bitcoin bottom

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling $21,000 on Bitstamp, refusing to invest in a strong trend.

The happy couple nevertheless prevented fresh indications of weakness, leading Cointelegraph contributor Michaël van de Poppe to think that the attack on important levels — particularly the 200-week moving average near $22,400 — might be next.

#Bitcoin bounced upwards after sweeping the lows at $20.6K.

Honestly, was expecting an additional correction towards $20.3K.

Still lengthy on my small positions on $FTM, $ADA, $AVAX & $ETH, as I am still presuming we’ll see continuation towards $22.4K and perhaps $23.1K. pic.twitter.com/dbwYQiuZZL

— Michaël van de Poppe (@CryptoMichNL) June 28, 2022

“Previously, Bitcoin is a steal under its recognized cost, i.e., aggregate cost foundation of all coins in supply. The recognized cost is presently sitting around $22,500,” popular buying and selling account Bet on Trades added.

While couple of expected a obvious bullish trend to emerge, lengthy-term perspectives also placed importance on current cost levels.

Included in this was John Bollinger, creator from the Bollinger bands volatility indicator, who inside a fresh undertake BTC/USD flagged the culmination of the trend years within the making.

The following move, he recommended, is possibly greater following a “picture perfect” double top pattern on Bitcoin in 2021.

Picture perfect double (M-type) top in BTCUSD around the monthly chart filled with confirmation by BandWidth and %b results in a tag from the lower Bollinger Band. No manifestation of one yet, but this is may well place to set up a bottom.https://t.co/KsDyQsCO1F

— John Bollinger (@bbands) June 27, 2022

Research: “Just about all” Bitcoin metrics whatsoever-time lows

Further analysis of if the bottom is within for Bitcoin originated from on-chain analytics firm Glassnode because the week started.

Related: 3 charts showing this Bitcoin cost drop is unlike summer time 2021

In the latest weekly e-newsletter, “A Few Days On-Chain,” Glassnode dissected a raft of on-chain metrics in a variety of stages of signaling a bottom formation.

Within an unparalleled macro atmosphere, however, nothing was certain.

“Inside the current macroeconomic framework, all purchases and historic precedents could be offer the exam,” it concluded.

“In line with the current positioning of Bitcoin prices in accordance with historic floor models, the marketplace has already been in an very improbable level, with simply .2% of buying and selling days finding yourself in similar conditions.”

It noted that individuals who’d bought BTC in 2020 and 2021 had provided the driving pressure behind recent selling.

“Just about all macro indicators for Bitcoin, varying from technical to on-chain, are in all-time lows, coincident with bear market floor formation in the past cycles. Most are buying and selling at levels with only single-digit percentage points of prior history at similar levels,” the e-newsletter added.

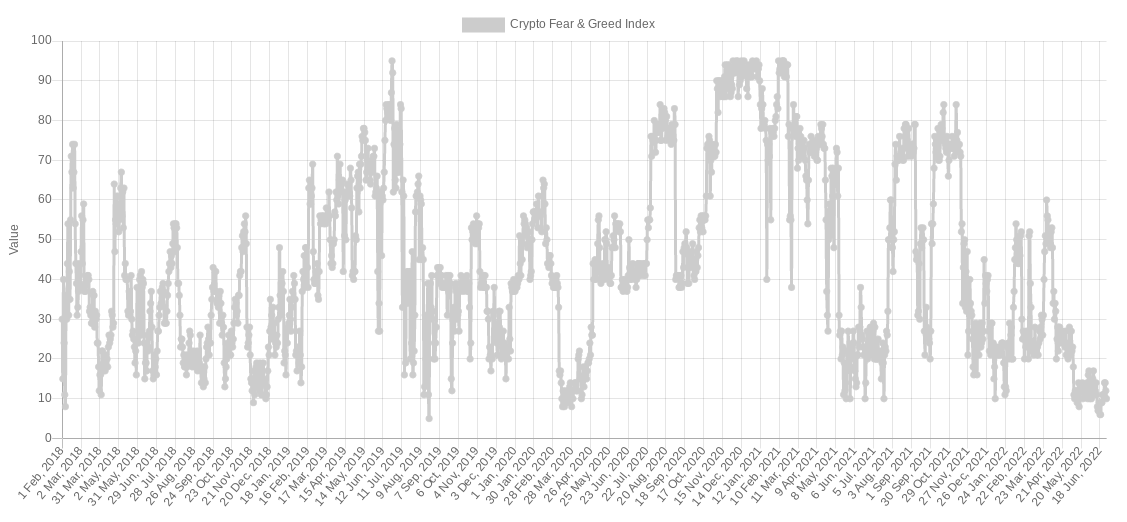

Sentiment wasn’t any different at the time, using the Crypto Fear & Avarice Index at 10/100 or “extreme fear,” also constituting a vintage reversal level in bear markets passed by.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.