In the monthly crypto tech column, Israeli serial entrepreneur Ariel Shapira covers emerging technologies inside the crypto, decentralized finance (DeFi) and blockchain space, in addition to their roles in shaping the economy from the twenty-first century.

The crypto market, just like every other market, runs in cycles. Despite the fact that digital assets are known, otherwise infamous, to be more volatile than a number of other asset types, their cost action still follows a well-recognized pattern of highs and lows. A number of this, for example Bitcoin’s (BTC) four-year cycle, largely comes lower towards the algorithm’s intrinsic rules — more particularly, the halving of miners’ rewards. Off-chain factors, like the U.S. tax-reporting rules, may also come up.

Still, as the market’s logic dictates change, the logic itself remains largely constant. Quite simply, in the same manner a bull run eventually has no steam and hits a plateau, bears eventually lose grasp from the market too, giving method to another upshoot.

For the time being, obviously, the marketplace is still dealing with Terra’s crash and lots of other pressures that there’s been an abundance of previously couple of years. As fragile since it’s rebound attempts might be, so that as red as every gold coin is when compared with only a couple of several weeks ago, the worldwide crypto scene is hunkering lower and powering on in watch for another bull run. So, where would it originate from?

Related: How you can survive inside a bear market? Strategies for beginners

National governments

Only a couple of years back, the concept that Bitcoin might be legal tender in almost any given nation appeared just like a far-fetched delusion. But, after El Salvador’s daring Bitcoin gambit, the Central African Republic (Vehicle) became a member of the fray at the end of April, granting Bitcoin along with other cryptocurrencies the status of legal tender.

Both of these countries alllow for a fascinating comparison. It’s right now common understanding within the crypto space that remittances from abroad constitute a significant part of El Salvador’s budget, which fact was viewed as the economical rationale behind the experiment. While reports suggest the operation is shaky, the nation’s government does shop for Bitcoin, embracing the “buy the dip” stratagem.

Using the Vehicle, things couldn’t happen to be more different. The economy from the war-ravaged nation continues to be ailing for quite a while. In addition, no more than 10% from the country’s population has access to the internet, based on World Bank data. Quite simply, using crypto will probably be limited to a little area of the population — and, because of the geopolitical and native context from the move, the prospects can certainly be rather murky.

Still, more emerging economies might want to follow, especially considering that El Salvador isn’t the only nation leaning a great deal on remittance transfers for budget cash. Even the truth that there’s precedent for that’s large enough to obtain the momentum going, and really should even yet another nation join the club this season, the crypto markets knows it.

Related: El Salvador’s Bitcoin Law: Understanding options to government intervention

Blockchain for institutions

As the early crypto rallies mainly originated from private retail investors and traders, institutional investors happen to be joining the fray too recently. From top banks and hedge funds delving in to the crypto space to fintech giants adding support for digital assets for their platforms, institutional adoption is not a fantasy — it’s reality.

The inside-baseball use cases, for example JPMorgan tinkering with its private blockchain intended for interbank use or several top information and communication technology providers tapping ClearX’s blockchain solution for data-on-demand services, matter. They add extra credibility towards the technology powering the crypto ecosystem, which contributes to lengthy-term investor confidence.

Despite the fact that a number of enterprise-grade blockchain projects will probably remain on private blockchains, the growing investor confidence within the technology will probably further normalize crypto making headlines and draw more eyes towards the public blockchain space. In addition, such projects make for an entire specialized niche of solutions that can help companies build their private chains. Another niche might be in bridging these private chains using the public space. Crypto is, in the end, about connectivity and inclusion, so such aspirations only seem sensible.

Asset managers

The very first Bitcoin exchange-traded fund (ETF) within the U.S. required off at the end of 2021, and the quantity of interest it came from investors is yet another testimony to simply how much appetite the marketplace has for crypto exposure. We’ve come enough where some financial advisors are recommending that everybody, no matter how old they are and risk preferences, must have a minimum of some contact with crypto.

Because of a general change in sentiment like this, increasingly more asset managers is going to be searching in to the crypto space, whether it’s on the client’s request or by themselves inclination. At the same time, increasingly more high earners is going to be joining the ranks of crypto investors, getting more quality in to the blockchain economy.

With all of due respect to ETFs along with other traditional assets, any crypto-savvy user will explain that actual crypto is preferable to a conventional asset mimicking its movements. The reason behind that’s that crypto is much more dynamic. Your Ethereum-pegged ETFs (if individuals appear at some point) is only going to sit together with your broker. Using the actual coins, however, you are able to stake, use yield farms, and tap many other DeFi services for additional passive earnings.

In this way, it will likely be interesting to look at and find out if traditional asset managers soon start losing ground to crypto-native alternatives for example EQIFi, supported by EQIBank. Among the platform’s key services is its yield aggregator, which effectively functions being an asset manager by allocating the user’s funds into various DeFi protocols to ensure maximum returns. Such services make crypto more profitable being an asset class that may work with its owner 24/7 through platforms which are always accessible and take only a couple of clicks to handle.

Related: Elusive Bitcoin ETF: Hester Peirce criticizes insufficient legal clearness for crypto

Games and gamers

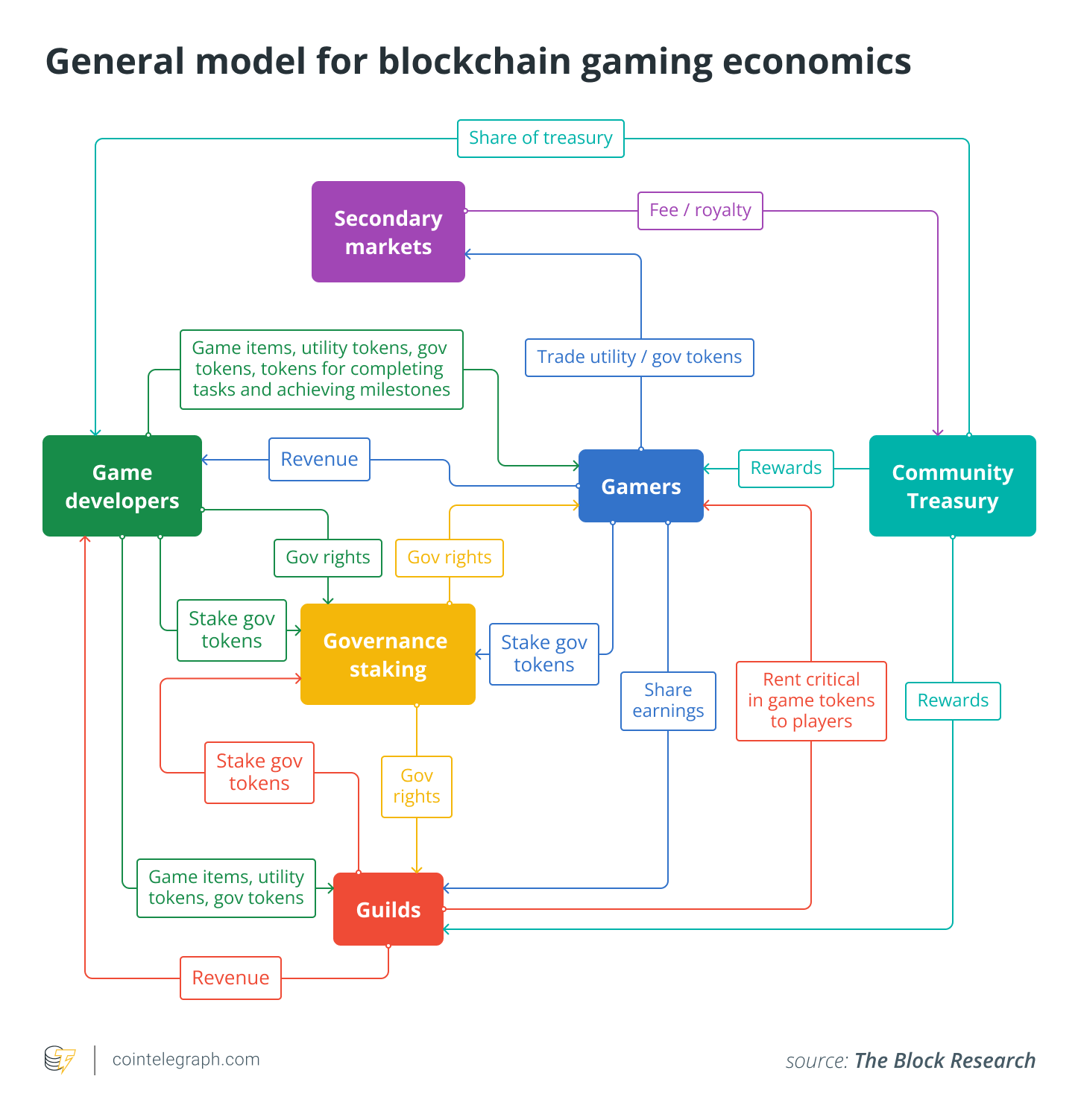

Blockchain games aren’t exactly something totally new, as anybody who remembers the CryptoKitties craze can verify. Still, when Axie Infinity started making the news as individuals the Philippines switched into it looking for an earnings among the COVID-19 pandemic, the play-to-earn industry walked proudly in to the limelight.

Now, it’s not to question if a number of this pride might have been misplaced, because of the plights that Axie Infinity, the industry’s standard-bearer, has become facing. The sport has lengthy had an inflation problem since it’s underlying business design started to provide way. Contributing to this problem was the current hack, among the worst ones on record within the DeFi space.

Axie Infinity’s pains might be yet another situation of the nascent industry working out its very own guidelines. Lots of new projects has become preparing to maneuver this space further, ambitious to create it to AAA-level polish when it comes to visuals and game play. Once these new juggernauts go into the arena, we’ll likely see more gamers start to explore crypto.

It might be tempting to create blockchain gaming off as yet another subset from the retail market, there is however more into it over time. The recording game market is an undisputed powerhouse within the entertainment world, and wherever it is going, its adherents follows. From esports to in-game ads, the standard gaming industry has created several satellite markets, and every one of individuals alllow for new use cases, new audiences and start up business possibilities.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Ariel Shapira is really a father, entrepreneur, speaker, cyclist and can serve as founder and Chief executive officer of Social-Knowledge, a talking to agency dealing with Israeli startups and helping these to establish connections with worldwide markets.