A brand new economic climate a far more democratized, much more inclusive, financial sector the way forward for the web — the crypto ecosystem continues to be referred to as many of these things. However, out of the box evidenced by digital assets’ natural correlation using the Nasdaq 100, many people neglect to conceptualize blockchain as anything apart from extra time from the traditional tech economy. While blockchain’s proponents laud its benefits and potential, they’ve been not able to create a comprehensive situation for blockchain to people.

Many crypto natives anticipate “the decoupling,” by which digital assets become financially independent from traditional tech equities. But with no obvious strategy for the way to distinguish decentralized crypto technology, industry independence is going to be unrealized. Individuals people who have confidence in the lengthy-term commitment of blockchain technology have to completely re-think how you can pitch blockchain to broader society.

Related: A brand new intro to Bitcoin: The 9-minute read that may improve your existence

What’s “the decoupling”?

The Bitcoin (BTC) whitepaper — printed 14 years back — shown, at its core, the ambition to construct an enormous amount of permissionless, decentralized payments. Up to now, this goal continues to be partly advanced with developments like El Salvador’s national Bitcoin adoption.

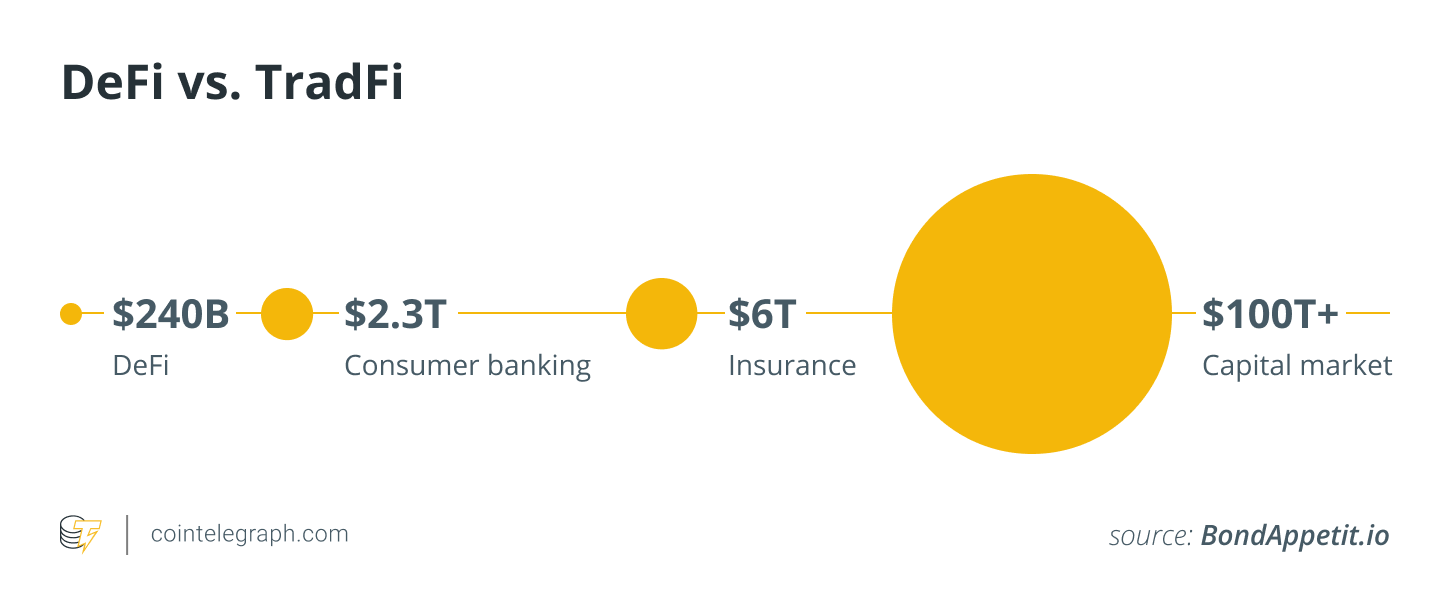

However, the cryptocurrency ecosystem hasn’t supplanted traditional finance. Actually, it’s ingrained itself in it. Switch on CNBC and you’ll learn about the most recent legacy institution entering the crypto space, and you’ll see minute-by-minute graphs of crypto cost action alongside types of traditional equity markets. You likely won’t hear any blockchain commentator or leader in the industry talking about improving financial transactions, eliminating third-party financial institutions, or other defining aspect of the original crypto ethos.

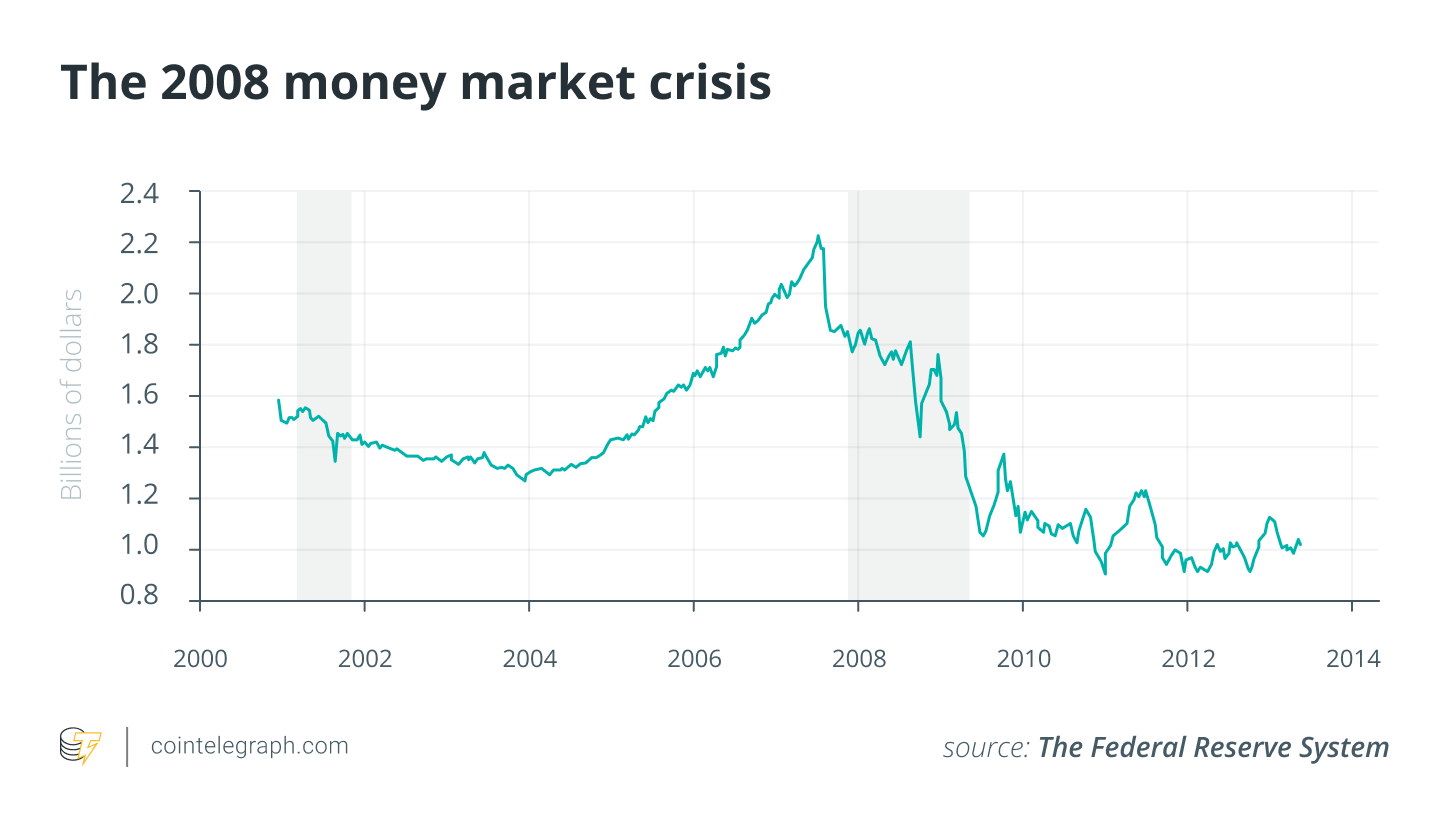

Caused by this broad alternation in purpose and perception is the fact that crypto — despite being created lessen reliance on traditional finance — grows and declines using the movements and behaviors from the traditional economy. Obviously, the Fed’s meeting memos and Amazon’s quarterly earnings calls have, at the moment, a better sway around the crypto ecosystem than anything specified by Satoshi Nakamoto’s whitepaper.

If cryptocurrency can’t be financially independent in the legacy financial and technical industry it seeks to exchange, what’s the reason for cryptocurrency? Decoupling isn’t an industry luxury — it’s a necessary step for that industry’s survival.

Related: The significant shift from Bitcoin maximalism to Bitcoin realism

So how exactly does crypto decouple?

The broader community must acknowledge a couple of things. First, you can’t wish the right path right into a new financial reality the decoupling won’t happen simply because we would like it to. Second, it’s stated that madness does exactly the same factor again and again while expecting spun sentences. The narratives which have built crypto to the current status arrived at the boundaries of the influence ongoing adherence towards the same strategy will undoubtedly perpetuate stagnation.

To completely decouple, I suggest three broad steps:

- We, within the crypto-community, make blockchain technology and narratives more approachable

- We concentrate on use cases with tangible real-world effects and

- We highlight the obvious juxtaposition between crypto and it is alternatives.

Approachable blockchain technology and narratives

Jargon may be the antithesis of ease of access. Technically complex language can be a mainstay in information technology circles but, to a lot of the population, terms like zero-understanding proofs, and layer 2 interoperability protocol, may as well be Latin. Ironically, for blockchain to decouple from tech, the expertise of using it must be a lot more like those of Meta.

Say what you should about Facebook and it is sister products, however, you cannot deny they have become both indispensable to teenagers and addictive for grandma and grandpa — for crypto to sustain lengthy-term growth, it has to emulate this model built around approachability. Nobody interfacing with Facebook needs to understand the intricacies of their base algorithms. They simply type and scroll. This must be the amount of intuition needed to have interaction with crypto. Crypto cannot belong solely to computer nerds it has to make its situation across society.

Related: In defense of crypto: Why digital currencies deserve a much better status

Use cases with tangible real life effects

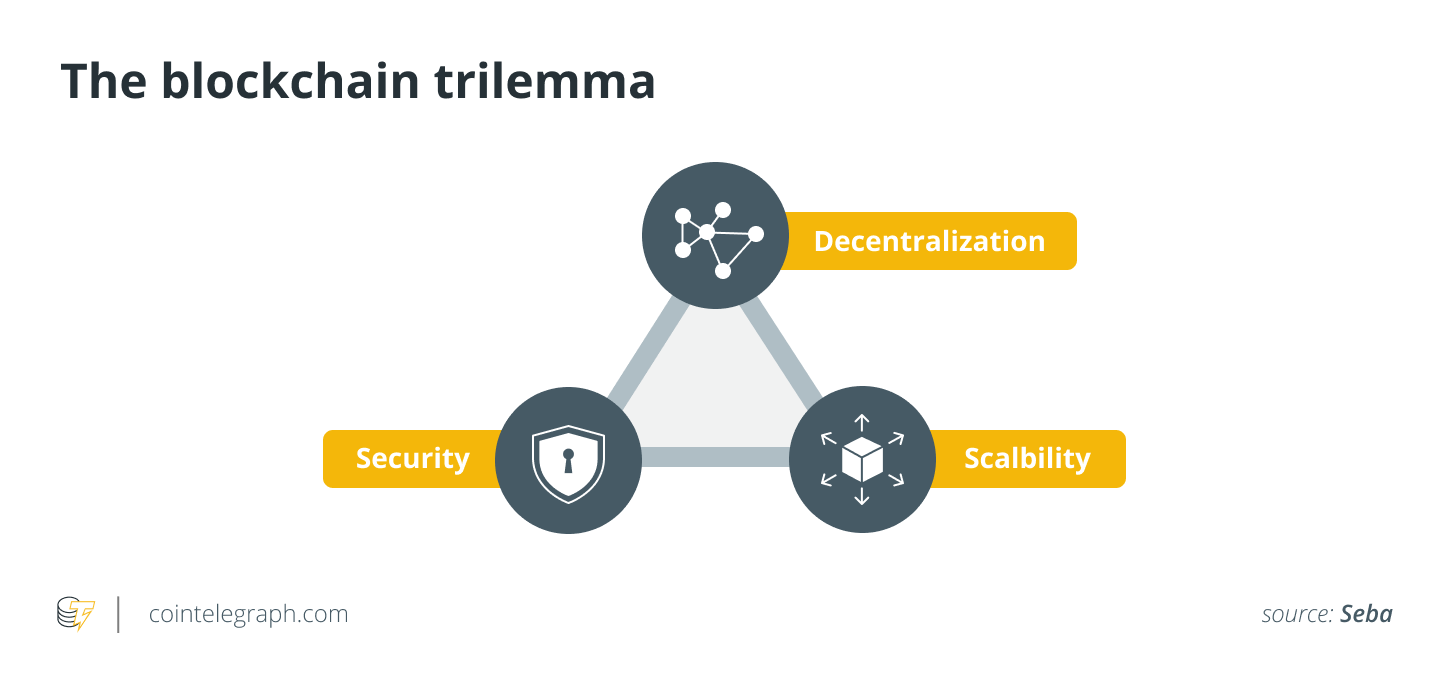

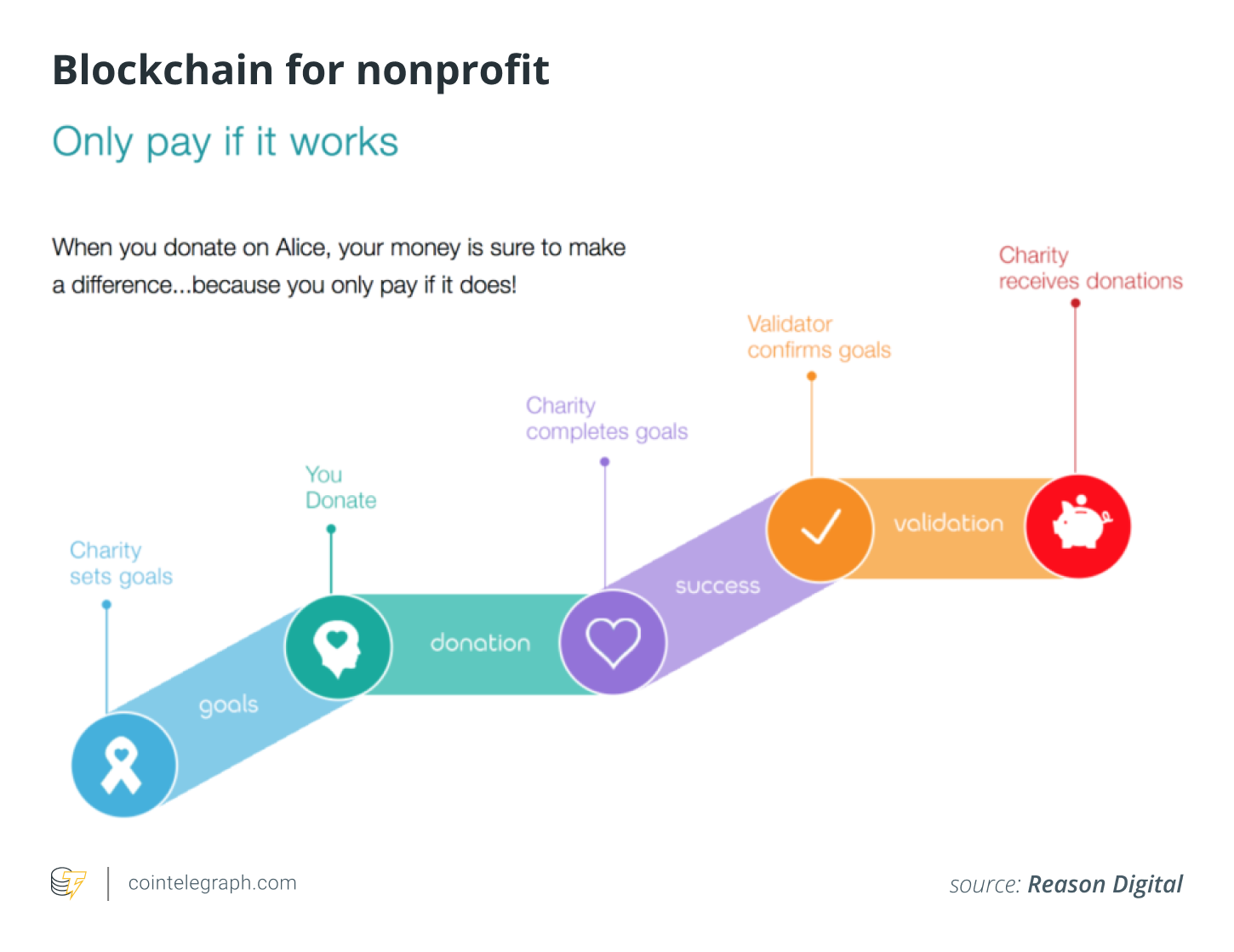

The crypto community must determine if blockchain is really a jack of trades, or perhaps a master of some. Even though many pitch blockchain like a universal technology able to transforming whole industries, there’s been little evidence that blockchain alone is really a silver bullet its today’s-day woes. A minimum of for a while, it is best to pay attention to creating real-world transformational alternation in a couple of key sectors instead of going after numerous theoretical, yet unrealized, applications.

The utilization cases using the maximum potential are individuals individuals in the center of Nakamoto’s whitepaper — those most foundational to crypto natives: a cash system immune from government interference, a mix-border economic climate available to the 99%, along with a novel possession mechanism able to providing people with possession over financial infrastructure. The remainder is noise.

Juxtaposing blockchain using its alternatives

The main reason I acquired into crypto is straightforward: It’s unrivaled possibility to improve specific, yet critical, facets of our economic climate. The vision organized by Nakamoto’s whitepaper — forged in the middle of an unparalleled economic crisis — colored an image of the economically empowered society. While big banks’ avarice produced financial chaos, Nakamoto described a global where individuals would, essentially, be their very own bankers. Using novel blockchain technology, mix-border transfers turn into fully frictionless. Financial privacy could safeguard vulnerable people’s savings from major corporations and autocratic governments. Crypto’s inherently limited supply could safeguard against economically corrosive inflationary policies.

These core concepts are central towards the origins of blockchain and are required to secure its future. We’re already seeing these concepts for action. In El Salvador, Bitcoin institutionalization is enabling migrant workers to receive and send funds without troublesome transfer charges. In Ukraine, we view humanitarian donations flowing in to the country via blockchain quicker than official condition aid. As the story of crypto continues to be not even close to perfect, these kinds of use cases constantly help remind us of methods crypto can augment the economical power the in the past disadvantaged.

Rome wasn’t built per day blockchain continues to be a fledgling industry barely entering its teenage life. It’s time for you to realize its potential. However, lack of ability to effectively promote its core merits means ongoing “coupling” to established order industries. Without decoupling, crypto’s founding ethos is going to be drowned out by tech volatility, geopolitics, and endless lukewarm commentary from CNBC’s speaking heads.

In order to save crypto out of this fate, we have to double lower on which managed to get revolutionary to begin with.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Dennis Jarvis is definitely an accomplished executive who’s enthusiastic about building stellar groups of people and promoting economic freedom through cryptocurrency adoption. He brings experience from his previous global management roles at Apple and Rakuten in addition to blockchain startup Orb. Dennis became a member of Bitcoin.com in 2018 as Chief Product Officer, and grew to become Chief executive officer of Bitcoin.com in 2020.