Bitcoin (BTC) unsuccessful to reclaim recent losses into This summer 2 as traders ready for stagnant cost action to carry on.

“Downtrend acceleration” still in pressure

Data from Cointelegraph Markets Pro and TradingView tracked a limp BTC/USD because it chopped round the $19,000 mark in to the weekend.

The Wall Street buying and selling week had finished without surprises, with U . s . States equities practically stagnant — supplying little impetus for crypto volatility. The U.S. dollar index, or DXY, fresh from the retest of twenty-year highs, ran from steam to circle 105 points.

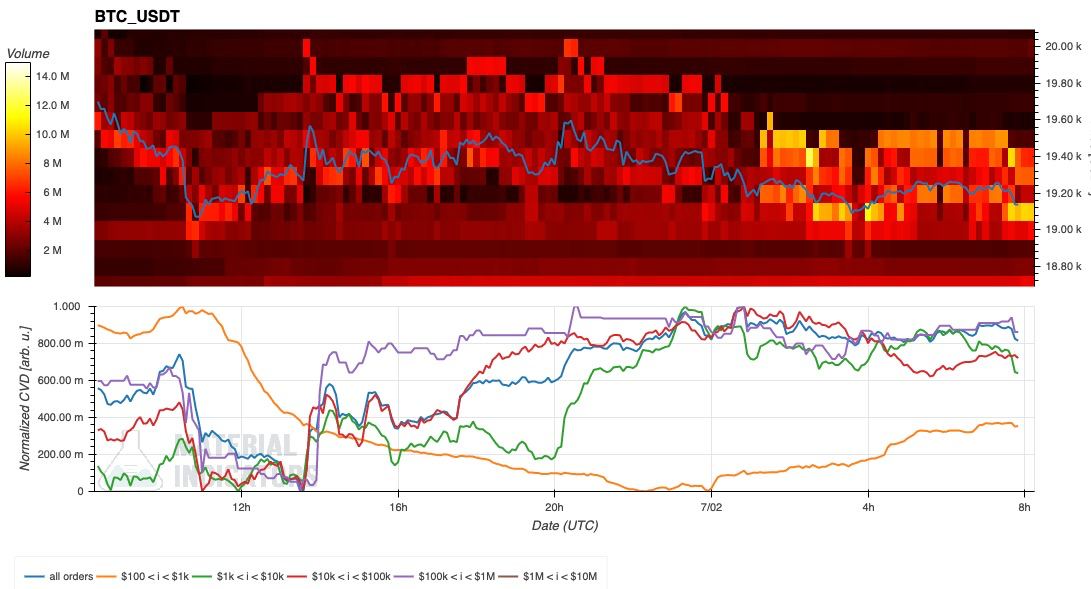

Order book data from largest global exchange Binance demonstrated BTC/USD caught between purchase and sell liquidity near to place cost, making certain too little volatility until traders maneuvered or added considerably to bids or asks.

Zooming out, the outlook hardly appeared anymore positive for bulls.

For popular buying and selling account Altcoin Sherpa, current conditions guaranteed a long duration of uninspiring performance from Bitcoin that could last a lot of 2022.

“Its gonna take several weeks to reduce around and accumulate when the bottom is located,” it told Twitter supporters.

“And the underside may not even come for an additional couple of several weeks from today. Hunker lower for any lengthy bear market IMO.”

The sentiment was echoed by trader and analyst Rekt Capital, who contended that Bitcoin hadn’t yet made new macro lows or began to consolidate.

#BTC can always somewhat be within the “Downtrend Acceleration” phase of their correction

However this phase will precede the “Multi-Month Consolidation” phase

That will precede the “New Macro Uptrend” phase$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) This summer 1, 2022

“Deleverage yourself. Get the Bitcoin into cold storage. Sit tight,” Checkmate, add-chain analyst at research firm Glassnode added.

Will volume all-time highs echo 2018?

The following couple of weeks could end up being this cycle’s lows, meanwhile, lending a diploma of aspire to individuals concerned the bottom continues to be several weeks away.

Related: Cost analysis 7/1: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, Us dot, LEO, SHIB

Inside a Twitter thread at the time, economist, trader and entrepreneur Alex Krueger noted that volume denominated in BTC hit all-time highs recently.

“Typically, buying and selling volume may be the greatest when markets capitulate,” he described.

Typically, buying and selling volume may be the greatest when markets capitulate, and the like capitulation creates major bottoms.

This weekly chart includes the aggregated bitcoin volume for many BTC pairs (place & perpetuals across exchanges).

Volume hit its in history high two days ago. pic.twitter.com/6ONLibQiL2

— Alex Krüger (@krugermacro) This summer 2, 2022

Within the 2018 bear market, he added, the amount all-time full of fact happened several days prior to the cost bottom, and really should this time around stick to the trend, This summer may be the site from the next.

Formerly, Rekt Capital had contended that buy-side volume was not sufficiently strong to sustain fresh cost upside within the lengthy term, whilst highlighting the 2018 volume moves.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.