Bitcoin (BTC) is not this the best value because it cost $1,130, one analyst argues as BTC provides a “compelling” risk/reward ratio.

Inside a Twitter thread on This summer 7, Jurrien Timmer, director of worldwide macro at asset manager Fidelity Investments, simply described $20,000 Bitcoin as “cheap.”

Timmer: “Quite simply, Bitcoin is affordable”

While fears that crypto markets could suffer further drawdowns this season remain, some think that current Bitcoin cost levels offer the type of good value not observed in years.

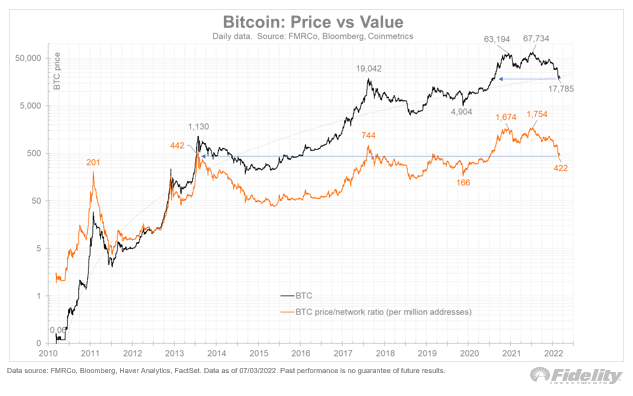

Analyzing the BTC cost versus the amount of non-zero addresses — wallets having a positive balance — Timmer figured that BTC/USD has become back at where it had been in the peak from the 2013 bull market.

At that time, BTC/USD were able to hit around $1,130 before spending many years consolidating because of the demise of exchange Mt. Gox.

“I make use of the cost per countless non-zero addresses being an estimate for Bitcoin’s valuation, and also the chart below implies that valuation is completely to 2013 levels, despite the fact that cost is just to 2020 levels,” Timmer described.

“In short, Bitcoin is affordable.”

The Bitcoin cost/network ratio isn’t the only encouraging sign with regards to Bitcoin’s growth regardless of the current bear market. Timmer added that Bitcoin adoption still reflects an upswing from the internet, which the Bitcoin network “appears to become intact” with regards to its growth cycles.

With regards to cost/network ratio, it’s further not only Bitcoin showing indications of solid investment potential.

“If Bitcoin is affordable, then possibly Ethereum cost less,” he authored.

“If ETH is how BTC was 4 years ago, then your analog below shows that Ethereum could bond with a bottom.”

“.5X downside, 12X upside”

$20,000 BTC should meanwhile still give a “compelling” investment situation even going to individuals who think that a 50% cost dip continues to be possible.

Related: This ‘biblical’ Bitcoin pattern suggests BTC cost can rise 30% by October

Which was the final outcome of James Lavish, an old hedge fund manager switched macroeconomics expert, who came focus on the straightforward maths involved with a Bitcoin bet in the current atmosphere.

“At $20K BTC, if you think maybe the downside risk is $10K and also the upside potential is $250K, then at these prices there’s a .5X downside and 12.5X upside. This can be a 25 to at least one Reward to Risk profile,” he told Twitter supporters.

“This is compelling.”

While difficult to picture this year, a $250,000 cost tag for BTC/USD is actually fairly modest by historic standards of cost conjecture.

Among its adherents is millionaire Tim Draper, who nevertheless initially was adamant that Bitcoin would cost you a quarter of the million dollars by 2022.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.