The Ethereum network moved a measure nearer to finishing its transition to proof-of-stake (PoS) now following the effective completing its second-to-last major Merge trial on the Sepolia public test network.

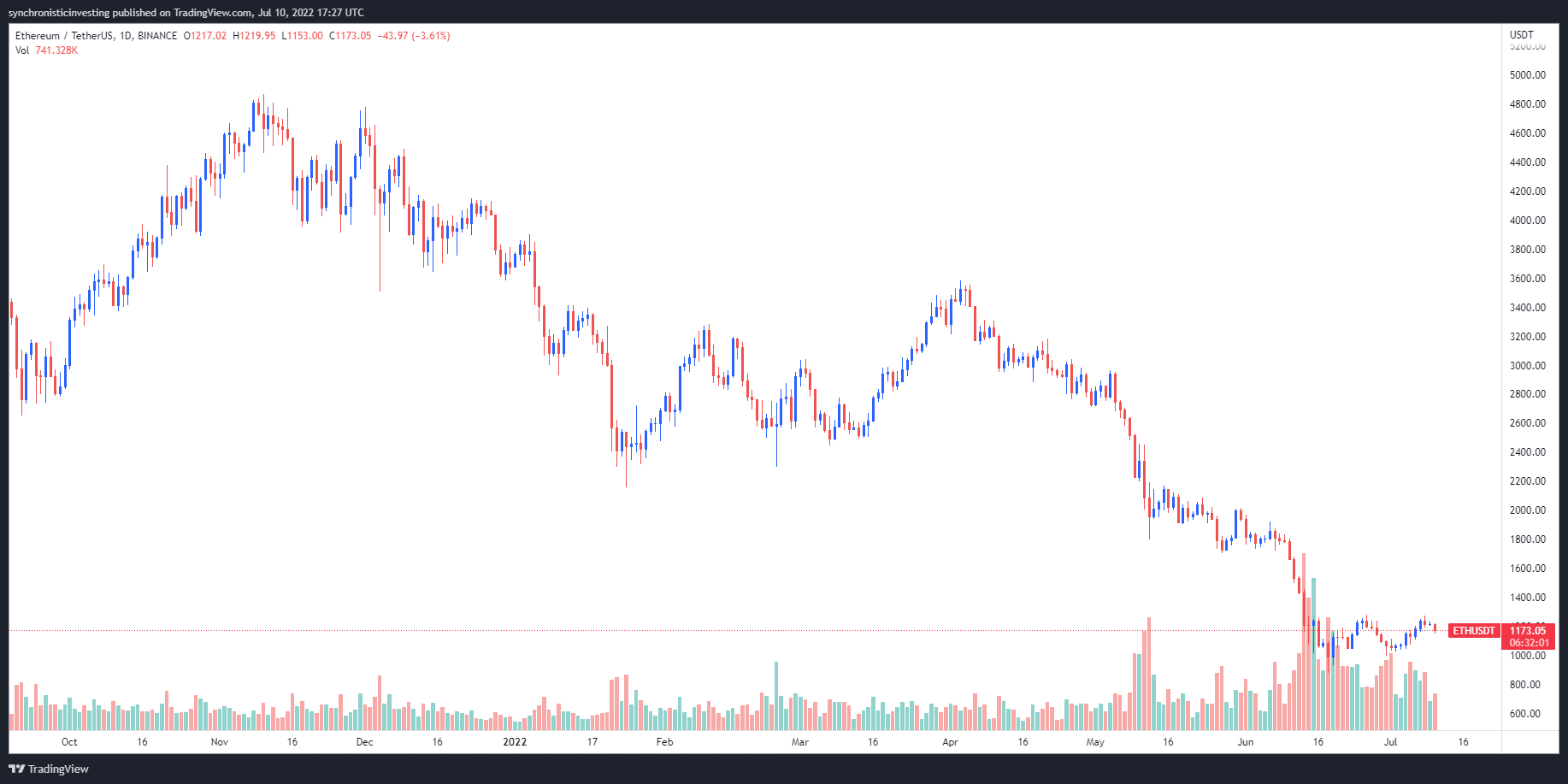

Data from Cointelegraph Markets Pro and TradingView implies that following a Sepolia Merge on This summer 6, the cost of Ether (ETH) rallied to some high near $1,280 on This summer 8 but has since trended lower hitting a regular low of just one,153 on This summer 10.

Using the Ethereum network nearing the house stretch in the shift to PoS, here’s what analysts say might happen using its cost for the short term.

Consider a pullback to $1,020

The current cost action for Ether that adopted the effective Merge on Sepolia “is giving more clearness than $BTC atm [right nowInches based on crypto trader and engineer Crypto Feras, who published the next chart outlining the rejection at $1,280.

Crypto Feras stated:

“PA continues to be showing clean rejection from the range-high. Potential bull-flag being created (insufficient yet). When we continue bleeding below flag support, $1,020 is originating.”

Double top warning

A potentially bearish formation around the chart for Ether was stated by analyst and pseudonymous Twitter user Profit Blue, who published the next chart warning that “both BTC and ETH are developing exactly the same double top pattern and bearish PA.”

Profit Blue stated:

“More bad thing is likely, take notice of the important levels within this chart.”

In line with the chart provided, the main amounts of lower support are located at $1,170, $1,043 and $941.

Related: BTC bull Michael Saylor: Ethereum is ‘obviously’ a burglar

Climbing triangular formation

Overall, the cost of Ether continues to be buying and selling inside a range from $1,050 and $1,245 within the last handful of days, as proven within the following tweet published by Twitter user Nika Deshimaru, which explains the main support and resistance levels for that top altcoin.

Weekly S/R for $ETH: ~1050/1200

Monthly S/R for #ETH: ~1100/1700 (argument for 1400 like a waypoint also)Daily S/R ~1130/1245

Bullish TA lads need to see the triangular meme engage in off the rear of 1M/1W support confluence bounce.

Bears searching at EMA failure, strong resistance. pic.twitter.com/icEe5Sq0m5

— Nika Deshimaru (@Nikadesh) This summer 10, 2022

As highlighted by Deshimaru, bulls have to break with the resistance at $1,200 if they would like to create a sustained move greater, as the bears are searching for that resistance supplied by the 21-day exponential moving average (EMA) to carry firm and then apply downside pressure.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.