Bitcoin wealth has been distributed from weak hands to strong hands because of ongoing capitulation from retail investors and miners, signaling the bottom might be close.

The most recent ‘The Week On-Chain’ report from blockchain analysis firm Glassnode on This summer 11 explains that market capitulations happen to be ongoing for around per month which other signals suggest bottom formations in Bitcoin prices.

However, Glassnode analysts authored the bear market “still requires some duration” as Lengthy-Term Holders (LTH), who generally have greater confidence in Bitcoin like a technology, more and more bear the finest unrealized losses.

“For a bear sell to achieve a supreme floor, the proportion of coins held baffled should transfer mainly to individuals who’re minimal responsive to cost, along with the greatest conviction.”

They added the market may require further “downside risk to completely test investor resolve, and let the marketplace to determine a resilient bottom.”

Unrealized losses are losses within the dollar worth of a holder’s position before selling.

Glassnode chose to make this assessment in line with the observation that in the past bear markets in 2015 and 2018, LTH held over 34% from the Bitcoin (BTC) supply which was in unrealized loss. The STH proportion taken into account just 3% to 4%.

Presently, Short-Term Holders (STH) are holding 16.2% from the coins in loss, while LTH are holding 28.5%. Coins are relocating to new STH who try to speculate on cost but tight on conviction concerning the asset, it added.

This means that as LTH scoop up more coins, they have to have gemstone hands, meaning they have to not sell, for analysts to notice a real market bottom. Cointelegraph echoed this concept acknowledging that Delphi Digital also believes more time is needed under market conditions to this the underside.

Related: Despite ‘worst bear market ever,’ Bitcoin is becoming more resilient, Glassnode analyst states

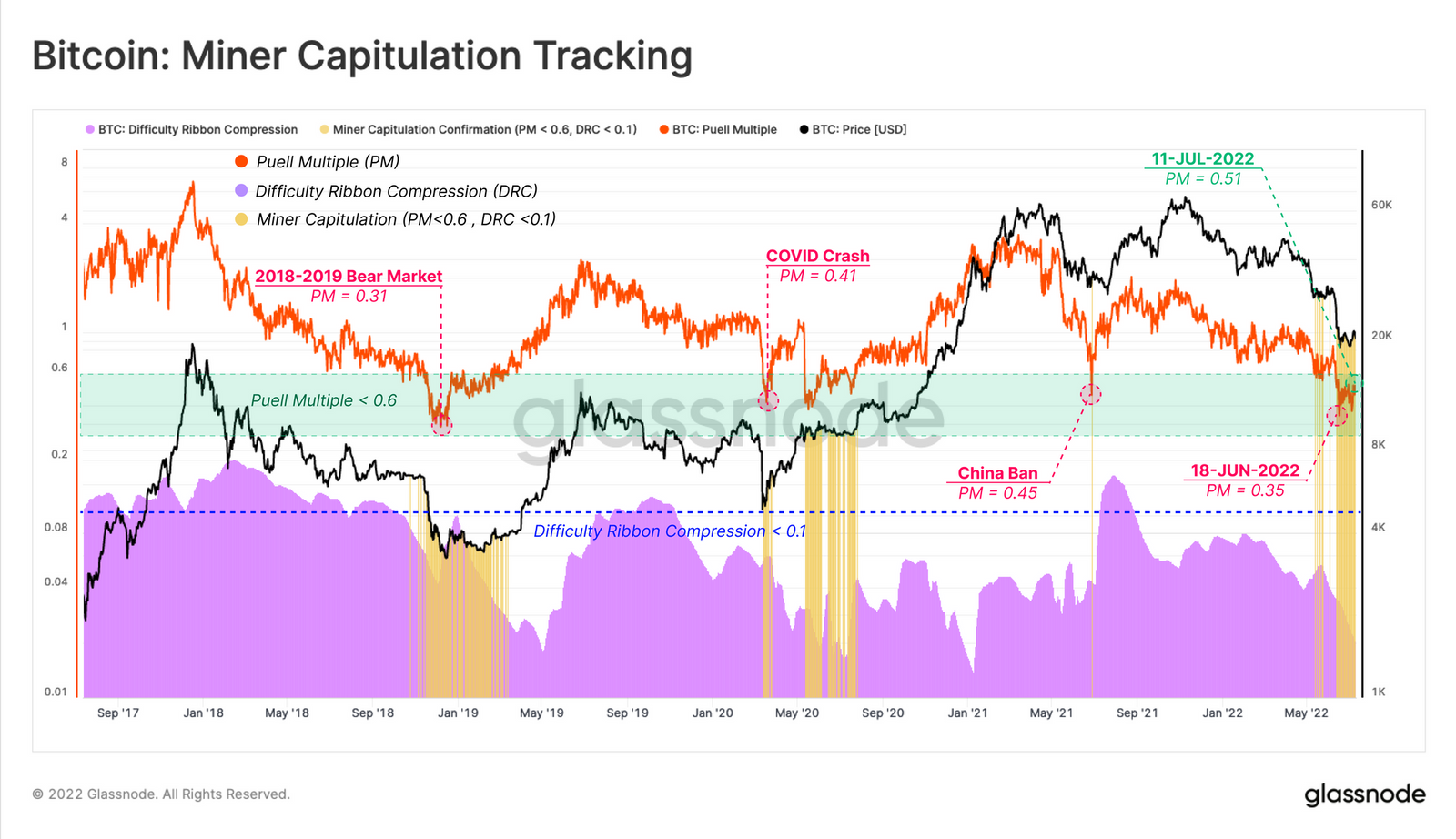

Bitcoin miners selling coins is evidence the market might be testing bottom ranges. Glassnode shown that miners have offered 7,900 BTC since late May but have lately slowed spending to around 1,350 BTC monthly.

Duration is again highlighted like a critical element in figuring out in which the market bottom might be. Throughout the 2018-2019 bear market, miner capitulation required four several weeks to mark the underside they’ve only been selling in 2022 for around a couple of months. Miners still hold about 66,900 BTC, so “the next quarter will probably remain vulnerable to further distribution unless of course gold coin prices recover meaningfully,” the report concluded.

Overall, Glassnode noted the market looks close to the bottom, proclaiming that it “has many hallmarks from the later stage of the bear market” however that investors must be aware that further discomfort might be available.

“Overall, the fingerprint of the prevalent capitulation and extreme financial pressure is unquestionably in position.”

Bitcoin is lower 3% in the last 24 hrs, dipping below $20,000 to $19,939, according to CoinGecko.