Axie Infinity, the blockchain-based game which has popularized the play-to-earn gaming model, frequently invites awe and suspicion. The sport has produced a new kind of business market and enables a fast return for game investors. However, its highly volatile in-game crypto (the graceful Love Concoction, or SLP), the hacking of their Ronin chain, and also the resulting new digital inequality pose threats to the existence. Axie is a kind of “extreme entrepreneurship,” in which failure and success can occur almost overnight, susceptible to the dynamics of SLP. Many predictions happen to be made regarding Axie’s coming collapse and lost trust among its players. Can Axie rise to the former glory among the crypto winter and unsure global economy?

Like a game lover myself, I had been very intrigued regarding Axie Infinity’s future, which brought to my need to research and focus it. I interviewed greater than a dozen Axie managers, guild people, and students –– many are still active while some have quit or gone dormant –– through the first 1 / 2 of 2022. I additionally viewed them playing Axie Infinity while communicating with them to understand the nitty-gritty issues hanging around and assess Axie’s mistakes and potential. I offer some techniques for how Axie can re-engineer its future and move ahead.

Smoothing the interest in SLP

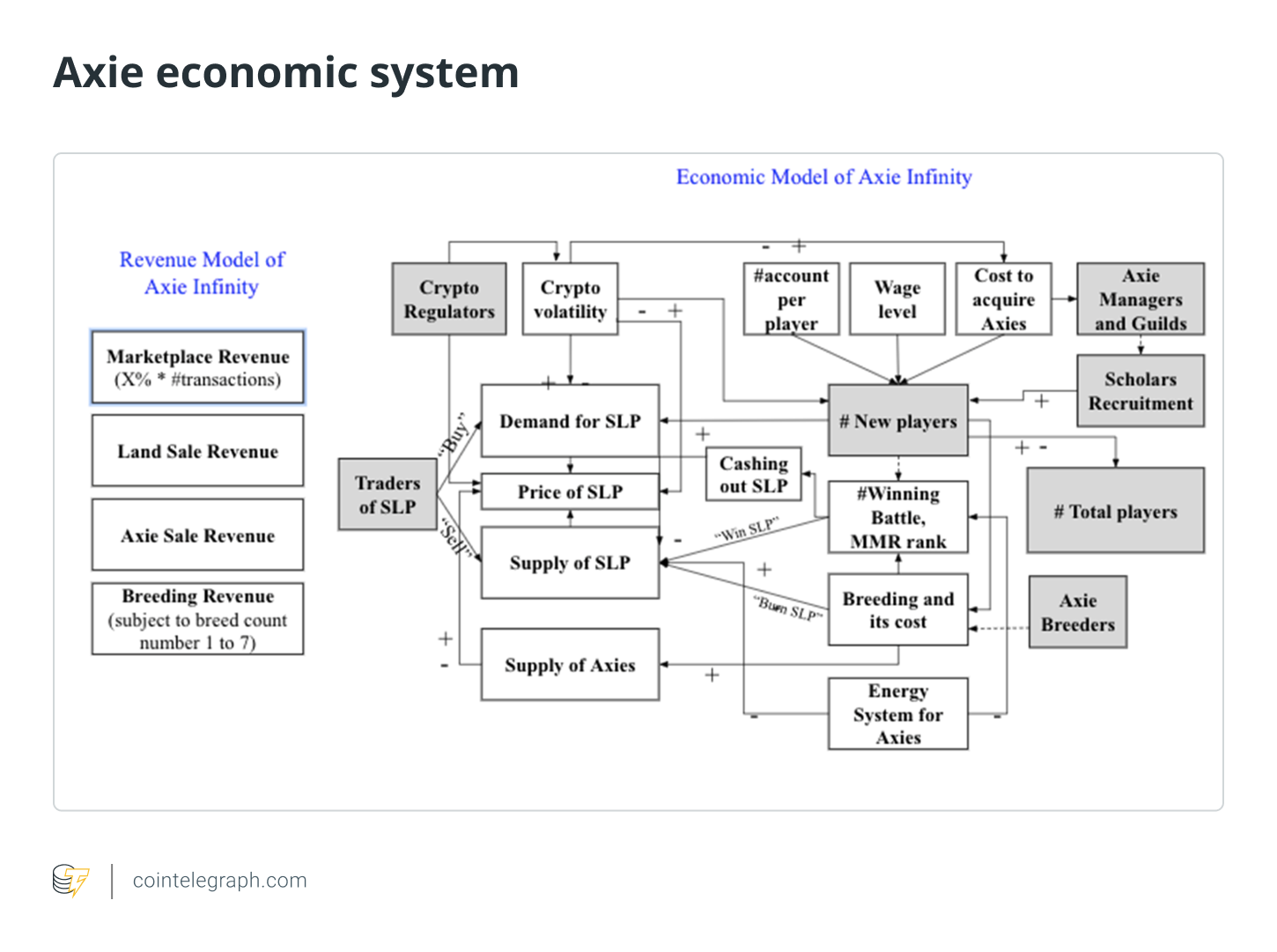

One mistake Axie made was engineering an excessive amount of interest in SLP. New player increase should be stored steady although not grow excessively to be able to provide a smoother demand curve for SLP. This might have prolonged the game’s shelf existence. The price to get Axies (the game’s collectible digital creatures you can use in combat and commerce) –– that will influence how investors and beginners plan their roi (Return on investment) and govern their appetite to recruit new scholars –– ought to be stored steady but slightly growing with time.

Another mistake is the fact that Axie continues to be covered with players from lower-wage countries. This is actually the situation since the SLP earned is extremely attractive when compared with their local living standards. However, it’s too dangerous to bet on one number of players. Risk diversification is essential. Axie can attract players from medium- to high-wage countries and concentrate on the game’s “fun factor” while putting the “earning factor” like a bonus. Moving toward a play-to-own model, where players possess a say around the game’s development, is essential.

Related: Crypto gaming and also the monkey run: The way we should build the way forward for GameFi

Among the greatest mistakes was the abuse of Axie Infinity by multi-account players, which inflated the availability of SLP. I heard tales of single players who performed on as much as 50 accounts using multiple cell phones. Axie was not fast enough to respond to this issue.

Balancing the availability of SLP

Another mistake was Axie’s in-game financial aspects that reward players SLP for those battles won. This seriously inflated the availability of SLP, which brought towards the downfall of their value. One technique to correct this really is introducing more balancing mechanisms that burn SLPs. These include getting an SLP penalty for individuals losing a fight.

Something is the fact that many players don’t spend their hard won SLP. A proper cashing out ratio of SLP is required to prevent an oversupply of SLP. Axie ought to keep the “gas fee” in cashing out SLPs very low, and may introduce a period-based system for cashing out SLPs or losing them, and hang the price of breeding Axies optimal for burning more SLP.

The component of uncertainty is essential in in-game financial aspects to avoid a game title from being exploited by players. Regrettably, Axie has simply been too foreseeable in how players can win SLPs. Another strategy is always to provide a time delay between your breeding and birth of recent Axies, or perhaps adding some SLP costs to boost baby Axies.

Related: How can GameFi and P2E blockchain gaming evolve in 2022? Report

Creativizing the company plan of Axie

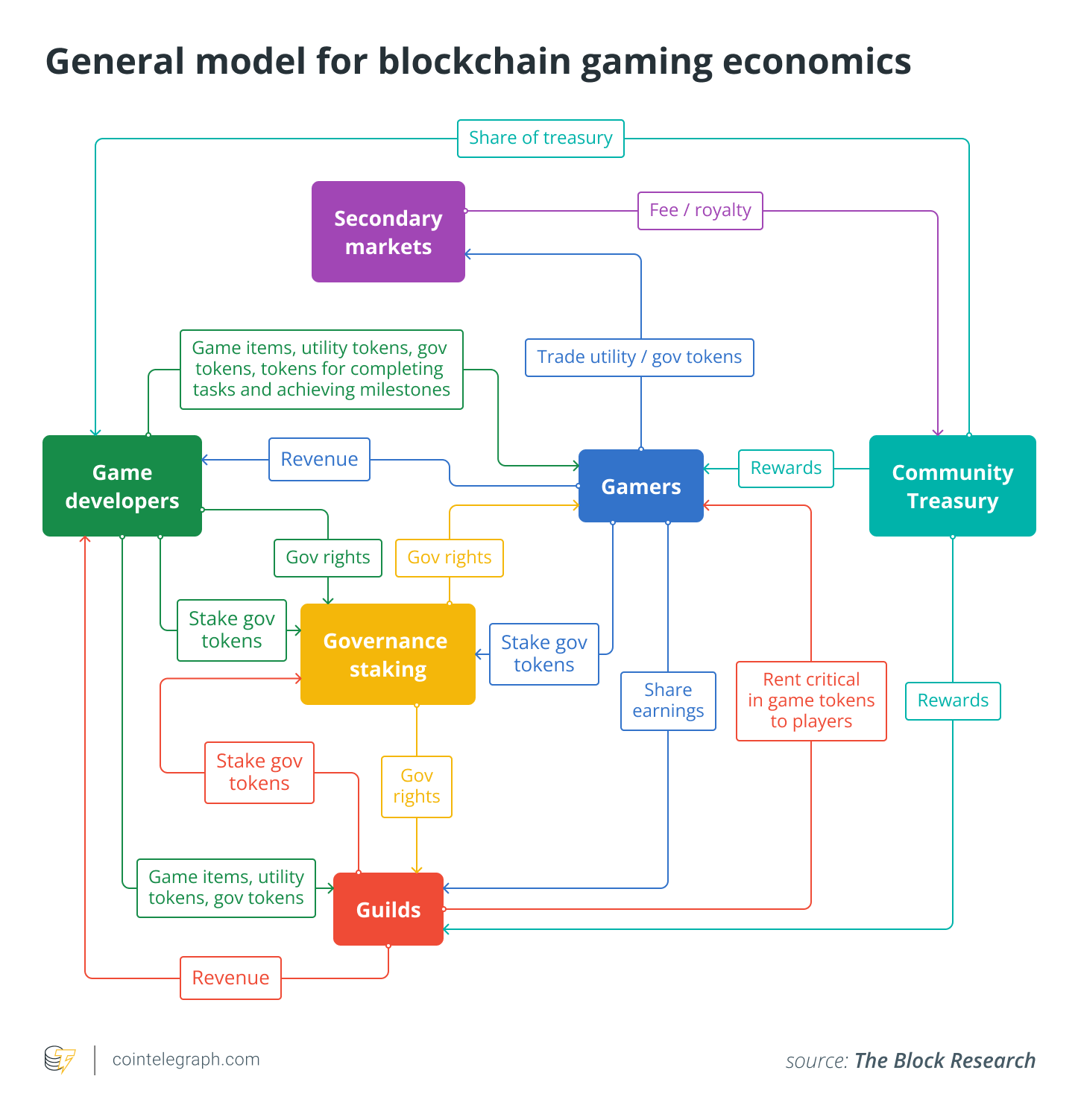

An essential component of Axie Infinity’s business design may be the cost of SLP, that is affected by a number of factors: demand and supply of SLP, way to obtain Axies, crypto rules, the volatility of crypto and also the behavior from the SLP traders. Thus, the cost of SLP is partially manageable and partially beyond Axie’s sphere of influence. Nansen believed that Axie’s $1.35 billion revenue (from May 2021 to May 2022) came mostly from breeding charges (85%) and marketplace charges (13%). This shows how limited Axie’s income is. Axie Infinity have to get methods to expand its revenue sources beyond breeding and marketplace charges.

A far more creative business design is essential. To improve the amount of beginners, Axie must innovate and provide gaming experience beyond a static atmosphere of their small square fight space, that is boring for players. The small monsters could be permitted to wander all over the world of Lunacia and face danger (e.g., a lethal epidemic) or Axie-eating monsters that will burn SLP or reduce its supply. Players should be permitted to get together their Axies along with other players’ Axies inside a colossal combat other Axies — such as the epic battles in mecha anime series Gundam — thus growing new interest in SLP. Co-developing the sport with indie developers is important, however this needs a profit-discussing model for results. Axie may also modify Pokémon Go’s approach by permitting players to put money into adornments, avatars and merchandise to strengthen its revenue sources.

A number of my informants recommended that Axie should allow “burning SLP to upgrade into effective Axies,” “grow the AXS market,” and “host global esports tournaments.” Esports is a lucrative arena by which Axie might make an indication.

Another mistake was the perceived no communication between Sky Mavis, the developer and writer of Axie Infinity, using its community. A lot of my informants claimed that Axie’s plans for future years are cloudy. There are also complaints concerning the “power play” displayed through the core group of Sky Mavis from the Axie Infinity community. This involves a cultural fine-jamming the Axie ecosystem.

The not too bleak way forward for Axie Infinity

In the middle of this crypto winter, Axie offered over 325,000 Axies at greater than 3,500 ETH as a whole, roughly $3.9 million. Within my real-time experiments hanging around with a few Axie scholars in June 2022, time to locate opponents for every fight has continued to be exactly the same, suggesting there are still many Axie players available, resistant to the conjecture that many players could leave Axie. There’s, however, the temptation for Axie players and managers to participate other attractive play-to-earn games. This can be a new fight for Axie: the “switchers.”

Axie Infinity may not disappear altogether. It’ll most most likely reinvent itself and chart a brand new future within the fast-altering GameFi landscape. GameFi is not going anywhere soon like a space for experimentation within the Metaverse that blurs the boundary between fun and work/investing.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph nor The Hong Kong Polytechnic College or its affiliates.

Yanto Chandra is definitely an affiliate professor in the Hong Kong Polytechnic College. He’s a pioneer investigator in the area of Web3, NFT, GameFi, and also the Metaverse while using organization and entrepreneurship science perspectives.