Bitcoin (BTC) starts a brand new week nearing key resistance because the shock from the latest U . s . States inflation data passes — can the force continue?

The This summer 17 weekly close might have been practically like the last, but BTC/USD is showing some necessary strength before the This summer 18 Wall Street open.

A week ago would be a testing here we are at crypto hodlers everywhere, with inflation dictating the atmosphere across risk assets and also the U.S. dollar capping the gloomy atmosphere. With individuals pressures now easing — for the time being — the atmosphere has room to unwind.

Simultaneously, on-chain data shows that now’s a do or die moment for Bitcoin miners, and capitulation over the market feels close.

As talk over where Bitcoin’s macro bottom could lie continues, Cointelegraph analyzes several factors primed to shape BTC cost performance within the future.

All eyes on weekly moving averages

Individuals watching the weekly chart on BTC have a feeling of deja vu now — BTC/USD finished This summer 17 under $100 from where it had been on This summer 10.

The most recent weekly close is one thing of the disappointment by itself, with Bitcoin erasing gains in the last second to print a “red” candle within the last 7 days.

What went down next, however, had the alternative tone — a quick overnight march greater, the biggest cryptocurrency adding $1,400 within twelve hrs.

Everything leads up to and including familiar challenge on intraday timeframes — BTC/USD is approaching both $22,000 along with a key trendline at $22,600 by means of the 200-week moving average (WMA).

Formerly serving as support in bear markets, the 200 WMA has actually flipped to resistance now, getting been lost in mid-June rather than reclaimed.

As a result, analysts are eyeing that much cla like a key market should bulls have the ability to sustain upside pressure.

For PlanB, creator from the Stock-to-Flow group of BTC cost models, an issue beyond place cost is meanwhile reinforcing its importance. As with previous bear markets, the 200 WMA briefly went above Bitcoin’s recognized cost this season, supplying a vintage market reversal signal.

Recognized cost refers back to the average cost where all of the bitcoins around last moved.

“In the bear market of 2014/15 and 2018/19 (blue) recognized cost was above 200WMA and also the bull market didn’t start until recognized cost and 200WMA touched,” PlanB told Twitter supporters on This summer 17 alongside an associated chart.

“Now recognized cost and 200WMA already touched at $22K. For the following bull market we want BTC above recognized cost and 200WMA.”

As Cointelegraph reported, bulls appear to play a game title of moving averages on longer timeframes, too. Additionally towards the 200 WMA, the 50-week and 100-week exponential moving averages (EMAs) also estimate forecasts.

The 50 EMA presently sits at $36,000 and also the 100 EMA just above $34,300, data from Cointelegraph Markets Pro and TradingView shows.

Ethereum gets near $1,500 in potential trendsetter move

One catalyst that may take Bitcoin over its key resistance mark at $22,600 could originate from an unlikely source — altcoins.

While normally progresses Bitcoin see other cryptocurrencies before copycat rises or lower, now, many are waiting to find out if BTC/USD follows largest altcoin Ether (ETH) greater.

Among news that it is transition to Proof-of-Stake (PoS) mining could soon complete, Ethereum has outperformed when it comes to cost gains in recent days, and it is up 25% in the last week alone.

During the time of writing, ETH/USD involved to challenge $1,500 the very first time since June 12.

“$eth reclaimed its 200 week moving average now, btc will most likely in a few days, time to become bearish has defo for an finish imo,” popular Twitter account Bluntz summarized at the time.

Fellow commentator Light likewise belief that Ethereum’s strength ought to keep upward pressure on Bitcoin, noting liquidations among individuals traders ignoring the ETH moves and ongoing to become short BTC.

shorts had days to leave on BTC. need to be short it when ETH did what it really did.

A sizable asset within the ecosystem ripping 40% stokes risk seeking behavior otherwise. It can make people take into account that assets can certainly increase in cost. It results in catch-up/rotational flows. https://t.co/nae0WIys9M

— light (@lightcrypto) This summer 18, 2022

Mix-crypto short liquidations within the 24 hrs into This summer 18 totaled around $132 million, data from on-chain monitoring resource Coinglass confirms.

Moving forward, however, not everybody thinks that Ethereum can break its overall downtrend, using the implications apparent for other tokens consequently.

Cointelegraph contributor Michaël van de Poppe contended the pull from the weekend CME futures gap on Bitcoin could give a downside pressure to puncture the optimism.

CME futures finished their previous buying and selling day, This summer 15, around $21,200.

“With the potential for a CME gap beneath us (and Bitcoin swimming round the previous CME gap), I will not be amazed having a fake-out move and retest lower for $ETH,” he authored within an update.

“Looking to get involved with longs round the $1,250-1,280 region.”

Dollar strength finally flips in Bitcoin’s favor

Around the subject of macro movements, the landscape looks overall less frenetic than what welcomed crypto investors a week ago.

Inflation data originates and gone, and also the debate over whether inflation has or hasn’t peaked within the U.S. thus cools before the next Consumer Cost Index (CPI) print in August.

The Fed will decide regarding how to tackle inflation in regards to key rate of interest hikes later this month, the government Open Markets Committee (FOMC) nevertheless set to satisfy only on This summer 26.

Any macro cues with regards to BTC cost action will thus be originating from other locations, with geopolitical triggers high among the list of potential factors.

Asian markets were more powerful because the week started because of a modest recovery in Chinese tech stocks formerly hammered by Coronavirus nerves.

Simultaneously, the U.S. dollar, the star of latest days as equities worldwide felt pressure, started to consolidate its gains.

The U.S. dollar index (DXY), strength by which has lengthy been inversely correlated with cryptoasset performance, headed south under 108 at the time, getting arrived at fresh two-decade highs the prior week.

“Finally visiting a drop around the daily,” Twitter analyst IncomeSharks commented, highlighting the opportunity of DXY to check a trendline from May.

“Even a drop for this trend line could be big for Stocks and Crypto. Would fall into line perfectly having a bullish week prior to the Given meeting.”

Fellow account Rickus also felt that Bitcoin wouldn’t “break lower again” despite a pullback still being possible — because of the DXY comedown along with a more powerful finish for that S&P 500.

SPX were built with a good close prior to the weekend, DXY also looks a little weak on ltf while BTC is near to resistance levels..Lines I’m watching..Personally, i don’t believe we break lower again although I’m searching for any pullback. pic.twitter.com/KcYRJFrrbS

— Rickus (@rickus_trades) This summer 17, 2022

“Should give room now for equities & crypto to bounce until it find near support,” 0xWyckoff, creator of crypto buying and selling resource Rekt Academy, added partly of the thread concerning the DXY.

Inside a separate observation meanwhile, Dan Tapiero, managing partner and Chief executive officer at 10T Holdings, noted that the macro USD high in comparison to the Chinese yuan should mark a turnaround point for BTC.

“Last 3 major BTC highs in 2014, 2018, 2021 roughly coincided with highs in Chinese RMB/lows in USD,” he noted partly of the tweet on This summer 18.

“Suggests that Dollar peak soon could be supportive of BTC low.”

Miners dump 14,000 BTC in days

With the much hope that the trend turnaround might be around the cards, on-chain data showing Bitcoin miners selling inventory looks even more bleak.

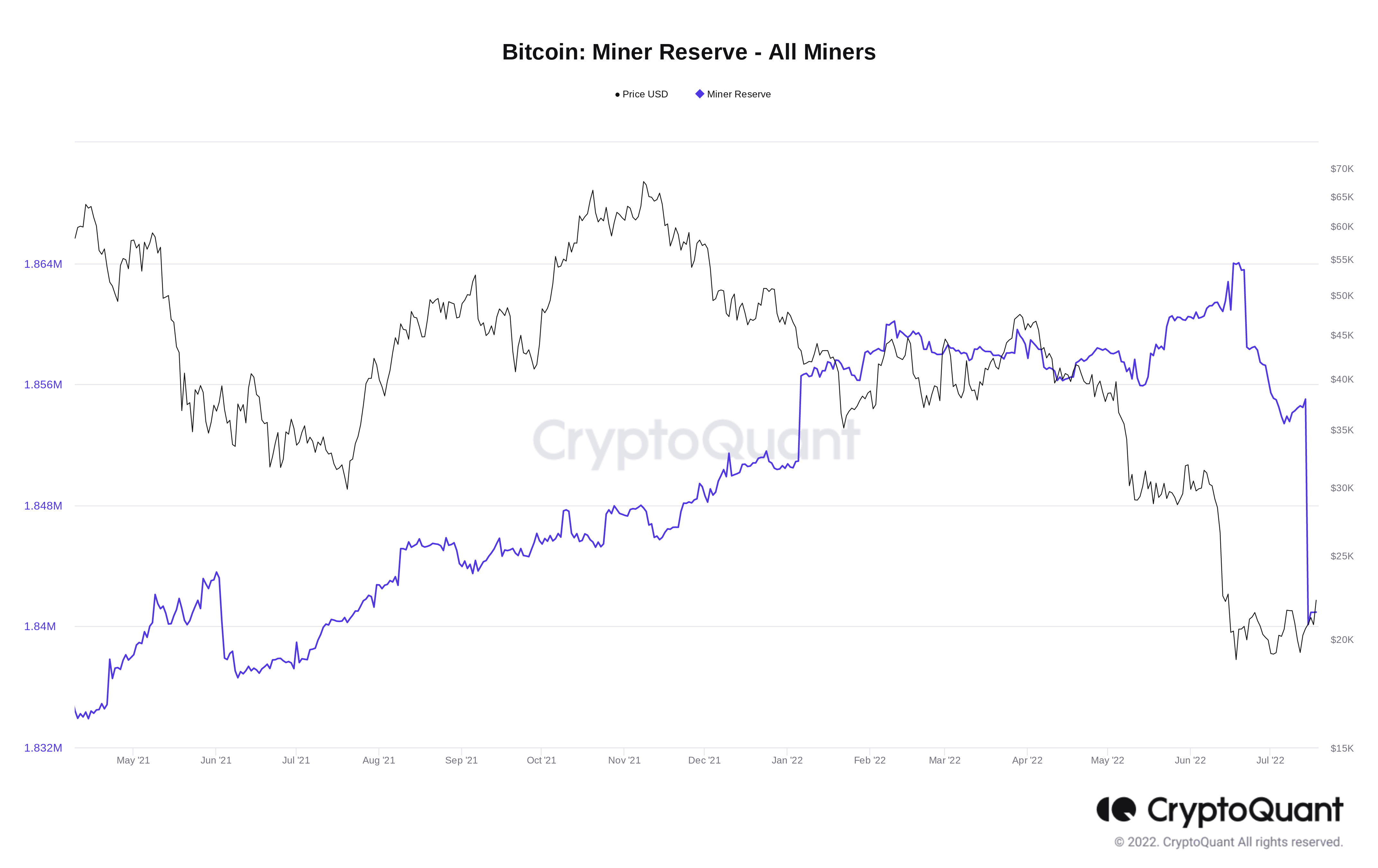

Based on data from on-chain analytics platform CryptoQuant, beginning This summer 14, miners removed a significant chunk of BTC using their reserves.

The result was that miner reserves fell for their cheapest levels since This summer 2021, a place that also marked a BTC cost low.

Reserves was at 1.84 million BTC on This summer 18, lower 14,000 BTC in comparison to the This summer 14 tally.

For CryptoQuant contributor Edris, the figures were a good sign, meaning that miners were now adding to creating a macro BTC cost floor.

“Bitcoin miners are finally capitulating,” he summarized over the past weekend.

“BTC cost continues to be consolidating in the $20K level within the last couple of days, making investors question whether a build up or distribution phase is happening. Searching in the Miners’ Reserve chart, it appears such as the latter may be the situation.”

Macro analyst Alex Krueger meanwhile described June’s miner sales like a “clear manifestation of capitulation,” adding that miners “tend to amass in route up then puke when things go south.”

RSI sparks “unusual” BTC cost inflection point

Finally, a “rare” event around the Bitcoin chart might just have given the fuel for any historic turnaround, analysis suggests.

Related: 5 Best cryptocurrencies to look at now: BTC, ETH, MATIC, FTT, ETC

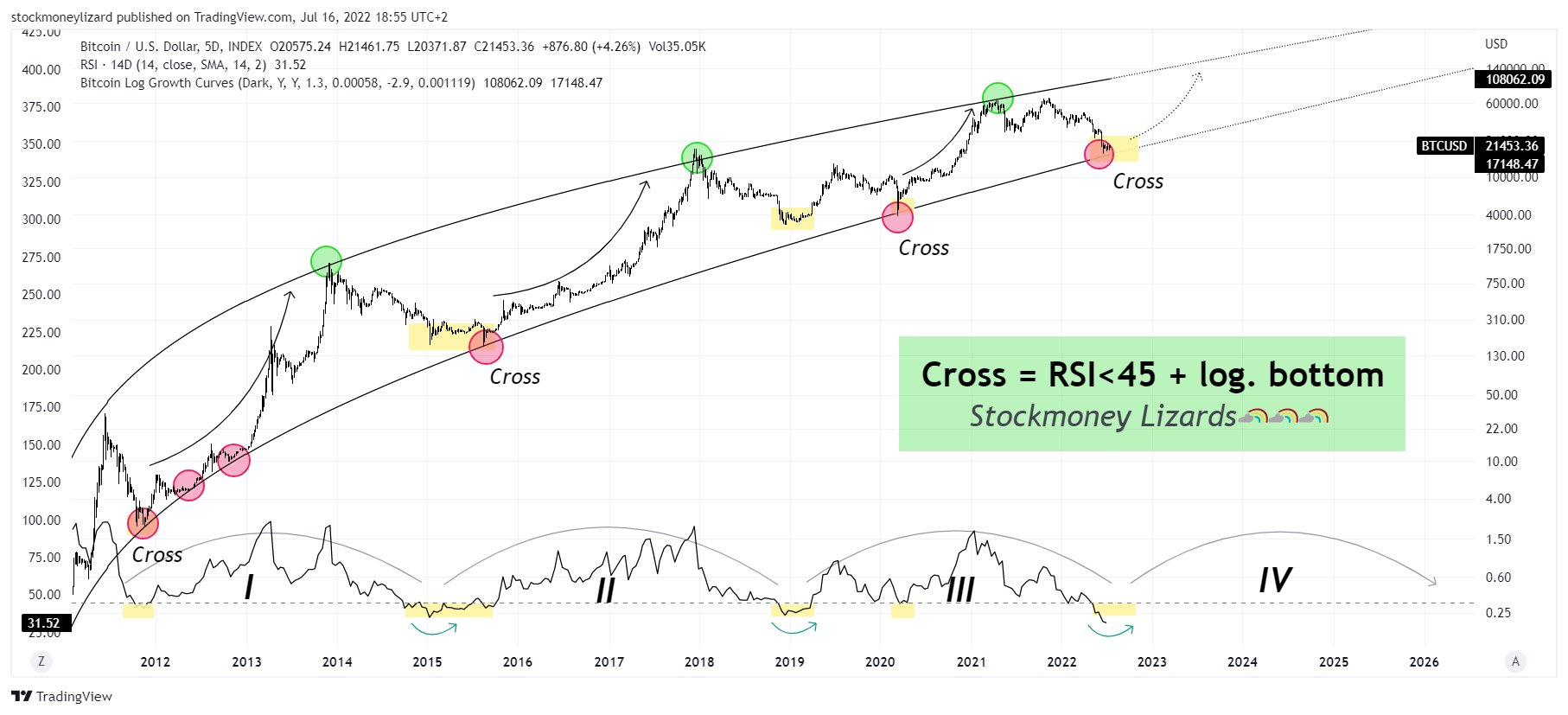

Using the BTC/USD chart right from the start of Bitcoin’s lifespan, Stockmoney Lizards noted that Bitcoin’s relative strength index (RSI) has become at suitably lower levels and it has coupled with a little a log chart trendline which sparked the finest BTC cost recoveries.

“Current exciting and incredibly rare situation now,” it announced in the weekend.

“RSI below 45 and logaritmic bottom demonstrated an excellent reversal previously, adopted with a crazy bull run. Mix = RSI<45 + log. Bottom.”

An associated chart demonstrated the strength of this kind of event, which follows RSI hitting its cheapest levels on record.

For CoinPicks analyst Johnny Szerdi, meanwhile, Bitcoin required to break the 50 mark on RSI, a vital resistance focus recent several weeks, to prevent the chance of a brand new sell-off.

GM! #Bitcoin reaches a vital point. It has not had the ability to break 50 RSI since 3/14. It rejected from this 5 occasions since 4/20. Spot the vertical lines where it matches track of the large sell offs. With volume, when we reject for a sixth time, it might mean another sell. pic.twitter.com/znZNpfJ3K8

— Johnny Szerdi (@johnnyszerdi) This summer 17, 2022

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.