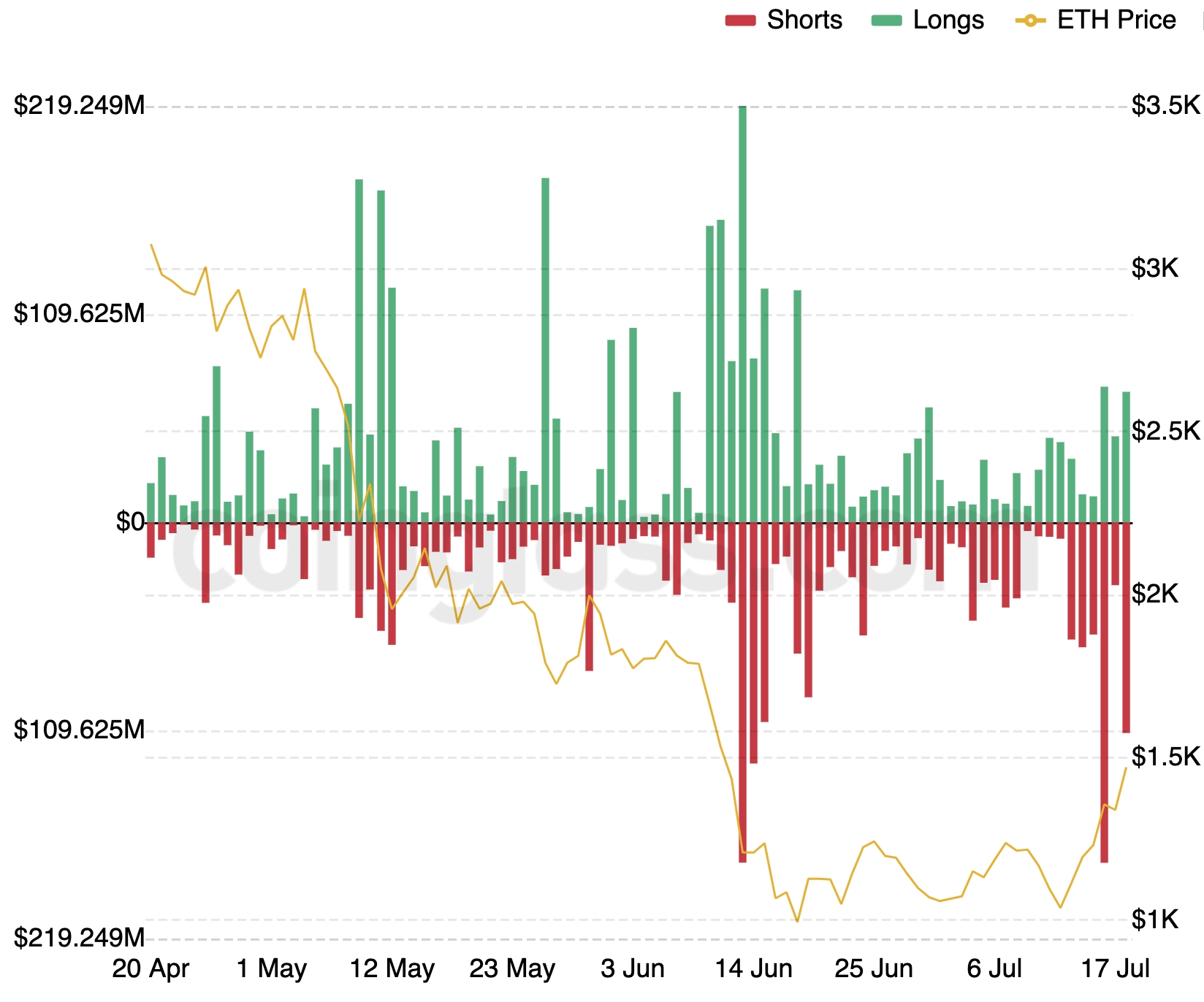

Liquidations of leveraged short positions in Ethereum’s native token ETH surged over the past weekend plus a strong move over the key USD 1,300 cost level as sentiment within the ETH market improved markedly.

Per data in the derivatives tracking site Coinglass, liquidations of leveraged ETH shorts arrived at USD 179.4m on Saturday, the greatest degree of liquidations in additional than three several weeks. The weekend spike in liquidations came as ETH entered the USD 1,300 barrier and established itself around USD 1,350.

The strong move was adopted by another begin short liquidations on Monday, because the cost of ETH flirted using the USD 1,500 level the very first time since June 12. During the time of writing (10:10 UTC), USD 113m in ETH shorts had recently been liquidated across crypto exchanges since night time UTC time.

The bullish moves for ETH came as ‘the Merge’ – Ethereum’s transition in the proof-of-work (Bang) towards the proof-of-stake (PoS) consensus mechanism – moved closer, with September 19 now formally suggested because the tentative Merge date.

However, some reason that the Merge might be pressed all over again, with respect to the market conditions. Martin Hiesboeck, Mind of Blockchain and Crypto Research at digital buying and selling platform Uphold, commented within an email to Cryptonews.com that,

“Ethereum developers announced a period for that Merge that appears more credible than anything we view to date, namely several steps prior to a few days of September 19. We remain skeptical, and when the general markets don’t improve, the launch might be pressed back further still.”

Rising sentiment, flippening, and warnings

Nevertheless, this news the long awaited event is inching closer has brought to elevated optimism within the Ethereum community, that also coincided with bullish cost moves from late a week ago. Since This summer 14, once the tentative Merge date was revealed, ETH has risen by more than 30%.

The event seemed to be stated on Twitter, where one user stated the Merge has “filled the narrative void.”

Within the Ethereum community on Reddit, some fans spent their Sunday discussing when ETH would “flip bitcoin,” talking about a possible event where ETH’s market capital exceeds those of bitcoin (BTC).

“I’m within the camp that believes it’ll [switch]. But 2023 can be a bit early,” one user commented, while another, who accepted that his “entire portfolio is ETH only,” opined that it’ll most likely never happen.

Meanwhile, other crypto community people required the chance a few days ago to discuss ETH from the buying and selling and investment perspective, with a few quarrelling digital asset continues to be “expensive” from the fundamental perspective.

Included in this was Andrew Kang, co-founding father of crypto hedge fund Mechanism Capital, who on Twitter mentioned that activity and earnings around the Ethereum network have declined greater than the cost of ETH from the peak this past year, producing a high cost-to-earnings (PE) ratio.

“I think it’s entirely possible that ETH bottoms having a high PE, but I am not betting onto it yet,” Kang stated, before acknowledging that lots of vc’s “are alright to buy costly.”

The vista that ETH is “expensive” wasn’t shared by everybody, however. Popular crypto trader and economist Alex Krüger known as PE “a rather useless metric for lengthy term analysis when salary is so volatile and reflexive.”

“Value is subjective. Narratives shift. With regards to crypto (layer 1s) valuation metrics are just helpful for driving narratives,” Krüger authored as a result of Kang’s tweet.

Meanwhile, others cautioned the current rally in ETH is not likely to last, with Chris Burniske, someone at investment capital firm Placeholder, sounding the alarm over what he known as “bear market pumps.”

“Bear market pumps need to happen to obtain the majority offsides, therefore enabling further nasty falls,” Burniske stated.

He added that although the market for some time continues to be “too bearish to fall further,” this doesn’t mean the marketplace is “out from the forest.”

“Don’t get too cocky one direction or another,” he cautioned, while recommending the dollar-cost average (DCA) strategy as “most peoples’ best choice.”

At 10:50 UTC on Monday morning, ETH traded at USD 1,487, up 10% within the last 24 hrs and 27% within the last seven days. It had been, during the time of writing, the day’s best artist one of the top ten cryptoassets by market capital.

____

Find out more:

– Ethereum Merge Date Suggested for September

– Ethereum’s Step Towards PoS

– Ethereum Transaction Charges Dip to Cheapest Since December 2020, Bitcoin Charges Relatively Stable

– Gold coin Race: Top Winners/Losers of June, Q2, and H1 Bitcoin Sees Worst Month Ever

– Crypto Falls In front of US Inflation Figure as Bitcoin On-Chain Metrics Signal ‘Oversold Conditions’

– Wolf of Wall Street States Bitcoin Investors Will ‘Almost Certainly Profit,’ But What’s His Bitcoin History Like?