Solana (SOL) ticked modestly lower on This summer 20 after testing a vital technical resistance, suggesting further pullback moves within the coming days.

SOL cost eyes 50% wipeout

SOL’s cost decreased by over 4% to $44 after neglecting to breach a multi-week climbing trendline resistance. Interestingly, this level of resistance comes as part of what seems to become a bearish continuation pattern dubbed the “bear flag.”

An earlier test of the identical resistance trendline at the end of June had preceded a 30%-plus cost drop, illustrating a greater distribution sentiment among SOL traders close to the level. Therefore, the most recent pullback in the same range can lead to a long downside retracement.

Meanwhile, the bear flag’s lower trendline continues to be capping SOL’s sharp pullback moves. Consequently, SOL’s extended correction scenario might have its cost hit the support level, now near $35.40 — a 20% drop from current cost levels.

Furthermore, a decisive close underneath the lower trendline would risk triggering the bear flag breakdown setup, in which the cost falls up to the peak from the downtrend (known as “flagpole”) that preceded the flag’s formation.

That puts SOL on the path to levels near $21 by September, lower 50 plusPercent from today’s cost.

What experts say about Solana

The bear flag setup seems after SOL’s 80%-plus cost rally since June 14, mainly driven with a similar recovery over the crypto market.

For example, Ether (ETH), Solana’s top rival within the smart contract space, has risen over 85% greater than a month after bottoming out in your area at $880. Similarly, Bitcoin (BTC) is up 35% within the same period.

Independent market analyst Altcoin Sherpa sees SOL’s cost rising towards the $60-$80 area in 2022 if Bitcoin is constantly on the climb.

On the other hand, Andrey Diyakonov, chief commercial officer at Choise, notes that interest in SOL could drop because of Ethereum’s transition to proof-of-stake in September.

“The brand new Ethereum protocol has got the same advantages as Solana, and investors might want to stick to Ethereum if the high gas charges and scalability woes be solved,” Diyakonov described.

Related: three reasons why Solana can repeat Ethereum’s 2018 fractal to five,000% gains

Paweł Łaskarzewski, co-Chief executive officer at Synapse Network, fears SOL’s ongoing cost rally might be a bull trap, noting that SOL, alongside all of those other crypto market, still faces macro hurdles brought by greater inflation and rising lending rates.

He stated:

“We may see small ups around the cost of Solana but because of the market condition, I wouldn’t expect any big changes”

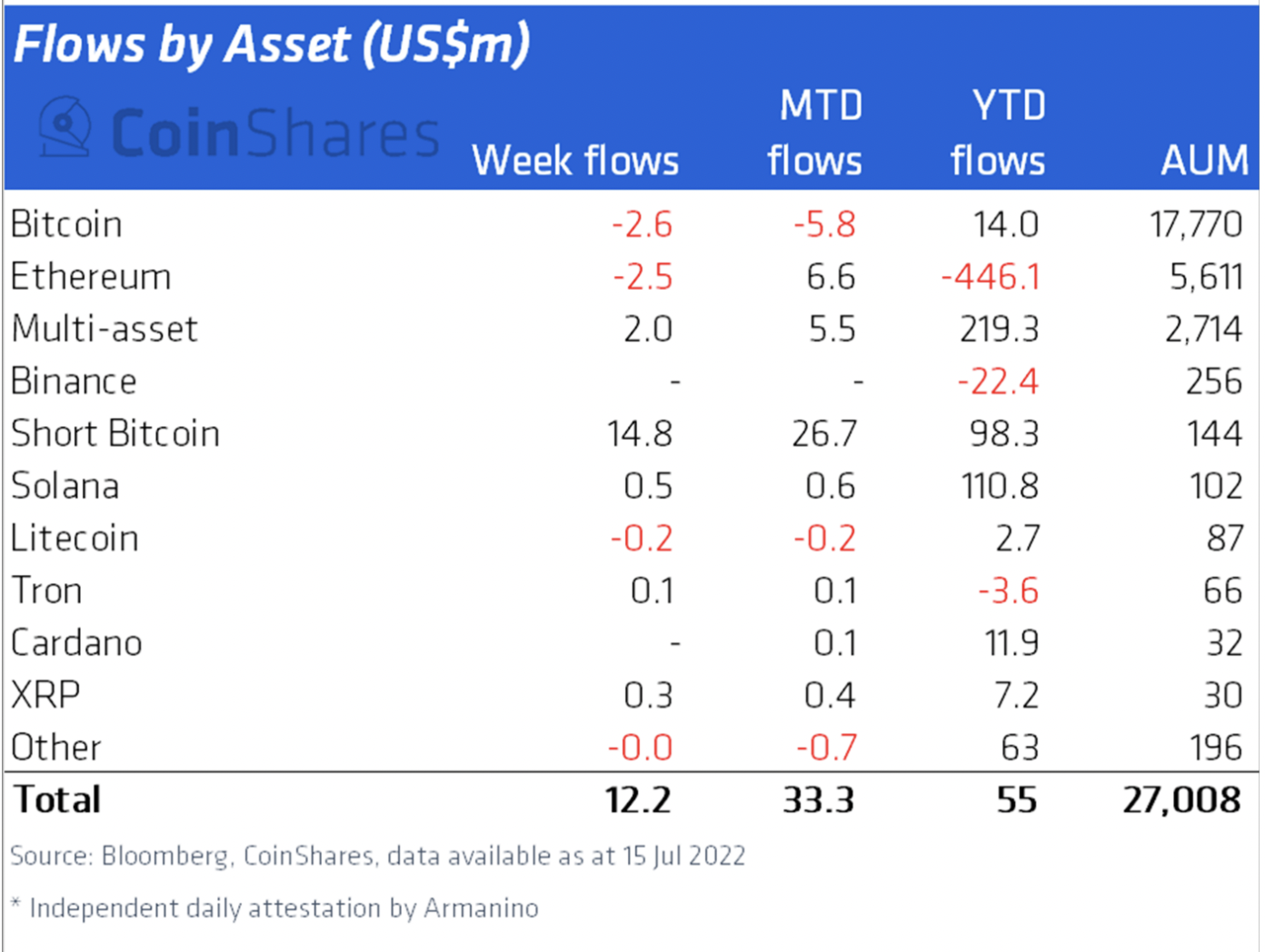

Solana funds add $110.8M in 2022

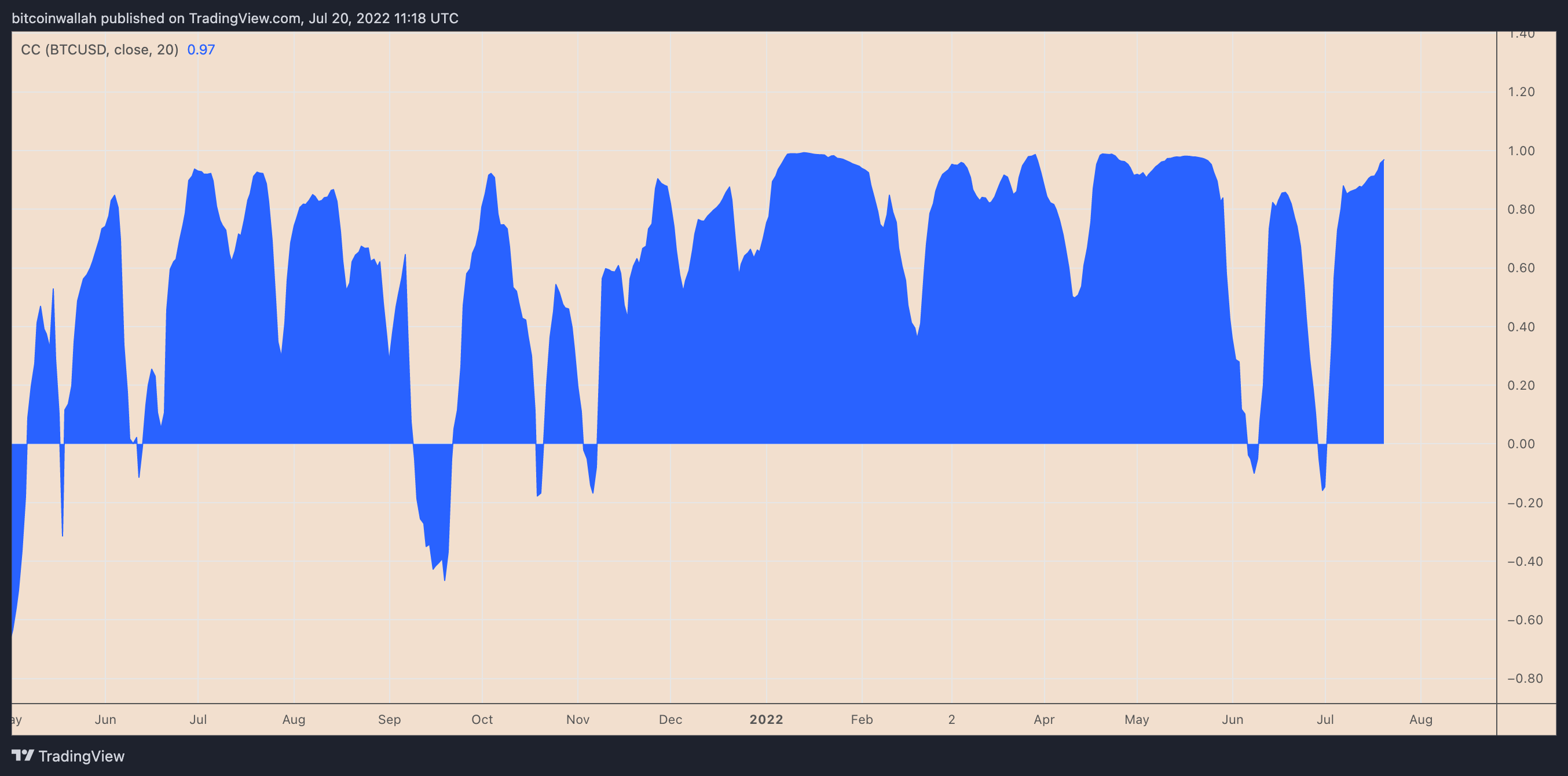

Meanwhile, institutional curiosity about Solana is constantly on the look better when compared with Ethereum, based on CoinShares’ latest weekly report.

Particularly, Solana-backed funds have attracted $110.8 million into its coffers forever of the year. Compared, Ethereum-based investment vehicles have observed withdrawals worth $446.a million using their reserves within the same period, including $2.5 million within the week ending This summer 15.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.