On This summer 26, Bitcoin (BTC) cost dropped below $21,000, giving back a lot of the gains accrued in the last week and coming back towards the $23,300 to $18,500 range that Glassnode analysts call “the Week 30 high and Week 30 low.”

A number of analysts and traders attribute the This summer 26 to This summer 27 Federal Open Market Committee (FOMC) meeting and also the expected Fed rate hike because the primary causes of the present sell-off.

Barring the announcement the U . s . States economy has joined an economic depression, a couple of traders think that the expected 75 to 100 basis point (BPS) hike is going to be adopted with a relief rally that may see BTC, Ether along with other large-cap altcoins snack back to the peak of the current range. Obviously, this sentiment reflects more speculation than seem analysis, so go having a touch of suspicion.

Considering that BTC cost is just ongoing to exchange exactly the same range that it’s been in within the last 42 days, the question for you is if the market brings more consolidation or any other round of capitulation.

In the This summer 26 on-chain e-newsletter, Glassnode analysts posit that investors will find their “conviction through confluence” of multiple technical as well as on-chain metrics which suggest the height of capitulation has lengthy past.

Based on the analysts, rapid deleveraging put many metrics into “extreme record deviations” along with the worst from the selling possibly behind us, Bitcoin cost coming back towards the high $20,000 zone was expected.

Glassnode notes the:

“The June leg lower in cost action has created the cheapest 4-yr moving Z-Score value on record.”

And also the analysts described the 4-year moving MVRV Z-score “signaled undervaluation for those bear cycle bottoms, including 2015, 2018, and also the March 2020 flash crash.”

In comparison against various cohorts of lengthy and short-term sellers, and metrics like Realized Cost, Mayer Multiple and longer-term daily and weekly moving averages, Glassnode shows that confluence within the indicators and historic data indicate growing bullish momentum.

On-chain data spots a bottom, what does technical analysis say?

In the outlook during technical analysis, Bitcoin’s proceed to $24,200 presented a short breakout in the current range, however the lack of ability to sustain momentum only at that level presented the required alternative of the lower support retest in the range midline close to the 20-day moving average ($21,500).

Based on independent market analyst Michaël van de Poppe, $21,600 was the region for BTC to carry and below this the asset’s cost action depends upon commentary out of this week’s FOMC comments.

The financial markets are correcting and preferred was $21.6K to carry for #Bitcoin.

This is a crucial breaker now too whether it breaks towards the upside -> new highs.

Searching in a $20.5K-20.7K place to hold for #Bitcoin entering FOMC tomorrow.

If upwards after. pic.twitter.com/tueXPNprza

— Michaël van de Poppe (@CryptoMichNL) This summer 26, 2022

CryptoISO expressed an identical sentiment concerning the correlation of equities to Bitcoin and the significance of the $21,500 zone for BTC cost.

A part of longing the 21.5k zone on BTC was confluence w support on NQ.

That’s gone.

Retesting an outbreak now but all of this appears like crap to tell the truth.

Selling before tomorrow is interesting though.

If you’re bullish you need to observe that but earnings is driving it to date. pic.twitter.com/rh5d3wKgjG

— CryptoISO (@crypto_iso) This summer 26, 2022

Fractal enthusiasts will observe that the cost action inside the current range is eerily like the May 8 through This summer 12 range-bound buying and selling and following breakdown that required put on This summer 12, but analysts would rapidly explain that back-to-back calamities like Voyager, Celsius and 3AC growing performed a substantial role for the reason that sell-off, whereas presently there seems to become no discernible black swan occasions coming.

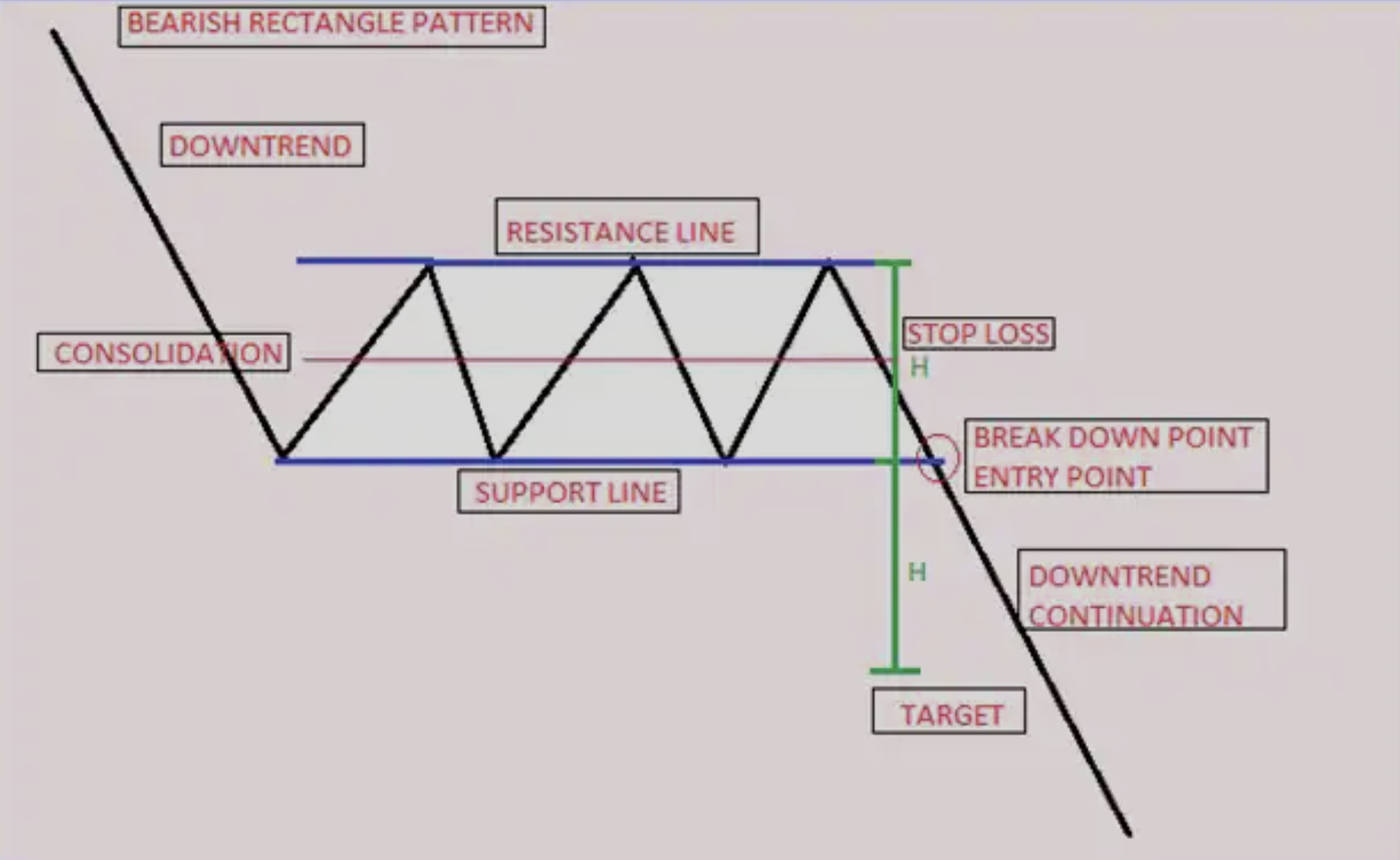

Regardless, both reflect periods of 34 to 42 times of sideways buying and selling and more often than not, veteran trader Peter Brandt has identified the present market structure like a “bearish rectangle” technical analysis pattern.

When the pattern breaks towards the downside in the current range, this could put the cost within the $14,500 to $13,000 zone some traders happen to be lusting for.

Ultimately, last week’s range breakout to $24,200 (This summer 20) pierced top of the gang of the Bollinger Bands momentum indicator now that cost is underneath the midline, there’s an elevated chance that BTC could trade lower towards the lower band which easily resides at the end of the present range ($24,200 to $18,600).

Buying and selling within range isn’t much to bother with until an outbreak or breakdown catalyst emerges. Possibly tomorrow’s (This summer 27) earnings from big tech companies, the condition from the market in the opening bell and comments in the FOMC determines the direction Bitcoin decides to consider.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.