Bitcoin (BTC) spoofed an outbreak to fresh six-week highs into This summer 31 like a showdown for the weekly and monthly close came near.

“Bart Simpson” greets traders into BTC monthly close

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD canceling out its gains from at the start of the weekend, shedding from $24,670 to $23,555 in hrs.

The resulting chart structure was very familiar to lengthy-term market participants, developing a “Bart Simpson” shape on hourly timeframes.

Liquidations nevertheless continued to be manageable, using the mix-crypto tally totaling $150 million within the 24 hrs towards the duration of writing, according to data from analytics resource Coinglass — under on previous days.

For popular trader and analyst Rekt Capital, there wasn’t any need to think that the approaching weekly candle close would make sure Bitcoin had reestablished a vital trendline as support after days of failure.

Appears like #BTC has effectively retested the 200-week MA as support$BTC #Crypto #Bitcoin pic.twitter.com/yg75xrxXQB

— Rekt Capital (@rektcapital) This summer 30, 2022

Searching forward, however, not everybody was believing that the present market strength had much room left to carry on.

In a single of numerous Twitter updates over the past weekend, Material Researcher, creator of on-chain analytics resource Material Indicators, eyed funding rates on derivatives platforms turning more and more positive, indicating too strong consensus that prices may go up unchecked.

“Negative funding has almost completely reset, much like at the end of March. We may even see positive funding on some alts soon,” he authored:

“I think there’s the last pop in to the shaded area prior to the bear rally fizzles away.”

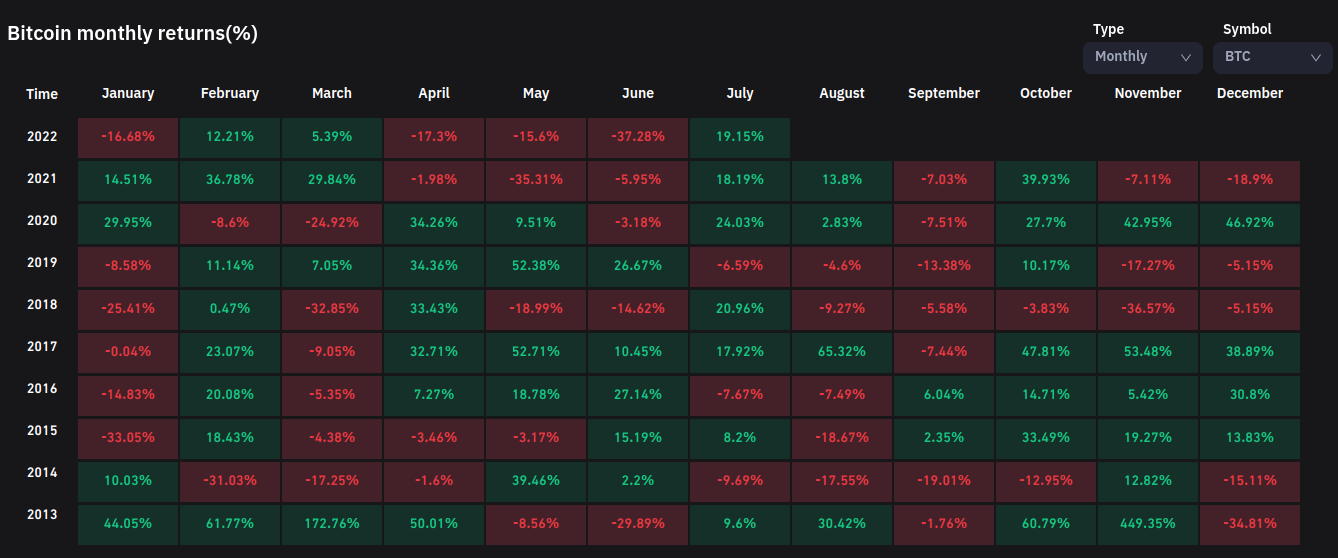

Nevertheless, BTC/USD was still being on the right track to provide roughly 19% monthly gains for This summer, these starkly contrasting with every other month of the season to date.

Based on data from Coinglass, July’s returns were even poised to become Bitcoin’s best because the 2021 all-time highs.

Certainly one of “greatest bull markets” could now await Bitcoin

Other perspectives compensated little focus on the possibilities of a brand new correction for the short term.

Related: In the past accurate Bitcoin metric exits buy focus ‘unprecedented’ 2022 bear market

Eyeing potential performance within the other half of 2022, Mike McGlone, senior commodity strategist at Bloomberg Intelligence, left little question regarding how Bitcoin particularly would fare.

Hints the Fed would address rate hikes on the “meeting by meeting basis,” according to Chair Jerome Powell now, “may mark the pivot for #Bitcoin to resume its inclination to outshine most assets,” he contended on social networking.

“July marked the steepest discount in Bitcoin history to the 100-and 200-week moving averages, with implications for this to recuperate,” he added concerning the 200-week trendline:

“I see risk versus. reward tilted favorably for among the finest bull markets ever.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.