With several on-chain metrics for Bitcoin (BTC) still inside a bearish range, a continuation from the recent cost recovery will need elevated demand and charges spent within the network, states Glassnode.

The assessment of mediocre market growth in the last week originated from blockchain analysis firm Glassnode in the latest A Few Days On Chain report on August 1.

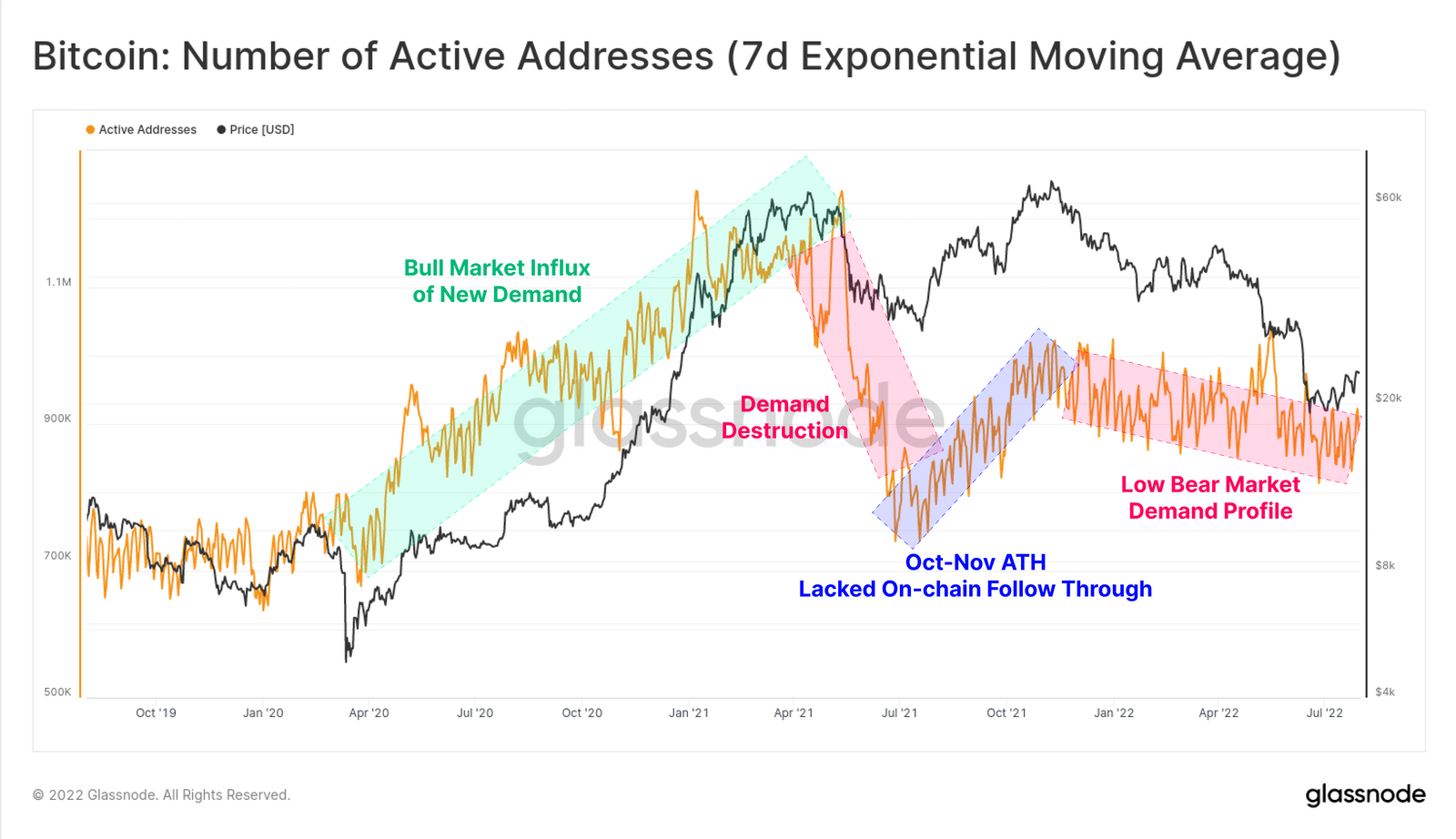

Inside it, analysts pointed to sideways development in transactional demand, active Bitcoin addresses residing in “a well defined downward funnel,” minimizing network charges as good reasons to temper investors’ excitement concerning the 15% spike in BTC cost in the last week. However, BTC is presently lower 2% in the last 24 hrs buying and selling below $23,000 to $22,899 according to CoinGecko.

#Bitcoin and #Ethereum have rallied strongly from the bottom, reaching over the Recognized Cost.

Attention now turns as to whether this can be a bear market rally, or if the basic principles are doing it in support.

Find out more within the Week On-chain https://t.co/taOkbeVlyv

— glassnode (@glassnode) August 1, 2022

The report begins by highlighting the options of the bear market with a loss of on-chain activity along with a rotation from speculative investors to lengthy-term holders. It shows that the Bitcoin network continues to be demonstrating all of individuals traits.

Glassnode authored that the loss of network activity could be construed as too little new interest in the network from speculative traders over lengthy-term holders (LTHs) and investors who have a superior degree of conviction within the network’s technology. The report states:

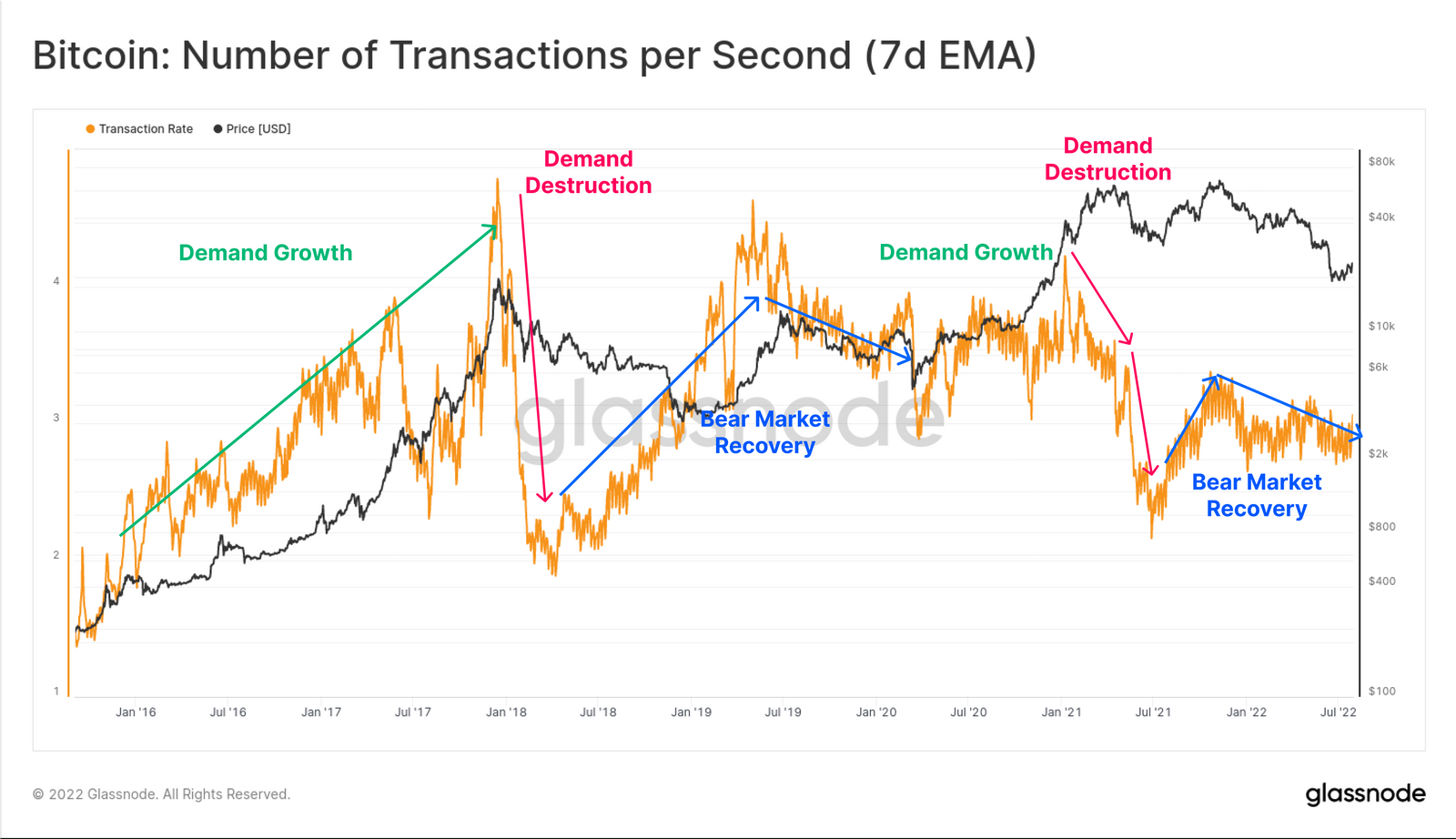

“With exception of the couple of activity spikes greater during major capitulation occasions, the present network activity shows that there remains little increase of recent demand up to now.”

As opposed to a week ago whenever a significant degree of demand made an appearance to become established in the $20,000 level for BTC and developing a floor, the extra demand required to sustain any more cost increases isn’t observable. Glassnode refers back to the steady loss of active addresses like a “low bear market demand profile” that has been essentially basically since last December.

Case study observed similarities between your current network demand pattern and also the one established within the 2018-2019 period. Like the previous cycle, network demand dried out following the April 2021 all-time full of BTC cost. There is a notable recovery sought after prior to the next November as prices retrieved to a different ATH.

However, since last November, demand from customers has been in a downward trend, having a major spike lower throughout the mass sell-offs in May.

“The Bitcoin network remains HODLer dominated, so that as yet, there is not any significant return of recent demand.”

Glassnode added the poor demand from anybody apart from dedicated Bitcoin enthusiasts is forcing network charges into “bear market territory.” In the last week, daily charges amounted to simply 13.4 BTC. By comparison, when prices arrived at ATH last April, daily network charges capped 200 BTC.

Related: Bitcoin bulls defend $23K among warning bear market rally ‘alive and well’

Presuming fee rates increase to the significant degree, Glassnode suggests that could mean demand is rising, assisting to sustain further “constructive structural shift” in Bitcoin network activity.

“Whilst we’ve not seen a notable uptick in charges yet, keeping track of this metric will probably be an indication of recovery.”