Bitcoin (BTC) rose to daily resistance in the August. 3 Wall Street open as U . s . States equities acquired on relief over Taiwan.

Stocks gain as US dollar coils

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD coming back towards the area just beneath $23,500, which in fact had figured as resistance since the beginning of the month.

The happy couple had formerly held exactly the same zone as support, and it was now choosing whether a brand new resistance/ support switch was around the cards.

For popular trader Crypto Tony, $23,500 was thus the cost to look at to lengthy BTC.

Make it simple today on #Bitcoin ..

– Lengthy above resistance at $23,500

– Short below support at $22,650 pic.twitter.com/onXXRvdXx8— Crypto Tony (@CryptoTony__) August 3, 2022

Towards the downside, fellow trader Pentoshi highlighted the region between $21,800 and $22,000 because the “line within the sand” for BTC.

Stocks performed well at the time, meanwhile, using the S&P 500 and Nasdaq Composite Index gaining 1.2% and a pair ofPercent, correspondingly, following the open. News that U.S. house speaker Nancy Pelosi had begun a trip to Taiwan without repercussions from China buoyed the atmosphere.

The U.S. dollar index (DXY), after solid gains of their own at the beginning of a few days, consolidated after facing resistance at 106.8 on hourly timeframes. The intra-day lows matched with highs from May, analysis noted, with the opportunity of new two-decade highs still in play with what would represent friction for crypto and risk assets.

“Because the dollar begins to show potential indications of strength (and yields start to rip greater), will stocks still remain resilient? Cost action throughout 2022 informs us ‘no,'” market analyst Caleb Franzen cautioned.

ARK taps “emerging risk-on atmosphere”

In a listing of the established order in Bitcoin and Ether (ETH), meanwhile, investment firm ARK Invest colored an assorted picture of in which the market may go in 2022.

Related: ARK Invest ‘neutral to positive’ on Bitcoin cost as analysts await capitulation

Within the latest edition of their research series, “The Bitcoin Monthly,” ARK analysts including Chief executive officer, Cathie Wood yet others stated that “all eyes” were now on macro triggers.

“Because of the positive correlation between bitcoin and US equities since COVID, the united states to be the leading cost mover of bitcoin suggests a growing risk-on market atmosphere,” they authored.

The U . s . States, ARK added, had likely symbolized nearly all buy curiosity about Bitcoin during July’s recovery.

Moving forward, however, the chances of the extended rebound were uncertain. Describing its stance as “neutral,” ARK delivered a possible “unlikely” bearish target of just below $14,000.

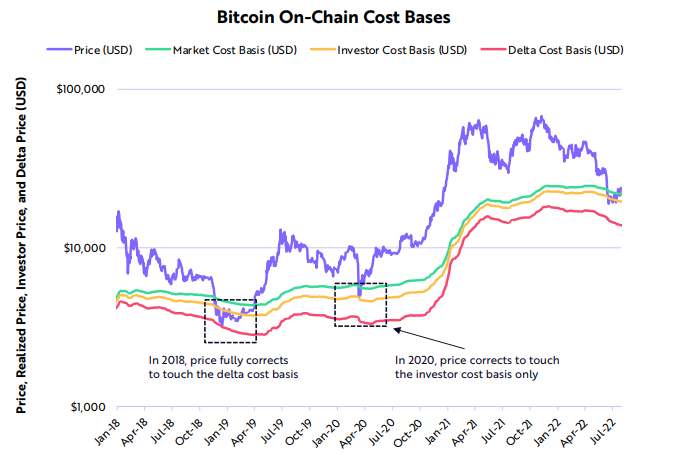

“Similar to the selloff in the peak from the COVID crisis, bitcoin’s cost didn’t achieve its delta cost basis, a cost adjusted cost basis that subtracts the existence-up to now moving average of market cost from the market cost basis and can serve as bitcoin’s most powerful support level,” the report mentioned.

“While the probability of touching its delta cost basis has reduced, bitcoin’s downside risk inside a bear market technically is its delta cost basis, presently $13,890.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.