Cardano (ADA) cost continues to be rebounding after falling to the worst levels since Feb 2021. Meanwhile, a technical fractal shows that ADA’s upside retracement could continue within the coming days.

Can ADA cost extend the recovery?

ADA’s cost has began bouncing after testing exactly the same support area that preceded a 65% bull run in March 2022.

Particularly, ADA/USD observed a bullish rejection since it’s cost fell below $.75 on February. 24, moving that adopted a brief period of sideways consolidation.

It later broke from the flat cost range, rising to $1.24 on March 26, indicating a powerful buying sentiment close to the area surrounding the $.75-level (the red bar within the chart below).

The March 2022 fractal also demonstrated ADA’s three-day relative strength index (RSI) treading near its oversold threshold of 30. The momentum indicator has came back to close exactly the same level as ADA consolidates within the flat range.

Because of this fractal, Cardano eyes a clear, crisp rebound from $.75 in May 2022, using its interim upside target around $1, an amount that coincides using the upper trendline of ADA’s prevailing climbing down funnel pattern.

On the other hand, a rest underneath the $.75-level, supported by a rise in volume, might have ADA test the climbing down channel’s lower trendline since it’s next downside target (near $.55).

ADA whales purchasing the dip

Cardano may also undergo a clear, crisp rebound due to strong accumulation sentiment.

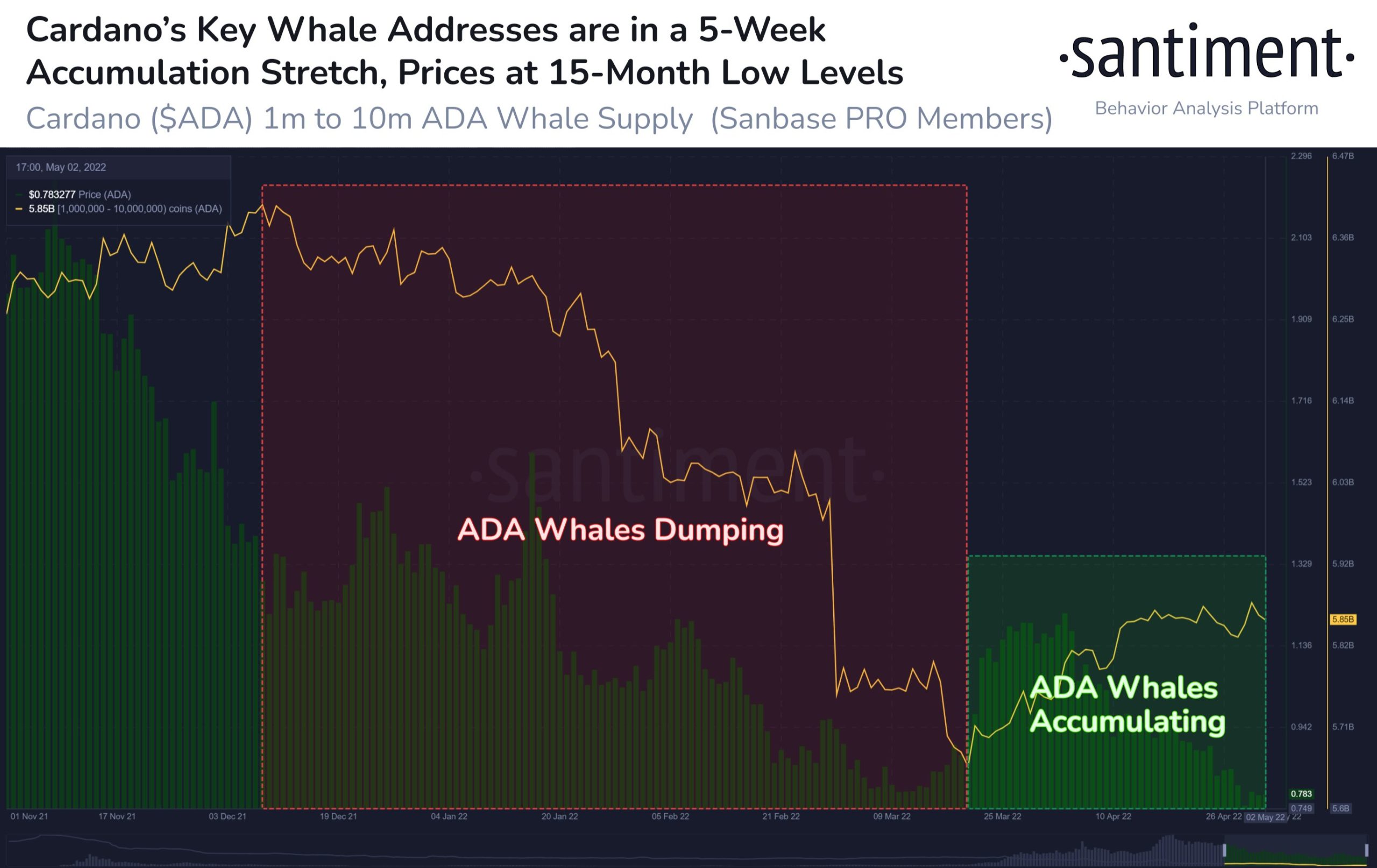

Particularly, Cardano’s wealthiest investors, or “whales” that hold between a million ADA and ten million ADA, have added 196 million ADA (worth $147 million at May 3’s cost) for their addresses previously five days, on-chain data from Santiment shows.

The buildup sentiment grows as ADA trades near its 15-month lows, suggesting that investors happen to be purchasing the dip awaiting a clear, crisp rebound. Earlier, a distribution phase observed across whale addresses between December 2021 and March 2022 coincided with ADA cost shedding from $1.75 close to $.75.

“Basho” factor

Digital Trend, a pseudonymous analyst at Seeking Alpha, anticipates Cardano to carry on heading lower within the next three–four several weeks, mainly because of its correlation with all of those other crypto market that risks correction because of macroeconomic factors.

Related: 400 new projects and 100K new wallets inside a month on Cardano

Nevertheless, the analyst noted that ADA’s cost would rebound to a different all-time high dads and moms resulting in “Basho,” Cardano’s next technical upgrade that offers to bring greater scalability.

“ADA’s cost has always rallied strongly prior to the update,” he described, adding:

“Within the several weeks prior to Shelley, ADA went from $.02 to $.15. Between Shelley and Goguen, ADA also appreciated considerably, so we see only eco-friendly within the several weeks prior to the upgrade.”

The Basho update goes live between 2022 or early 2023, based on Cardano’s roadmap.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.