Bitcoin (BTC) hit multi-day lows into August. 10 as crypto traders braced for impact with fresh U . s . States inflation data.

Trader: Market “might get ugly” if CPI carries on growing

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD dipping to $22,668 on Bitstamp at most recent daily close — its cheapest since August. 5.

Bullish momentum had evaporated throughout the day prior, and also the mood among traders was firmly risk-off as markets anticipated the most recent Consumer Cost Index (CPI) readout.

Covering This summer, the information was due at 8.30am Eastern time August. 10, with expectations demanding it reveal that U.S. inflation had already peaked.

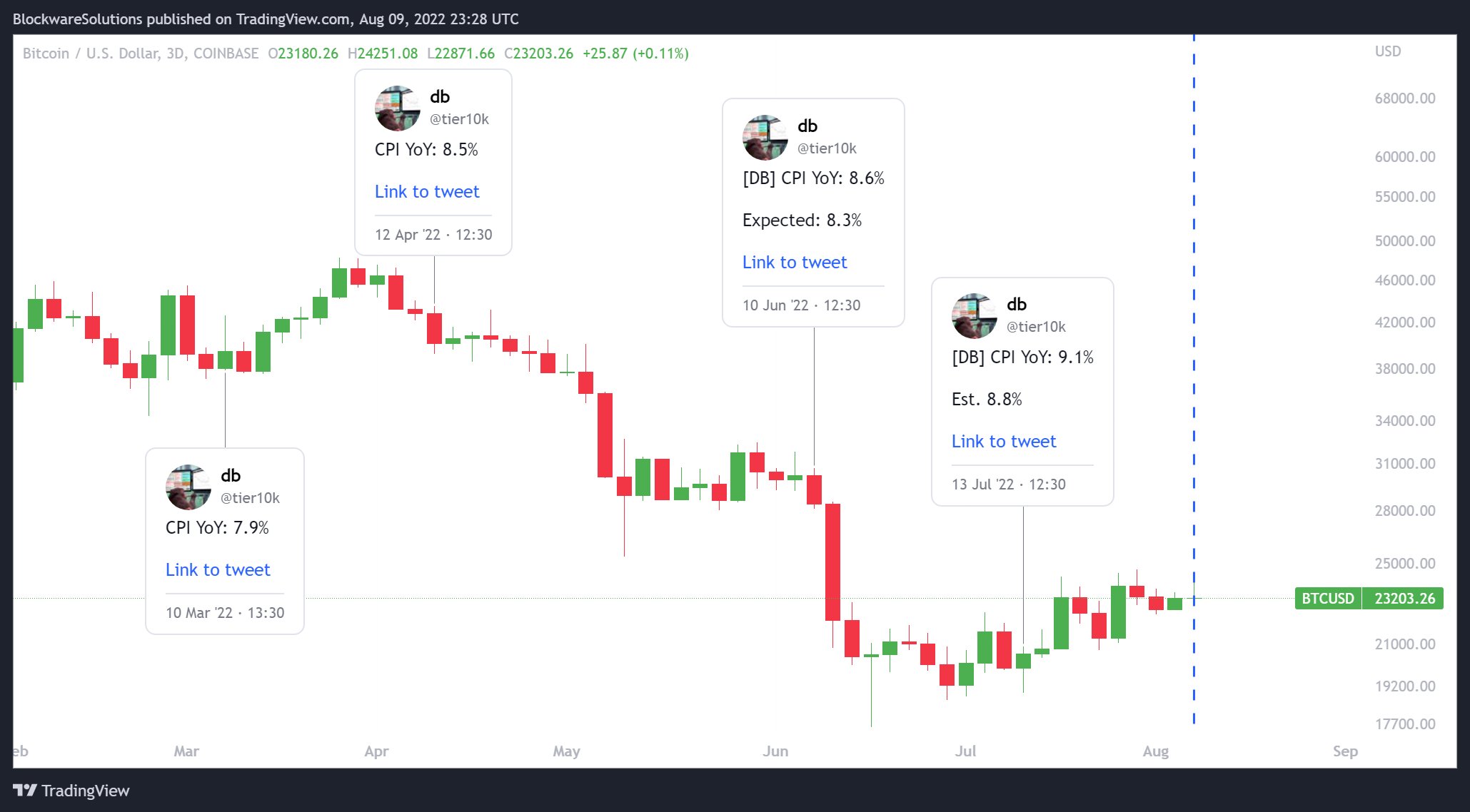

“CPI prints happen to be pretty pitoval for BTC cost action,” Blockware lead insights analyst William Clemente authored partly of the tweet concerning the event, adding that CPI would form a “big day” for crypto.

An associated chart demonstrated the outcome of previous CPI readouts on BTC/USD.

Trader and analyst Daan Crypto Trades meanwhile gave a CPI studying of 9.1 or over as “bearish” for cost action against current expectations of 8.7.

CPI Guide for today for me:

CPI YoY:

8.7-9.1 Neutral most likely slightly bearish

9.1> BearishCore CPI YoY

5.9-6.1 Neutral

6.1> BearishMore ideas below

— Daan Crypto Trades (@DaanCrypto) August 10, 2022

“The market continues to be pumping on the thought of inflation getting likely peaked yesteryear month,” he authored inside a dedicated thread.

“If it doesn’t have that confirmation today It might get ugly temporary because the peak will probably be moved on another 1-2 several weeks. Which likely means a delayed Given pivot too.”

Macro analyst Alex Krueger was more dismissive, meanwhile, calling CPI a “little number” while acknowledging its effect on risk asset trends.

BTC cost still not even close to bullish pivot zone

BTC cost action thus remained wedged inside a familiar range with classic support and resistance levels still in play.

Related: Bitcoin dominance hits 6-month lows as metric proclaims new ‘alt season’

BTC/USD circled $23,000 during the time of writing after shedding greater than $1,000 your day prior.

Daan Crypto Trades flagged $24,300 like a crucial level to interrupt and hold for Bitcoin to “fly,” with $21,000 a possible target in case of a failure.

$BTC Testing a vital support level here using the 4H 200EMA arriving below it at $22.7K.

If we’d i believe on breakdown then your logical target could be low $21Ks.

Break and hold above $24.3K and we’ll fly.

Individuals are my levels to look at for the moment. pic.twitter.com/UrDmxuebGf

— Daan Crypto Trades (@DaanCrypto) August 9, 2022

On-chain monitoring resource Whalemap meanwhile ongoing its analysis of whale purchase and sell levels.

“$BTC has returned towards the whale accumulation area,” the Whalemap team summarized on August. 9.

“Prices where whales accumulate usually behave as support or resistance for cost action of Bitcoin. Real question is, can we obtain a bounce again or go much deeper.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.