Following the rising wedge formation was damaged on August. 17, the entire crypto market capital rapidly dropped to $1 trillion and also the bulls’ imagine recouping the $1.2 trillion support, last seen on June 10, grew to become much more distant.

The worsening the weather is not only at crypto markets. The cost of WTI oil ceded 3.6% on August. 22, lower 28% in the $122 peak seen on June 21. The U . s . StatesTreasuries 5-year yield, which bottomed on August. 1 at 2.61%, reverted the popularity and it is now buying and selling at 3.16%. All of these are signs that investors feel less confident concerning the central bank’s policies of requesting more income to carry individuals debt instruments.

Lately, Goldman Sachs chief U.S. equity strategist David Kostin mentioned the risk-reward for that S&P 500 is skewed towards the downside following a 17% rally since mid-June. Based on a customer note compiled by Kostin, inflation surprises towards the upside will need the U.S. Fed to tighten the economy more strongly, negatively impacting valuations.

Meanwhile, extended lockdowns supposedly targeted at that contains multiplication of COVID-19 in China and property debt problems caused the PBOC brought the central bank to lessen its five-year loan prime rate to 4.30% from 4.45% on August. 21. Strangely enough, the movement happened per week following the Chinese central bank decreased the eye rates inside a surprise move.

Crypto investor sentiment is close to ‘neutral-to-bearish’

The danger-off attitude introduced by surging inflation brought investors to anticipate additional rate of interest hikes, that will, consequently, diminish investors’ appetite for growth stocks, goods and cryptocurrencies. Consequently, traders will probably seek shelter within the U.S. dollar and inflation-protected bonds in times of uncertainty.

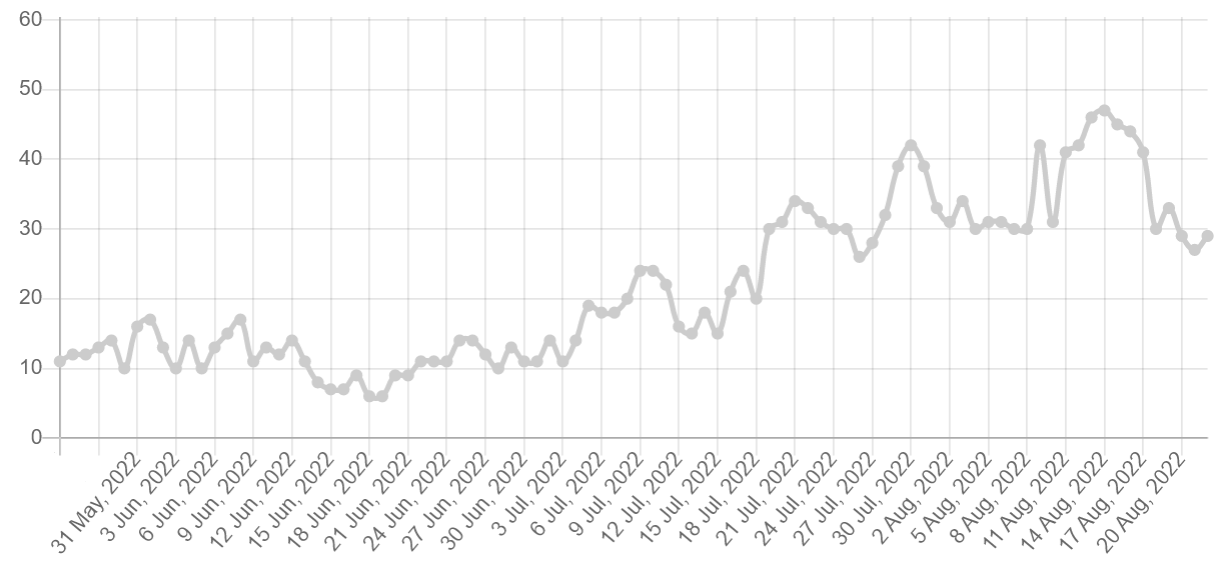

The Worry and Avarice Index hit 27/100 on August. 21, the cheapest studying in thirty days with this data-driven sentiment gauge. The move confirmed investors’ sentiment was shifting from an unbiased 44/100 studying on August. 16 also it reflects the truth that traders are relatively frightened of the crypto market’s short-term cost action.

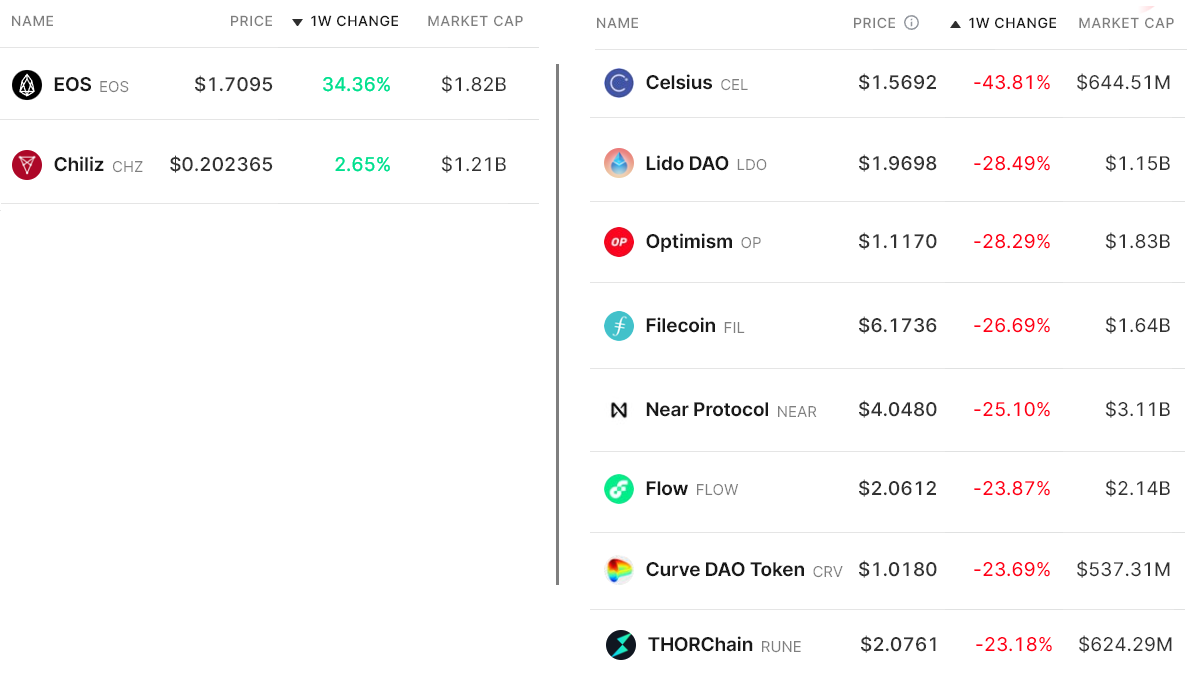

Here are the winners and losers in the past 7 days because the total crypto capital declined 12.6% to $1.04 trillion. While Bitcoin (BTC) presented a 12% decline, a number of mid-capital altcoins dropped 23% or even more at that time.

EOS leaped 34.4% after its community switched bullish around the “Mandel” hard fork scheduled for September. The update is anticipated to totally terminate the connection with Block.one.

Chiliz (CHZ) acquired 2.6% after Socios.com invested $100 million for any 25% stake within the Barcelona Football Club’s new digital and entertainment arm.

Celsius (CEL) dropped 43.8% following a personal bankruptcy filing set of August. 14 displayed a $2.85 billion funds mismatch.

Most tokens performed negatively, but retail demand in China slightly improved

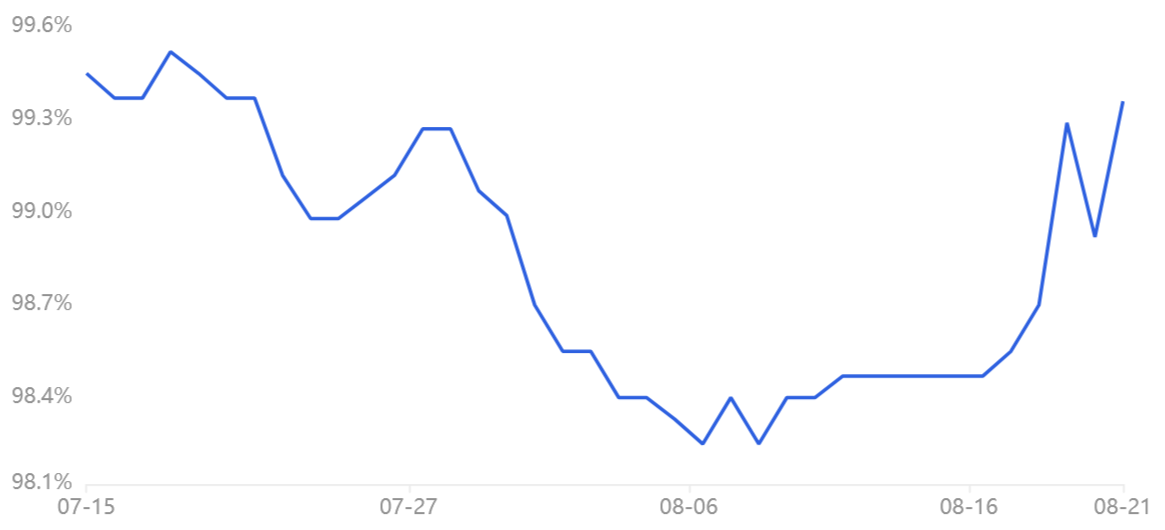

The OKX Tether (USDT) premium is a great gauge of China-based retail crypto trader demand. Its dimensions are the main difference between China-based peer-to-peer (P2P) trades and also the U . s . States dollar.

Excessive buying demand has a tendency to pressure the indicator above fair value at 100%, and through bearish markets, Tether’s market offers are flooded and results in a 4% or greater discount.

On August. 21, the Tether cost in Asia-based peer-to-peer markets arrived at its greatest level in 2 several weeks, presently in a .5% discount. However, the index remains underneath the neutral-to-bearish range, signaling low demand from retail buying.

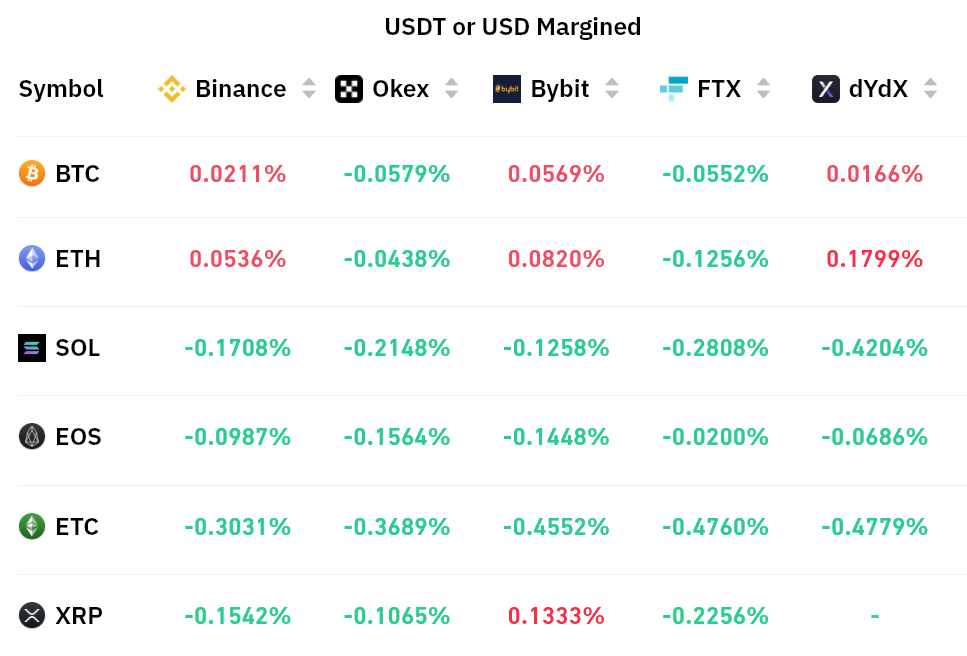

Traders should also evaluate futures markets to exclude externalities specific towards the Tether instrument. Perpetual contracts, also referred to as inverse swaps, come with an embedded rate usually billed every eight hrs. Exchanges make use of this fee to prevent exchange risk imbalances.

An optimistic funding rate signifies that longs (buyers) require more leverage. However, the alternative situation takes place when shorts (sellers) require additional leverage, resulting in the funding rate to show negative.

Perpetual contracts reflected an unbiased sentiment after Bitcoin and Ether held a comparatively flat funding rate. The present charges resulted from the balanced situation between leveraged longs and shorts.

When it comes to remaining altcoins, the .40% weekly negative funding rate for Ether Classic (ETC) wasn’t enough to discourage short sellers.

A 20% drop to retest yearly lows is probably within the making

Based on derivatives and buying and selling indicators, investors are moderately concerned about a steeper global market correction. The lack of buyers is apparent in Tether’s slight discount when priced in Chinese yuan and also the near-zero funding rates observed in futures markets.

These neutral-to-bearish market indicators are worrisome, considering that total crypto capital is presently testing the critical $1 trillion support. When the U.S. Fed effectively is constantly on the tighten the economy to suppress inflation, the chances of crypto retesting yearly lows at $800 billion are high.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.