While mainstream coverage of cryptocurrency continues to be overwhelmingly negative within the wake from the collapse from the Terra ecosystem, the personal bankruptcy of Celsius and nov Three Arrows Capital, these occasions ultimately show why more from the economic climate should work on-chain, getting more transparency and knowledge to promote participants.

In most three cases, the harm was caused and exacerbated by opaque, off-chain entities. Even though the reason behind the trio of occasions is essential, it’s also caused considerable harm to the general status of the profession. These occasions make it obvious the industry needs more transparency, something that may be permitted with increased on-chain data and knowledge analysis tools.

Advocates of blockchain technologies frequently tout their transparency: the systems are treasure troves of open, incorruptible financial data permitting business activities to become measured by having an unparalleled amount of precision. This latest technology creates immutable records of transactions where sentiment and investor behavior could be measured with the collection and focus of information.

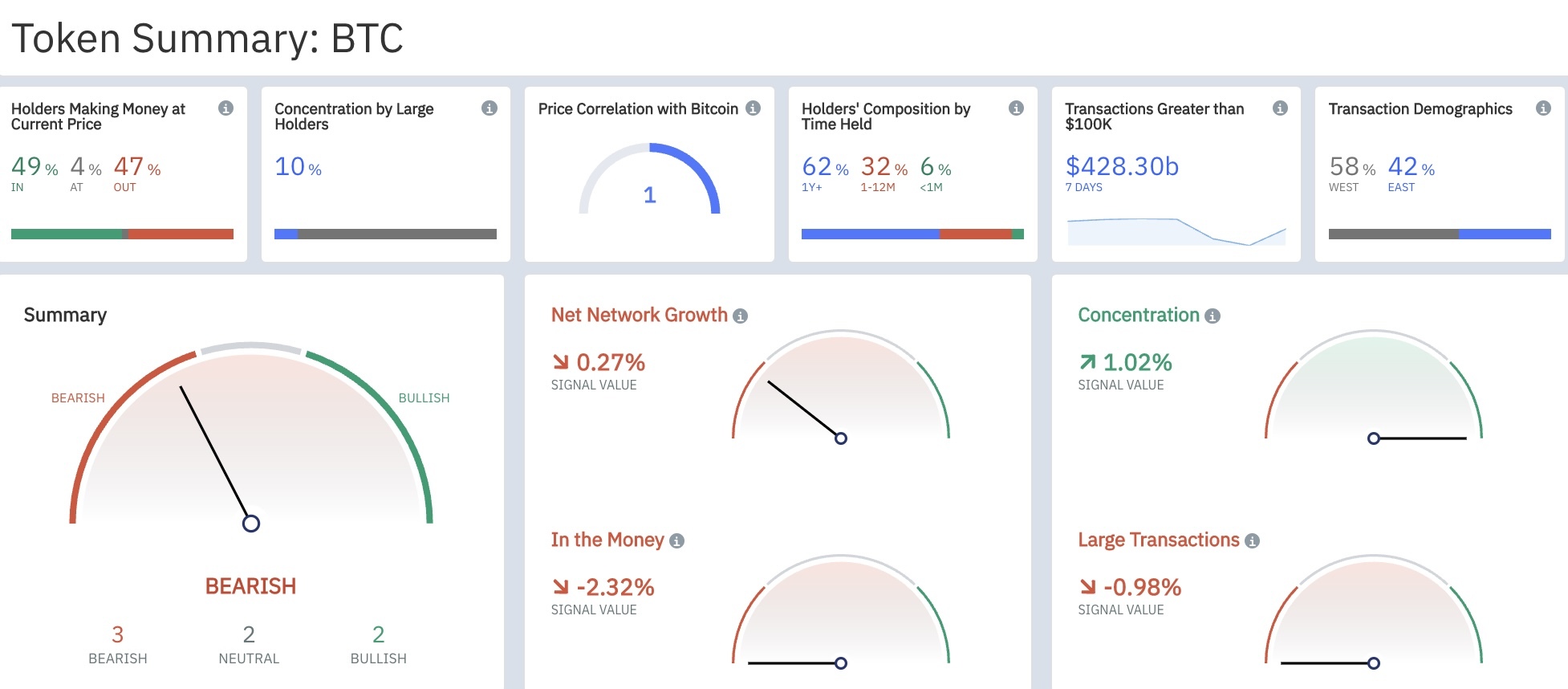

On-chain data provides for us understanding of market events

On-chain data analysis is becoming crucial in the blockchain space. By searching at transaction data and crypto wallet balances, we are able to gather valuable insights into market conditions. This really is crucial for participants and investors attempting to plan their next move. Besides data tell a tale from the market’s past, however it enables every single investor to create an educated decision before initiating any trades or getting together with the marketplace.

Related: A $10B hedge fund gone bust with founders on the move

The significance of analytics platforms is becoming more apparent than in the past — they’re required for gaining knowledge from our mistakes and understanding weaknesses inside the blockchain ecosystem. The occasions prior to Celsius’ collapse and also the unveiling of 3AC’s holdings were researched and examined completely by analysts and media alike. Studies have helped particularly to color an image that outlined in which the contagion began and just how it spread. It was only possible because some of this data was on-chain. If 3AC and Celsius were built with a full picture of the holdings on-chain — much like a platform for example Aave which anybody can audit and verify collateralization — less investors and creditors might have been duped.

Similarly, on-chain intelligence plays a part in real-time market movements, not only to analyzing yesteryear. Data that gives users near real-time details about the movements and positions from the industry’s most significant and largest players demonstrated to become essential when Terra USD (UST) lost its peg. Organizations with insights into this data were able to steer clear of the worst from the UST de-peg.

Leveling the arena

On-chain analysis provides the commitment of equal use of information and isn’t according to hype, sentiment, or technical analysis. This kind of analysis could be focused solely on data, in which the major advantage of on-chain metrics is they explain investor behavior and network health in tangible-time. Furthermore, on-chain data levels the arena by looking into making the techniques and activities of top participants public understanding.

Related: Crypto Biz: The 3AC saga takes another bizarre twist

Transparent information is a core feature of blockchain systems. As the collapse of Luna, 3AC, Celsius yet others was treated like a validation of the fact that it’s an ecosystem of “shadowy super-coders” where crooks and scams flourish, in fact these entities only were able to harm investors because such large aspects of their operations were off-chain.

Ultimately, the antidote to crypto contagion isn’t regulation or police force, however in getting more financial infrastructure on-chain where it may be examined and utilized by the broader public.

John Calabrese may be the mind of product at Nansen, a blockchain-analytics firm. He holds greater than 10 experience in product management and formerly labored for businesses within the finance technology space including FIS and Fidelity, and also at startups for example Cinch and Monit. John has roots in traditional finance, earning his CFA and FRM designations, but is most enthusiastic about the way forward for finance where goods are more decentralized, transparent, and efficient through blockchain technology. If not working or buying and selling crypto, John are available in your own home getting together with his Shiba Inu, Nutmeg.

The opinions expressed would be the author’s alone and don’t always reflect the views of Cointelegraph. This information is for general information purposes and isn’t supposed to have been and cannot be used as legal or investment recommendations.