Terra (LUNA) cost lost 31% in the last four days, erasing all the gains accrued year-to-date although the token is constantly on the outshine the broader cryptocurrency market by 20%, Terra is battling to carry over the $85 support.

Formerly, a couple of bullish catalysts were Terra’s USD (UST) stablecoin flipping Binance USD (BUSD) to end up being the third-largest stablecoin on April 18 and also the April 26 announcement that Fireblocks, an electronic asset child custody platform saw institutional clients invest over $250 million in to the Terra decentralized finance (DeFi) ecosystem.

This positive newsflow wasn’t enough to instill confidence in Terra investors there were additionally a couple of changes that may have partly subdued the continual inflow of deposits around the network.

For example, on May 1, Anchor Protocol, Terra’s largest DeFi application by deposits, introduced a semi-dynamic adjustment to the formerly fixed 20% annualized percentage yield (APY). The Anchor earn rate was cut to 18% on and on forward it will likely be reviewed monthly.

TVL increased, but Dapp transactions declined

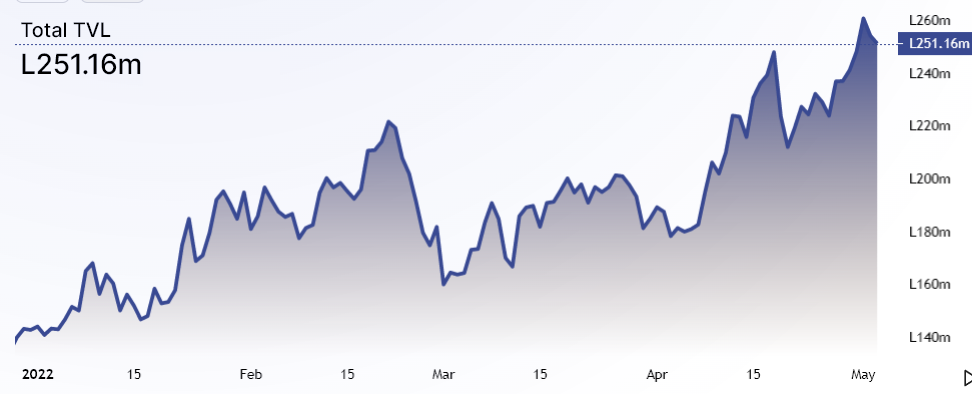

Terra’s primary decentralized application metric elevated by 41% in the last month because the network’s total value locked (TVL) hit an exciting-time high at 254 million LUNA.

Notice how Terra’s DApp deposits saw a 77% begin 2022, reaching the same as $21.2 billion. Like a comparison, Binance Chain’s TVL presently is $9.8 billion, a 9% rise in BNB terms year-to-date. Avalanche, another DApp scaling solution competitor, saw a 28% TVL rise in AVAX terms to some $7.9 billion value.

To verify whether DApp use has effectively elevated, investors also needs to evaluate the transaction count inside the ecosystem.

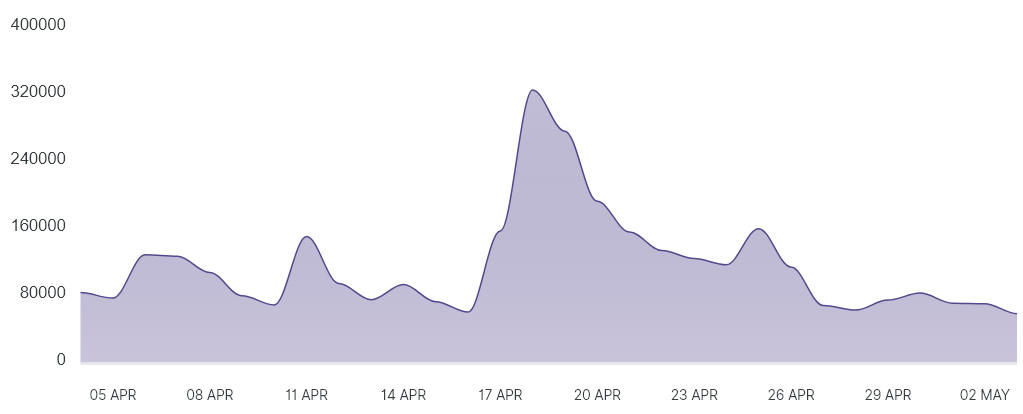

Anchor holds a $16.6 billion TVL, equal to 78% of Terra’s decentralized application deposits. The protocol averaged 70,150 transactions each day a week ago, that is 15% underneath the levels observed in early April.

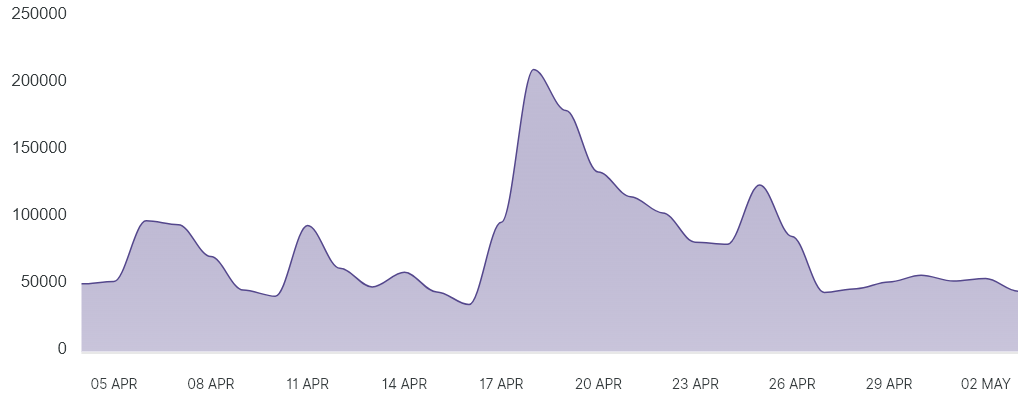

Astroport, an automated market-making project, supports the # 2 position in TVL terms within Terra’s ecosystem, with $1.6 billion price of deposits. Particularly, a week ago, typically 50,650 transactions each day required place, a 30% decline in the previous month.

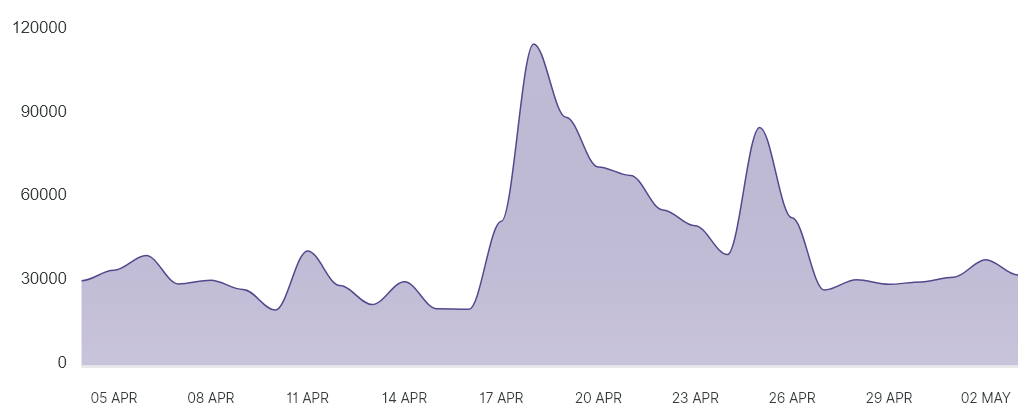

Based on Terrascope data, the Terraswap decentralized asset liquidity application had 31,400 average daily transactions in the last week. The amount is comparable to the amount observed in early April.

Derivatives data show no manifestation of distress

The lower utilization of Terra DApps doesn’t appear to possess impacted derivatives traders’ appetite.

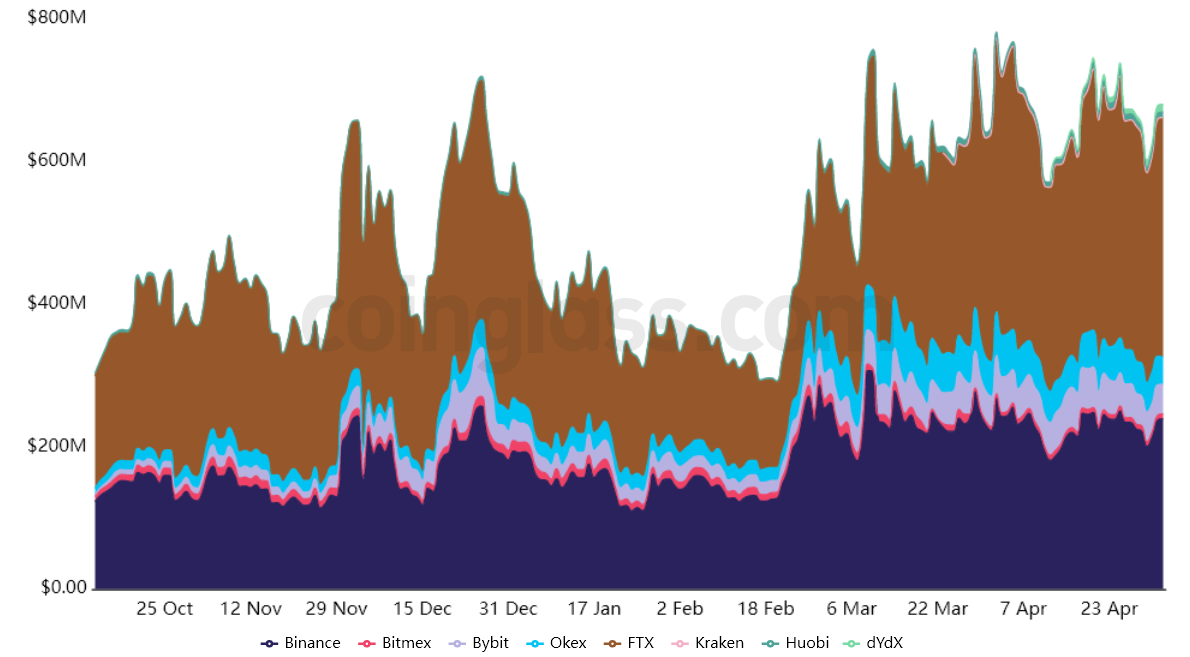

The above mentioned chart shows LUNA futures contracts open interest holding steady at $706 million. This information is critical just because a smaller sized quantity of futures contracts could limit arbitrage desks and institutional investors’ activity.

In addition, Terra has got the third-largest open interest behind Bitcoin (BTC) and Ether (ETH). Like a comparison, Solana (SOL) and XRP futures contracts hold a $660 million open interest.

LUNA Fundamentals continue to be solid

Though it appears impossible to pinpoint the reason for LUNA’s cost drop, the reduction in the network’s decentralized apps use can partly explain the movement. However, the rise in it’s good contract deposits, as proven through the TVL increase and seem interest from derivatives traders indicate a cost recovery within the near-term.

The information shows that Terra holders aren’t worried about the 31% cost correction and therefore are focused around the ecosystem’s growth versus its competitors. As lengthy because these metrics stay healthy, investors will not sell baffled.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.