Bitcoin (BTC) consolidated below $40,000 on May 5 after U.S. economic policy excitement saw a spike to 1-week highs.

Given sparks little crypto reaction

Data from Cointelegraph Markets Pro and TradingView confirmed a weekend peak of $40,050 on Bitstamp following comments in the Fed and Chair Jerome Powell.

The U.S. central bank had conformed to promote expectations having a .5% key rate hike, also suggesting that similar repeat hikes would follow.

With this, a modest market rally left Bitcoin eerily missing volatility with what would be a strong contrast to previous Given pronouncements on topics for example inflation.

Even though many expected risk assets en masse — including crypto — to deflate underneath the new policy, not everybody thought that this type of scenario would cause investors maximum discomfort.

“Because of so many people with melt ups and melt downs, most likely the discomfort trade would be to chop sideways in risk assets for any lengthy time,” economist Lyn Alden contended.

Bitcoin circles likewise weren’t expecting major trend changes. Ben Lilly, an expression economist at Jarvis Labs, highlighted low funding rates on BTC derivatives markets.

“Market saw some respite with Powell’s comments. And can it go on for the crypto market? To begin, funding rates happen to be negative for any lengthy time period. This would happen at range lows,” he authored in a number of tweets.

“A great structure for just about any upward momentum that begins here.”

Lilly added, however, that too little accumulation from whales at current cost levels was “not what we should wished to determine.”

“Max discomfort” for Bitcoin still a long way away

Concentrating on lower timeframes, popular trader Crypto Erectile dysfunction held out for any fresh push over the $40,000 mark on May 5.

Related: Bitcoin pushes to $40K, but they are bulls sufficiently strong to win Friday’s $735M options expiry?

For him, BTC/USD is at line hitting $40,800, even though there have been “lots of reasons” to discount a far more significant climb, it had been still a choice.

2/2

No, this isn’t a bold demand $43.5k in 1 go and before finish each week.

Will show you the chart above in the current video.

This is actually the best scenario while there are many good reasons to think this really is impossible.

Will attempt to complete YT before 10am, otherwise early mid-day— Erectile dysfunction_NL (@Crypto_Erectile dysfunction_NL) May 5, 2022

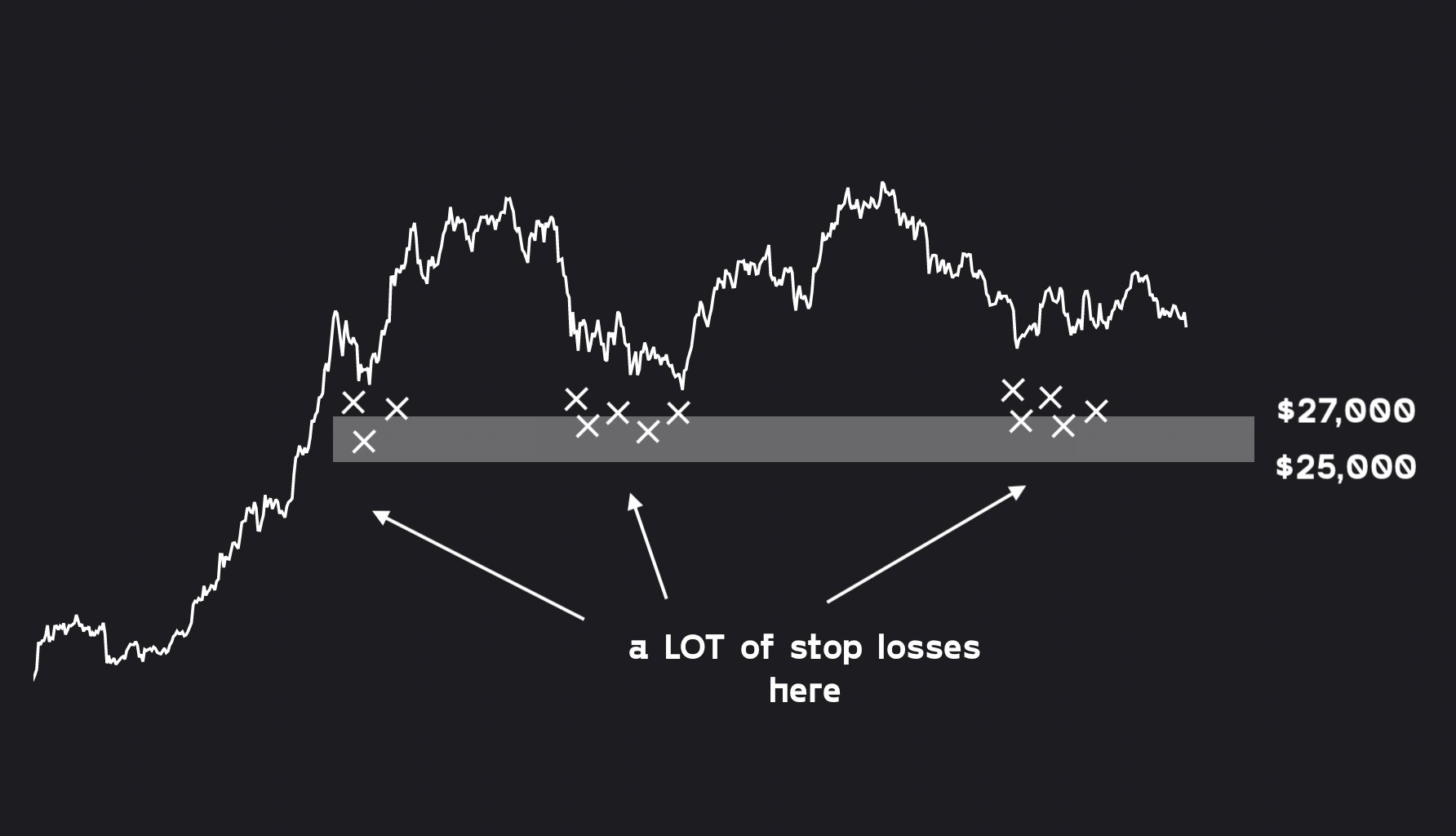

When it comes to BTC cost capitulation scenarios, meanwhile, on-chain monitoring resource Whalemap repeated its previous assertion the area between $25,000 and $27,000 would constitute “max discomfort” for Bitcoin hodlers.

“Lots of liquidity and prevent losses are stacked there,” it described included in Twitter comments.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.