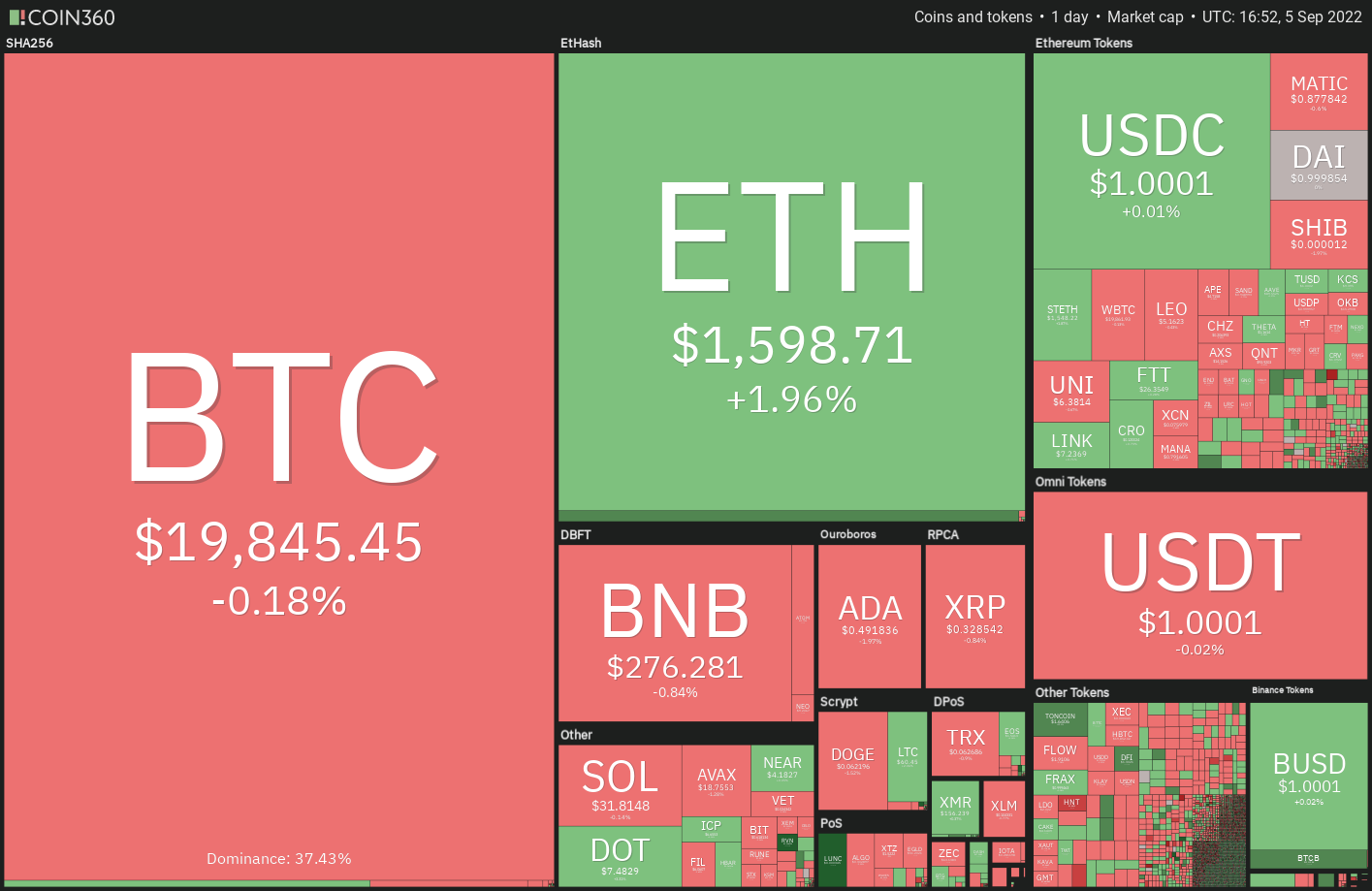

The cryptocurrency markets happen to be quiet over the past weekend. The sideways cost action proceeds Sept. 5 and you will find unlikely to become any fresh triggers in the U . s . States equities markets, that are closed for Labor Day.

However, the bullish picture for cryptocurrencies looks clouded because the energy crisis in Europe sent the euro to some two-decade low in comparison to the U.S. dollar. Meanwhile, the U.S. dollar index (DXY) that have an inverse correlation using the equities markets and cryptocurrencies soared above 110 the very first time since June 2002.

An optimistic sign of all the mayhem is the fact that Bitcoin (BTC) hasn’t quit much ground in the last couple of days and is constantly on the trade close to the mental degree of $20,000. This means that traders aren’t panicking and dumping their positions in a rush.

Could bulls push and sustain Bitcoin above $20,000 and can this trigger buying in altcoins? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin continues to be stuck in the tight range from $19,520 and $20,576 within the last couple of days. This signifies indecision one of the bulls and also the bears. Although bulls are purchasing the dips, they’ve unsuccessful to obvious the overhead resistance.

The downsloping 20-day exponential moving average (EMA) ($20,775) and also the relative strength index (RSI) within the negative territory increase the probability of a rest below $19,520. In the event that happens, the BTC/USDT pair could drop towards the strong support zone between $18,910 and $18,626.

Buyers are anticipated to protect this zone with all of their might. When the rebound breaks over the 20-day EMA, the happy couple could rise towards the 50-day simple moving average (SMA) ($22,253). The bulls will need to obvious this hurdle to spread out the doorways for any possible rally to $25,211.

On the other hand, if bears sink the cost below $18,626, the happy couple could retest the ultimate support at $17,622. A rest below this support could signal the resumption from the downtrend.

ETH/USDT

Ether (ETH) continues to be stuck between your 20-day EMA ($1,605) and also the neckline from the mind and shoulders (H&S) pattern since August. 31 however this tight-range buying and selling is not likely to carry on for lengthy.

If buyers push and sustain the cost over the 20-day EMA, the ETH/USDT pair could rally towards the overhead resistance at $1,700. It is really an important level to keep close track of just because a break and shut above it might signal that bulls have returned in charge. The happy couple could then rally to $2,030 and then towards the downtrend line.

This bullish view is going to be invalidated soon when the cost turns lower in the moving averages and breaks below $1,422. In the event that happens, the happy couple could slide to $1,280. The bulls are anticipated to protect this level with vigor however, if the bears overpower them, the decline could include the pattern target of $1,050.

BNB/USDT

BNB has been buying and selling close to the strong support of $275 within the last couple of days however the bulls haven’t been in a position to acquire a strong rebound off it. This signifies too little demand at greater levels.

The 20-day EMA ($286) continues to be sloping lower and also the RSI is below 41, indicating that bears possess the upper hands. When the cost breaks and closes below $275, the BNB/USDT pair will develop a bearish mind and shoulders pattern. The happy couple could then start its decline to $240 and then towards the pattern target of $212.

Unlike this assumption, when the cost appears in the current level and breaks over the moving averages, it’ll claim that bulls are during the game. The happy couple could then rise towards the overhead resistance at $308.

XRP/USDT

Ripple (XRP) continues to be stuck between $.32 and $.34 within the last couple of days however this tight range buying and selling is not likely to carry on for lengthy.

The bears will endeavour to sink the cost below $.32. When they succeed, the XRP/USDT pair could extend its decline towards the crucial support at $.30. Buyers will probably defend this level strongly because they tried on three previous occasions.

Alternatively, when the cost rebounds off $.32 and breaks above $.34, it’ll advise a short-term benefit to the bulls. The happy couple could then rise towards the 50-day SMA ($.36) and then towards the stiff overhead resistance at $.39.

ADA/USDT

Cardano (ADA) broke and closed over the 50-day SMA ($.49) on Sept. 4 however the bulls couldn’t sustain the breakout. This means that bears still sell on rallies.

The cost switched lower and broke underneath the 50-day SMA on Sept. 5, indicating that bears are trying to trap the aggressive bulls. When the cost dips underneath the 20-day EMA ($.47), the happy couple could drop to $.44 and then to $.42.

On the other hand, when the cost rebounds from the 20-day EMA and increases above $.51, it’ll suggest a general change in sentiment from selling on rallies to purchasing on dips. The ADA/USDT pair could then rise towards the downtrend line.

SOL/USDT

Solana (SOL) continues to be buying and selling near $32 within the last couple of days however a negative sign is the fact that buyers haven’t been in a position to push and sustain the cost above it.

When the cost turns lower and slips below $30, the SOL/USDT pair could decline towards the vital support at $26. It is really an important level for that bulls to protect if this support gives way, the happy couple could start the following leg from the downtrend.

Soon, if buyers push the cost over the 20-day EMA ($34), it’ll claim that the selling pressure might be reducing. The happy couple could then chance a rally towards the 50-day SMA ($38) in which the bears may again pose a powerful challenge.

DOGE/USDT

Dogecoin (DOGE) has remained over the immediate support at $.06 within the last couple of days however the bulls have unsuccessful to attain a powerful rebound off it. This signifies that demand dries up at greater levels.

A good consolidation near an assistance usually produces a breakdown. The downsloping 20-day EMA ($.06) and also the RSI within the negative zone indicate the road of least resistance would be to the down-side. If bears sink and sustain the cost below $.06, the DOGE/USDT pair could drop towards the crucial support at $.05.

To invalidate this negative view, buyers will need to push and sustain the happy couple above $.07. When they manage to achieve that, the happy couple could rise toward the overhead resistance at $.09.

Related: ETH Merge: CoinGecko co-founder shares technique for forked tokens

Us dot/USDT

Polkadot (Us dot) remains stuck inside a wide range between $6 and $10 within the last a few days. The cost has progressively been inching greater and also the bulls are trying to obvious the overhead hurdle in the moving averages.

When they manage to achieve that, it’ll claim that ‘abnormal’ amounts still attract buyers. The Us dot/USDT pair could then chance a rally to $9.17 and then towards the overhead resistance at $10.

However, when the cost does not go above the moving averages, it’ll claim that bears are active at greater levels. The sellers will make an effort to sink the cost underneath the strong support at $6.79. In the event that happens, the happy couple could drop towards the crucial support at $6, which will probably attract strong buying.

The cost action inside a wide range is generally random and volatile. Hence, it is not easy to project rapid-term cost moves within the range with certainty.

MATIC/USDT

Polygon (MATIC) continues to be range-bound between $1.05 and $.75 within the last a few days. Although bulls pressed the cost over the 50-day SMA ($.88) on Sept. 1, they haven’t yet had the ability to build this strength. This signifies that demand dries up at greater levels.

The bears will endeavour to sink the cost underneath the 20-day EMA ($.85). When they succeed, the MATIC/USDT pair could drop toward the strong support at $.75.

It is really an important level for that bulls to protect just because a break and shut below it might develop a mind and shoulders pattern. The happy couple could then begin a correction to $.63 and then towards the pattern target at $.45.

On the other hand, when the cost rebounds from the moving averages and increases above $.91, the probability of a rally to $1.05 increases. The bears are anticipated to pose a stiff resistance only at that level.

SHIB/USDT

Buyers pressed Shiba Inu (SHIB) over the 20-day EMA ($.000013) on Sept. 4 however the lengthy wick around the day’s candlepower unit implies that bears can sell at greater levels.

The cost switched lower and tucked underneath the moving averages on Sept. 5. The bears will attempt to sink the SHIB/USDT pair to $.000012, which will probably attract buyers. The 20-day EMA is flattening out and also the RSI is simply underneath the midpoint, indicating an account balance between consumers.

This balance could tilt in support of the bears when they pull the cost below $.000012. The happy couple could then decline to $.000010. Alternatively, if bulls drive and sustain the cost above $.000014, the happy couple could chance a rally to $.000018.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.