Crypto exchanges are vowing to help keep buying and selling open and unaffected during Ethereum’s (ETH) transition to proof-of-stake (PoS), despite deposits and withdrawals of ETH and ERC-20 tokens being stopped.

Meanwhile, the main exchange FTX went a step further, announcing a halt to wrapped ETH transactions on other chains too.

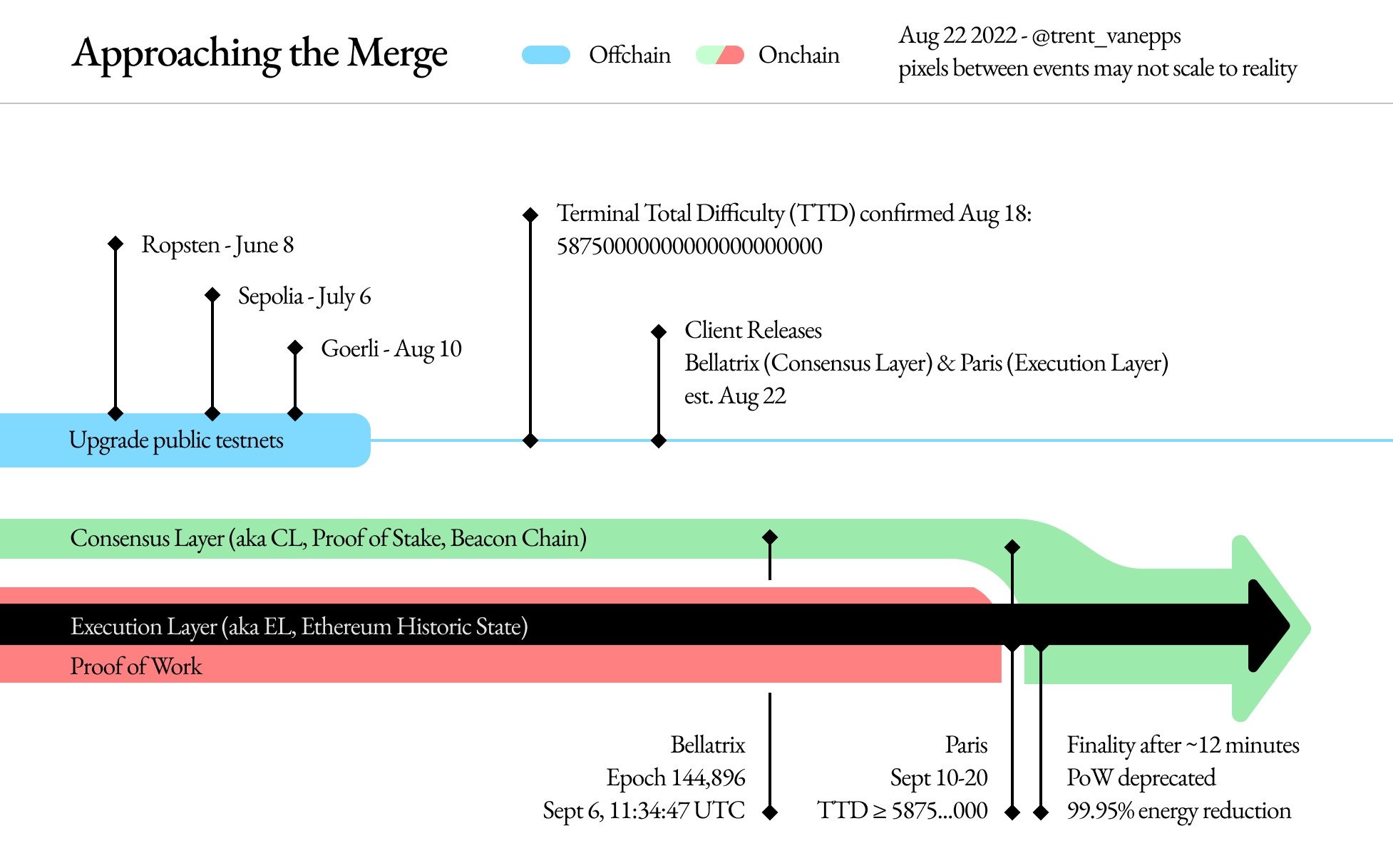

For FTX’s part, ETH and ERC-20 deposits and withdrawals is going to be suspended from September 6 at 11:34 UTC, roughly half an hour prior to the Bellatrix update – a vital step that must definitely be completed prior to the actual Merge, which marks the network’s transition to PoS. The exchange hasn’t stated how lengthy the suspension will stay in position.

Particularly, FTX on Monday also stated that it’ll suspend deposits and withdrawals of numerous types of wrapped ETH on other chains, including Arbitrum One ETH, Solana (Wormhole) ETH and Binance Smart Chain (BSC) ETH.

All buying and selling in ETH on FTX will stay open throughout the Merge, FTX Chief executive officer Mike Bankman-Fried has confirmed.

Meanwhile, the united states-based crypto exchange Kraken has stated that although ETH buying and selling will stay open, Ethereum deposits and withdrawals “may be unavailable for 12 hrs or longer throughout the merge.”

Exactly the same seemed to be reiterated by Kraken’s Mind of OTC Buying and selling, Juthica Chou, who stated inside a Bloomberg interview a few days ago there “might be considered a temporary suspension on withdrawals and deposits,” adding that “we won’t halt buying and selling.”

Among other major exchanges, Coinbase stated in August that it’ll “briefly pause new Ethereum (ETH) and ERC-20 token deposits and withdrawals like a precautionary measure,” but keep buying and selling open.

Binance, on its finish, has stated ETH and ERC-20 deposits and withdrawals is going to be suspended on September 6 at 11:00 UTC for that Bellatrix upgrade, and again on September 15 at 00:00 UTC for that Paris execution layer upgrade. The exchange has confirmed that buying and selling in futures and place markets won’t be affected.

The Paris execution layer upgrade may be the step that creates the particular Merge.

Traders preparing for that Merge

The confirmation that buying and selling will stay available throughout the Merge is probably welcomed by crypto traders, with lots of now likely preparing their action plans for that event.

Speaking within an interview using the Information recently, Samuel Harrison, managing partner at crypto venture fund Faction, known as the Merge “a very tradable event,” and stated exchanges – which generates charges from buying and selling – could be the finish as a few of the greatest winners.

An identical take seemed to be shared by Kraken’s Juthica Chou, who told Bloomberg that her team has seen a notable rise in positioning in ETH options along with other derivatives prior to the Merge.

Meanwhile, the exchange bulletins be several experts have cautioned users about getting together with Ethereum during and soon after the Merge.

The most recent person to warn others was Alex Svanevik, Chief executive officer of on-chain analytics firm Nansen, who stated on Twitter on Monday that quite a few users will probably get “absolutely rekt” round the Merge. “Would not play with anything involving debt/leverage unless of course you 100% understand what you’re doing. (You most likely don’t.),” Svanevik stated.

The Ethereum Foundation has formerly stated the Merge should be expected to occur sometime between September 10 and 20.