ETHPoW, a separatist proof-of-work (Bang) blockchain forked from Ethereum’s Merge, went survive Sept. 15. However, the chain endured intricacies following the launch, which put downward pressure on its ETHW token.

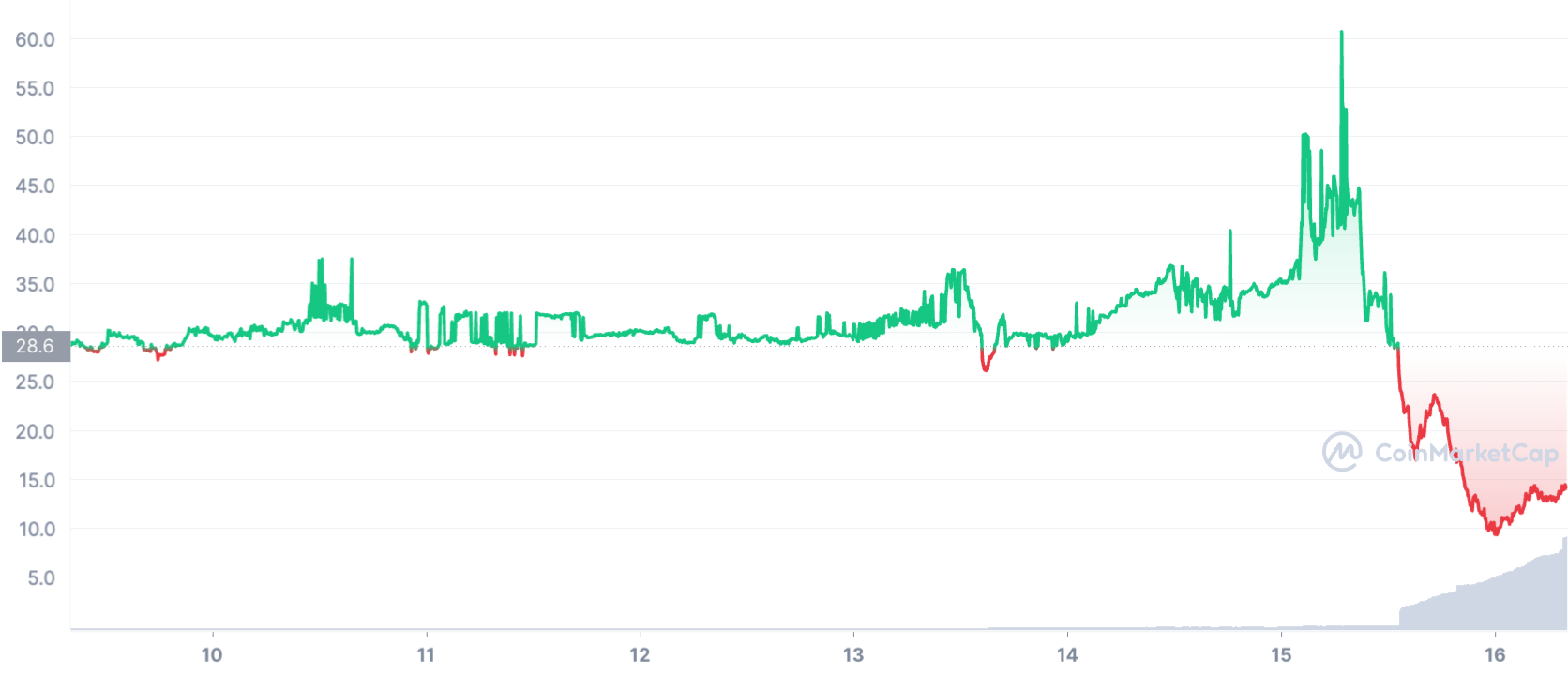

ETHW cost lower 65% among “ChainID” fiasco

The cost of ETHW has came by 65% since ETHPoW’s launch close to $14 on Sept. 16, based on CoinMarketCap. At its cheapest, the token was altering hands for $9.50.

The losses coincided having a technical issue associated with ETHPoW’s ChainID.

ChainIDs are identifiers which help users identify one blockchain from another. Thus, ETHPoW needed a brand new ChainID to split up its transaction data in the original Ethereum blockchain following the Merge, otherwise, it risked creating duplicate transactions.

Lol EthPow miners set to wrong chainID, so they’re mining testnet https://t.co/IichaPURjr

— David Trrrrrrr (@daveytea) September 15, 2022

They behind ETHPoW announced on Sept. 15 that it is unique ChainID is 10001. However, data from Chainlist shows that the cryptocurrency project known as Smart Bitcoin Cash, operating underneath the ticker BCHT, has got the same ID. This problem led to errors around the MetaMask cryptocurrency wallet.

The ETHPoW recognized the problem and adjusted the ChainID afterwards Sept. 15. However, several miners made an appearance to possess brought out despite a couple of major pools ongoing to mine the Bang chain.

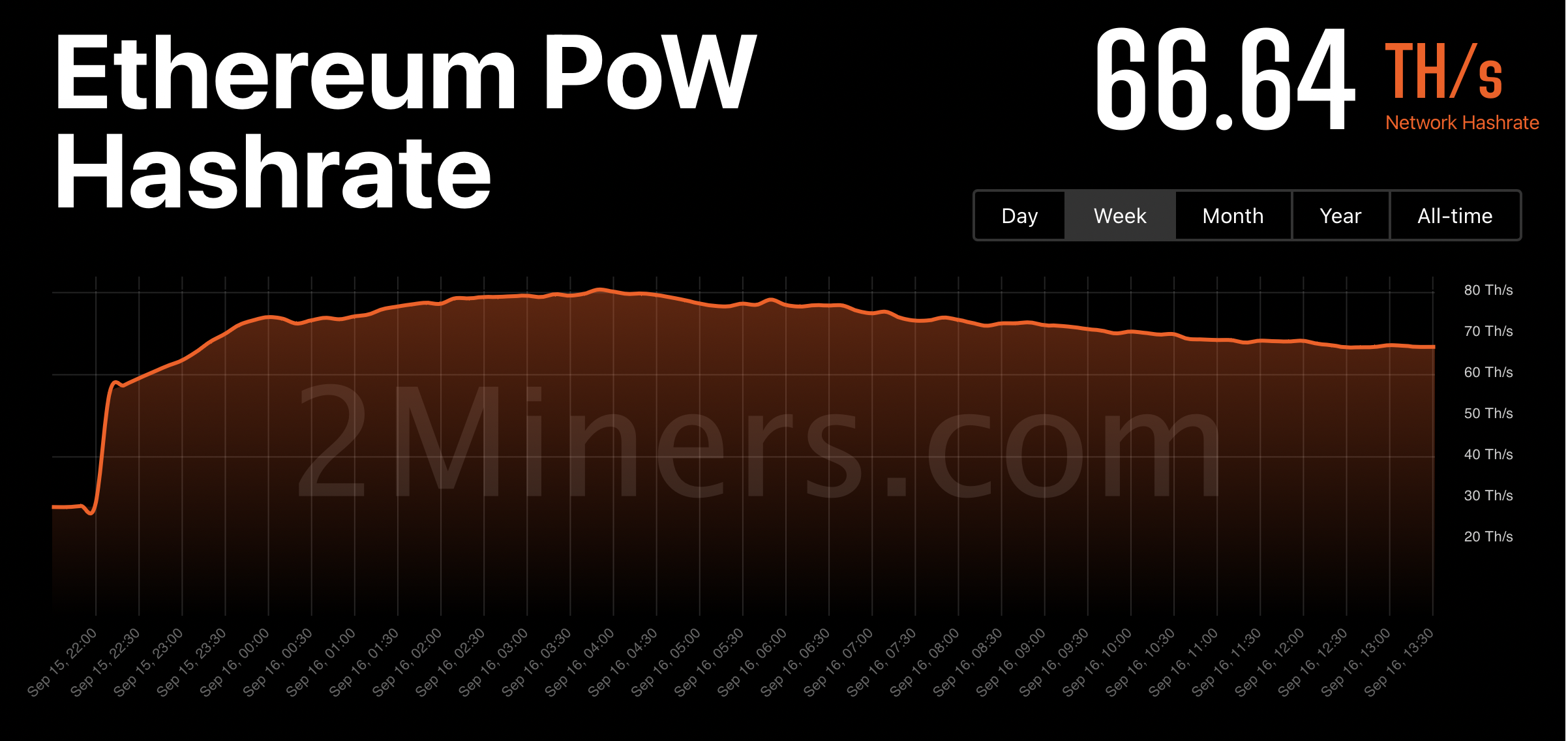

Particularly, the ETHPoW hash rate fell to 66.64 TH/s on Sept. 16 after peaking at 80.56 TH/s earlier within the day.

Compared, the hash rate of Ethereum Classic (ETC), another Bang alternative for Ethereum miners, was 234.56 TH/s on Sept. 16 versus its peak near 310.5 TH/s yesterday.

ETHW for auction on some exchanges despite concerns

Eric Wall, the main investment officer at cryptocurrency investment firm Arcane Assets, noted that ETHPoW miners couldn’t sustain the chain at current ETHW prices. He described:

“The daily rewards are 13100 ETH, $354k rather of $20m. There’s not a way miners can simply “keep mining” the ETHPoW chain, regardless of how you adjust the problem. There simply aren’t enough rewards within the system to cover the facility bills.”

Related: Dogecoin becomes second largest Bang cryptocurrency

Nonetheless, ETHW was listed at some leading cryptocurrency exchanges, including FTX and Huobi. Additionally, BitTrue has additionally introduced an ETHW-based liquidity staking service that provides depositors a 6% annual return.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.