El Salvador, the little Central American nation that made history just more than a year ago if this made Bitcoin (BTC), lately marked its newbie of BTC adoption.

The Salvadoran government touted BTC like a tool to draw in foreign investment, create new jobs and cut reliance upon the U . s . States dollar within the country’s economy during the time of adoption. Many BTC proponents and also the libertarian community rallied behind the little nation despite mounting pressure from global organizations like the World Bank and Worldwide Financial Fund (IMF) to remove BTC like a legal tender.

A great deal has altered in the last year since El Salvador grew to become the very first “Bitcoin nation.” Enthusiasm and public interest rose soon after very good of BTC, using the cost surging to new highs.

Salvadoran President Nayib Bukele became a member of the growing league of Bitcoin proponents to purchase several market dips as well as reaped the advantages of their BTC purchase in the past because the country built schools and hospitals using its profits.

As market conditions switched bearish, however, the regularity of BTC purchases slowed lower, and also the president, who had been frequently seen getting together with the crypto community on Twitter and discussing future Bitcoin endeavors, reduce his social networking interactions considerably.

El Salvador has purchased 2,301 BTC since last September for around $103.9 million. That Bitcoin is presently worth roughly $45 million. The newest purchase is made in mid-2022 once the nation bought 80 BTC at $19,000 a bit.

Because the cost of BTC tanked, critics who’ve lengthy been raising concerns in regards to a crypto bubble felt validated, with several comments like “I said so.” However, market experts believe El Salvador’s BTC experiment is way from the failure.

El Salvador’s Bitcoin Volcanic bond, a task designed to raise $1 billion from investors to construct a Bitcoin city, was already delayed on numerous occasions now and skepticism keeps growing not only round the project but around the overall BTC adoption itself.

Samson Mow, a Bitcoin entrepreneur who performed a vital role in designing the Bitcoin Volcanic bond — also known as the Volcanic token — told Cointelegraph that unlike common outdoors perceptions, El Salvador is building with the bear market. He noted the Volcanic bond was delayed because of several reasons and it is presently waiting for the passage of the digital securities law. He described:

“We’re still waiting around the new digital securities laws and regulations to visit congress, and when passed, El Salvador can begin the main city raise for that Bitcoin Bonds. I’m hopeful it happens prior to the finish of the year. Similar to Bitcoin companies, El Salvador is centered on building with the bear market. I can’t see President Bukele not stacking more at these prices.”

The BTC cost recorded a brand new all-time-a lot of $68,789 only a month after El Salvador’s adoption on November. 10. Since that time, however, the cost has tanked by over 70% and presently buying and selling around $19,000. Many critics think that the way forward for the Volcanic bond and it is native token is extremely determined by the crypto market and therefore it might only gain traction during bull markets.

Paolo Ardoino, chief technical officer at Bitfinex, told Cointelegraph the Volcanic tokens would generate interest from investors regardless of the marketplace conditions, he described:

“The Volcanic token would be the first available. While investor appetite for brand new choices is usually greater throughout a bull market, we’re certain that the initial proposition this token represents will garner significant interest no matter market conditions. The Volcanic token has prevalent support within the Bitcoin community and there’s manifestly an excellent appetite for that offering even if we’re inside a bear or bull market.”

Bitfinex is paramount infrastructure partner from the El Salvador government accountable for processing transactions in the purchase of Volcanic tokens.

Bitcoin adoption boosted remittance and tourism

While critics have known as El Salvador’s Bitcoin experiment failing because the start, proponents view it like a revolution of sorts and believe El Salvador’s adoption could produce a domino effect for other nations concentrating on the same financial challenges like a large number of unbanked citizens and significant remittance volumes.

Bukele has formerly pointed out the primary focus of recognizing BTC ended up being to offer banking services to greater than 80% of unbanked Salvodrans. Within six several weeks from the law passing, the country’s national Bitcoin wallet were able to onboard 4 million users, making certain that 70% from the unbanked population got use of payment and remittance services without getting to visit a financial institution.

Recent: Metaverse graphics strive for community and ease of access — Not realism

Aarti Dhapte, a senior research analyst at Researching The Market Future, told Cointelegraph that El Salvador’s BTC adoption has shown successful on several fronts, whether it is banking the unbanked or boosting tourism:

“We should believe that digital currency helps the Central American nation of El Salvador rebuild its tourism industry, regardless of the country still getting difficulty long lasting the lengthy crypto winter. Based on information in the Secretary of state for Tourism, El Salvador’s paying for travel has elevated by 81% within the publish-pandemic period. In 2021 the country welcomed 1.two million visitors and 1.a million throughout the first 1 / 2 of 2022.”

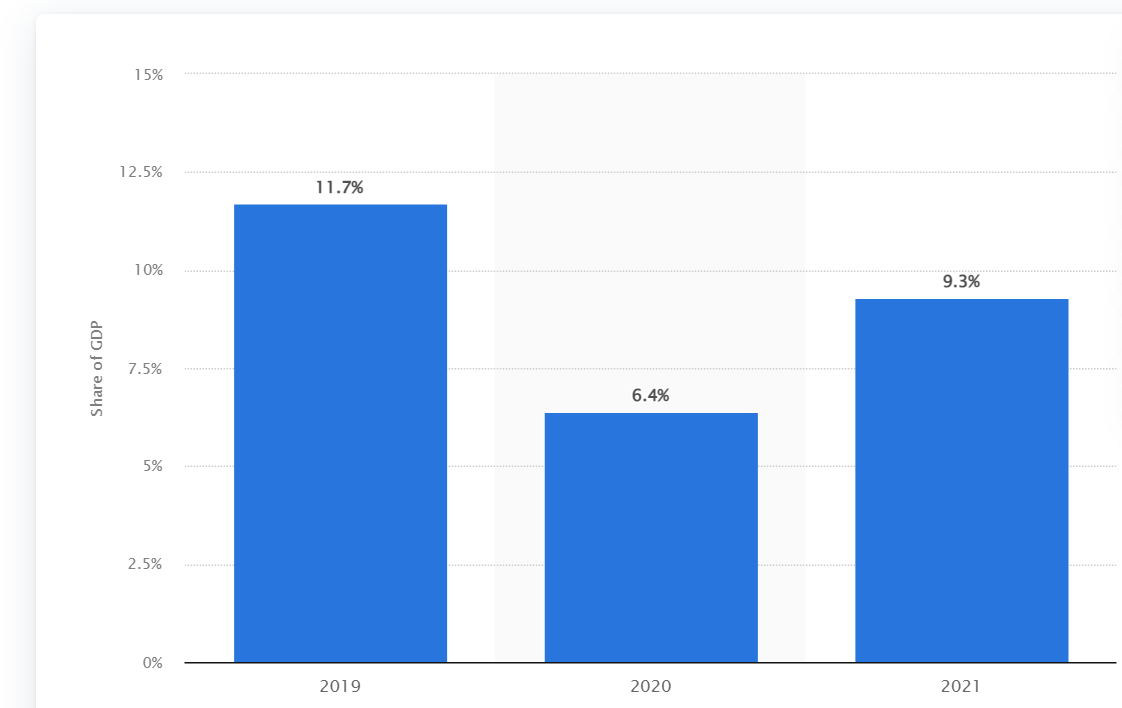

Statista data shows which more than 9% of El Salvador’s GDP consists of the tourism industry, so an almost doubling of tourism is really a significant boon for that country.

Aside from tourism and offering financial services towards the unbanked, BTC adoption has additionally proven advantageous when it comes to mix-border remittances, cutting transaction costs considerably.

The El Salvador Central Reserve Bank estimates that from The month of january to May 2022, remittances from citizens residing abroad totaled greater than $50 million. The adoption of Bitcoin and also the Chivo wallet, an initiative based on the federal government of El Salvador, helped boost Lightning Network transactions by 400% in 2022.

The downsides of Bitcoin adoption

The greatest problem with El Salvador’s Bitcoin adoption continues to be macroeconomic factors which have brought to some loss of BTC cost along considering the variety of pushback it’s become from around the globe. The pushback wouldn’t matter inside a bull market, when you are a little nation-condition with financial challenges, the nation can’t afford to be bad terms with worldwide financial organizations.

At this time, most El Salvador’s Bitcoin was bought at a greater value of computer presently enjoys. Bitcoin continues to be tracking carefully with traditional assets, like the stock exchange — particularly tech stocks. They, too, took a beating this season because the world tries to handle the aftermath of pandemic-related government handouts.

Past the cost of Bitcoin, the larger problem for El Salvador is when the worldwide financial world views the move.

The country’s move toward Bitcoin has limited the country’s use of traditional markets, causing Bukele some real problems in financing the repayment of their bond obligations. Moody’s, captured, credited disagreements about Bitcoin like a reason El Salvador was getting difficulty accepting the terms using the IMF.

Recent: Ethereum publish-Merge hard forks are here: Ok now what?

Richard Gardner, Chief executive officer at institutional infrastructure company Modulus, told Cointelegraph that perhaps in 5 years, Bukele’s decision won’t look that bad, but presently, it’s questionable:

“Bukele’s proceed to Bitcoin doesn’t look wise. Despite high inflation for that USD, Bitcoin has ultimately unsuccessful being an inflation hedge, given its dip. However, we’re searching in a one-year snapshot throughout a recession. For any country like El Salvador, use of funding through organizations such as the IMF is essential. Which makes Bukele’s Bitcoin gambit hard to defend.”

El Salvador’s future depends a great deal on the prosperity of the delayed Volcanic bonds, that could bring billions in revenue and hang a precedent for other people to follow along with. Before the launch from the bond, the outdoors world continuously measure its success according to its BTC purchases.