ETHW has logged a substantial cost rebound despite its blockchain network, ETHPoW, suffering a good contract hack within the first week after its launch.

Rapid research into the attackhttps://t.co/87OVRqaYb2 https://t.co/vhRJyZVc72

— BlockSec (@BlockSecTeam) September 18, 2022

Bull trap risks surround ETHW market

ETHW rebounded greater than 150% eight days following the attack and traded for approximately $10.30 on Sept. 27.

Essentially, this means that traders overlooked the hack and reliable ETHPoW’s lengthy-term viability like a blockchain project.

But theoretically speaking, the ETHW cost rally has supported less strong buying and selling volumes. Quite simply, less traders have tried the pumping from the ETHPoW token’s cost previously eight days, because the Bitfinex exchange data shows within the chart below.

The growing divergence between ETHW’s rising prices and falling buying and selling volumes shows that traders’ curiosity about the ETHPoW token continues to be dwindling. Quite simply, ETHW’s cost risks a clear, crisp correction within the future.

Related: Dogecoin becomes second largest PoW cryptocurrency

This “bearish divergence” setup is based on a climbing down trendline which has offered as resistance for ETHW since Sept. 2.

Around the four-hour chart below, traders have proven their probability of dumping their ETHW positions close to the stated resistance. Furthermore, the token’s latest pullback move ahead Sept. 27 has originated close to the same trendline, raising the potential of a long cost correction.

Consequently, ETHW’s short-term technical bias is skewed toward the bears. So, if it is correction extends, the Bang token risks falling in to the $8–$9 cost range, that also coincides with climbing trendline support, or perhaps a 25% drop from current cost levels.

ETHPoW hash rate recovers

On the better note, the ETHPoW’s network hash rate has retrieved considerably because the smart contract hack, rising from 29.44 TH/s on Sept. 19 to 48.48 TH/s on Sep. 27. Although, the present hash rates are still lower about 40% from the record a lot of 79.42 TH/s.

Still, an increasing hash rate means more miners have became a member of the ETHPoW network after its split in the Ethereum proof-of-stake (PoS) chain on Sept. 15. Theoretically, it ought to ensure better protection against potential 51% attacks.

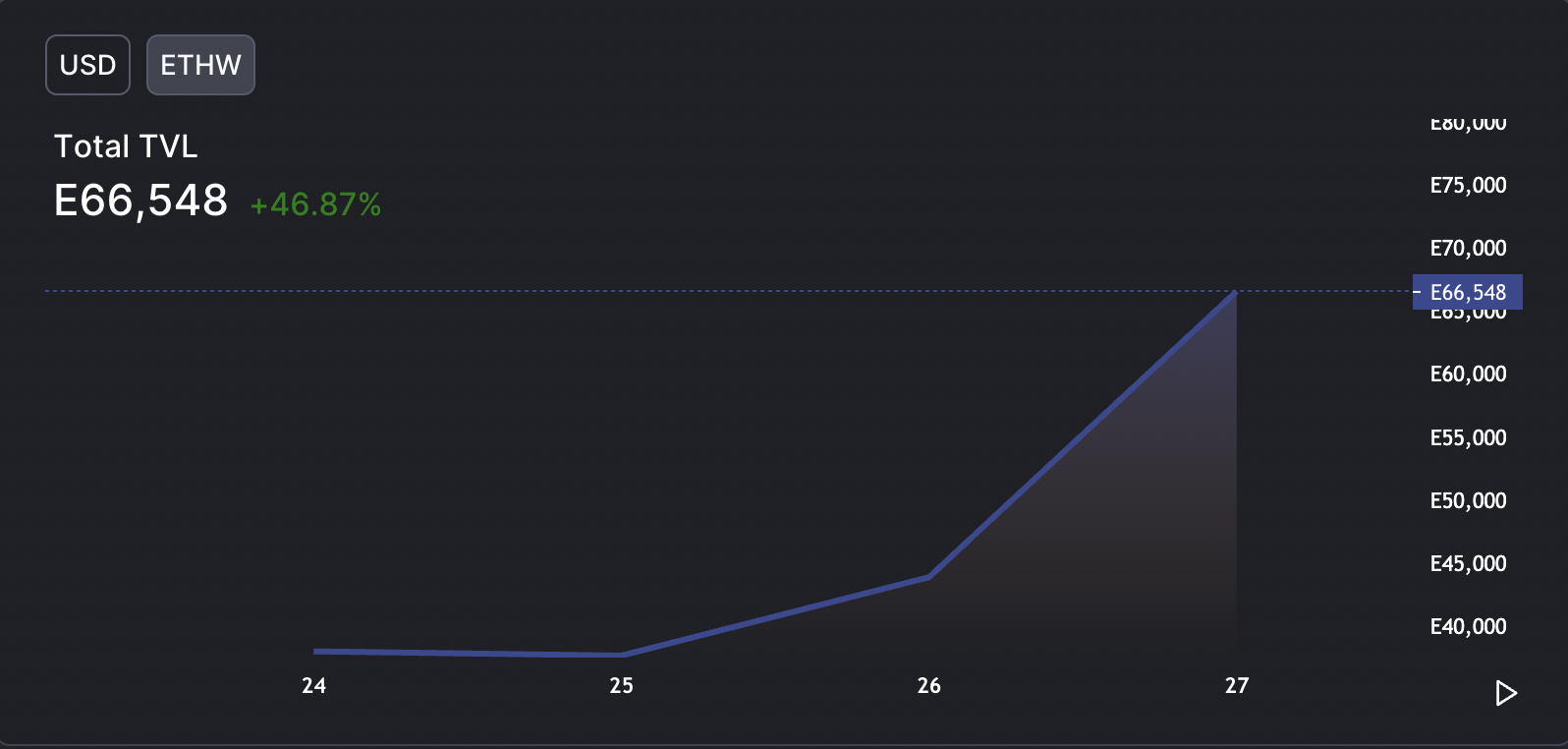

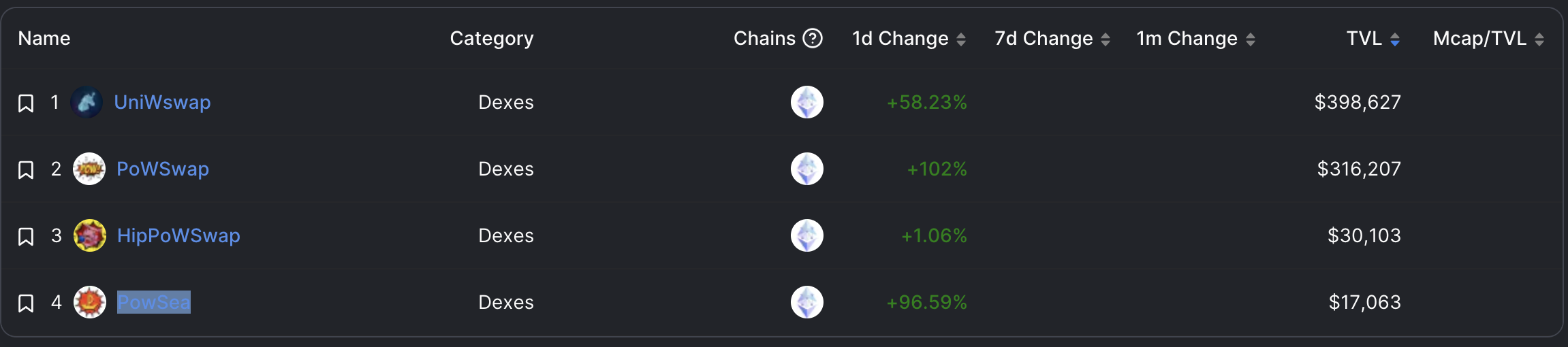

Concurrently, ETHPoW has observed a rise in the network’s total valued locked (TVL). By Sept. 27, ETHPoW had 66,548 ETHW deposited across four decentralized exchanges functioning atop its blockchain when compared with nearly 38,000 ETHW 72 hours prior, or perhaps a 75% increase within the last 72 hours.

Interestingly, UniWswap, a fork from the Ethereum blockchain-based decentralized exchange Uniswap, comprises greater than 50% from the ETHPoW chain’s TVL.

Other DApps include PoWSea, a nonfungible token ( marketplace, in addition to exchanges PoWSwap and HipPoWSwap.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.