For bulls, Bitcoin’s (BTC) daily cost action leaves a great deal to be preferred, and right now, you will find couple of indications of an imminent turnaround.

Following a trend of history six or even more several weeks, the present factors still place pressure on BTC cost:

- Persistent concerns of potential stringent crypto regulation.

- U . s . States Fed policy, rate of interest hikes and quantitative tightening.

- Geopolitical concerns associated with Russia, Ukraine and also the weaponization of high-demand natural sources imported through the Eu.

- Strong risk-off sentiment because of the chance of a U.S. and global recession.

When combined, these challenges make high volatility assets under interesting to institutional investors, and also the excitement seen throughout the 2021 bull market has largely dissipated.

So, day-to-day cost action isn’t encouraging, but searching at longer duration metrics that gauge Bitcoin’s cost, investor sentiment and perceptions of valuation do present some interesting data points.

The marketplace still flirts with oversold conditions

Around the daily and weekly time-frame, BTC’s cost is pressing against a lengthy-term climbing down trendline. Simultaneously, the Bollinger Bands, an easy momentum indicator that reflects two standard deviations above and below an easy moving average, are starting to tighten.

Tightening within the bands usually occurs before a directional move, and cost buying and selling at lengthy-term resistance can also be typically suggestive of a powerful directional move.

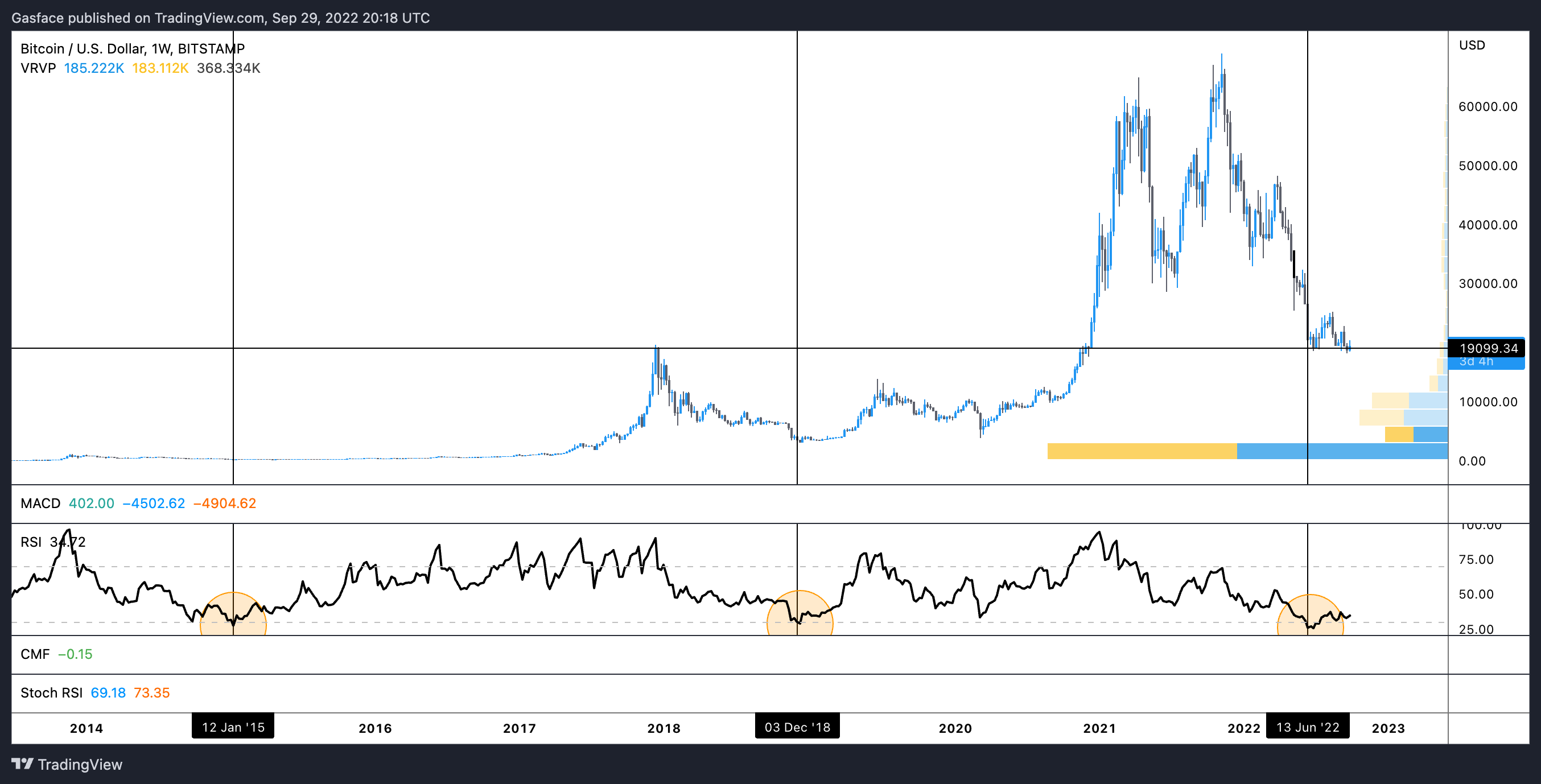

Bitcoin’s sell-removed from March 28 to June 13 sent its relative strength index (RSI) to some multi-year record low, along with a quick look at the indicator compared against BTC’s longer-term cost action implies that buying once the RSI is deeply oversold is really a lucrative strategy.

As the short-term scenario is dire, a cost agnostic look at Bitcoin and it is market structure indicate that now’s an expedient moment to amass.

Now, let’s contrast Bitcoin’s multi-year cost action within the RSI to find out if any interesting dynamics emerge.

For me, the chart speaks by itself. Obviously, further downside could occur, as well as other technical as well as on-chain analysis indicators haven’t yet confirm an industry bottom.

Some analysts have forecast a drop towards the $15,000–$10,000 range, and it is entirely possible that the buy wall at $18,000 is absorbed and becomes a bull trap. In addition to that event, growing position size at the appearance of an oversold weekly RSI has produced good results for individuals brave enough to consider a swing.

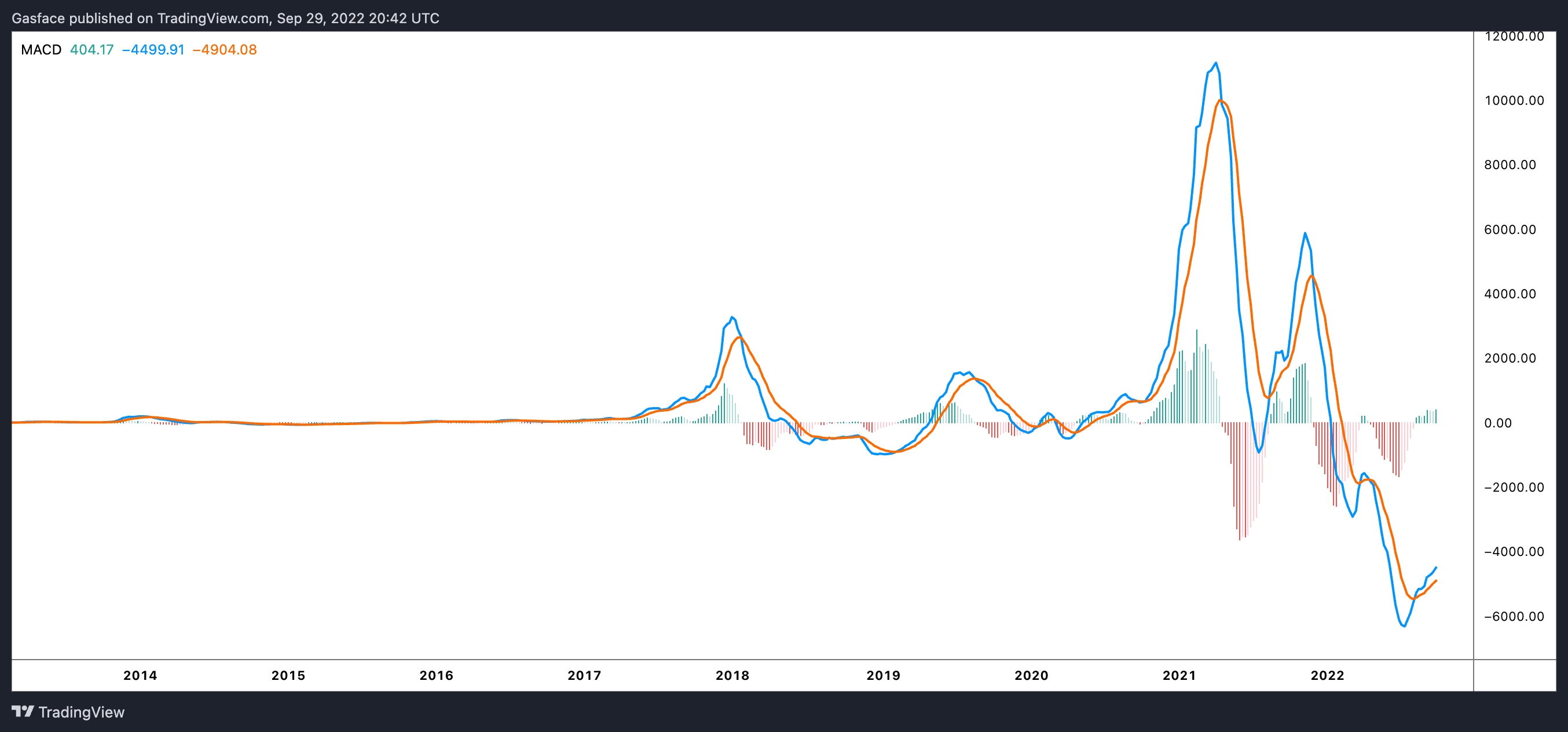

Another interesting metric to see within the longer time-frame may be the moving average convergence divergence (MACD) oscillator. Such as the RSI, the MACD grew to become deeply oversold as Bitcoin’s cost collapsed to $17,600, even though the MACD (blue) has entered over the signal line (orange), we are able to observe that still it lingers in formerly untested territory.

The histogram has switched positive, which some traders interpret being an early trend reversal sign, but given all of the macro challenges facing crypto, it shouldn’t be heavily relied upon in cases like this.

Things I like is the fact that while Bitcoin’s cost is painting lower highs minimizing lows around the weekly chart, the RSI and MACD are relocating the alternative direction. This is whats called a bullish divergence.

In the standpoint of technical analysis, the confluence of multiple indicators shows that Bitcoin is undervalued. Now, with this stated, the underside doesn’t seem to be in, considering that a group of non-crypto-specific issues is constantly on the inject weakness into BTC’s cost and also the wider market. A drop to $10,000 is yet another 48% slide from BTC’s current valuation near $20,000.

Let’s check out exactly what the on-chain information is showing right now.

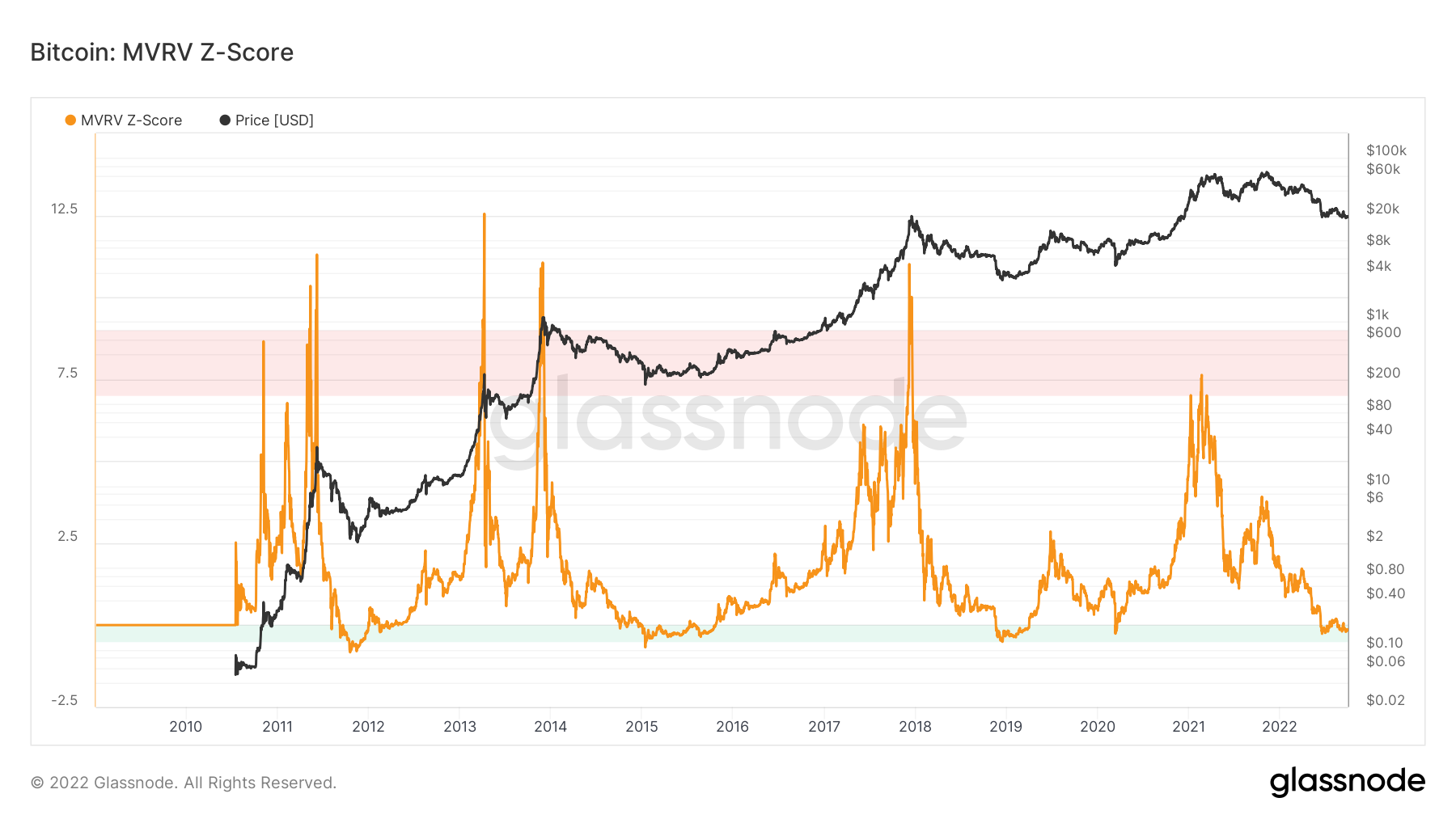

MVRV Z-Score

The MVRV Z-Score is definitely an on-chain metric that reflects a ratio of BTC’s market capital against its recognized capital (the quantity people compensated for BTC when compared with its value today).

Based on co-creator David Puell:

“This metric clearly displays the peaks and busts from the cost cycle, emphasizing the oscillation between fear and avarice. The brilliance of recognized value is it subdues ‘the feelings from the crowds’ with a significant degree.”

Essentially, if Bitcoin’s market price is measurably greater than its recognized value, the metric enters the red area, indicating a potential market top. Once the metric enters the eco-friendly zone, it signals that Bitcoin’s current value is below its recognized cost which the marketplace might be nearing a bottom.

Searching in the chart, in comparison against Bitcoin’s cost, the present .127 MVRV Z-Score is incorporated in the same range as previous multi-year lows and cycle bottoms. Evaluating the on-chain data from the technical analysis indicators pointed out earlier again shows that BTC is undervalued as well as in an ideal zone for creating a lengthy position.

Related: Bitcoin cost slips under $19K as official data confirms US recession

Reserve Risk

Another on-chain data point showing interesting information is the Reserve Risk metric. Produced by Hendes Hauge, the chart supplies a visual of methods “confident” Bitcoin investors are contrasted from the place cost of BTC.

As proven around the chart below, when investor confidence is high, but BTC cost is low, the danger to reward or Bitcoin attractiveness versus the chance of buying and holding BTC enters the eco-friendly area.

During occasions when investor confidence is low, however the cost is high, Reserve Risk moves in to the red area. Based on historic data, creating a Bitcoin position when Reserve Risk enters the eco-friendly zone is a great time to determine a situation.

By Sept. 30, data from LookIntoBitcoin and Glassnode both show Reserve Risk buying and selling at its cheapest measurement ever and outdoors the limitations from the eco-friendly zone.

This e-newsletter was compiled by Big Smokey, the writer of The Standard Pontificator Substack and resident e-newsletter author at Cointelegraph. Each Friday, Big Smokey will write market insights, trending how-tos, analyses and early-bird research on potential emerging trends inside the crypto market.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.