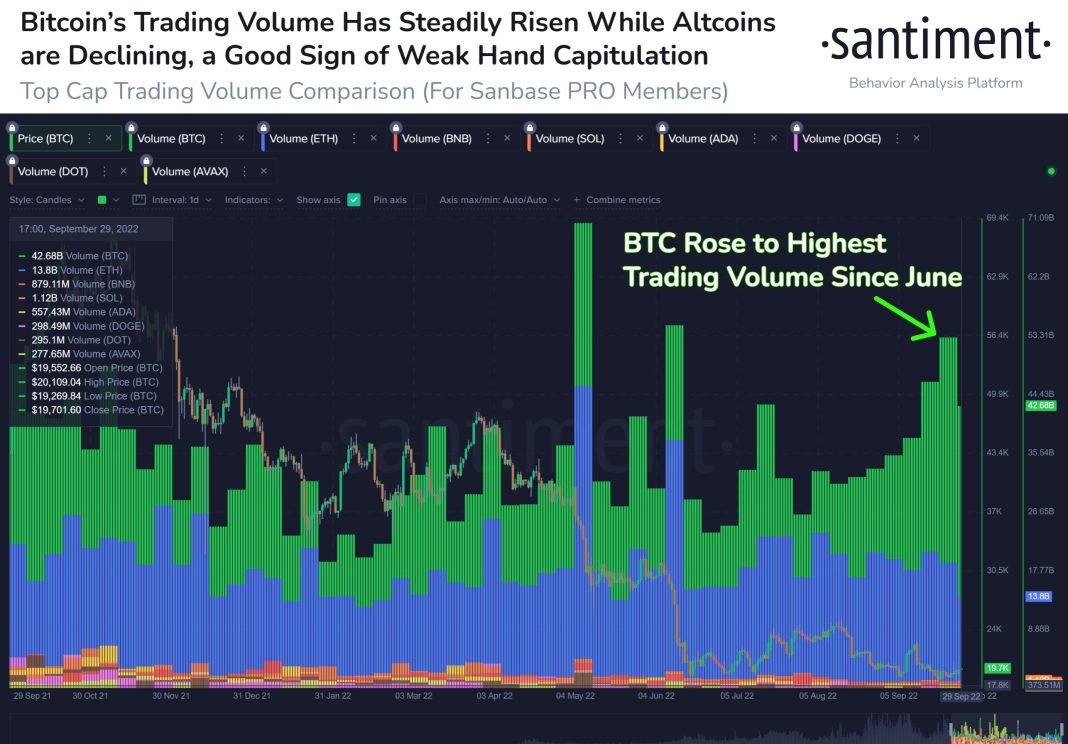

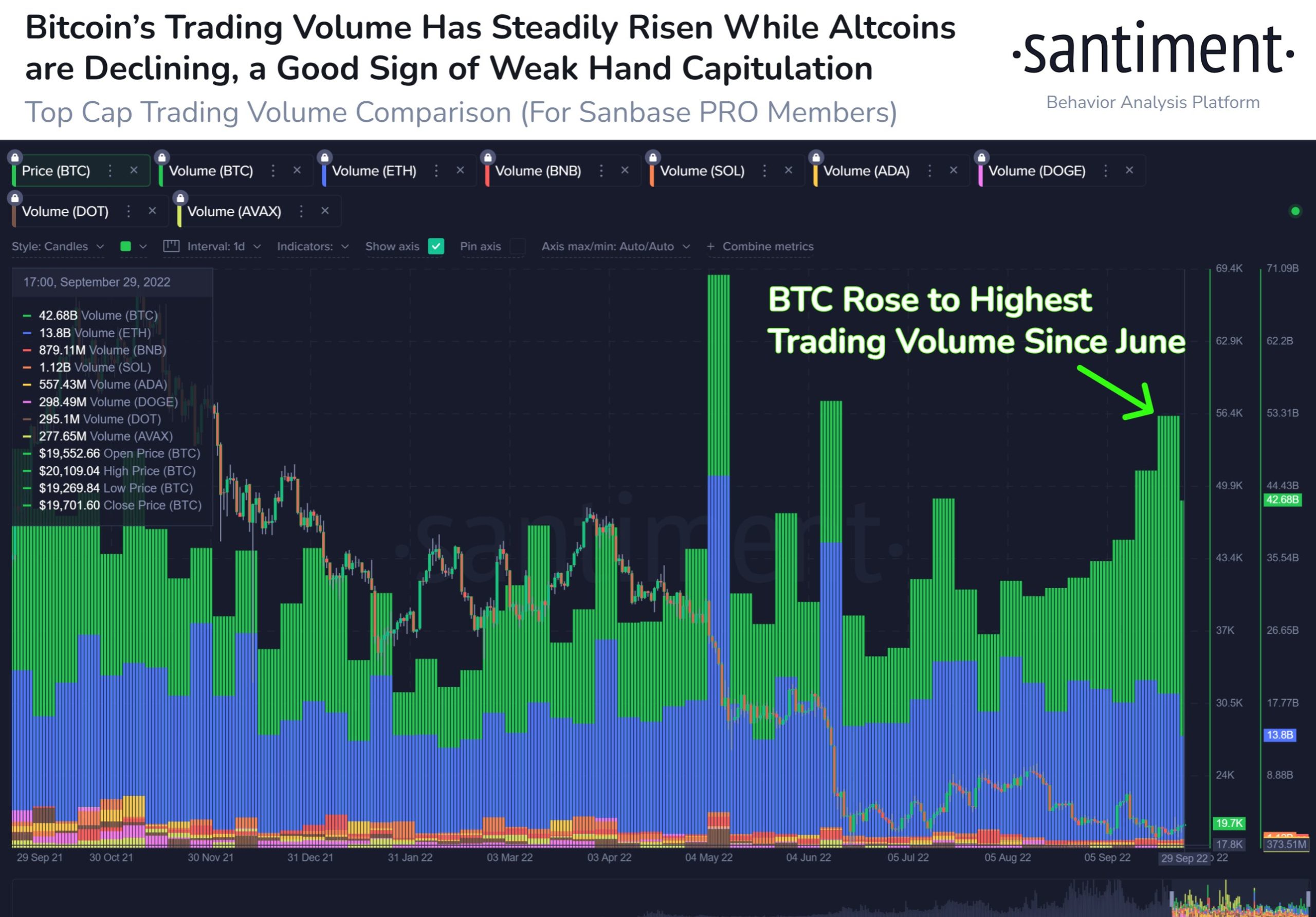

Bitcoin’s buying and selling volume has continuously expanded since mid-June as the buying and selling volumes of some of the best capital assets have declined, indicating the leading crypto might be more and more considered a “safe haven” for traders fleeing other asset groups, based on a current analysis by crypto-focused market intelligence platform Santiment.

“Trader interests are starting to go back to relative #safehaven assets like BTC,” the woking platform stated inside a tweet.

Additionally for this, Santiment has additionally observed an associated market trend that may also effect on the key crypto’s cost spike soon.

Some BTC 34,723 left crypto exchanges on September 30. This might represent a possible hint of trader confidence in bitcoin that may continue with the 4th quarter of 2022, according towards the platform.

“The before a minimum of that much BTC left exchanges was June 17th [when] … prices leaped +22%” during the period of the following four days, Santiment stated.

Among an more and more gloomy outlook for that world economy, the most recent days have introduced numerous positive developments for that crypto markets, suggesting a brand new crypto boom might be soon in. Inside a positive manifestation of a possible market rebound, a seven-week bull operate on bitcoin (BTC) short positions is finished with outflows of some $5.a million, based on a current analysis by digital asset investing firm CoinShares.

Such positive news for crypto has lead some industry players, for example MicroStrategy’s chairman and co-founder Michael Saylor, to condition that, because the cost of Bitcoin finds a reliable bottom around $20,000, it might retake its former peak cost amounts of about $60,000 over the following 4 years.