Bitcoin (BTC) holding $19,000 may well be more important than traders realize, new data reveals.

Within the latest edition of their monthly report series, “The Bitcoin Monthly,” investment management firm ARK Invest flagged a continuing fight for that defense of Bitcoin’s investor cost basis.

Bitcoin investor cost basis buoys market

Bitcoin cost action is presently characterised by volatile moves inside a clearly defined range only around $4,000 across.

Getting held since June, this range contains what immediately sticks out as a focus — the last halving cycle’s all-time a lot of $20,000.

With BTC/USD crossing that threshold frequently, however, traders have lengthy searched for alternative lines within the sand with regards to new trends for that pair.

For ARK and also the report’s guest contributor, Reflexivity Research co-founder William Clemente, it’s $19,000, that could work as important support.

It’s because Bitcoin’s so-known as investor cost basis — the mixture cost where the BTC supply was bought, without the portion of miners.

“For the majority of September, bitcoin traded between two major historic levels: its 200-week moving average ($23,500) as resistance and it is investor cost basis as support ($19,000),” ARK described.

BTC cost has become at $19,000, the level that, if violated, would spark considerable losses throughout Bitcoin’s investor base.

“As strong holder behavior battles an inadequate macro atmosphere, resolution either to side will have a substantial role in bitcoin’s short- to mid-term performance,” the report added.

As Cointelegraph reported now, analysts are acutely eyeing the general proportion from the supply presently being held baffled.

In prior bear markets, this always entered 60% before a cost bottom hit, leading these to conclude that in 2022, the marketplace has further left to fall.

Investor cohorts echo 2018 behavior

Further figures covering the losses of lengthy-term holders (LTHs) paint an identical picture by mid-September — BTC cost action could target $14,000 before echoing prior bear market bottoms.

Related: Bitcoin continues to have $14K target, warns trader as DXY due ‘parabola’ break

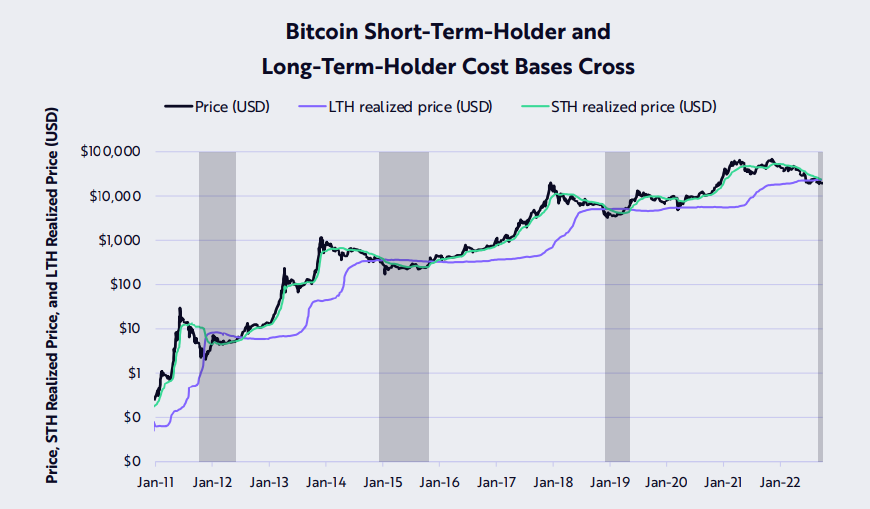

Ongoing, ARK noted the cost foundation of LTHs and short-term holders (STHs) had entered over the very first time since 2018 — the entire year t saw the macro bottom of $3,100 at the end of Q4.

An STH is understood to be a business holding BTC for approximately 155 days, with LTHs creating investments for extended periods.

“The short-term-holder (STH) cost basis has entered underneath the longterm-holder cost (LTH) basis, an indication usually correlated rich in-conviction market bottoms,” the report commented.

“Likely an indication of low speculative excesses, this mix shows that short-term holders have capitulated or are aging into longterm holders.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.