Bitcoin, and crypto prices more generally, happen to be treading water now, however that could vary from today as producer cost index (PPI) inflation data and FOMC minutes are freed.

First of all to disturb the marketplace from the slumber may be the US PPI data, a stride of inflation in the factory gate.

Any manifestation of cooling is going to be treated as confirmation of the requirement for the Given to help ease off on rate of interest increases. This kind of outcome would light a fireplace under stocks and crypto prices.

On the other hand, if producer cost inflation is constantly on the warm up, then expect risk assets to resume their sell-off.

PPI inflation is available in less than August studying

Well the information is within and Core PPI month-on-month rose at double the amount level expected, by .4% instead of the .2% forecast.

Meanwhile, year-on-year headline PPI was 8.5%, hotter compared to 8.4% forecast, although that’s lower from 8.7% in the last month (August) – which last point appears, initially, is the key takeaway for that market.

As a result, reaction to date is rather positive – Bitcoin remains largely unchanged, but tend to move greater if equities can select up some positive momentum.

The S&P 500 expires .2% to 3595, the Dow jones 61 points greater and also the Nasdaq .38% the greater at 10468.

Elsewhere, the United kingdom 30-year government bond sell-off has selected up, with yields speeding up upwards 23 basis suggests 5.00% (more about the United kingdom economic crisis below)

However the PPI information is the nice and cozy-up act for that primary show, the US consumer cost index (CPI) inflation data release on Thursday.

FOMC minutes could awaken the crypto market

However, before individuals hotly anticipated figures are freed, market participants will discover plenty to ruminate over once the Federal Open Market Committee (FOMC) releases the minutes from the 21 September meeting at 18:00 UTC.

The minutes will probably reveal that there’s a firming consensus around the requirement for a 75 basis points rates hike in November.

Given watchers is going to be searching for just about any changes of language that may be construed as whether hardening of hawkishness or perhaps a readiness to pivot from this type of trajectory, should incoming data indicate that inflation may be beginning to weaken.

A place of possible disagreement though, or at best too little alignment, is going to be within the terminal rate – quite simply the speed that will mark the height from the hike cycle.

Based on Refinitiv data, the consensus forecast for that terminal rate now is 4.45%, way-from the earlier projections produced in August that targeted 3.7%. The date for that terminal rates are assumed is the 22 March 2023.

Any shows the terminal rate coming after expected and also at a greater level will prompt selling both in the stock and crypto markets.

Some economists think the terminal rate is going to be nearer 5%. In either case, the FOMC minutes could throw some light around the considering its people.

Bitcoin is holding its timid player than United kingdom government inflation-linked bonds at this time

Possibly probably the most striking observation to make on market conditions in crypto in the last couple of days, continues to be the relatively stability, particularly when appraised alongside those of other asset classes.

Take United kingdom government bonds for instance, in which the trauma in individuals markets continues, possibly visiting ahead on Friday once the Bank of England states – even though the signals are confusing the marketplace – that it’ll finish its bond purchase in the lengthy finish from the curve (30-year bond maturities).

Check out this chart from the recent Financial Occasions story:

The chart shows the bitcoin cost is lower 67% since November 2021 however the United kingdom inflation-linked maturing in 2073 is lower nearly 80%.

That’s an incredible juxtaposition. It underlines the way a maturing bitcoin market really competes well within the volatility stakes facing formerly solid asset class instruments for example United kingdom inflation-linked government bonds, or ‘linkers’ because they are known.

Bitcoin volatility may spike soon, but overall volatility is on the declining trend

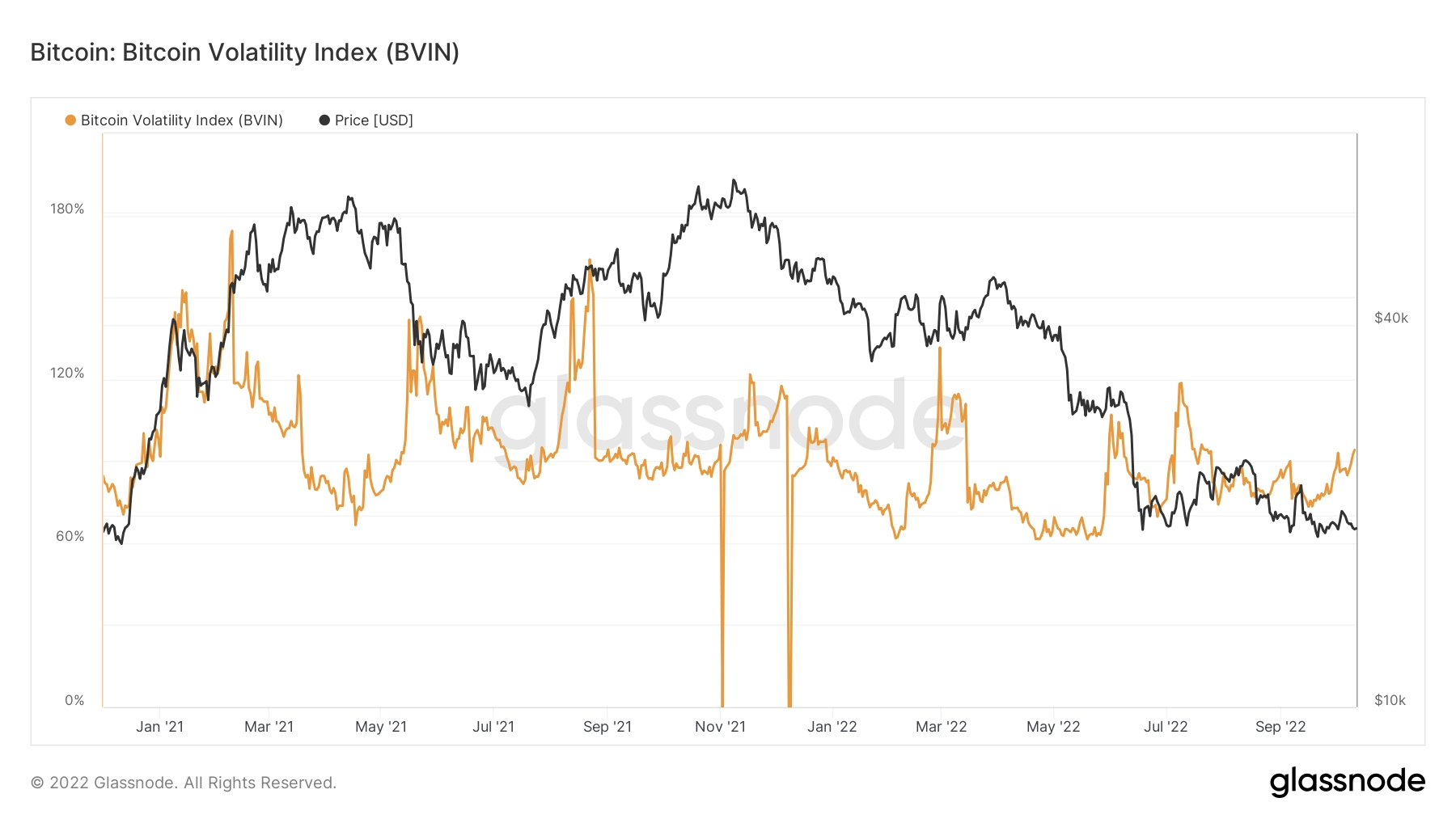

Our second indicate consider may be the weakening volatility from the bitcoin cost.

This obviously matters because volatility is a way of expressing risk – which is becoming less dangerous to carry bitcoin.

We are able to check this out within the climbing down peaks from the Bitcoin Volatility Index highlighted through the orange line around the chart below (the 2 lower spikes are described by missing data):

How can the FOMC minutes and inflation data play in to the bitcoin’s ongoing bottom formation?

And just what everybody wants to understand is when might this news in the economic statisticians and also the Given feed in to the calculations whether the bitcoin cost is near its bottom?

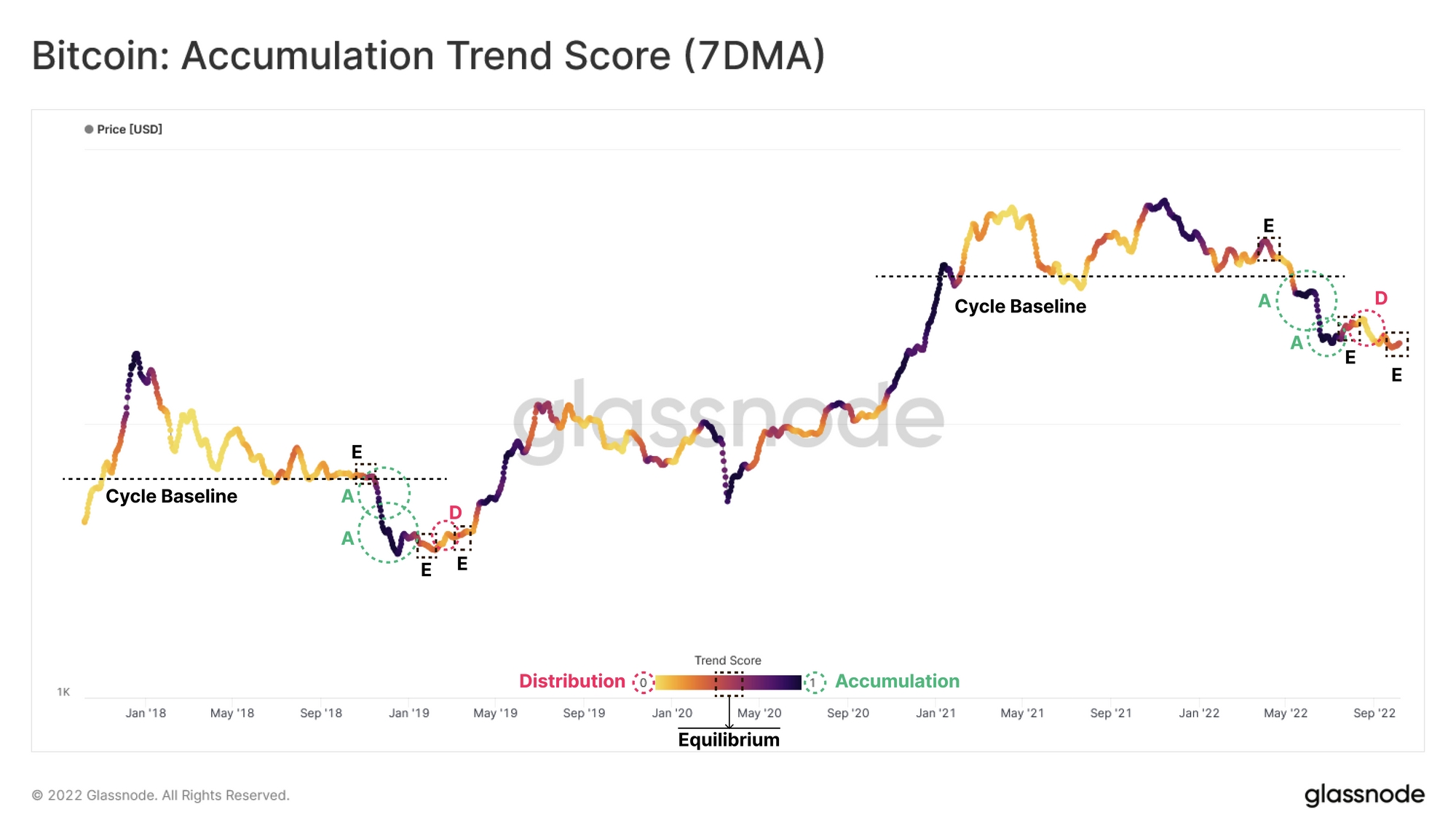

With that, the bitcoin accumulation trend score can help to clarify matters.

It’s a relatively recent (March 2022) Glassnode metric here is a useful definition:

The Buildup Trend Score is definitely an indicator that reflects the relative size entities which are positively accumulating coins on-chain when it comes to their BTC holdings. The size from the Accumulation Trend Score represents both how big the entities balance (their participation score), and the quantity of new coins they’ve acquired/offered during the last month (their balance change score). A Build Up Trend Score of nearer to 1 signifies that on aggregate, bigger entities (or a huge part from the network) are accumulating, along with a value nearer to signifies they’re disbursing or otherwise accumulating. This gives understanding of the total amount size market participants, as well as their accumulation behavior during the last month.

If you wish to obtain a bit much deeper in to the metric, watch this video:

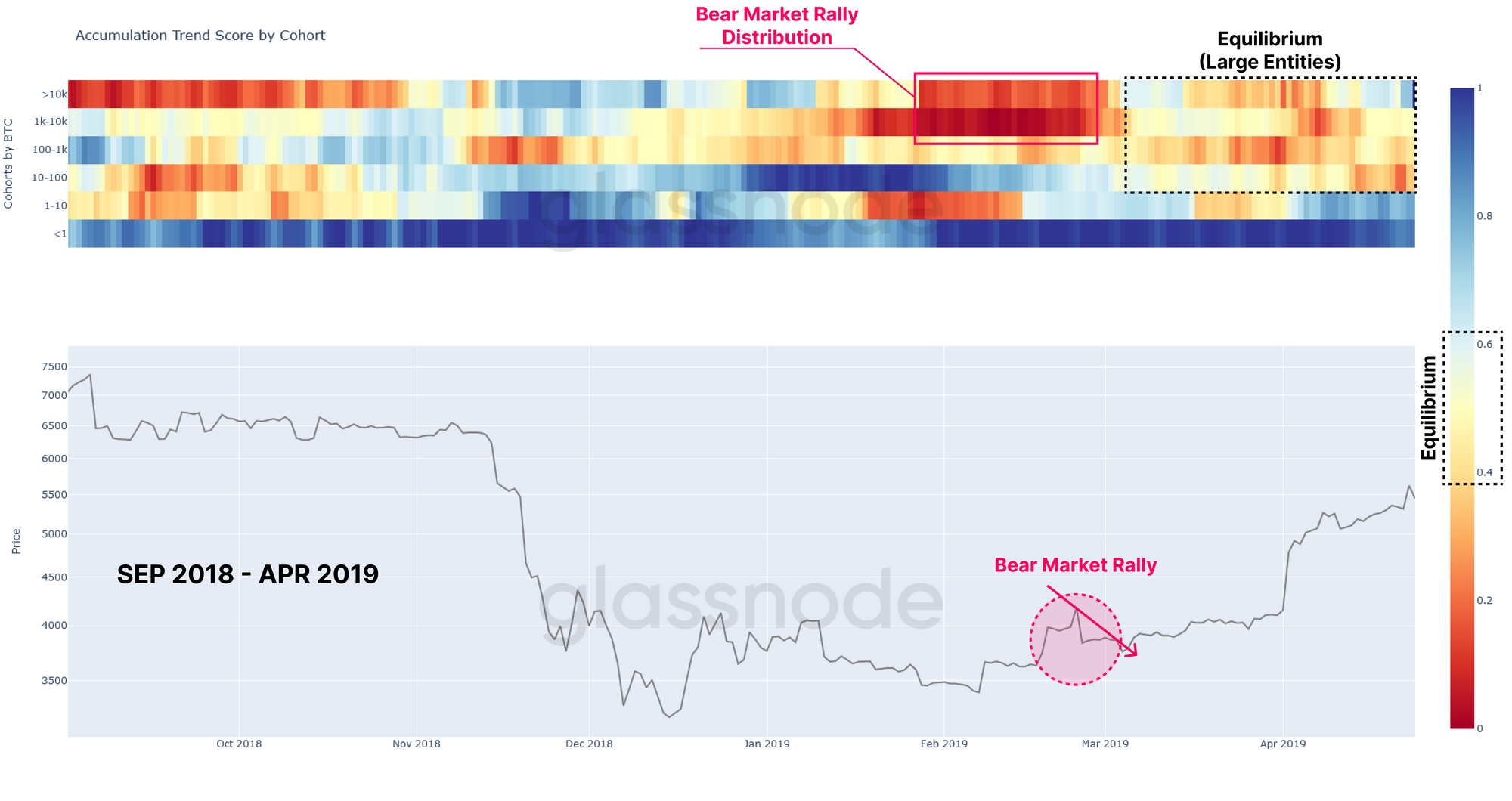

What’s notable concerning the chart may be the possible repeat today towards the bottom formation pattern seen in the finish of 2018 and first quarter of 2019.

Here’s the annotated Glassnode chart:

Glassnode highlights, amongst other things, how “the buildup Trend Score for whales holding 1k-10k BTC highlights aggressive accumulation since late September”:

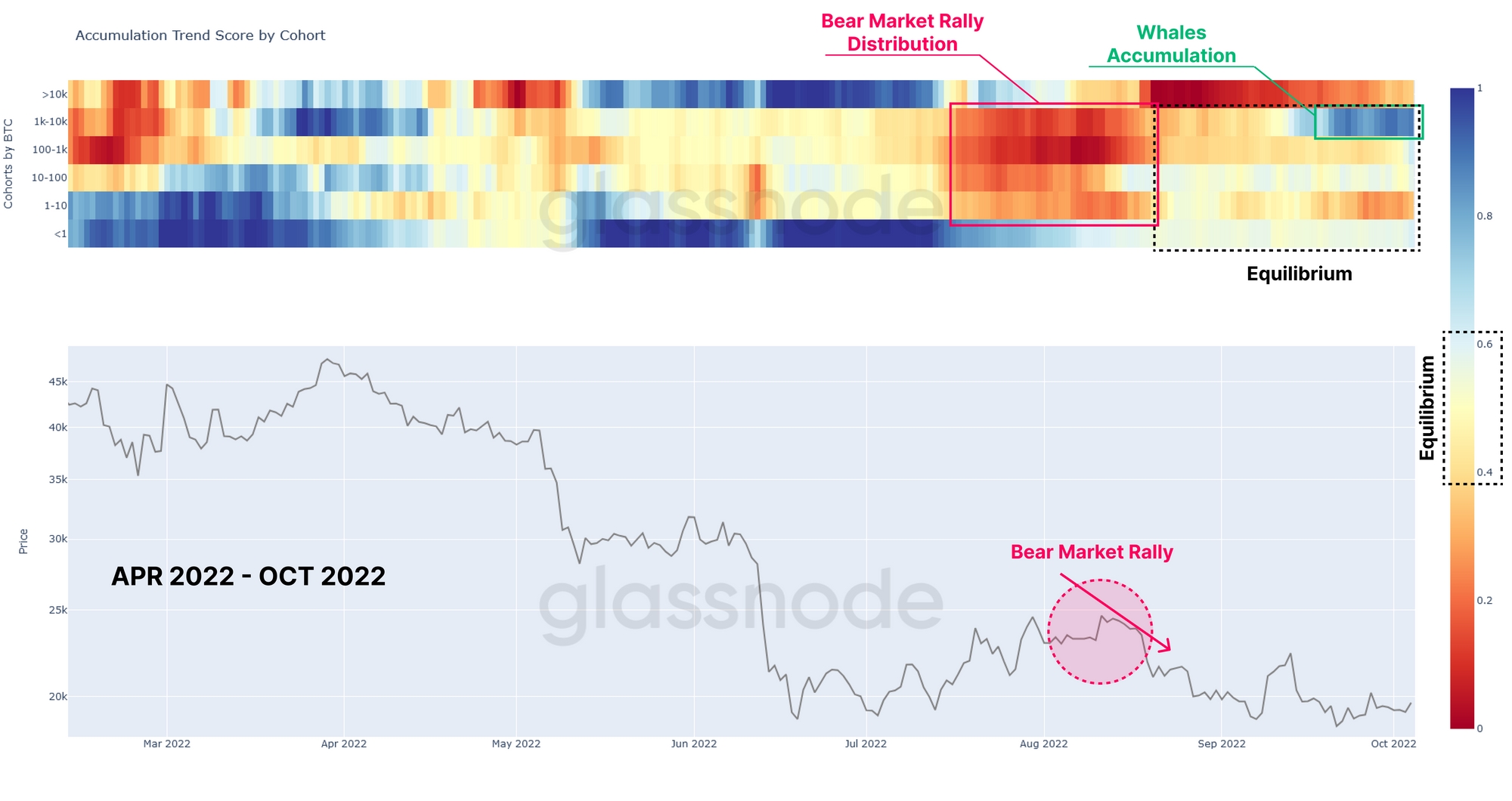

Within our market structure, and noting approximately 10x in BTC prices, we are able to see much the same behavior occurring in large entities, however driven much more through the 100-1k BTC cohort throughout the August rally.

Additionally towards the relative neutrality across promising small to medium-address cohorts, the buildup Trend Score for whales holding 1k-10k BTC highlights aggressive accumulation since late September. Whales owning >10K BTC are biased towards weak distribution over recent several weeks.

A closer inspection in the two periods is proven below:

When the apparent fractal may be the right interpretation, then no matter what when it comes to near-term volatility, bitcoin is within the right place.

Cost-averaging in to the market underneath the $20k level might be a relatively good access point, particularly if you are purchasing the BTC/GBP pair.

Portfolio diversification – go eco-friendly

Also it you fancy fishing among a few of the rising altcoins, a great diversifier should you already hold bitcoin may well be a eco-friendly eco-friendly crypto for example IMPT, that is presently on presale.

It’s worth a mention since it is the only real gold coin available that’s targeting shoppers by enabling these to offset their carbon footprint.

The presale allocation is selling in an impressive clip, with $3 million price of tokens clicked up per week, but do your personal research.