Bitcoin (BTC) is showing textbook macro bottom signs inside a “business as usual” bear market, data suggests.

In fresh findings printed on March. 13, popular Twitter trader Alan says BTC cost action is carefully mimicking prior cycles.

Trader on Stoch data: “You shouldn’t be shaken out”

Although some are worried concerning the current condition of Bitcoin and crypto markets, on-chain indicators have lengthy recommended the 2022 bear marketplace is comfortingly much like previous ones.

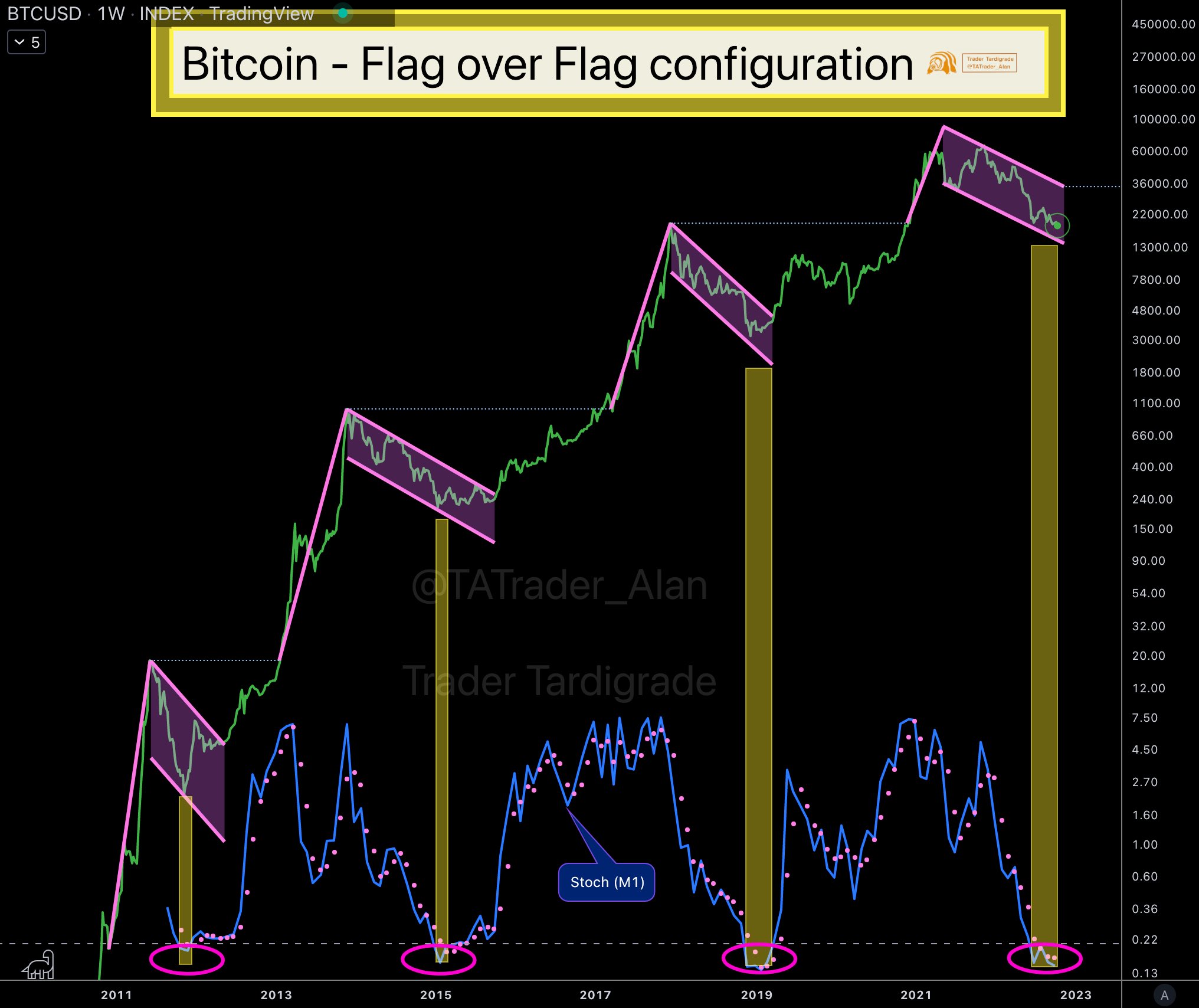

Eyeing the main one-month stochastic chart for BTC/USD, Alan highlighted Bitcoin repeating a structure present with both 2014 and 2018 bear markets.

Stochastic oscillators are classic tools for identifying cost cycles and bullish and bearish interplay.

Bitcoin has demonstrated to become the same, with monthly low Stochastic readings perfectly matching bear market cost floors, data from Cointelegraph Markets Pro and TradingView confirms.

Now, individuals lower levels have returned — figures that have only made an appearance three occasions before.

Not just is Stoch with an imminent new macro BTC cost low, but it is also accustomed to determine where Bitcoin might bottom later on.

Inferring potential cost points from existing data, Alan predicted the following cycle’s low might be $35,000.

“Bitcoin forms Flag within the previous Flag configuration. Yellow zone form Stochastic indicator shows (a minimum of) other half from the flag, where we’re at this time,” he commented plus the chart.

“Next pole low = $35k. Quick rebound always follows a dip. No emotion, never be shaken out.”

A significantly-needed silver lining

Phenomena for example Stoch behavior might console traders who’ve viewed as Bitcoin descends as much as 75% all-time highs just eleven several weeks ago.

Related: Cost analysis 10/14: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

With popular sources insisting the bottom isn’t yet in, there seems to become little to become confident about while analyzing short-time-frame BTC cost action.

Optimists are couple of and between, included in this well-known analyst Philip Quick, who now predicted to Cointelegraph the 2022 bear market should finish up being exactly that — done and dusted through the finish of the season.

Other medication is less hopeful. Around the subject of monetary asset values generally, Goldmoney senior analyst Alasdair Macleod now told investors to overlook the good occasions before the U . s . States Fed changes course on rate of interest hikes.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.