Bitcoin (BTC) starts a brand new week keeping everybody guessing like a small buying and selling range stays in play.

A non-volatile weekend continues a well-recognized established order for BTC/USD, which remains just above $19,000.

Despite requires a rally along with a go to lower macro lows next, the happy couple has yet to consider on the trajectory — or perhaps signal that the breakout or breakdown is imminent.

Following a brief spell of pleasure seen on the rear of last week’s U . s . States economic data, Bitcoin is thus back at where you started — literally, as cost action has become wherever it had been simultaneously a week ago.

Because the market wonders what it could take to hack the number, Cointelegraph analyzes potential catalysts available now.

Place cost action has traders dreaming about breakout

For Bitcoin traders, it’s a situation of “almost too quiet” with regards to the BTC/USD weekly chart.

Getting come lower considerably in volatile conditions within the first 1 / 2 of 2022, recent several weeks have experienced a nearly eerie insufficient volatility.

Data from Cointelegraph Markets Pro and TradingView proves the purpose — on a single-week timeframes, Bitcoin is constantly on the print candle lights with no one whatsoever.

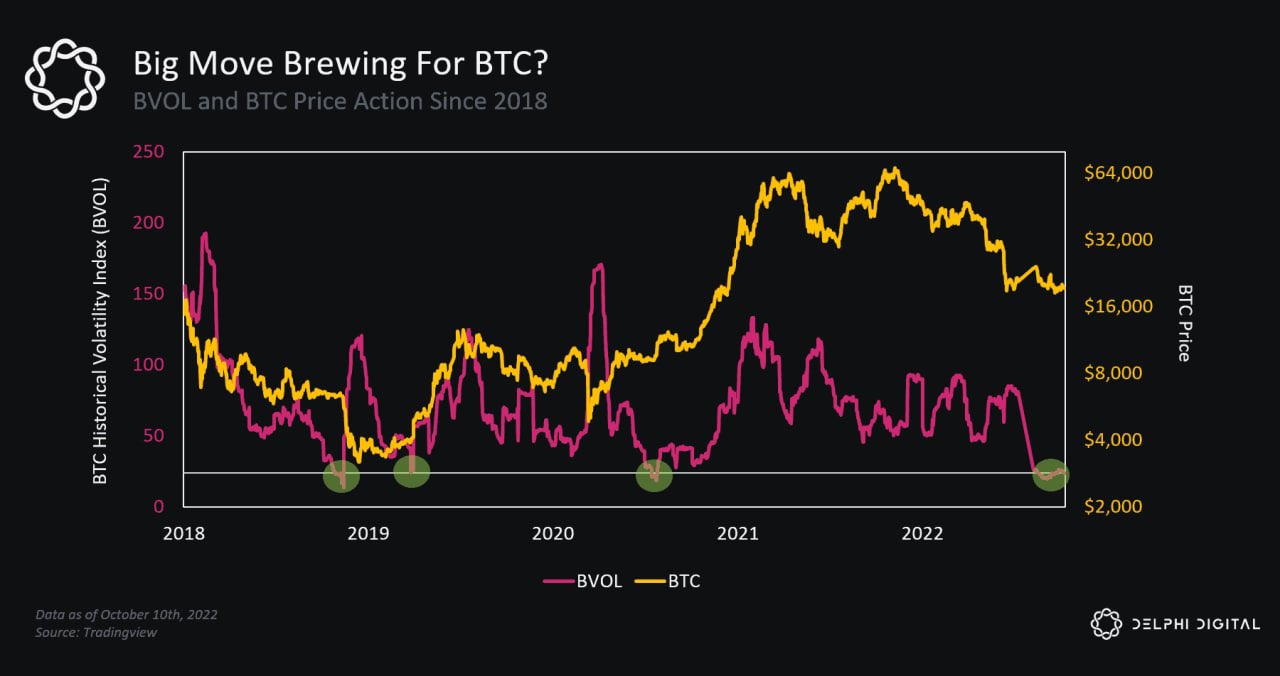

Such may be the stickiness of the present range that, as Cointelegraph reported, the Bitcoin historic volatility index (BVOL) reaches lows only seen a number of occasions.

“Equity volatility (VIX) in accordance with Bitcoin volatility (BVOL) is approaching all-time highs,” William Clemente, co-founding father of digital asset research and buying and selling firm Reflexivity Research, added in comments a week ago:

“This illustrates simply how much volatility compression Bitcoin is presently experiencing.”

An associated chart nicely taken Bitcoin like a strangely enough stablecoin-esque pick in the present climate, with Clemente implying that the go back to the classic, more volatile paradigm should follow.

A few days prior, economist, trader and entrepreneur Alex Krueger furthermore noted that the “explosive move” had adopted all prior journeys to macro lows on BVOL.

He contended that U . s . States macro data missing expectations “would do it” when it comes to rekindling volatility, but in case, the figures continued to be just lacking the trigger range.

Cryptocurrency research firm Delphi Digital agreed.

“Historically speaking, once the BVOL falls below something of 25, a sizable spike in volatility has a tendency to follow shortly after that,” it mentioned partly of Twitter comments.

Now, meanwhile, popular crypto investor and analyst Miles Deutscher told traders to “get ready” while commenting around the Delphi data.

The issue for everybody continued to be the direction that volatility would go ahead and take market in.

For Il Capo of Crypto, the trader who predicted Bitcoin’s descent to $20,000 levels all-time highs, expectations continued to be exactly the same.

$21,000 should feature included in a relief bounce, simply to be eclipsed with a fresh dive to multi-year lows for BTC/USD, these potentially arriving at $14,000-$16,000.

“Some shitcoins are experiencing scam pumps over these days, while $BTC would go to 21k. This may offer you the illusion the bull marketplace is back,” he cautioned over the weekend:

“My advice: never be greedy. Take profits should this happen. Safeguard your capital.”

Fresh macro triggers fall into line for crypto

While little is anticipated in the Fed when it comes to direct changes to our policy now, there’s still lots of fire wood for crypto volatility set to become supplied by exterior forces.

Within the U . s . States, company earnings is going to be arriving thick and fast, with tech stocks particularly likely to move markets in case of results falling wide of expectations.

Reporting firms represent over 20% from the S&P 500, which like other U.S. indexes is showing rare weakness this season.

“In my thoughts, the chances of the low coming within the next couple of weeks are decently high,” Raoul Pal, founder and Chief executive officer of RealVision, predicted overnight alongside an associated chart:

“The SPX weekly DeMark hits in a few days, near the foot of the funnel and also the 50% retracement, with RECORD bearish sentiment.”

Charting a few days ahead, financial commentary resource the Kobeissi Letter likewise told subscribers to “prepare for additional volatility.”

More U.S. data will join earnings now, it described, while Given officials will discuss overall policy.

“The median bear market having a recession dating back 1929 has fallen 39%,” it authored about stock exchange strength within the various posts over the past weekend:

“Furthermore, the median bear market having a recession lasts 16 several weeks. We’re presently only 10 several weeks in and also the S&P 500 is lower just 28%. History is constantly on the claim that more discomfort is in front of us.”

Beyond stocks, the U.S. dollar index (DXY) was mercifully still in to the new week, to date staying away from another attack on twenty-year highs seen earlier.

Echoing Il Capo of Crypto’s theory, Michaël van de Poppe, founder and Chief executive officer of buying and selling firm Eight, hinted that could be now or next that “some relief” enters for risk assets more broadly.

“A crucial position for Bitcoin, as it is still hovering within the range for over a month,” he summarized at the time:

“It must break $19.4-19.6K clearly. In the event that happens, volatility can finally start working. Because of the structure from the $DXY and also the Yields, I expect this to happen in 1-2 days.”

RSI breakdown risk echoes 2018

Further out, the image for Bitcoin becomes murkier, and individuals divining bearish scenarios from current chart data are busy channeling comparisons towards the 2018 bear market bottom.

Included in this is popular analyst Matthew Hyland, who even just in his characteristic bullish market takes has little to celebrate with regards to the following couple of months’ BTC cost action.

Inside a tweet out of this weekend, Hyland flagged Bitcoin’s relative strength index (RSI) repeating behavior observed in the build-to the 2018 floor.

An associated chart clearly shown familiar bear market forces in play, contributing to accusations that Q4 2022 could carefully mirror the scenes from 4 years ago.

Buying and selling account Stockmoney Lizards confirmed it “100% agreed” using the idea, which utilizes the three-day chart.

The 2018 RSI breakout structure involved a dive from $5,500 to $3,100 for BTC/USD — or roughly 40%.

“Obviously, we’re still awaiting this massive proceed to come,” Hyland added inside a related video concerning the idea.

He furthermore demonstrated the classic Bollinger Bands volatility indicator was still being predicting an incoming storm, with narrowing bands demanding an outbreak of volatility.

Hodlers stay as determined as always

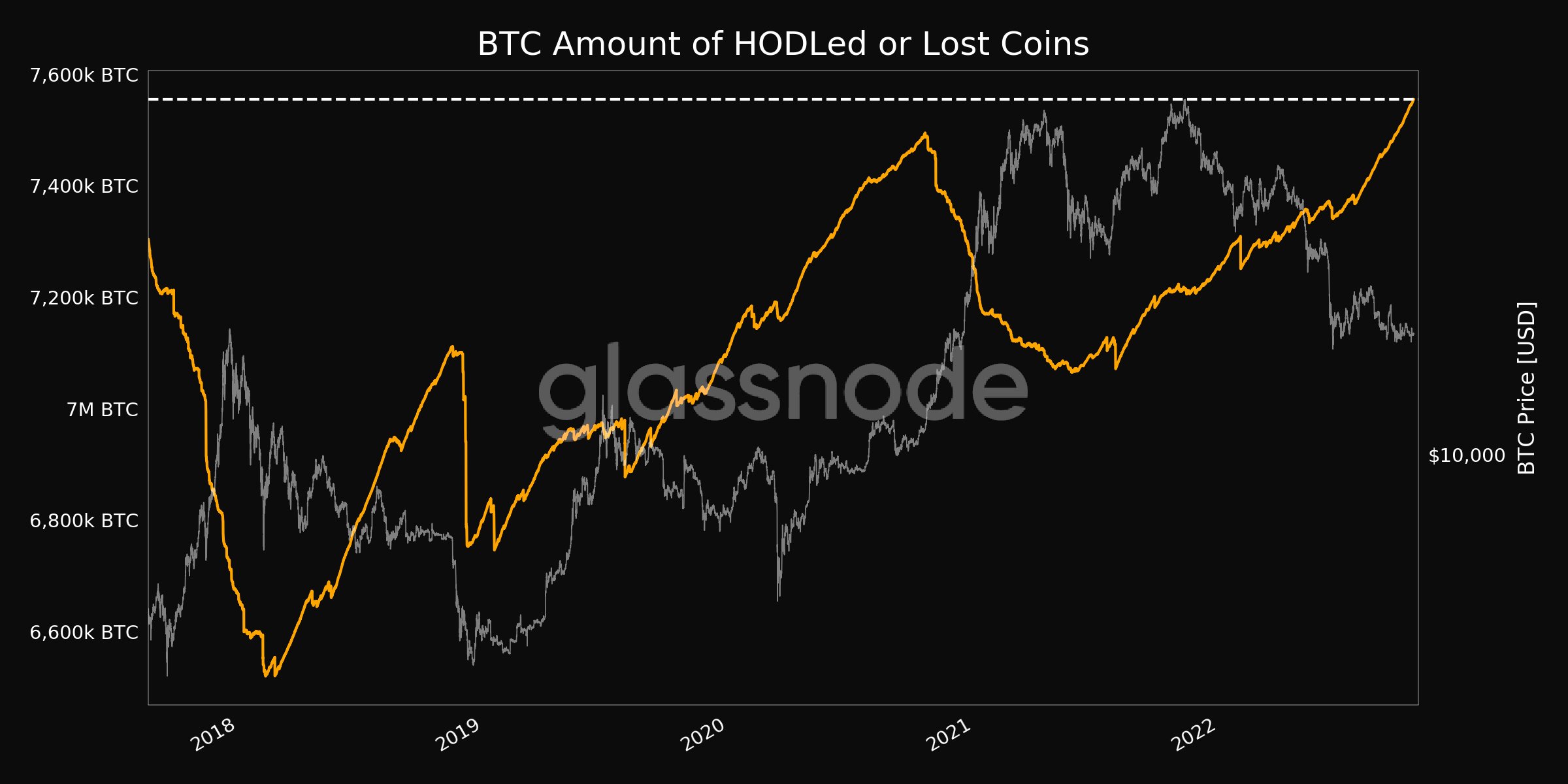

Considering hodler behavior also it becomes apparent the resolve from the average lengthy-term holder (LTH) remains steadfast.

The most recent data from on-chain analytics firm Glassnode confirms a 5-year full of the amount of Bitcoin either lost or from circulation in cold storage.

The “hodled or lost coins” metric place the tally at 7,554,982.124 BTC — or 40% of the present supply — by March. 17, and therefore more BTC is from the market than anytime since late 2017.

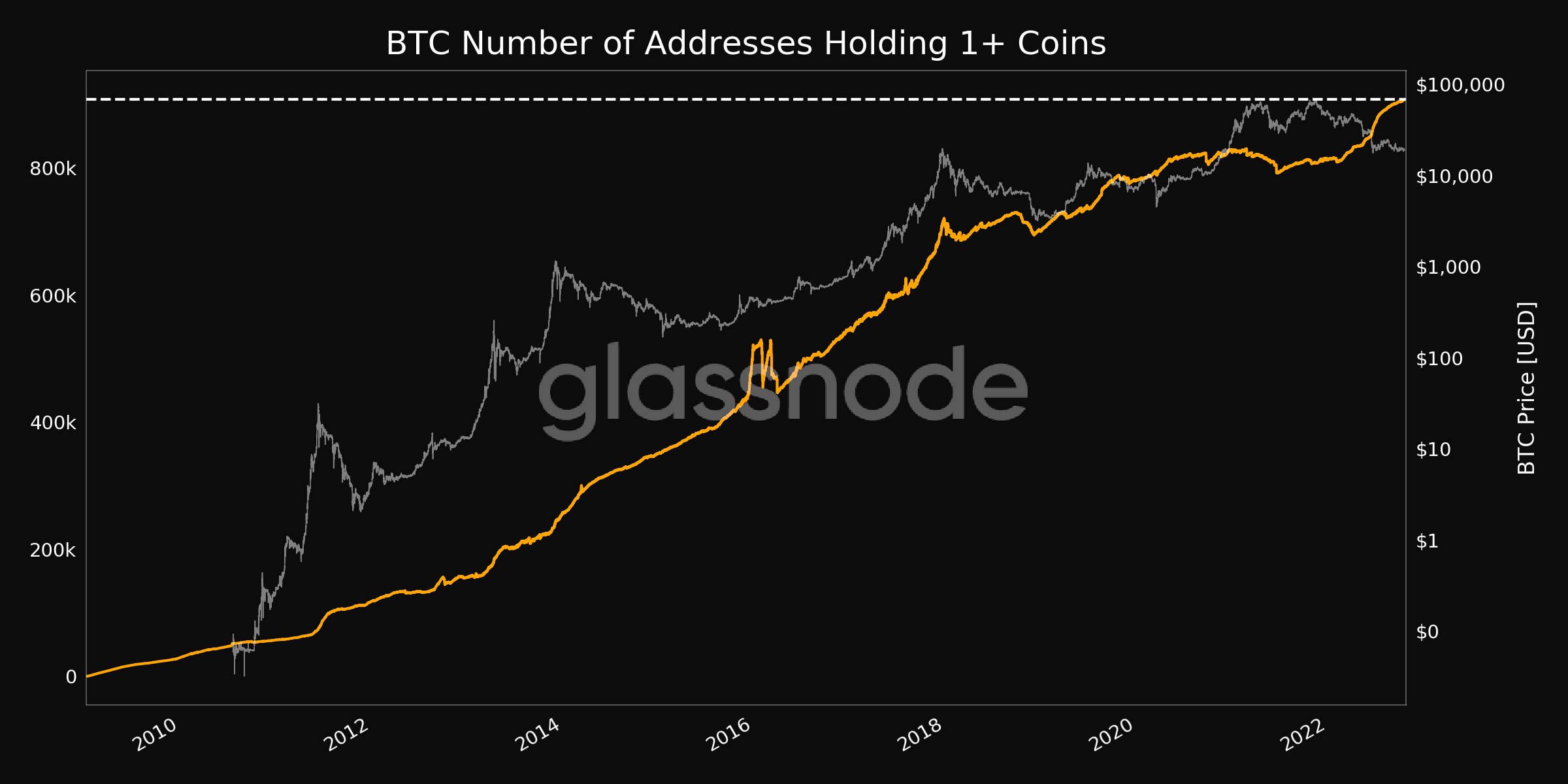

Likewise, distribution can also be ongoing an speeding up trend visible throughout 2022. The amount of wallets having a balance with a minimum of one whole Bitcoin has become in an all-time a lot of over 908,000.

While growing overall with the latter 1 / 2 of 2021, the popularity has acquired noticeable momentum this season, Glassnode shows.

Analyzing lost coins included in its weekly e-newsletter, “The Week On-Chain,” Glassnode, meanwhile, figured that the present bear market has yet to complement others when it comes to intensity with regards to hodlers.

“Network profitability hasn’t quite hit exactly the same degree of severe financial discomfort as past cycles, however adjustment for lost and lengthy HODLed coins can explain an acceptable part of this divergence,” it described a week ago.

Nevertheless, with regards to individuals accustomed to hodling through bear markets, it seems that there’s little appetite for capitulation from current cost levels.

Fear enters its second consecutive month

There appears to become no trembling the worry with regards to crypto market sentiment.

Related: ‘No emotion’ — Bitcoin metric gives $35K as next BTC cost macro low

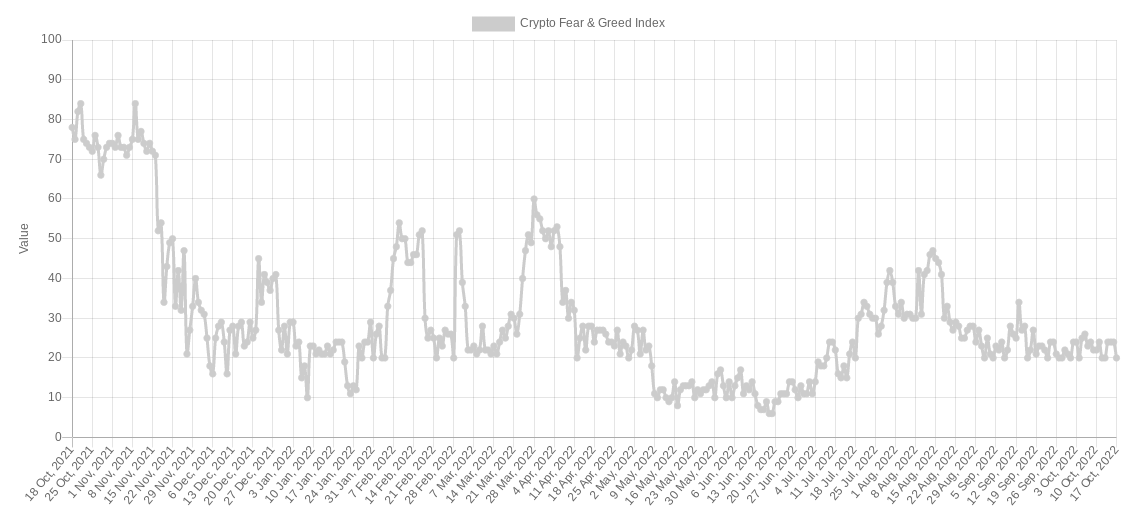

Inside a sign that has taken the this season, the Crypto Fear & Avarice Index has had sentiment in the “fear” or “extreme fear” for 2 several weeks straight.

Fear & Avarice utilizes a basket of things to compute a normalized score for market sentiment, and 2022 has delivered results unlike most years.

Earlier, the Index saw its longest-ever stint in “extreme fear,” a task that is presently 30 days from repeating.

By March. 17, the Index measured 20/100 — around 10 points greater than classic bear market bottoms however a full 14 points greater than 2010 low.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.