The blockchain industry doesn’t appear in a bubble. The outcome of all of those other world’s economic turmoil appears to become stomping all around the progress from the “blockchain revolution.” Traditional markets such as the S&P 500 index crashed by greater than 11.5% in September, as the tech-heavy Nasdaq 100 index plummeted by 12.5%. However, Bitcoin (BTC) might have seen a decoupling, getting only dropped 3% in this same period.

For many, they are indications of a bottom for Bitcoin, but it doesn’t always mean an instantaneous reversal is outdated. Exist other positive flashing signals we are able to see within the charts?

Each month, Cointelegraph Research releases a trader Insights are convinced that analyzes key indicators from various sectors from the blockchain industry. Gauges from 10 segments within the blockchain space — including regulation, crypto mining, security tokens, Bitcoin and Ether (ETH) derivatives, and investment capital (VC) activities — are examined by individuals working carefully with the topic.

Download and buy this set of the Cointelegraph Research Terminal.

Bitcoin and beyond

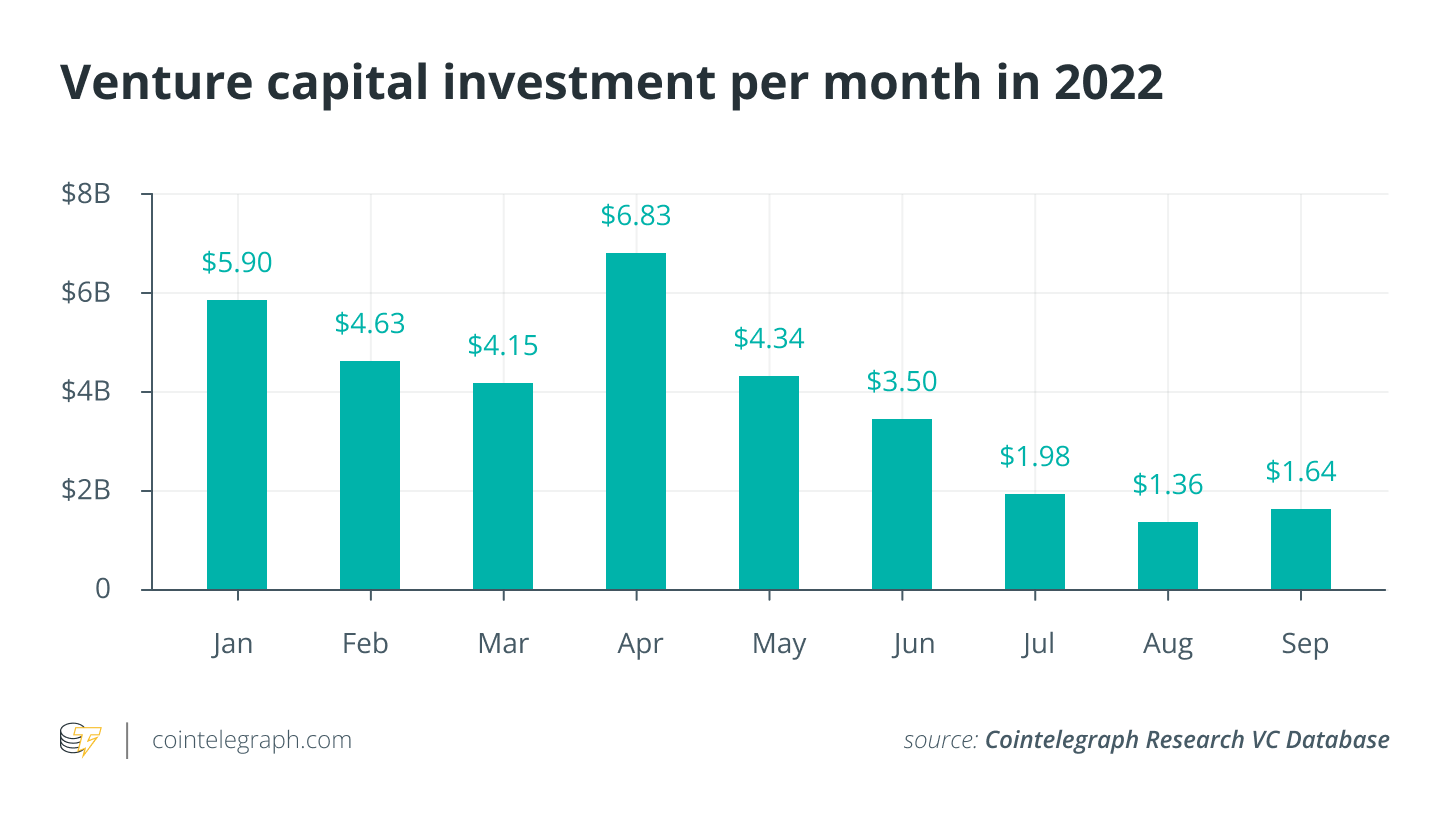

Investment capital is frequently a lagging indicator of market sentiment in traditional markets. In 2021, the blockchain space saw continuous increases in capital inflows per quarter. In 2022, Q1 ongoing this trend, while Q2 started to exhibit a slowdown in VC capital entering the area. However, September saw a 20.6% uptick within the capital investment of VCs over 93 deals through the month.

Web3 had the finest quantity of individual deals at 31 and introduced in $378.8 million, while Infrastructure had 29 deals and saw the majority of investment at $913.six million. This may be another indicator that the foot of this cycle from the bear market is within.

Security token volume grows

In September, security token market capital increased by 6.27% — $18.7 billion in contrast to $17.6 billion in August. The amount also exploded by 19.76% within the previous month. The experience within security token markets isn’t the only positive, as news that Hong Kong’s government is encouraging proposals for security tokens obtain towards the Securities and Futures Commission (SFC) bodes well for that sector.

While this can be an frequently neglected market through the average blockchain investor, security tokens do help demonstrate mainstream adoption in various applications for that blockchain industry and is a great symbol of how all crypto markets engage in soon.

The Cointelegraph Research team

Cointelegraph’s Research department comprises the best talents within the blockchain industry. Getting together academic rigor and filtered through practical and difficult-won experience, they around the team are dedicated to getting probably the most accurate and insightful content in the marketplace.

Demelza Hays, Ph.D., may be the director of research at Cointelegraph. Hays has compiled a group of subject material experts from over the fields of finance, financial aspects and technology to create towards the market the premier source for industry reports and insightful analysis. They utilizes APIs from a number of sources to be able to provide accurate, helpful information and analyses.

With decades of combined experience of traditional finance, business, engineering, technology and research, the Cointelegraph Research team is perfectly positioned to place its combined talents to proper use using the Investor Insights Report.

Disclaimer: The opinions expressed within the article are suitable for general informational purposes only and aren’t meant to provide specific advice or recommendations for anyone or on any sort of security or investment product.