Bitcoin’s (BTC) insufficient volatility continues to be the dominant discussion point among traders within the last two days and also the current sideways buying and selling inside the $18,000 to $25,000 range has been around effect for 126 days. Most traders agree that the significant cost move is imminent, but precisely what are they basing this thesis on?

Let’s check out three data points that predict an increase in Bitcoin volatility.

Muted volatility and seller exhaustion

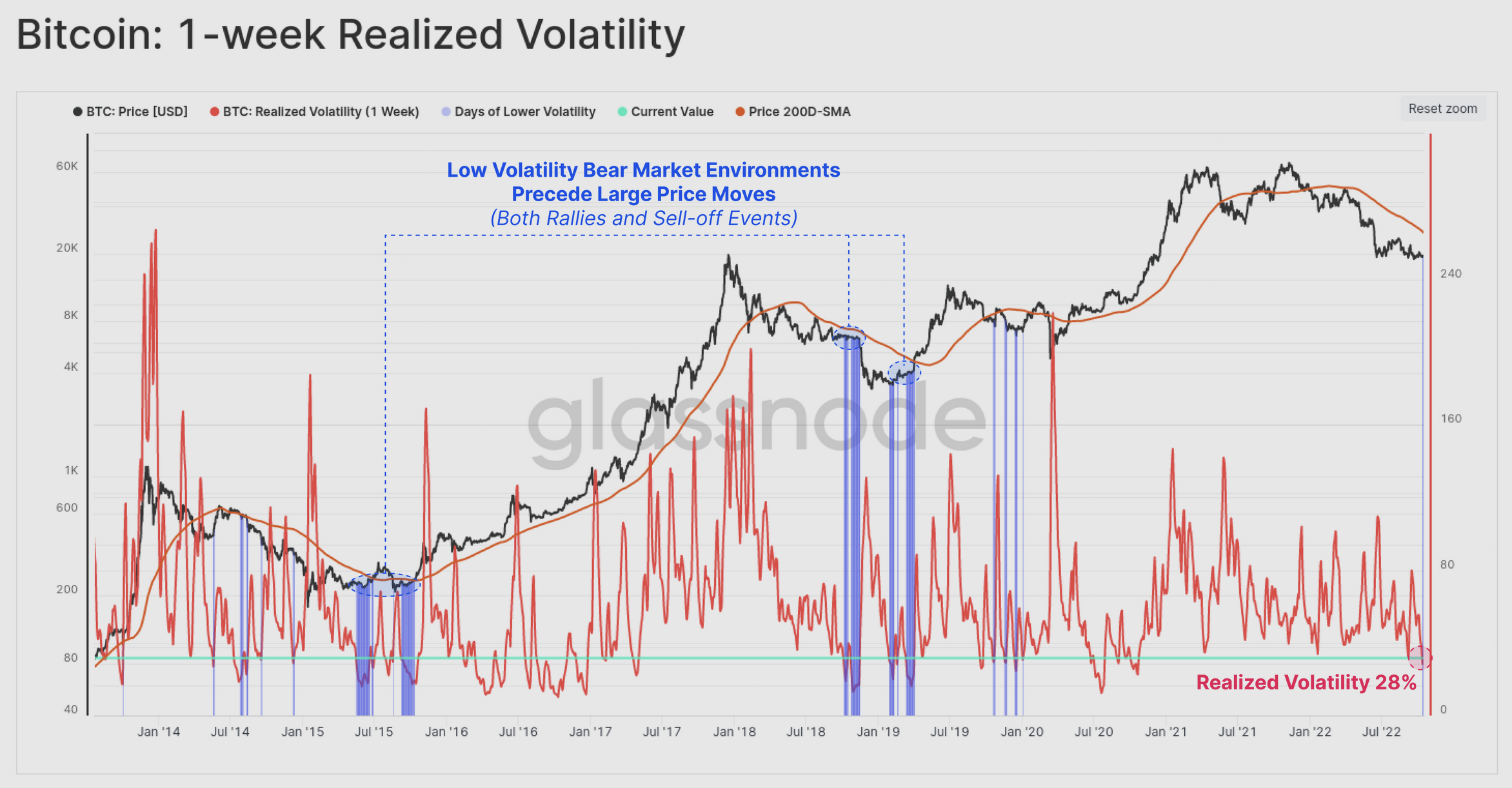

Based on Glassnode research, the “Bitcoin marketplace is primed for volatility,” with on- and off-chain data flashing multiple signals. They observe that 1-week recognized volatility has fallen to twenty-eightPercent, an amount that’s typically adopted with a sharp cost move.

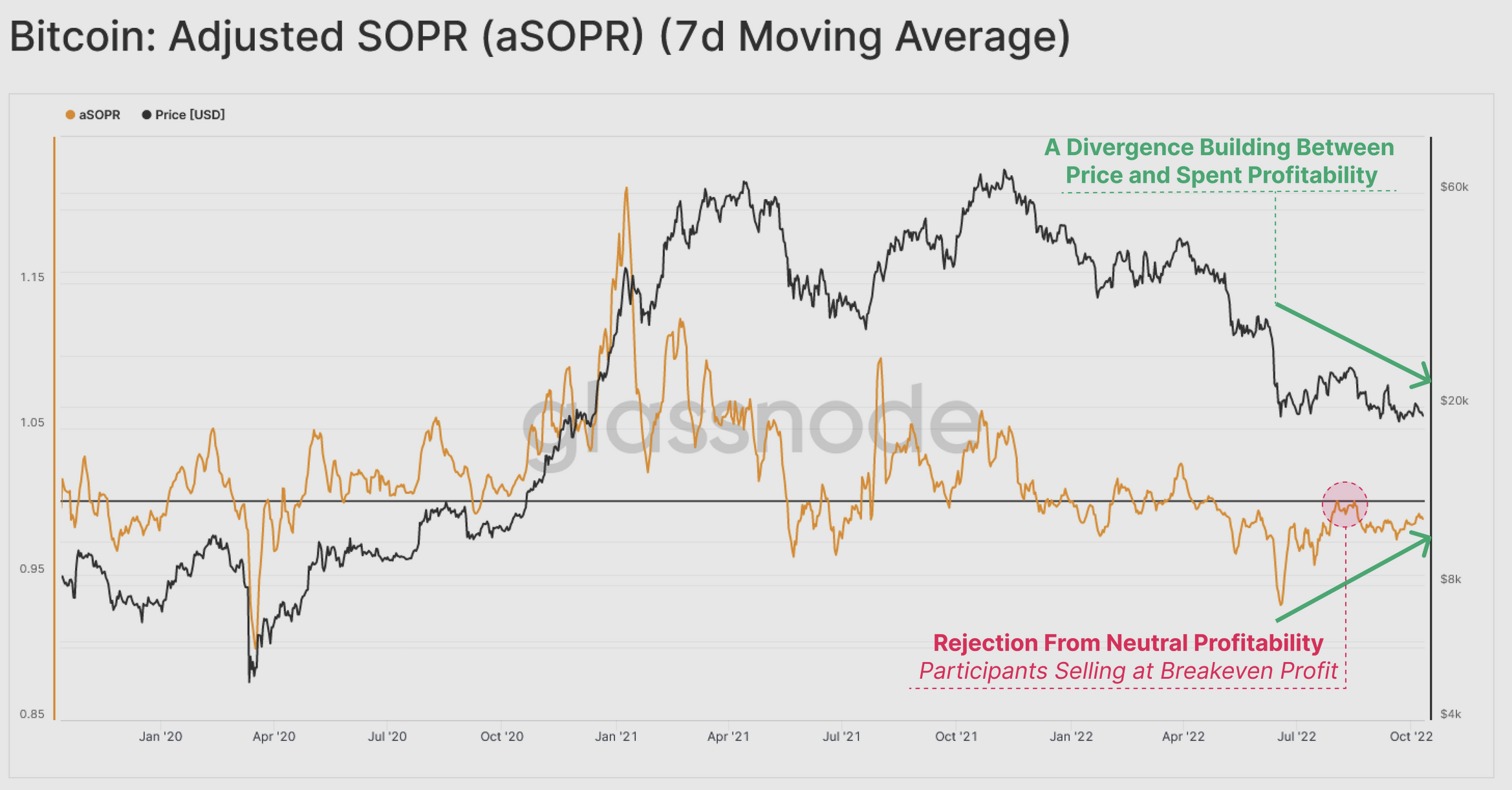

Search for Bitcoin’s aSOPR, a metric which “measures a typical recognized profit/loss multiple for spent coins on a day” shows:

“A large divergence is presently developing between cost action, and also the aSOPR metric. As prices trade sideways or decline, the magnitude of losses that being kept in are diminishing, indicating an exhaustion of sellers inside the current cost range.”

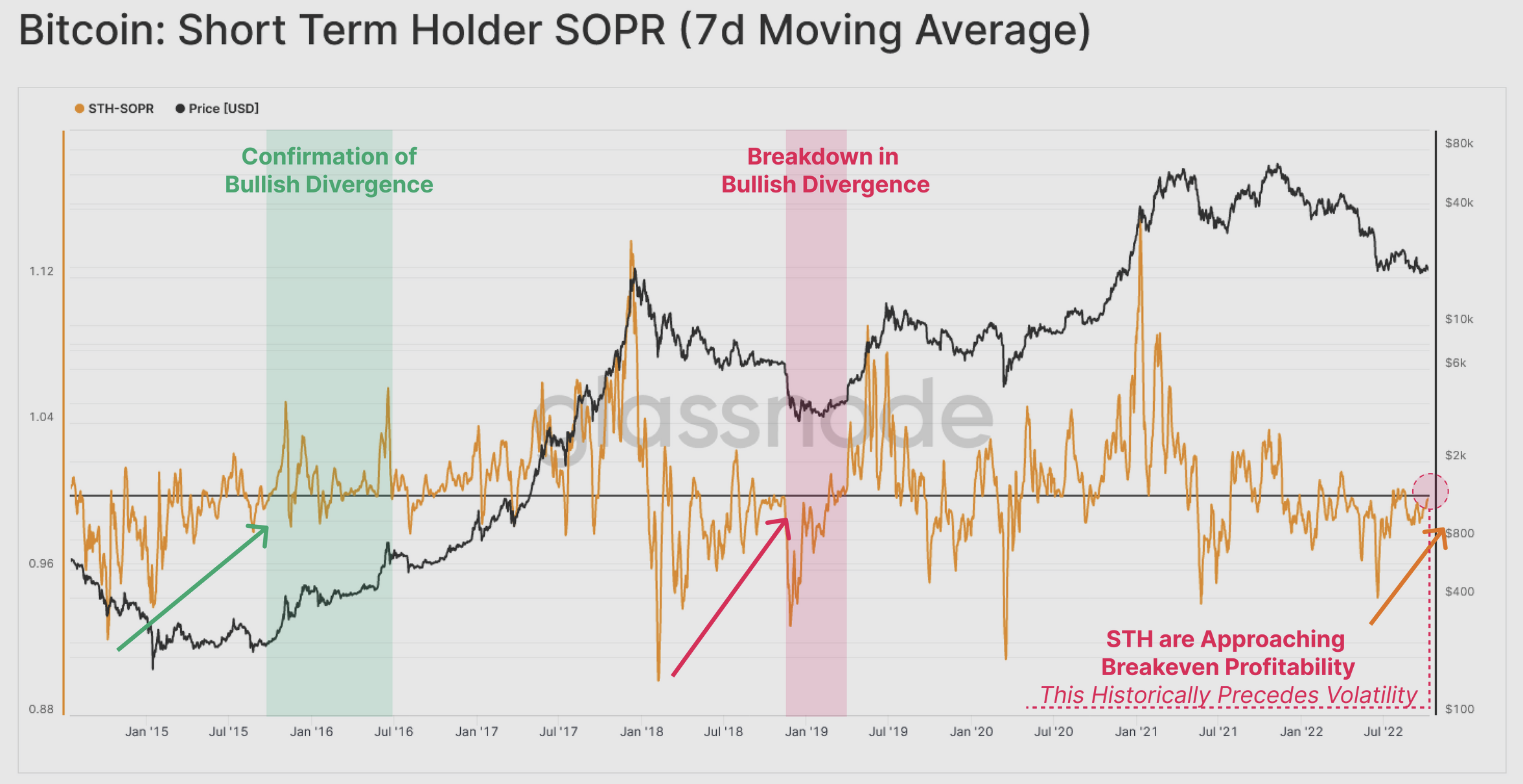

Additionally towards the divergence between your cost and also the adjusted SOPR, short-term Bitcoin holders are approaching their breakeven level because the short-term holder SOPR approaches 1..

This really is significant just because a studying of just one. throughout a bear market has in the past functioned as an amount of resistance and there’s a inclination for traders to exit their positions near breakeven.

When the aSPOR would crest above 1. and switch the amount to aid, it may be an earlier manifestation of a fledgling trend change inside the market.

Buying and selling indicators will also be at pivot points

Multiple technical analysis indicators will also be flashing an indication that the strong directional move is incorporated in the cards, a place noted by independent market analyst Big Smokey.

Based on the analyst:

Bitcoin cost range, SuperGuppy and Bollinger Bands are becoming real tight. ETH looks exactly the same. Guess what happens which means. pic.twitter.com/e7s6ScG7jz

— Big Smokey (@big_smokey1) October 18, 2022

Crypto research firm Delphi Digital lately issued an identical perspective, citing “compression” inside the Guppy Multiple Moving Average as an indication of “shorter-term momentum and the opportunity of a rally because this cohort tries to switch the more-term moving averages.”

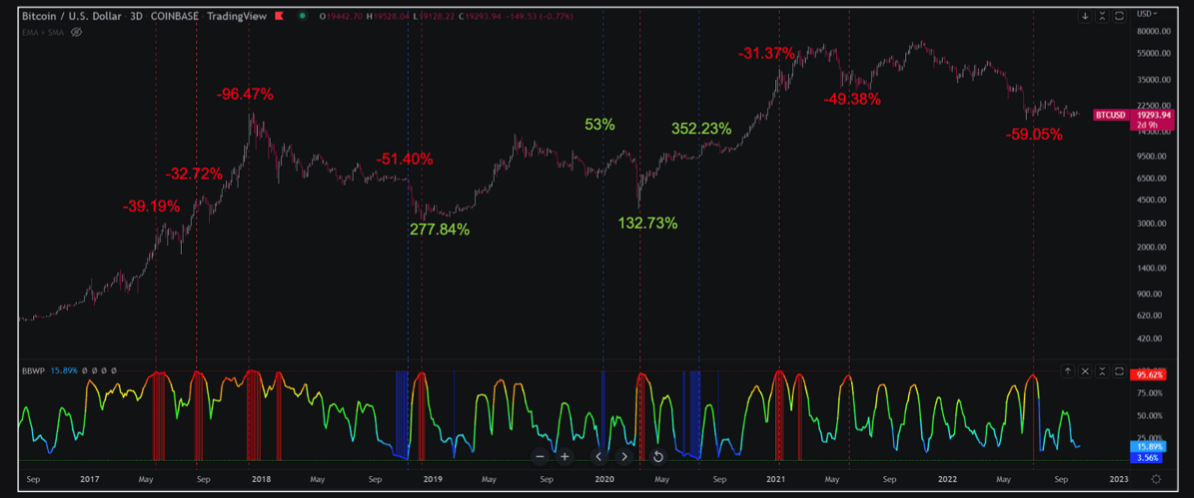

On March. 10, Delphi Digital researchers referenced the Bollinger Band Width Percentile (BBWP) metric and recommended the potential of “a big move brewing for BTC.” They described that “historically, BBWP readings above 90 or below 5 have marked major swing points.”

Related: Bitcoin mirrors 2020 pre-breakout, but analysts at odds whether this time around differs

The condition of Bitcoin derivatives

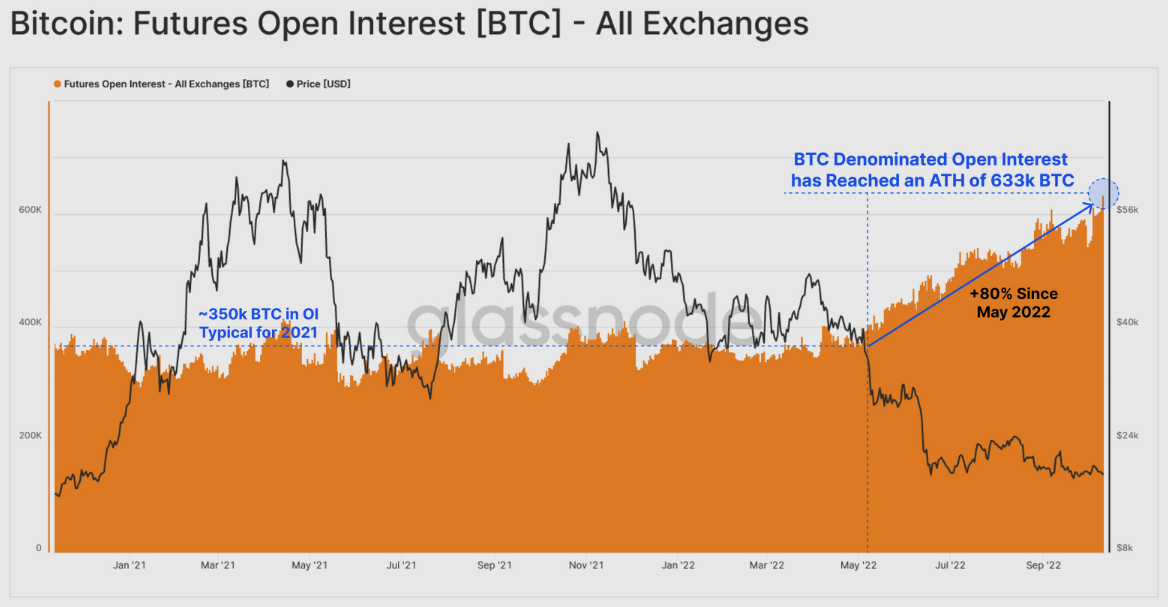

Crypto derivatives financial markets are also flashing multiple signals. Bitcoin futures open interest has arrived at an exciting-time a lot of 633,000 contracts, while buying and selling volumes have plummeted to some multi-year low of $24 billion daily. Glassnode notes these levels were “last observed in December 2020, prior to the bull cycle had damaged with the 2017 cycle $20K ATH.”

As you would expect throughout a bear cycle, liquidity, or how much money flowing interior and exterior the marketplace, has declined, re-enforcing the reason behind believing that the eventual spike in volatility could cause a clear, crisp cost move.

While derivatives metrics like futures open interest, lengthy liquidations and gold coin margined futures open interest are breaking multi-year records, it’s worth noting that neither provide absolute certainty on market directionality. It’s hard to see whether most market participants are situated lengthy or short and many analysts will claim that the boost in open interest rates are reflective of hedging strategies which are in play.

One factor that’s certain is the fact that on-chain data, derivatives data and fundamental technical analysis indicators all point toward an impending explosive relocate Bitcoin cost.

Bitcoin’s current prolonged duration of low volatility is sort of unusual, but reviewing the information presented by glassnode and Delphi Digital could provide valuable insight on what to anticipate when certain on-chain metrics hit specific thresholds which should give investors some tips on how to position.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.