Cardano (ADA) cost is while painting its seventh red monthly candle consecutively because the token fell to the cheapest level since Feb 2021.

The popularity saw ADA’s cost rising nearly 800% to $3.16 between Feb 2021 and September 2021, adopted with a complete wipeout of individuals gains entering October 2022. Amusingly, the whole cost action required the form from the “Burj Khalifa,” the earth’s tallest skyscraper in Dubai.

Ada Khalifa pic.twitter.com/KE2SxTO3bN

— Trader_J (@Trader_Jibon) October 19, 2022

ADA cost eyes 35% cost crash

The ADA cost correction started mainly within the wake of the similar downtrend over the cryptocurrency market, brought through the Federal Reserve’s aggressive rate of interest hikes to tame rising inflation.

Even an positive Cardano network upgrade dubbed Vasil was insufficient to create its buyers to the marketplace.

Particularly, ADA’s cost has dropped by nearly 20% because the Vasil hard fork nearly last month — an update targeted at improving its network’s scalability and smart contract abilities.

Furthermore, the ADA/USD pair also broke below a vital support level that can lead to another major crash ahead in Q4.

The stated support level around $.42 is really a climbing down triangular, a continuation pattern. Quite simply, ADA’s possibility to continue its prevailing downtrend becomes greater whether it forms and breaks from a climbing down triangular towards the downside.

Meanwhile, usually of technical analysis, a climbing down triangular breakdown throughout a downtrend typically pushes the cost lower to an amount in more detail comparable to the pattern’s maximum height. Therefore, ADA risks shedding toward $.248, or by 35%, when the climbing down triangular breakdown plays out.

$ADA now losing the lights out level and visiting the place where coins go once they die. Prob had a -50% inside it from that breakdown level imo

And I am in no way picking onto it. I published charts for nearly several alts such as this including $SOL and $ETH in 12 ,-Jan pic.twitter.com/Of0TNZfXKK

— Pentoshi (@Pentosh1) October 19, 2022

On the other hand, a retest adopted with a close over the triangle’s lower trendline as resistance raises ADA’s possible ways to invalidate the bearish outlook. By doing this, it might trigger a climbing down funnel setup developing concurrently using the climbing triangular, as proven below.

The climbing down funnel setup sees ADA bouncing from the lower trendline to check top of the trendline near $.45 since it’s immediate upside target. Quite simply, a 30% interim cost rebound.

Macro risks remain

Overall, Cardano is constantly on the tread ahead under macro risks, mainly after September’s 8.2% inflation studying, which elevated the potential of the Given ongoing its rate hike spree through out 2022.

Risk assets overall have observed a loss of individual investors’ enthusiasm, that was instrumental in pushing thcryptocurrency prices greater in 2020 and 2021. For example, Robinhood Chief executive officer Vlad Tenev noted:

“2020 and 2021, everyone was really thinking about purchasing stocks. There is prevalent participation in the stock exchange. Now individuals are speaking about gas prices and inflation.”

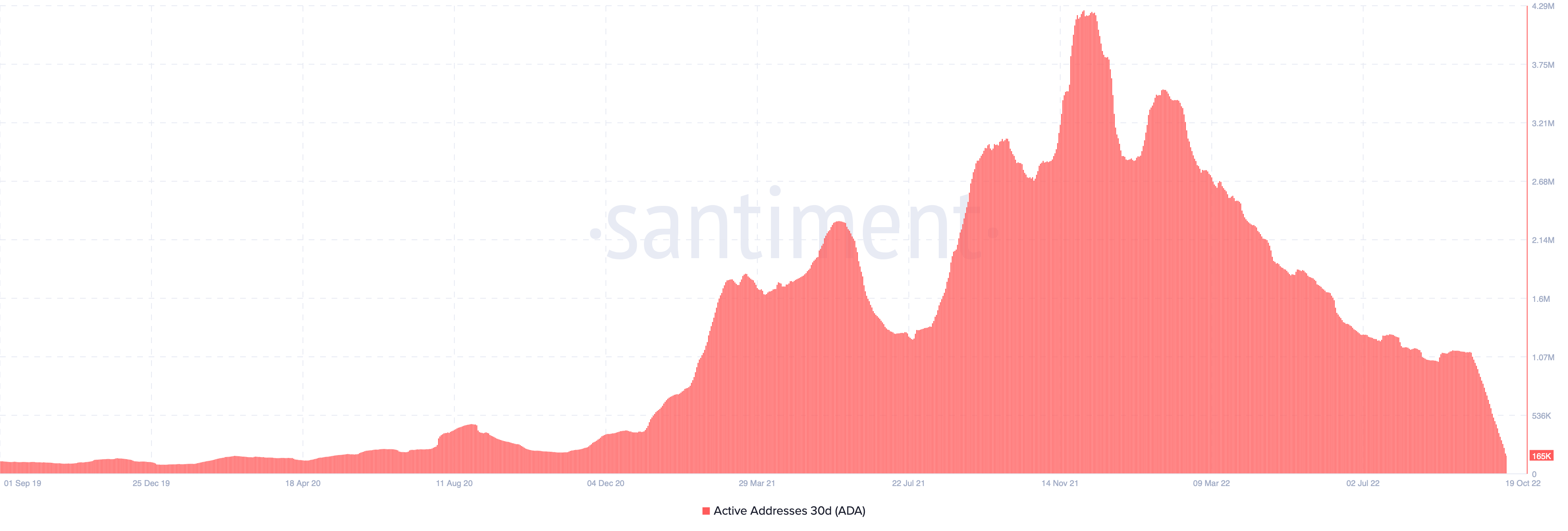

ADA, whose positive correlation coefficient using the U.S. benchmark S&P 500 has continued to be above $.80 for many of 2022, also observed a clear, crisp loss of its daily active addresses (DAA) since November 2021’s market top.

Related: Cardano founder highlights flaws in Ethereum and Bitcoin

Particularly, its 30-day DAA average dropped to 165,000 on March. 19, its cheapest level in 2 years, data from Santiment shows.

On the better note, the amount of Cardano addresses holding 100–1,000 ADA and 1,000–10,000 ADA tokens has elevated throughout the bear cycle, meaning at potential accumulation by large investors, approximately-known as whales.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.