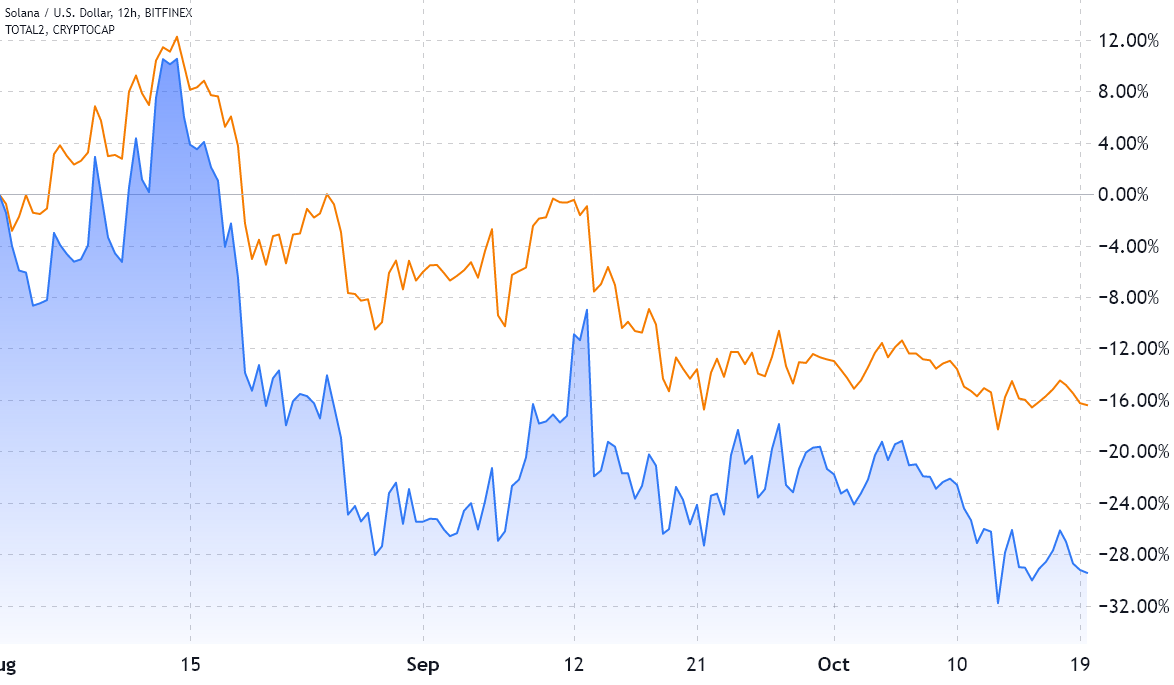

Yesteryear 80 days happen to be moderately bearish for cryptocurrencies because the altcoin market capital declined by 16%. The down-side movement could be partly described through the U.S. Federal Reserve’s quantitative tightening, rising rates of interest and also the halting of asset purchases. Even though they are targeted at curbing inflationary pressure, the insurance policy also increases borrowing costs for consumers and companies.

Solana’s (SOL) downfall continues to be much more brutal, using the altcoin facing a 29% correction since August. The smart contract network concentrates on low charges and speed, however the frequent outages highlight a centralization issue.

The most recent setback happened on Sept. 30 following a misconfigured validator stopped tblockchain transactions. A replica node instance caused the network to fork, because the remaining nodes couldn’t agree with the right chain version.

Lately, Solana’s co-founder Anatoly Yakovenko placed his bets on Firedancer, a scaling solution produced by Jump Crypto together with the Solana Foundation. Dubbed the lengthy-term fix towards the network outage problem, the mechanism should be prepared for testing within the coming several weeks.

On March. 11, Solana-based decentralized finance exchange Mango Markets was hit by having an exploit well over $115 million. The attacker effectively manipulated the need for MNGO native token collateral, getting “massive loans” from Mango’s treasury.

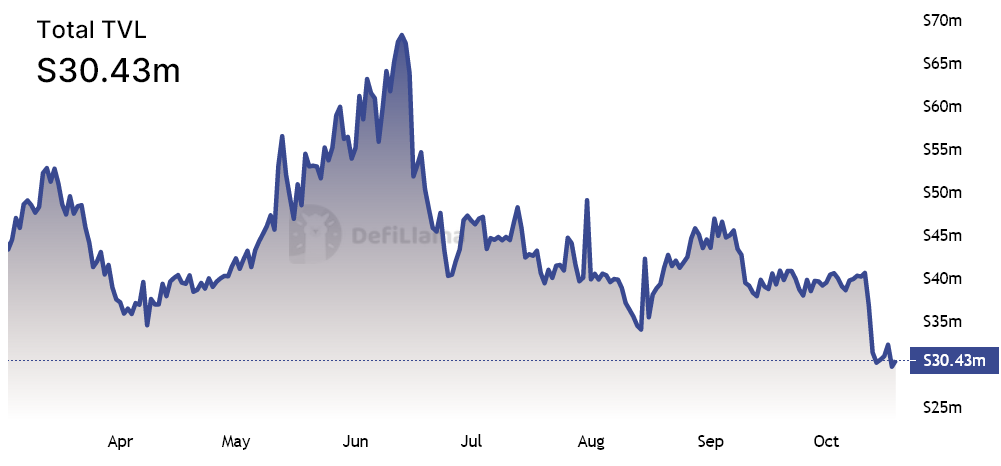

Solana’s TVL and the amount of active addresses dropped

Solana’s primary decentralized application metric began to show weakness earlier in November. The network’s total value locked (TVL), which measures the quantity deposited in the smart contracts, broke to the cheapest level since September 2021 at 30.4 million SOL.

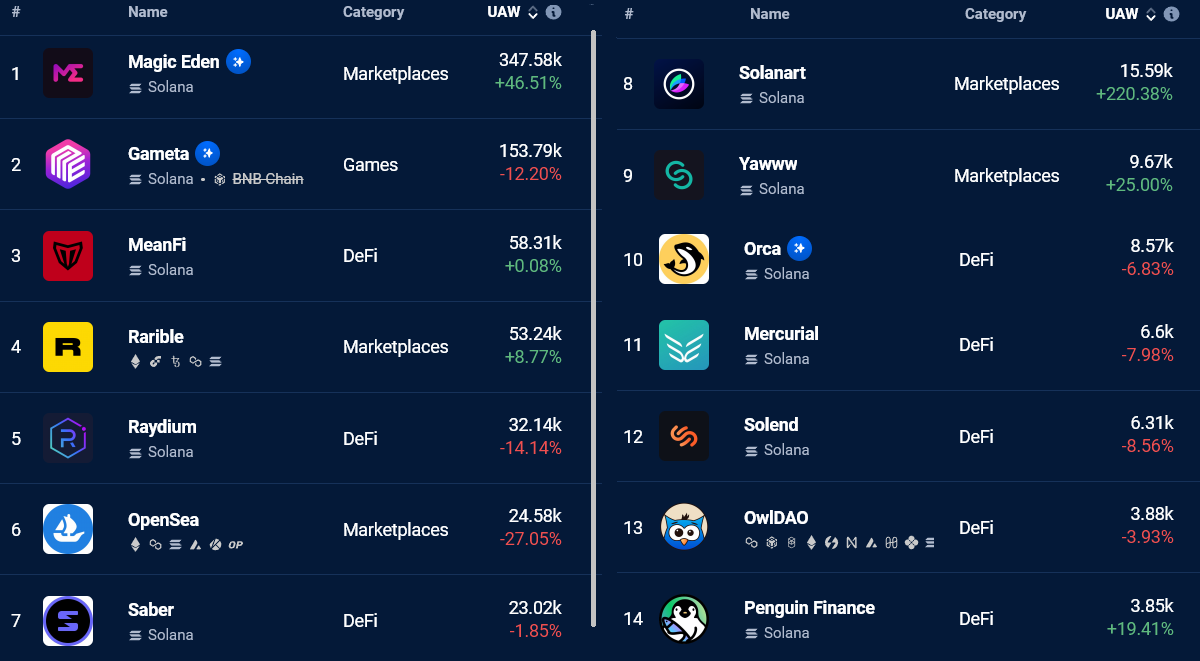

There are more factors that influence Solana’s reduction in value and TVL. To verify whether DApp use has effectively decreased, investors also needs to evaluate the amount of active addresses inside the ecosystem.

March. 19 data from DappRadar implies that the amount of Solana network addresses getting together with decentralized applications declined in 13 from the top 20 DApps. The lower interest seemed to be reflected in SOL’s futures markets.

Related: Moola Market attacker returns the majority of $9M looted for $500K bounty

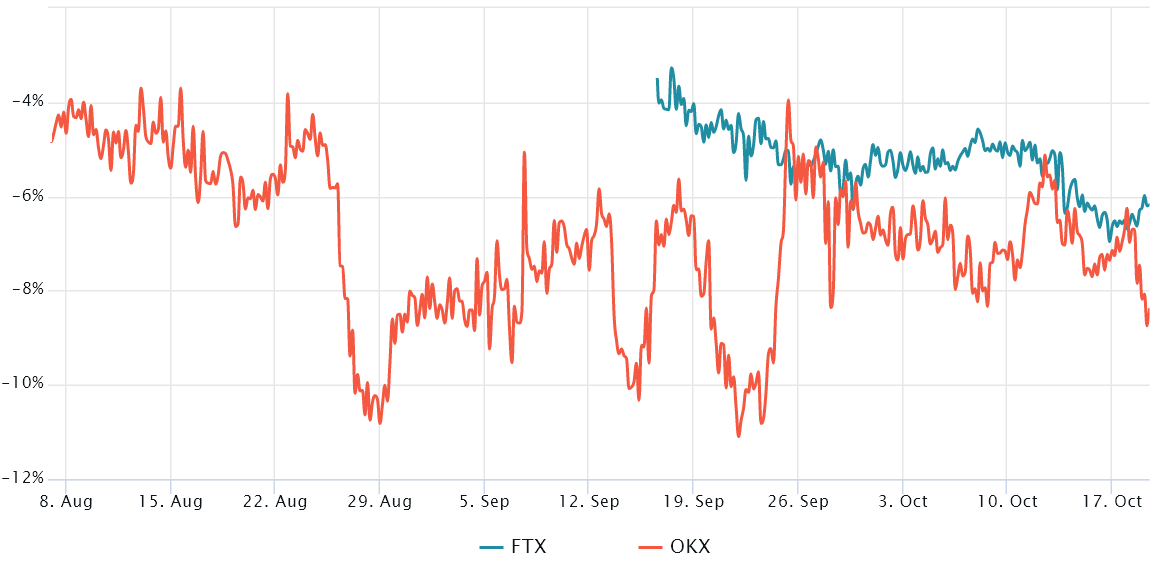

Fixed-month contracts usually trade in a slight premium to place markets because investors require more money to withhold the settlement. Whenever this indicator fades or turns negative, it is really an alarming, bearish warning sign signaling a scenario referred to as backwardation.

The above mentioned chart shows how Solana futures happen to be buying and selling in a 7% discount in comparison to the current place cost. This information is concerning because it signals too little interest from leverage buyers.

SOL continuously underperform until it flips these metrics

It’s tough to target the exact reason behind Solana’s cost drop, but it’s obvious that centralization issues, home loan business the network’s DApp use and fading interest from derivatives traders certainly performed a job.

If the sentiment switch, there must be an inflow of deposits, growing Solana’s TVL and the amount of active addresses. Consequently, the above mentioned data claim that Solana holders shouldn’t expect a cost bounce in the near future since the network health metrics remain pressurized.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.