The take-from digital gold can disrupt the for an unparalleled degree. In the past, gold has been utilized like a global currency like a hedge against inflation. It has additionally been becoming a good investment venue (goods), frequently preferred over other asset classes like equities or foreign currency, specifically in conventional markets.

However, there are specific disadvantages to owning physical gold, for example inconvenience in transport and storage, along with the chance of thievery. Gold exchange-traded funds (ETFs) might seem an alternate option, however it can’t be forgotten the traders don’t really own the gold while having to pay exactly the same taxes as gold bullion, or gold bars, as well as investors need to pay a yearly fee close to .4% to at least onePercent. Gold contains all types of metal, like coins and bars, whereas bullion includes all of the exchangeable physical types of other gold and silver, like silver and platinum.

In comparison, digitized gold stored on blockchain results in like a robust option. This is exactly what Comtech Gold (CGO) is available in, mixing the advantages of gold using the benefits of blockchain. CGO solves the current problems in gold buying and selling by moving out one hundredPercent gold-backed cryptocurrency.

CGO suits the requirements of individuals in addition to corporate investors. It eliminates the requirement for retail investors to go to local markets to purchase gold. Furthermore, it can make things better for institutional investors by putting aside any have to store gold in physical form.

Summary of Comtech Gold

Comtech Gold has added another dimension to gold buying and selling by issuing standardized digital gold supported by 100% physical gold. Built on XinFin XDC Network, a sophisticated blockchain, the work can also be Shariah-compliant and licensed by among the famous Shariah scholars group within the Uae.

Digital gold could be changed into physical gold anytime, resolving the storage and transfer-related issues connected with gold. The fractionalization from the rare metal makes purchase of gold more prevalent.

Holders of CGO tokens own gold physically within the same proportion. Though each holder is titled to some gold, may possibly not function as the specific bars they’d posted. The arrangement works that can compare with a financial institution in which the bank hands over bills of the certain value as requested by the pack leader withdrawing, although not always exactly the same bills that they deposited in cash.

Underlying physical gold

Each token on Comtech Gold represents 1 gram of gold with prices hinged towards the prevailing worldwide gold rate. The tokens are fully supported by the gold bars identifiable through their bar figures. They are standardized 1 kg bars of 999.9 wholesomeness.

Anybody holding gold-backed tokens has the capacity to convert their tokens to physical 1 kg gold bars. When a trader has gold tokens equal to 1 kg (1000 CGO tokens), they are able to convey a request concerning the submission of the tokens for physical 1 kg gold bars.

Because the network of Comtech Gold increases, one can purchase the tokens and redeem them during the time of their choice in smaller sized denominations at recognized retailers’ shops.

Sharia compliance

Fully according to Shariah concepts, Comtech Gold lays lower an ecosystem where physical gold connected with every gold-backed token is identifiable and segregated. As Shariah compliance requires, each transaction will culminate in the delivery of tokens in the seller towards the buyer. Every aspect of the token are totally auditable, from creation to redemption.

The Shariah certification (Fatwa) was from Amanie Advisory Group, a business focusing on the fields of shariah-compliant investments and Islamic finance solutions. Based on the guidance in the advisory team, the ComTech Gold Shariah certification was provided after confirming the structure, mechanism and relevant key legal documentations of Comtech Gold token met all of the necessary Shariah needs.

The certification is consistent with Islamic rules and standards based on the Accounting and Auditing Organization for Islamic Banking Institutions (AAOIFI).

Vault and storage

The physical bars underlying the gold tokens are stored with Transguard, a globally recognized vault. Underneath the users’ wallet account, the audit trail is fully complete. Users may use their wallets to see their balance and transfer tokens. All wallets are encrypted, enabling access simply to the dog owner.

Storing gold happens to be a discomfort, whether both at home and inside a bank because of safety and convenience issues. With Comtech Gold, however, users can store gold inside a tokenized form, move about their holdings as well as get rid of their investments when needed.

Tokenization of physical gold

Gold is really a valuable metal, making investments economically infeasible for any large slice of people. Digitization of gold results in fractional investment, enabling individuals to buy as little as 1 gram, thus considerably expanding the horizon for investors. Comtech Gold facilitates purchasing no less than .01 grams.

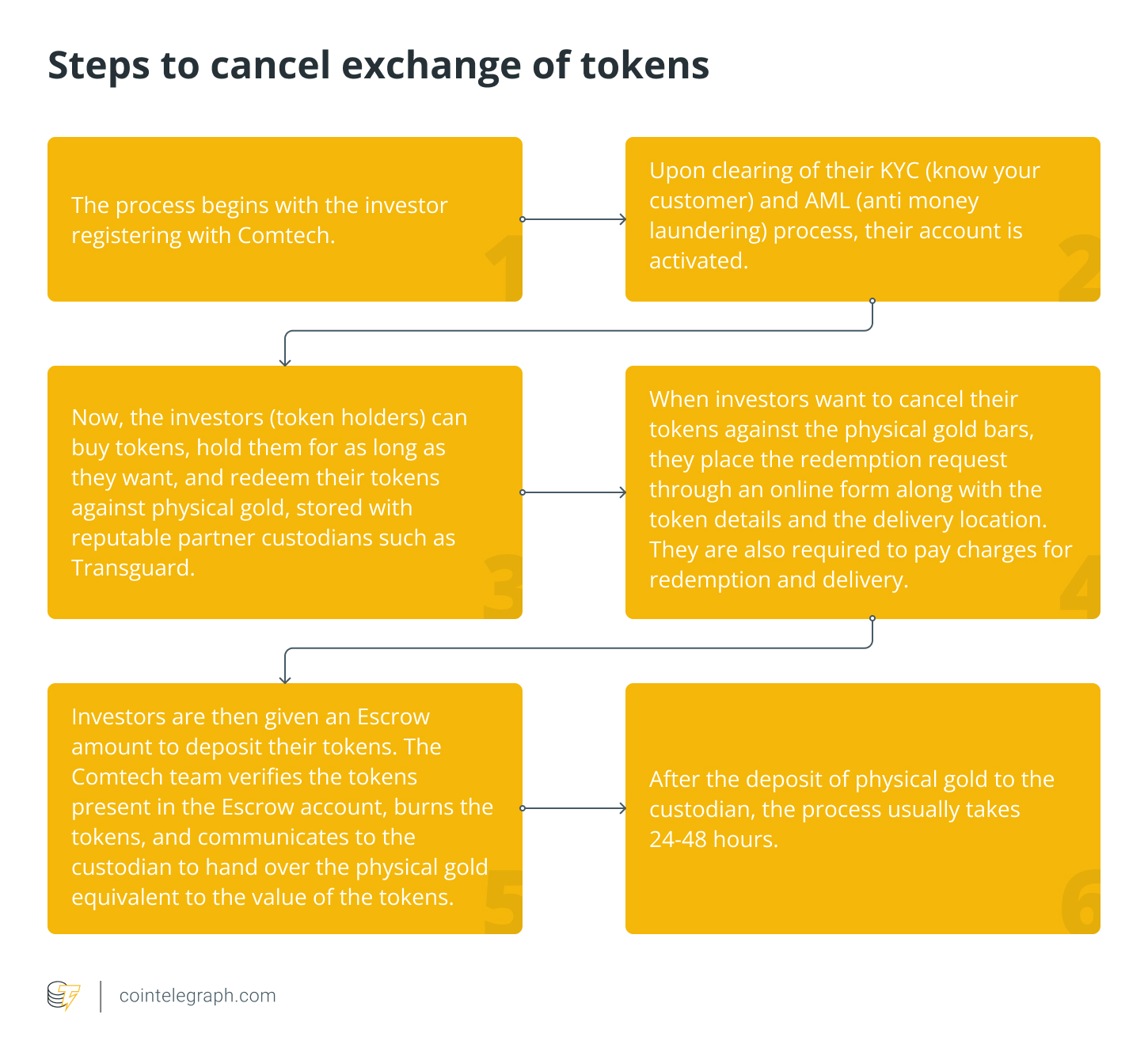

On Comtech Gold, users can deposit their personal physical gold inside a standardized 1 kilogram bar and obtain tokens against it. Any investor holding coins equal to 1 kg or even more of gold can cancel their tokens in return for equivalent gold in multiples of 1000 tokens (1 kg gold). The steps are highlighted below:

Regulatory oversight, collaboration with gold custodians having a robust history, and escrow account put aside any possible apprehensions.

So how exactly does Comtech Gold work?

In line with the XinFin XDC Network blockchain, Comtech Gold protocol brings out of all benefits of a decentralized ecosystem. Tokenization makes holding and buying and selling gold assets so simple in contrast to physical gold. Furthermore, unlike fiat currency or physical gold, tokens tend to be more fluid.

Native CGO tokens, stored around the XDC Network blockchain, could be managed through the user with the wallets that offer the XDC Network’s XRC-20 tokens. Users can observe the token balance and transfer tokens to some receiver address while using XDC Network. When the transaction is finished, users will tell you it with XinFin XDC network explorers. The whole transaction process requires a couple of seconds with near-zero transaction charges.

When transferring CGO tokens, users must pay a typical gas fee with an additional fee for CGO transfer. For example, if users have to transfer 20 CGO in one XRC-20 address to a different, they should send 20.003 CGO to pay for the charge levied. This fee helps manage the protocol and also the vault. There’s no child custody fee too.

As CGO is hinged on real physical gold, the cost will carefully follow worldwide gold prices. Market-related good and the bad within the gold prices offline will reflect within the cost from the CGO token.

An item from the occasions

We live currently when almost a parallel world is developing within the digital landscape. Millennials choose to handle all of their assets online, from bank assets to stocks and digitized gold is really a natural extension of the things they’re doing.

Asset-backed tokens on Comtech Gold help get rid of the issues not only winning conventional gold buying and buying and selling brings in additional advantages than items like gold ETF. Fractionalization from the underlying assets even helps individuals investors who have been from gold-related investments since it wasn’t financially viable on their behalf.

Because the technology advances and also the ecosystem gets to be more streamlined, chances are it will begin gaining more traction. If this accommodates functions like lending and borrowing later on, it’ll get a more dynamic proportion.

Buy a licence with this article. Operated by SharpShark.