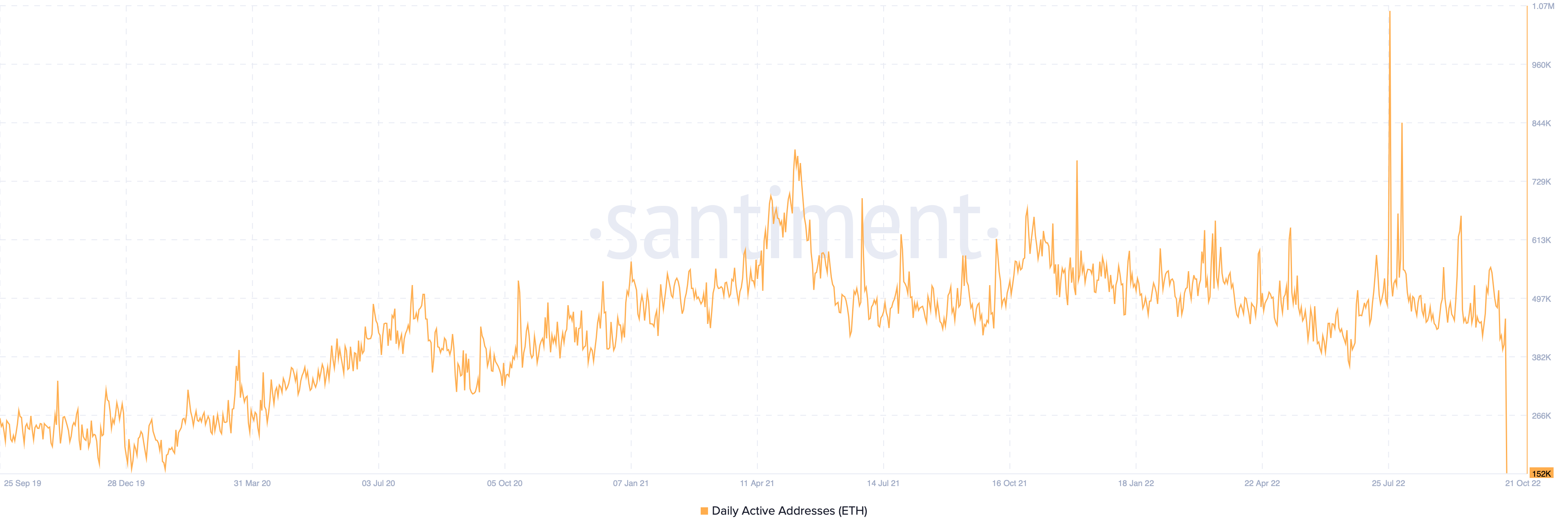

Ethereum has observed a considerable stop by its daily active address (DAA) count during the last four several weeks, raising fears about more downside for Ether (ETH) cost in the coming days.

Stagnant Ethereum cost spooks investors

The amount of Ether DAA dropped to 152,000 on March. 21, its cheapest level since June, based on data supplied by Santiment. Quite simply, the plunge demonstrated less unique Ethereum addresses getting together with the network.

Interestingly, the drop uses Ether’s 80%-plus correction from the November 2021 a lot of around $4,850. This coincidence can often mean a couple of things: Ethereum users made the decision to depart the marketplace and/or stopped their interaction using the blockchain network following the market’s downturn.

Santiment analysts blamed the drop on “weak hands,” sentimental traders who drop from the market throughout a bearish or stagnant phase, noting:

“Disinterest [is] in a high as [the Ethereum] prices have stagnated.”

Particularly, Ether’s cost continues to be buying and selling within the $1,200-$1,400 range for more than per month, supported with a stop by weekly buying and selling volumes.

Disinterest among investors can also be visible across Ethereum-based investment funds. These funds observed outflows worth $3.9 million within the week ending March. 14, according to CoinShares’ latest weekly report.

Furthermore, these outflows have arrived at $368.70 million on the year-to-date (YTD) time-frame.

40% ETH cost crash in play

Crypto prices have tumbled across 2022 along with other riskier assets, introduced lower by global central banks’ tightening policies to tame rising inflation. However, they risk bearish continuation as inflation remains elevated, prompting more rate hikes later on.

⚠️BREAKING:

*MAY 2023 Given FUND FUTURES HIT 5.00% AS TRADERS Cost IN ANOTHER RATE HIKE

— Investing.com (@Investingcom) October 20, 2022

Ethereum could suffer because of inflation-related macro risks. Quite simply, ETH/USD could slip below its prevailing rising trendline support, thus triggering a vintage continuation setup known as climbing triangular, as highlighted within the chart below.

The net income target of the climbing triangular pattern is measured following the adding the utmost distance between its horizontal trendline resistance and rising trendline support towards the breakdown point. Consequently, ETH’s downside target comes to be with $750, or 40% less than current cost levels.

Related: Exactly why is the crypto market lower today?

On the other hand, a rebound in the lower trendline might have Ether eye a rally toward top of the trendline. Quite simply, a climb toward $1,800 in October, up 40% from current prices.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.