The Bitcoin mining industry is constantly on the face a frightening year because the cost of Bitcoin (BTC) hovers below $20,000, along with rising energy costs in The United States and Europe. Regulators also have lately began clamping lower on crypto mining, like a recent report in the Bitcoin Mining Council (BMC) discovered that Bitcoin has witnessed a 41% increase in energy consumption year-on-year (YoY). Consequently, numerous crypto mining companies happen to be made to sell equipment, while others have declared personal bankruptcy.

Yet, this hasn’t been the situation for many miners, particularly individuals centered on clean energy solutions and proper approaches. For instance, in September, crypto mining firm CleanSpark announced a contract to get Mawson’s Bitcoin mining facility in Sandersville, Georgia, for $33 million. The crypto mining company White-colored Rock Management also lately expanded its mining operations to Texas.

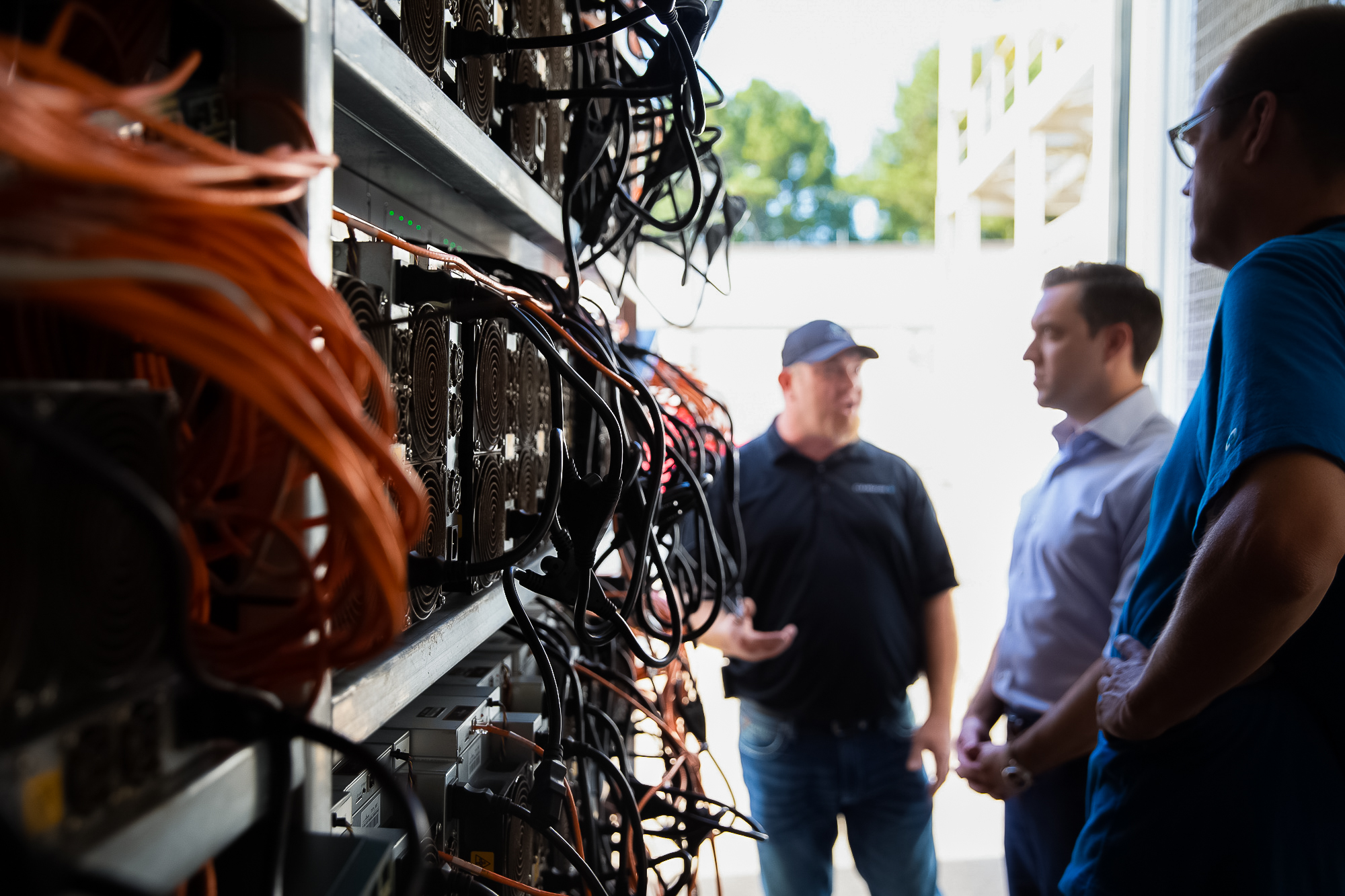

Why some Bitcoin miners are thriving inside a bear market

Matthew Schultz, executive chairman of CleanSpark, told Cointelegraph he views mining like a unique method to decrease energy costs when leveraged for reasons apart from making money. Based on Schultz, this angle has differentiated CleanSpark using their company crypto-mining companies. “Bitcoin mining is really a potential solution for making more possibilities for energy development,” he stated.

Schultz elaborated that CleanSpark partners with metropolitan areas within the U . s . States, like Georgia and Texas, to purchase excess energy. For instance, he noted that CleanSpark works together with local areas in Georgia that receive energy in the Municipal Electric Authority of Georgia.

“These metropolitan areas basically become our utility provider. They create a margin on every kilowatt hour we buy to conduct our mining operations. Yet, we’re buying such high amount of souped up that it brings lower energy costs for that communities make certain with. We try to impact metropolitan areas posivetly by driving energy costs lower,” he stated.

Schultz also noticed that CleanSpark created a partnership using the energy company Lancium to aid their data center in West Texas by buying excess alternative energy to produce grid stability. Consequently, Schultz shared that CleanSpark presently has half a billion U . s . States dollars price of assets on its balance sheet and under $20 million indebted, together with support from investors like BlackRock and Vanguard. With all this, Schultz believes the crypto bear market has impacted CleanSpark differently in comparison to other crypto miners.

For example, he noted that whenever one Bitcoin was worth $69,000 last year, many miners were discussing intends to hold BTC. “These miners also made huge commitments to the likes of Bitmain for future years delivery of mining rigs,” he stated. Yet, based on Schultz, CleanSpark conducted extensive research into the quantity of mining rigs being purchased this past year whilst searching at future energy projections. He mentioned:

“We arrived at the final outcome that instead of delivering a first deposit for mining equipment to providers last November which are at the moment being delivered, we had the potential of an oversupply of rigs and a rise in energy costs. And then we offered Bitcoin if this is at the $60,000 range and invested proceeds in infrastructure rather.”

Not just did this allow CleanSpark to get its new mining facility in Sandersville, Georgia, but Schlutz also noted the firm is presently purchasing Bitcoin mining rigs in a really low rate. “We are purchasing rigs for $17 per terahash that certain last year cost $100 per terahash.”

As numerous miners have to sell their equipment, both new and used mining rigs are now being offered at below market prices, creating buying possibilities for firms like CleanSpark.

Scott Offord, who owns Scott’s Crypto Mining — something that gives used and new mining equipment, together with mining courses — told Cointelegraph that prices for miners are actually very affordable, partially with different insufficient demand because of the low cost of Bitcoin. Offord added that lots of the used miners he’s presently selling came from hosting facilities indebted. He stated:

“During the final bull cost you couldn’t get miners with no 6-month lead time. It’s the alternative now because so many miners aren’t capitalizing. Usually, Bitcoin miners eliminate their gear because devices are old then one newer is available on the market, however it appears like now individuals are selling simply because they need income.”

Offord also noticed that he’s seeing lots of new mining gear hit secondary markets. “Many new generation Antminers are now being sold again. For instance, such things as S-19s, which are the most effective miners on the planet at this time,” he stated.

When it comes to prices, Offord described that crypto miners might be able to purchase a new Antminer S-19j pro for around $20 per terrahash. “This same machine might have cost three occasions just as much having a three-month lead time twelve months ago,” he added.

Echoing Offord, Andy Lengthy, chief operating officer of Bitcoin mining firm White-colored Rock Management, told Cointelegraph that miners who’re selling equipment are usually doing this to pay for debt payments for hardware bought when prices were greater. “Hardware has become being bought by well-capitalized miners and will still be accustomed to secure the network,” he stated.

Based on Lengthy, White-colored Rock Management’s operations within the U . s . States haven’t been influenced by the bear market, adding that it is facility in Texas operates completely off-grid. “White Rock’s U.S. operations are operated by flared gas, while our mining operations in Norway will also be 100% hydroelectric powered.”

Bitcoin miners re-think business strategies

While miners like CleanSpark and White-colored Rock Management keep growing, others might need to re-think their business strategies. Elliot David, mind of climate strategy and partnerships at Sustainable Bitcoin Protocol — a eco-friendly Bitcoin mining certification protocol — told Cointelegraph he believes conditions for miners are likely to worsen before things improve. “Miners that are looking to outlive the lengthy term will need to change their strategy,” he stated.

Indeed, some miners are earning adjustments. For instance, Jonathan Bates, Chief executive officer of crypto mining firm BitMine, lately pointed out in an announcement that because of the sharp loss of mining rig prices, the firm will presently only concentrate on self-mining instead of hosting for other people.

“Given the sharp stop by ASIC prices, we’re feeling that concentrating on self-mining is the perfect utilization of our datacenter equipment along with a better utilization of firm capital at the moment,” he mentioned. He added the firm intends to “pursue joint ventures and partnerships where our infrastructure equipment could be combined with ASIC miners worth current prices.”

The pr release further noted that on March. 19, Bitmine joined right into a repurchase and hosting agreement using the Crypto Company (TCC), a openly listed blockchain company.

Under this agreement, Bitmine decided to repurchase certain ASIC miners formerly offered to TCC whilst purchasing additional ASIC miners of TCC. Bitmine may also terminate the hosting agreement it had established with TCC.

To be precise, Bitmine offered TCC 70 Antminer T-17s for $175,000, together with 25 Whatsminers for $162,500, for any total acquisition of $337,500 during Feb this season.

Concurrently, Bitmine and TCC joined right into a hosting agreement to which Bitmine decided to host the miners, as well as other miners of TCC.

Because of current conditions, it’s been noted that Bitmine need the return from the 70 Antminer TY-17s for any credit of $175,000 like a warranty claim. Bitmine may also buy the 25 Whatsminers for $62,500 and also the 72 Antminer T-19s from TCC for $144,000. This marks a substantial reduction in cost from the time the units were initially offered.

In 2021 — throughout the height from the crypto bull run — Bitmine joined into a contract having a telecommunications company situated in Trinidad and Tobago. The agreement enables Bitmine to co-locate as much as 125 800-kilowatt containers for hosting miners over 93 potential locations. Bitmine can also be in a position to co-locate containers at its very own pace, having to pay a set amount per container, combined with the discovered another means suffered by its containers.

During the time of the agreement, Bitmine noted the electricity rate expected to cover the hosting containers was $.035 cents per kilowatt-hour. This took it’s origin from the speed presently compensated through the telecommunications company.

In October of the year, Bitmine completed installing its initial hosting containers in Trinidad. However, just before commencing operations, Bitmine shared the telecommunications company advised the utility company wouldn’t recognition its existing agreement and rather established that the speed could be roughly $.09 per kilowatt-hour. Even though the telecommunications company has protested this decision, Bitmine has selected to obstruct installing additional containers in Trinidad before the dispute is resolved.

The way forward for crypto mining

Given recent changes being produced by miners, David believes the crypto-mining market is approaching a junction. “Miners will have to diversify their revenue streams,” he stated. With this thought, he described that there’s been growing interest from clean energy miners that are looking to utilize Sustainable Bitcoin Protocol to make sure sustainable mining practices in an effort to become more financially resilient.

Echoing this, Offord pointed out that he’s seeing more interest from miners regarding ecological impact. “Miners are trying to find possibilities in places where there’s flare gas that should be mitigated, or where biofuel has been produced from farm waste. Miners are not only centered on creating a Bitcoin mine, but wish to build something sustainable that may be carbon negative.”

Additionally to sustainability, David noticed that rules have become more essential than in the past for crypto miners. He noted that this is also true inside the U . s . States, noting:

“The industry within the U.S. has become more and more conscious that unless of course they regulate themselves the various amounts of government might part of. I have spoken with numerous policymakers and staffers, as well as in a crunch the Bitcoin mining industry is a likely first target.”