Bitcoin (BTC) consolidated gains on March. 27 because the greatest levels in six days turned into sideways action.

Bitcoin impresses with stability on GDP print

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD circling $20,500 on Bitstamp after reaching local highs of $21,012 your day prior.

The biggest cryptocurrency trod water consistent with U . s . States equities in the Wall Street open, using the S&P 500 flat and also the Nasdaq Composite Index lower around 1% during the time of writing.

The U.S. dollar index (DXY), meanwhile, started to claw back losses at the time, supplying a headwind to risk assets absent for much each week. The DXY saw its cheapest levels since mid-September.

In front of a choice on rates of interest through the Fed, gdp (GDP) data demonstrated a rebound for that U.S. economy in Q3.

“This [GDP] number is less strong with regards to the signal it transmits concerning the forward strength from the economy compared to 4g iphone was, although the headline was positive,” Eric Winograd, director of developed market economic research at AllianceBernstein, nevertheless told the Financial Occasions.

In Europe, the ecu Central Bank (ECB) elevated key rates by .75%, not surprisingly.

“Big day today, because the ECB is available in using their policy and GDP figures in the U.S.,” Michaël van de Poppe, founder and Chief executive officer of buying and selling firm Eight, summarized.

“Honestly, Bitcoin remains calm at these levels, might have expected a far more significant correction because the last push.”

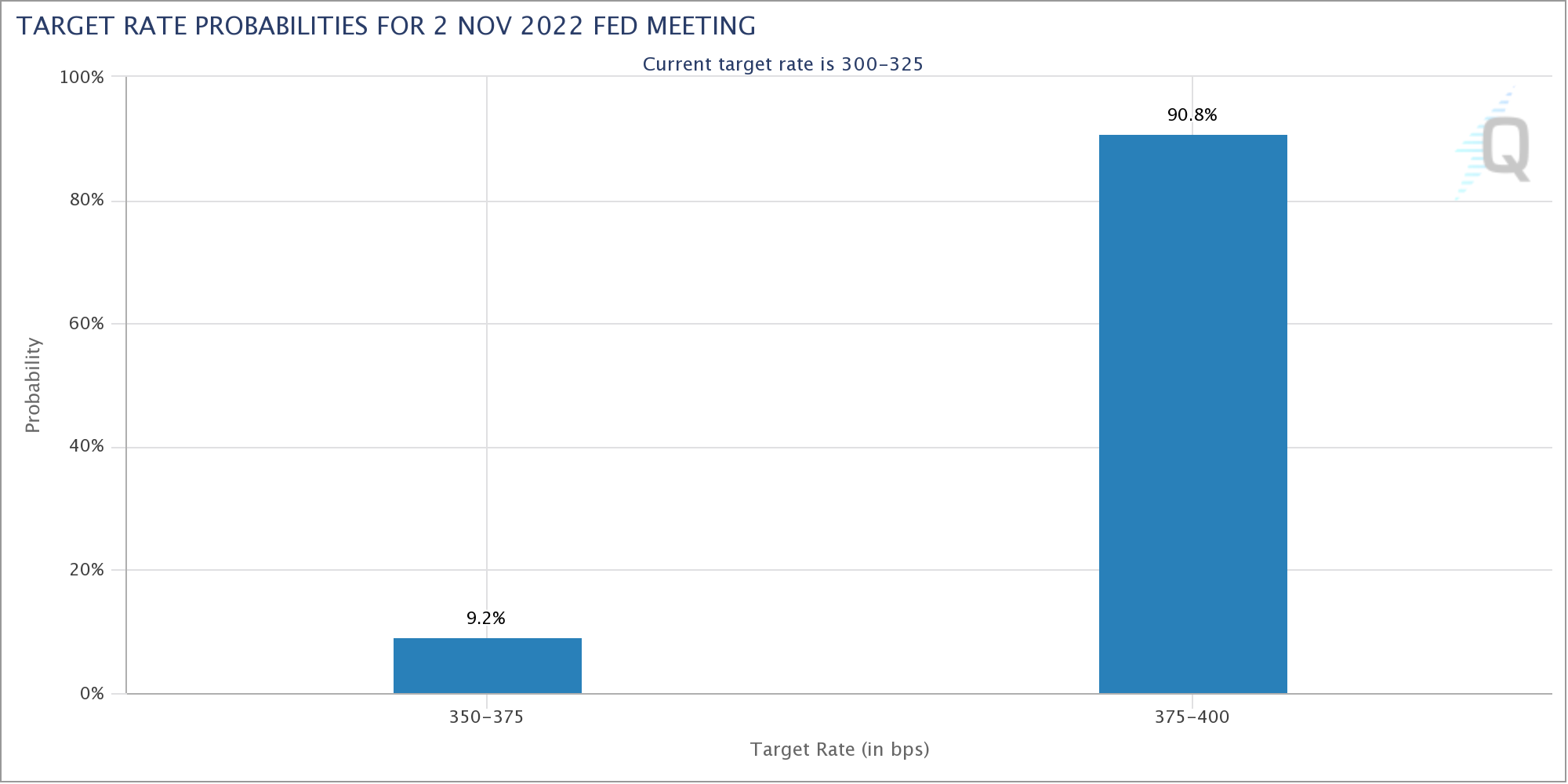

The most recent data from CME Group’s FedWatch Tool put the chances from the Given copying the .75% hike at 90.8% at the time.

$14,000 return still haunts trader’s chart

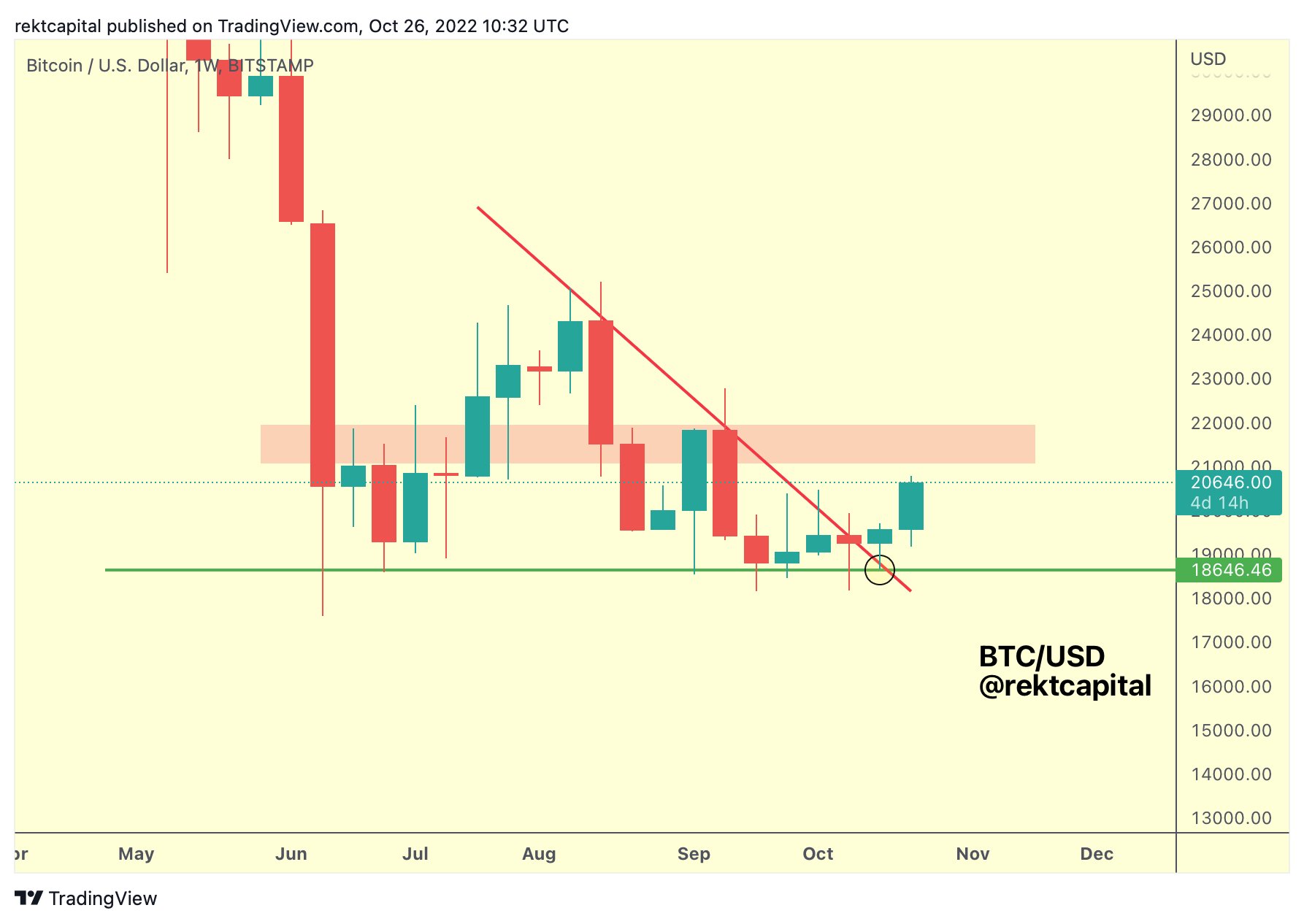

Analyzing the weekly BTC/USD chart, popular trader Rekt Capital highlighted the zone immediately below $22,000 being an important someone to reclaim for bullishness to carry on.

Related: An archive 55,000 Bitcoin, or higher $1.1 billion, only agreed to be withdrawn from Binance

“BTC is gradually approaching the red resistance area,” he authored within an update on March. 26.

Fellow analyst Il Capo of Crypto, meanwhile, stated that $21,500 will have to make up the grounds for consolidation should bulls need to see $23,000 materialize.

His “main scenario” continued to be a reversal to new macro lows for BTC/USD, potentially hitting $14,000.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.