Welcome readers, and thank you for subscribing! The Altcoin Roundup e-newsletter has become created by Cointelegraph’s resident e-newsletter author Big Smokey. Within the next couple of days, this e-newsletter is going to be renamed Crypto Market Musings, an every week e-newsletter that gives ahead-of-the-curve analysis and tracks emerging trends within the crypto market.

The publication date from the e-newsletter will stay the same, and also the content will still convey a heavy focus on the technical and fundamental analysis of cryptocurrencies from the more macro perspective to be able to identify key shifts in investor sentiment and market structure. Hopefully you like it!

Time for you to go lengthy?

Now, Bitcoin’s (BTC) cost has perked up, having a surge to $21,000 on March. 26. This brought a number of traders to proclaim the bottom may be in or that BTC is entering the next thing of some technical structure like Wyckoff, a variety break or some kind of support resistance switch.

Prior to all bullish and opening 10x longs, let’s dial to an earlier analysis to find out if anything in Bitcoin’s market structure has altered and if the recent spat of bullish momentum is suggestive of a broader trend change.

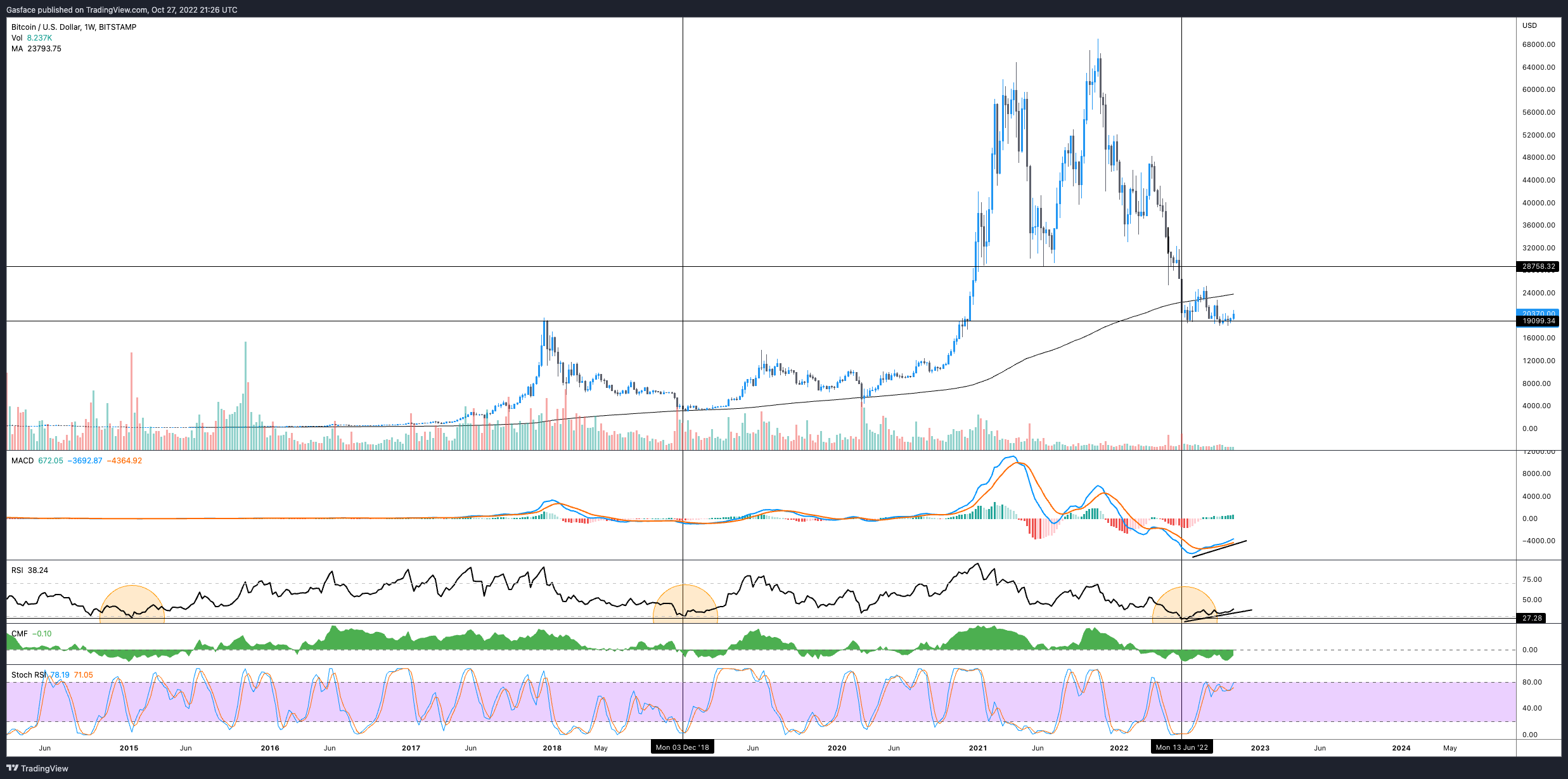

Once the last update was printed on Sept. 30, Bitcoin was around $19,600, that is still inside the bounds from the last 136 times of cost action. At that time, I’d identified bullish divergences around the weekly relative strength index (RSI) and moving average confluence divergence (MACD). There have been also a number of potential “bottoming” signals originating from multiple on-chain indicators, that have been at multi-year lows.

Let’s check out how situations are searching now.

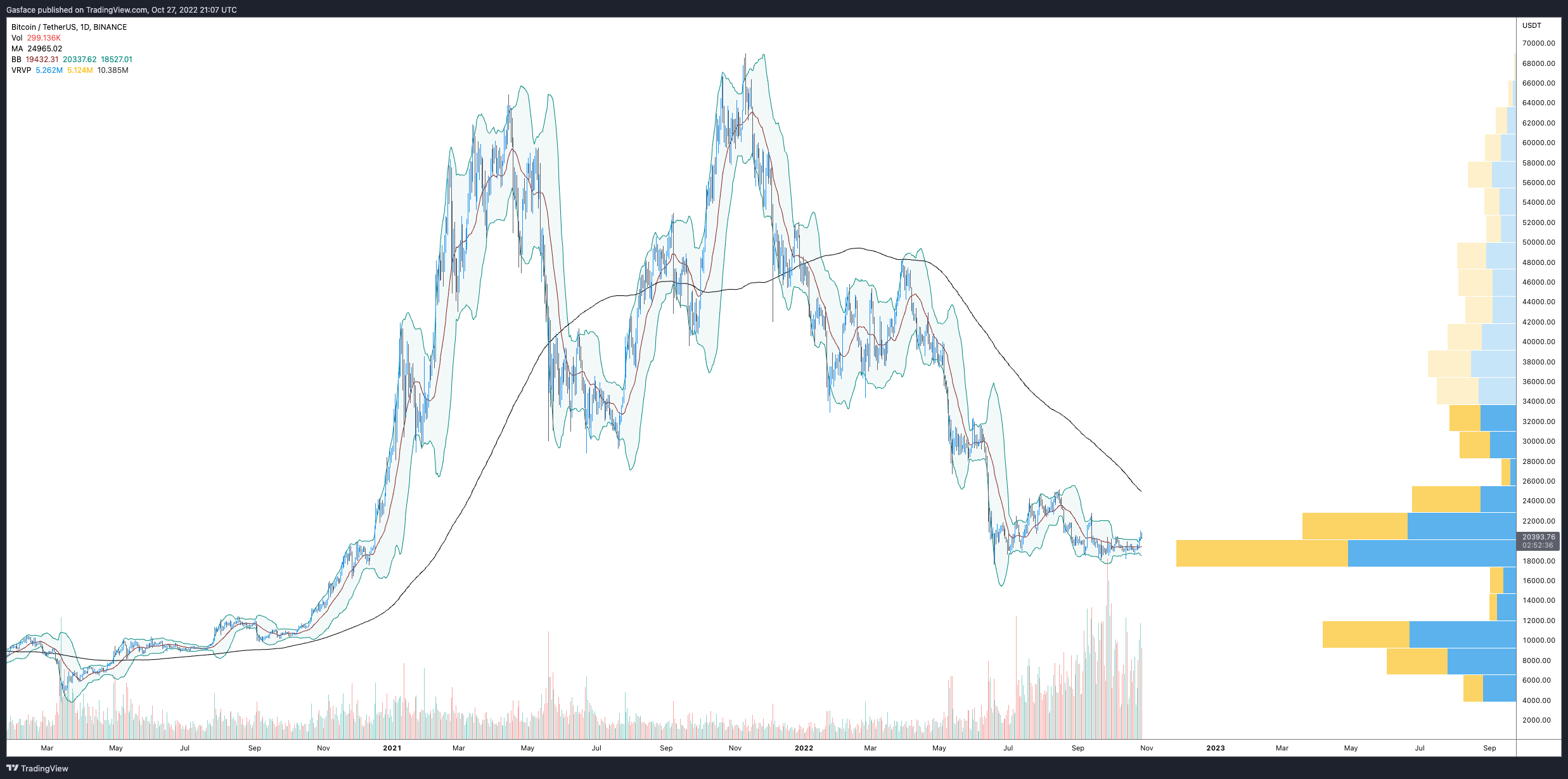

The Bollinger Bands are tight

The Bollinger Bands around the daily time period remains limited, which week’s surge to $21,000 was the development or spike in volatility that many traders happen to be expecting. Out of the box componen for that course, after breaking out of the upper arm, the cost has retraced to check the mid-line/mid-band (20MA) as support.

Despite the effectiveness of the move, the cost remains capped underneath the 200-MA (black line), which is unclear now when the 20-MA will function as support for Bitcoin’s cost.

After bouncing off an almost-all-time low at 25.7, the weekly RSI is constantly on the trend upward and also the bullish divergence identified in the last analysis remains in play. An identical trend may also be held by BTC’s weekly MACD.

Within the same chart, we are able to observe that the newest weekly candle is on the way to developing a weekly greater high. When the candle closes over the range a lot of the prior five days and also the cost sees continuation within the coming days having a daily or weekly close above $22,800, this may be the makings of the trend reversal.

Around the daily time-frame, BTC’s Guppy multiple moving averages (GMMA or Super Guppy) indicator is eyebrow-raising. There’s compression from the short-term moving averages, and they’re converging using the lengthy-term moving averages, which generally signifies an impending directional move or, sometimes, a macro trend reversal within the making.

Within the last couple of days, Bitcoin’s “record-low volatility” continues to be the talk from the town and while using the Bollinger Bands, the GMMA and BVOL, the tightening cost range does hint at expansion, but as to the direction remains a mysterious.

Bitcoin continues to be buying and selling within the $18,600–$24,500 range for 36 days and in the outlook during technical analysis, the cost remains near the center of that range. The proceed to $21,000 didn’t set a substantial daily greater high nor avoid the present range, which basically is really a sideways chop.

The cost is holding over the 20-day moving average for the time being, but we haven’t yet begin to see the 20-MA mix over the 50-MA, many the March. 26 rally has retraced to the reduced $20,000 level.

A far more convincing development would involve Bitcoin breaking from the current range block to check the 200-MA at $24,800 and finally making some make an effort to switch the moving average to aid.

An additional extension towards the $29,000–$35,000 range would inspire confidence from bulls searching for any clearer manifestation of a pattern reversal. Until that occurs, the present cost action is just more consolidation that’s pinned by resistance extending completely to $24,800.

Related: Exactly why is the crypto market up today?

Bitcoin on-chain data states to amass

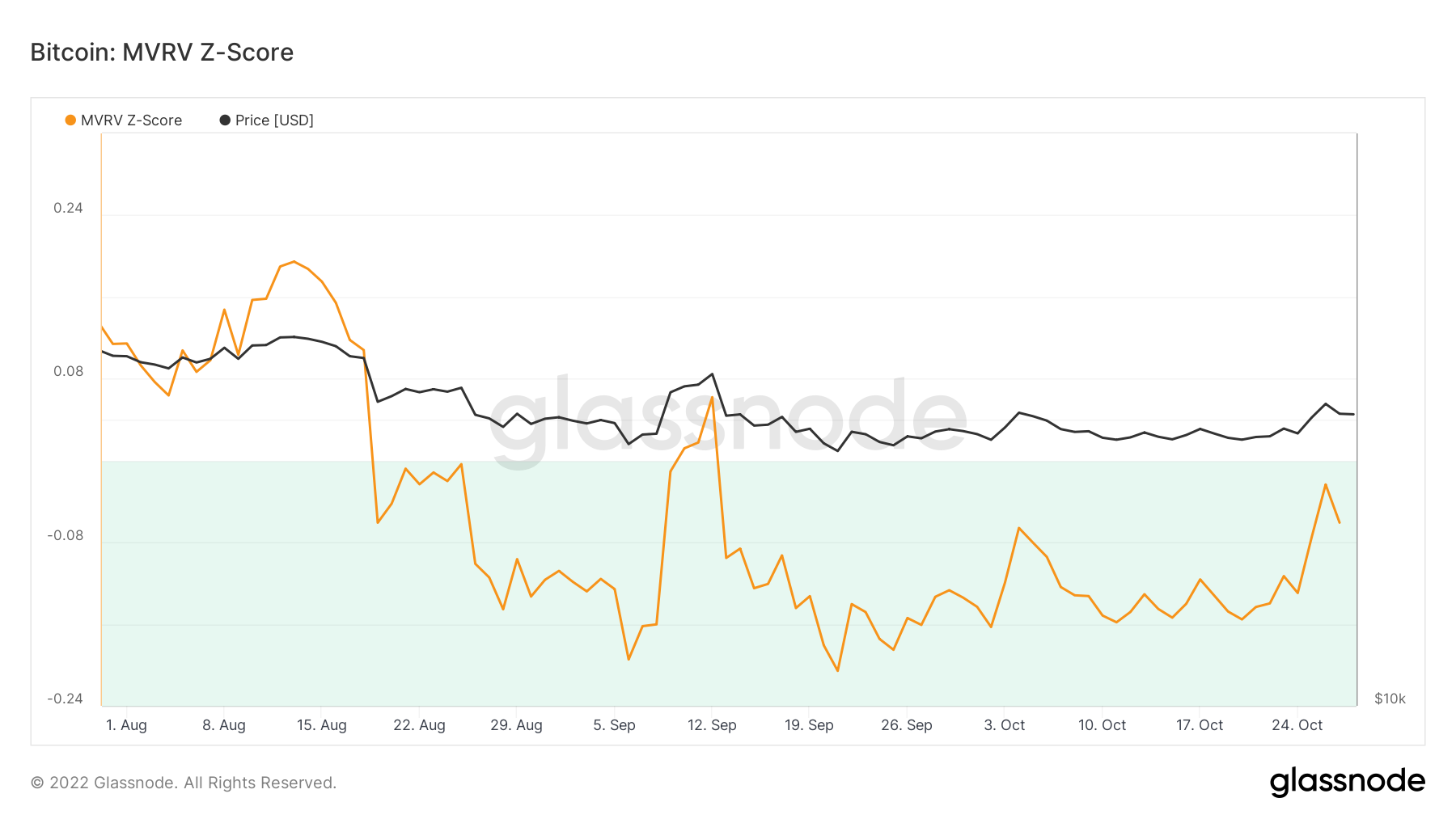

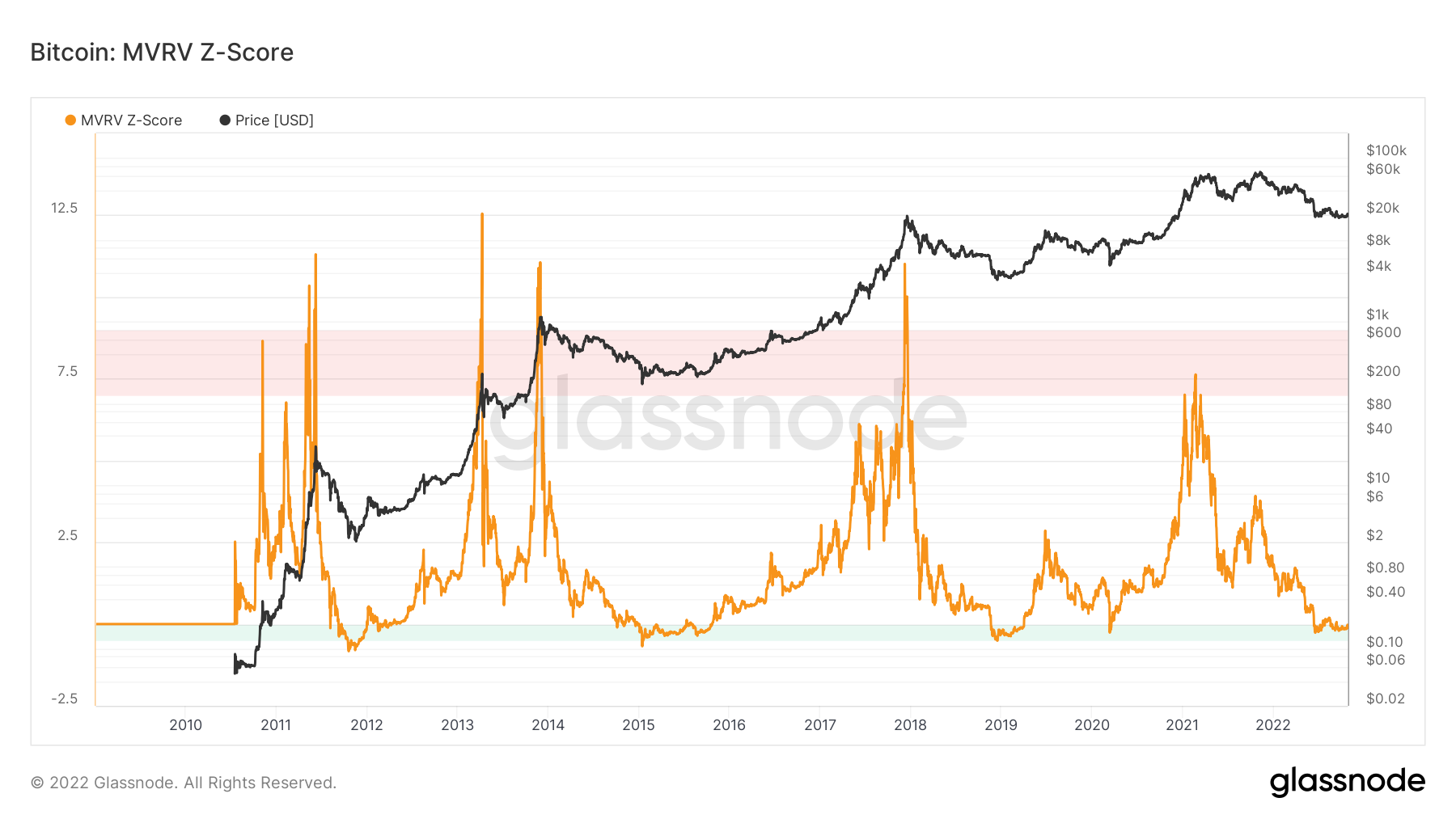

Like BTC’s place cost, the MVRV Z-Score has additionally bounced around within the -.194 to -.023 zone within the last three several weeks. The on-chain metric reflects a ratio of BTC’s market capital against its recognized capital (the quantity people compensated for BTC when compared with its value today).

In a nutshell, if Bitcoin’s market price is measurably greater than its recognized value, the metric enters the red area, indicating a potential market top. Once the metric enters the eco-friendly zone, it signals that Bitcoin’s current value is below its recognized cost which the marketplace might be nearing a bottom.

Based on the MVRV Z-Score chart, in comparison against Bitcoin’s cost, the present -.06 MVRV Z-Score is incorporated in the same range as previous multiyear lows and cycle bottoms.

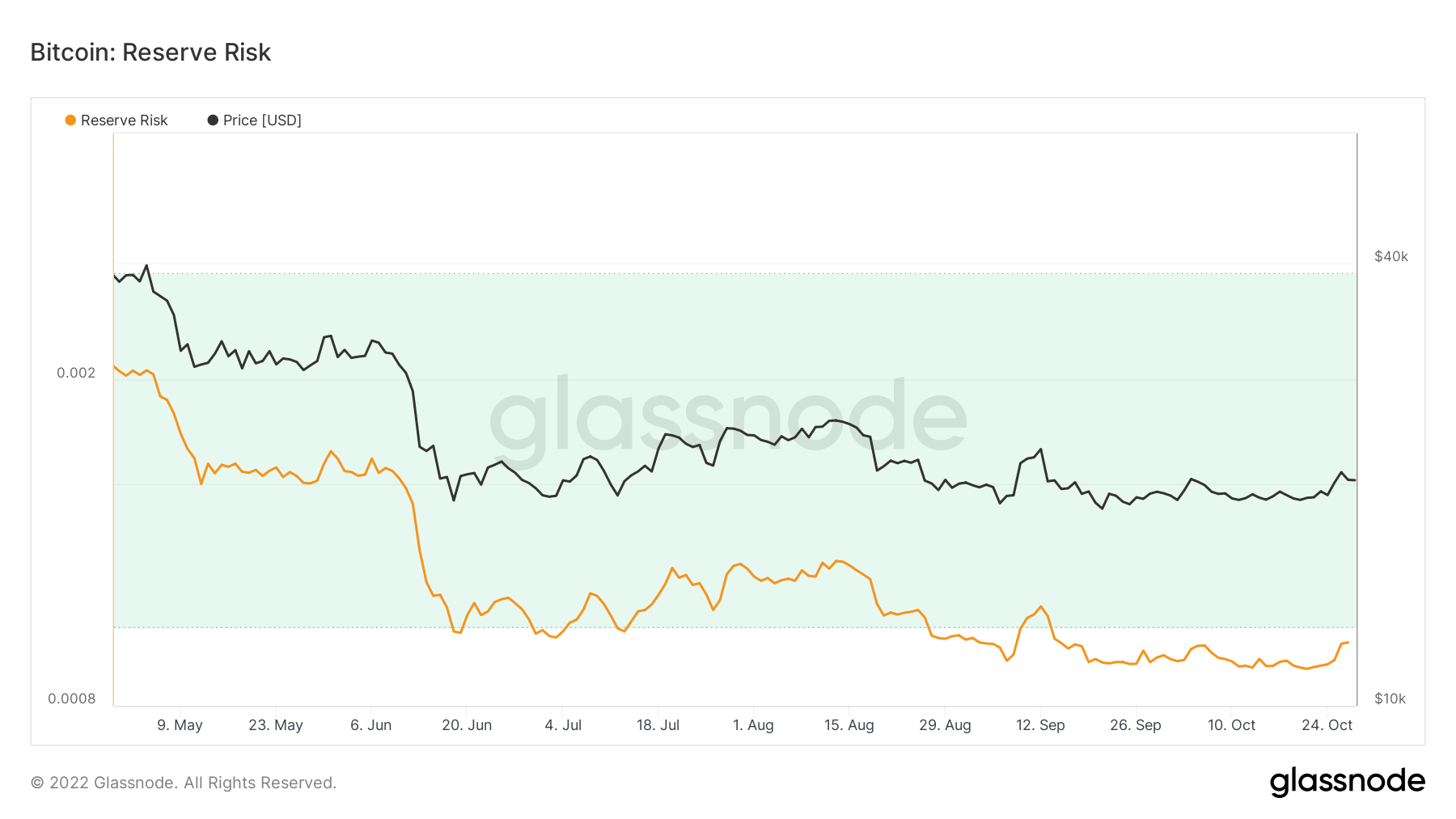

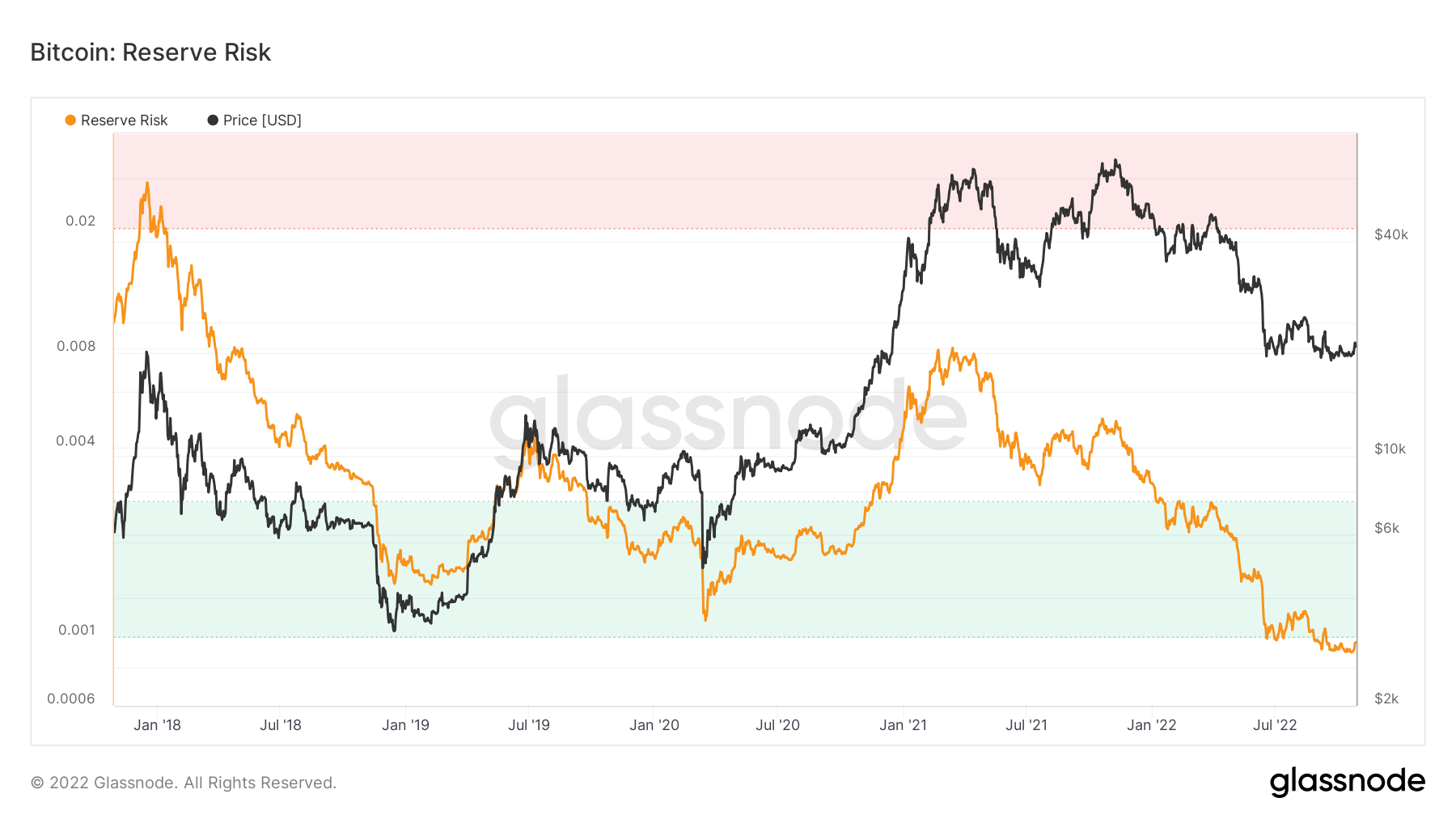

Reserve Risk

Bitcoin’s Reserve Risk metric displays how “confident” investors are contrasted from the market cost of BTC.

When investor confidence is high, but BTC’s cost is low, the danger-to-reward or Bitcoin attractiveness versus the chance of buying and holding BTC enters the eco-friendly area.

During occasions when investor confidence is low, however the cost is high, Reserve Risk moves in to the red area. Historic data shows that creating a Bitcoin position when Reserve Risk enters the eco-friendly zone is a great time to determine a situation.

Presently, we are able to observe that in the last six several weeks, the metric continues to be carving out what investors might call a bottom. During the time of writing, reserve risk is booming toward .0009, and frequently, crossing the .001 threshold in to the eco-friendly zone has marked the beginning of a recovery.

Searching forward

Multiple data points seem to claim that Bitcoin’s cost is undervalued but still while carving out a bottom, but none of them confirms the actual market bottom is within.

Now, as well as in previous several weeks, multiple Bitcoin mining companies have openly announced the necessity to restructure debt, the potential of missed debt payments, and a few have hinted at potential personal bankruptcy.

Most openly listed miners happen to be selling nearly all their found BTC since June, and also the recent headlines concerning Compute North and Core Scientific hint that Bitcoin’s cost continues to be in danger because of solvency issues among industrial miners.

Data from Glassnode shows the mixture size miner balances hovering around 78,400 BTC being “held by miners we’ve labelled (comprising 96% of current hashrate).”

Based on Glassnode, in case of “income stress,” it’s possible that miners will have to liquidate tranches of those reserves on view market, and also the knock-on impact on Bitcoin’s cost may be the next catalyst of the sell-off and away to new yearly lows.

This e-newsletter was compiled by Big Smokey, the writer of The Standard Pontificator Substack and resident e-newsletter author at Cointelegraph. Each Friday, Big Smokey will write market insights, trending how-tos, analyses and early-bird research on potential emerging trends inside the crypto market.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.