Bitcoin (BTC) asleep for approximately ten years is getting out of bed now as BTC cost action sees six-week highs.

Data from on-chain analytics firm Glassnode shows a few of the earliest “dormant” Bitcoin coming back to circulation.

BTC trends from hibernation

As BTC/USD stages something of the comeback within the other half of October, hodlers are altering their behavior following a year-lengthy bear market.

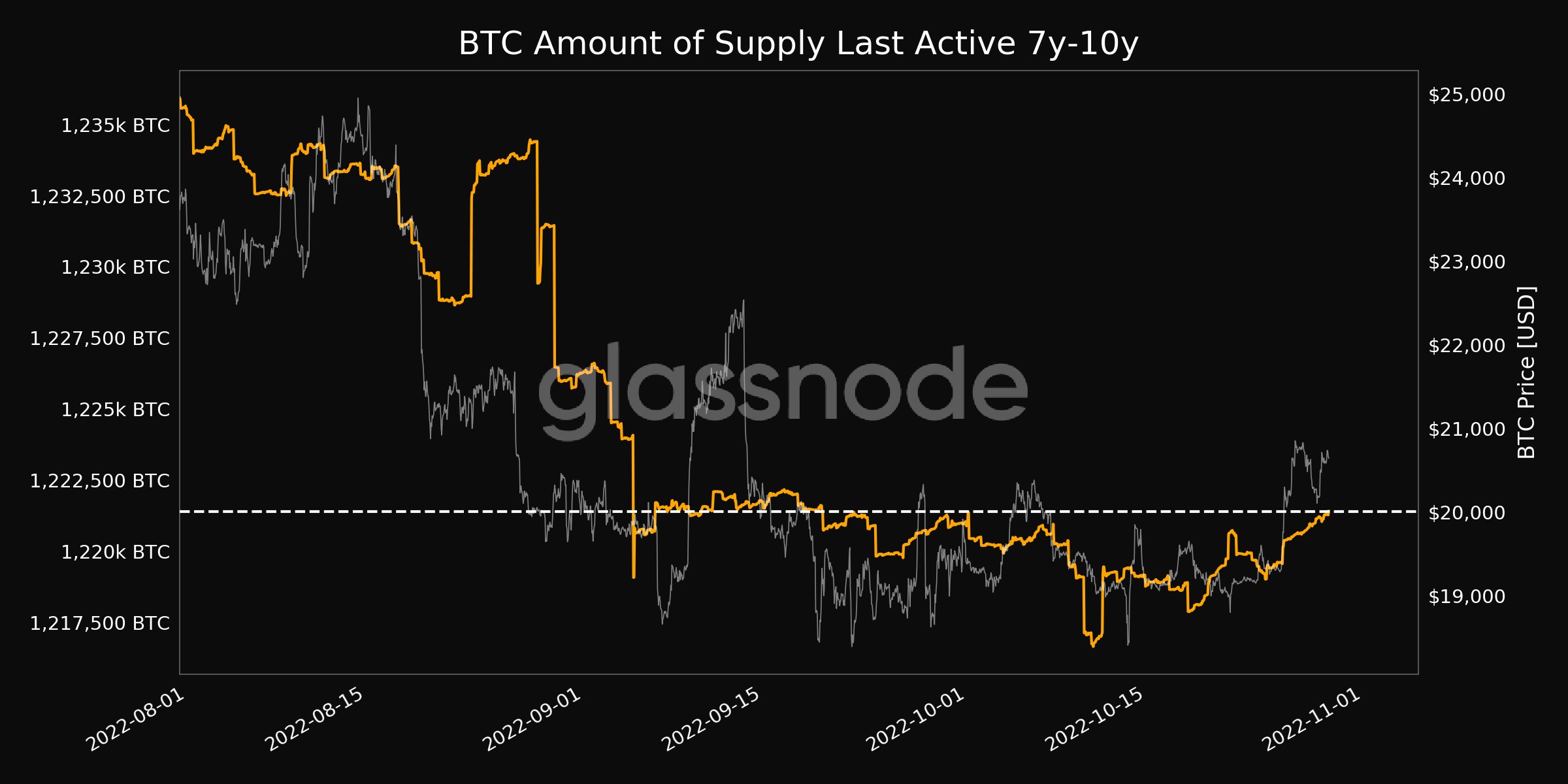

Based on Glassnode, the amount of Bitcoin formerly stationary within their wallet for 7-ten years although not active again arrived at a 1-month high on March. 29.

This is actually the most recent in a number of such highs, using the previous one seen on March. 1.

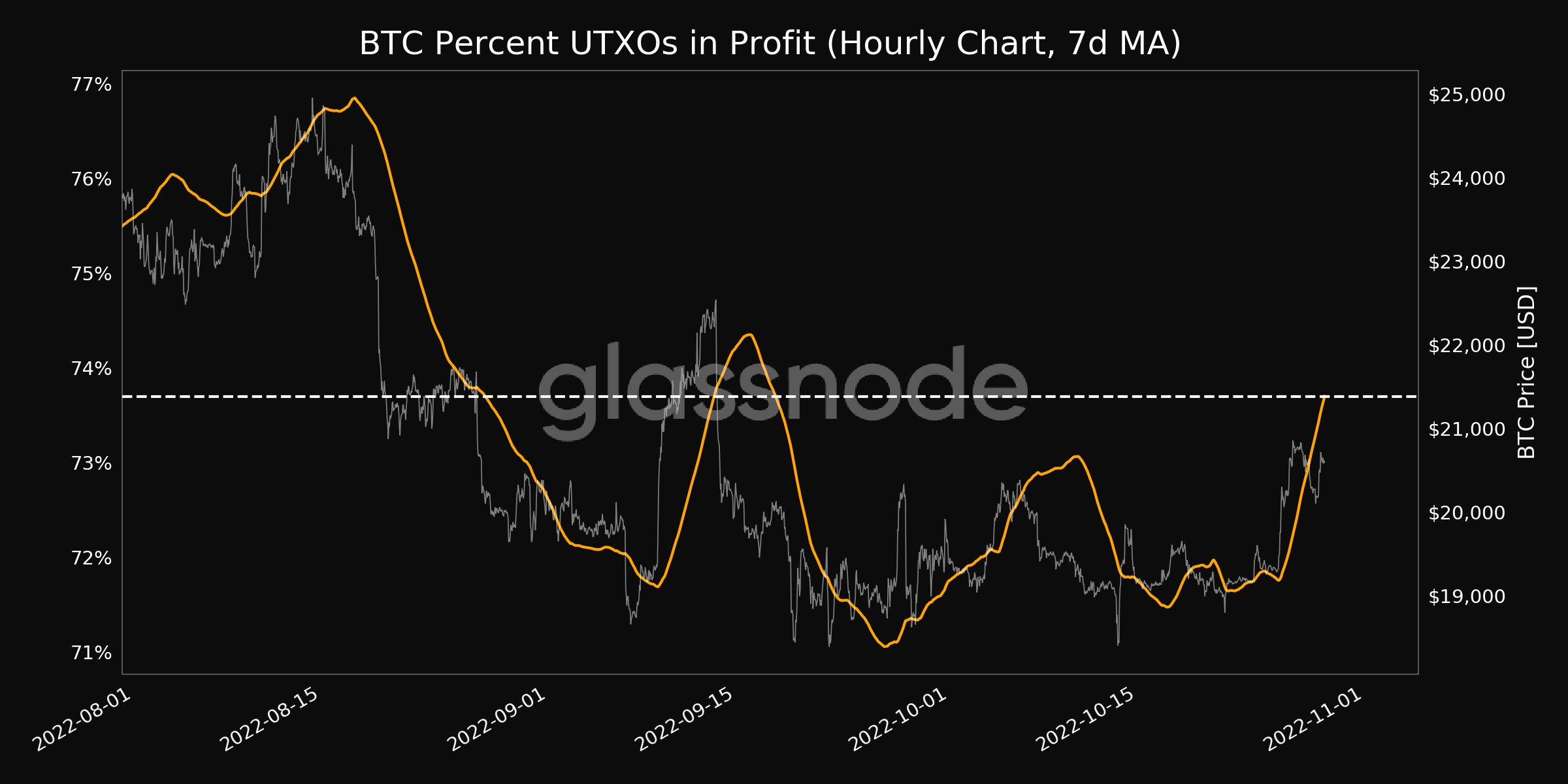

Further figures reveal the unspent transaction outputs (UTXOs) in profit arrived at a 1-month a lot of over 73% on March. 28, planning to eclipse levels from September.

Glassnode implies that Bitcoin being moved is quickly done this in a profit, instead of baffled.

SOPR spikes through key range

The information reinforces the idea that there’s an growing desire to take part in profit-taking, even among Bitcoin’s most seasoned hodlers, at current prices.

Related: Capitulation or profit-taking? Bitcoin whale moves 32K BTC dormant since 2018

Such profit-taking activities could increase considerably, even when place cost only puts in modest growth, a vital network metric states.

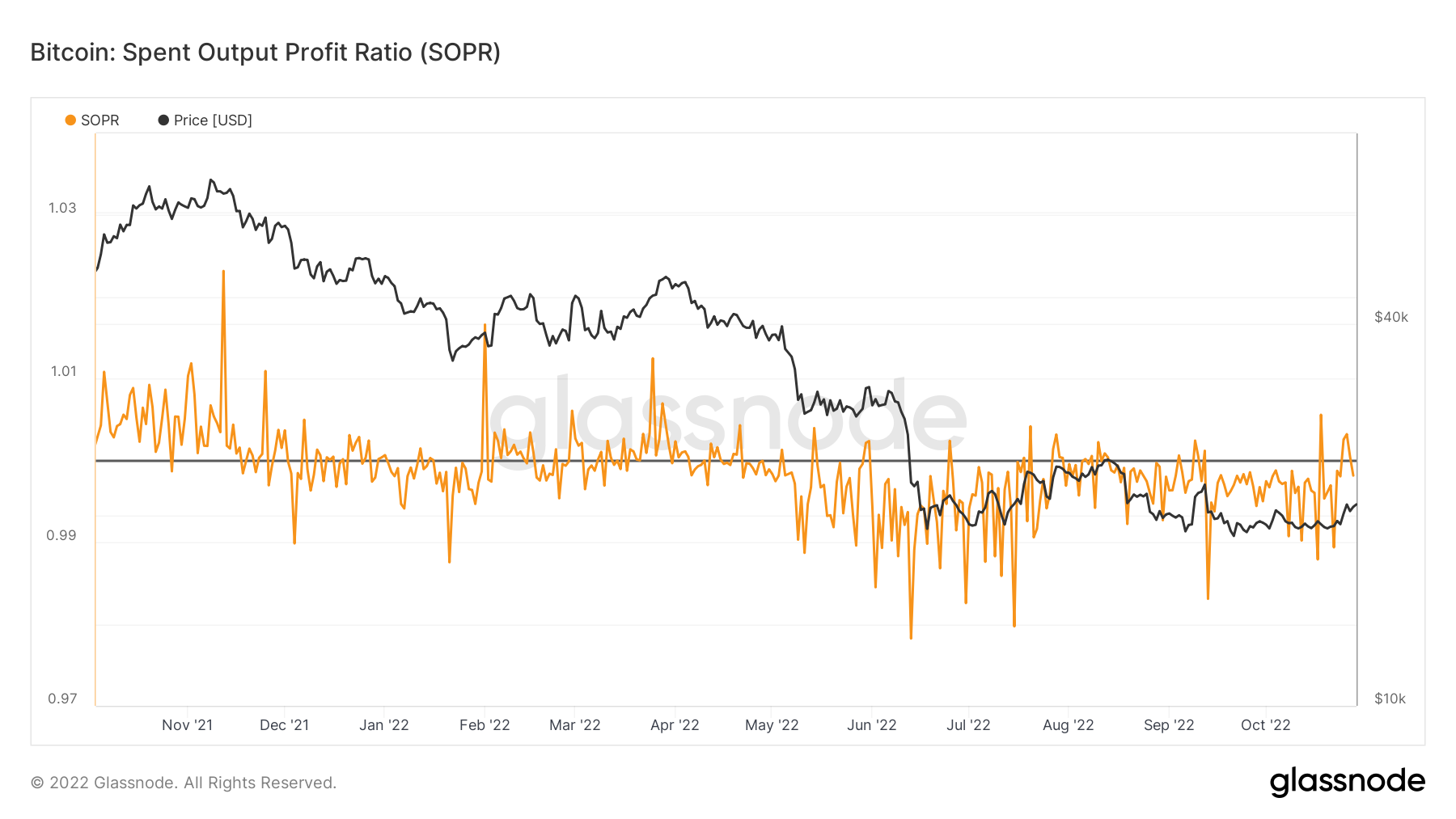

The most recent readings from Bitcoin’s Spent Output Profit Ratio (SOPR) reveal that further cost gains would place BTC/USD inside a classic profit-taking country.

SOPR basically shows the level that the BTC supply has been offered in profit or loss. Fluctuating around 1, the ratio is commonly negative during bear markets, so when it crosses 1 while going greater, it signals a supply increase that could, consequently, impact cost performance.

“In a bear market, everybody is selling or awaiting the break-even indicate sell,” creator Renato Shirakashi described in introducing the metric in 2019:

“When SOPR is close/more than 1, people begin to sell much more, because they achieve break-even. Having a greater supply, the cost plunges.”

As Cointelegraph reported, some on-chain signals claim that the overall picture is much more nuanced.

Binance, the biggest exchange by volume, now saw its greatest-ever BTC balance decrease, indicating that users withdrew over 55,000 BTC right away.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.